In the digital age, our online activities are more than just actions; they define our digital identity. This identity helps establish who we are in the virtual world, serving as a key to verify our presence when logging into websites, making purchases, or accessing services.

It is a fundamental element that enables trust; without it, organizations and governments would struggle to provide advanced, secure digital services to their customers and citizens. The scope of managing identities and access control systems has expanded dramatically.

This protection is essential for maintaining the integrity of our digital interactions and for the prevention of fraudulent activities.

In this blog, we’ll cover the concept of digital identity in detail, including best practices to complete digital identity verification, and tips to choose the best digital identity verification solution. Let’s begin!

Table of Contents

- What is Digital Identity?

- Importance of Digital Identity in an Increasingly Digital World

- Benefits of Digital Identity Use

- What is Digital Identity Used For?

- What is the Digital Identity Verification Process?

- How to Choose a Digital Identity Verification Service

What is Digital Identity?

Digital identity is the digital persona of an individual, constituted by various digital attributes and credentials that are unique to that person. It includes all the data that can be uniquely identified and traced back to an individual, allowing them to participate in the virtual ecosystem. It’s a complex combination of how a person is perceived online, their actions, preferences, access rights, and histories across platforms. This virtual identity becomes a key to unlocking personalized experiences, ensuring security, and engaging in digital transactions.

Digital Identity Types

There are several types of digital identities, each with its own characteristics and use cases. Here are the main categories:

- Attribute-based Identities: These consist of specific details about an individual such as age, nationality, or profession.

- Biometric Identities: These are unique physical traits like fingerprints, facial recognition, or DNA sequences used for verification.

- Anonymized Identities: These protect a user’s actual identity by providing a pseudonym or unique identifier that doesn’t reveal personal information.

- Federated Identities: These allow users to port their identity across different services and platforms without the need for separate credentials for each one.

Digital Identity Examples

Here are a few examples to illustrate digital identity in action:

- Social Media Profiles: Your profile on platforms like Facebook or LinkedIn is a form of digital identity, showcasing your personal and professional persona.

- Online Banking Credentials: The information you use to access your bank’s online services, including your customer ID and password.

- E-commerce Profiles: Your account details on Amazon or eBay, which include your purchase history and payment methods.

- Email Addresses: A primary mode of communication and a way to authenticate and access various services online.

- Government-Issued Digital IDs: Such as passports, which provide a secure digital identity.

Importance of Digital Identity in an Increasingly Digital World

In the tapestry of our modern digital existence, digital identity is the thread that intertwines individuals with the digital fabric of society. It’s the key to accessing services, engaging in commerce, and personalizing digital experiences. Especially in sectors like financial services and banking, a robust digital identity and access framework is not just an advantage—it’s a necessity.

Banking and Financial Services

In banking and financial services, digital identity verification process is critical. It forms the backbone of trust that enables the movement of capital in the digital marketplace. Banks rely on digital identity to comply with regulatory requirements, prevent fraud, and offer personalized services.

A customer’s digital identity can streamline the process of opening an account, applying for loans, and conducting transactions online, which in turn enhances user experience and operational efficiency.

Identity Verification and Trust

For financial institutions, establishing trust digitally is paramount. They need to know who is on the other side of the transaction. Digital identity serves as a means of verification, almost like a digital handshake that says, “I am who I claim to be.” This verification process is pivotal in preventing identity theft, money laundering, and other fraudulent activities that could undermine the financial health of the institution and the security of its customers.

Compliance and Regulation

Digital identity also plays a key role in compliance and regulatory adherence. With regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, financial institutions are mandated to have a clear understanding of their customer’s identity. Digital identity and access management systems enable them to maintain compliance while reducing the overhead of manual checks and verification processes.

Future of Digital Identity

The role of digital identity management will only expand. It will become more integrated with various aspects of our digital interactions, demanding more sophisticated and secure management solutions. The industries that embrace this evolution, ensuring that digital identities are managed with care and understanding, will be the ones that thrive in this increasingly digital world.

Benefits of Digital Identity Use

The implementation of digital identity systems carries a multitude of benefits that resonate across various sectors, especially as we navigate through a digital-centric era. Here are some of the most significant advantages:

Reduced Risk of Data Breaches

Digital identity solutions enhance security protocols, significantly reducing the risk of data breaches. By using advanced encryption and multi-factor authentication, digital identities are harder to compromise. This increased security of digital identifiers is crucial in protecting sensitive information and maintaining consumer trust, especially in industries where data sensitivity is paramount.

Less Reliance on Humans

Automating the identity verification process minimizes the need for human intervention, which can often be a source of error or inefficiency. Digital identity authentication systems can process and authenticate personal information with greater accuracy and speed, leading to a more streamlined and reliable verification process.

Reduced Bias

Digital identity systems can help in reducing bias in verification processes. By relying on data and established protocols, these systems can make objective decisions based on consistent criteria, rather than subjective human judgment. This can be particularly beneficial in processes such as loan approvals, hiring, and law enforcement, where impartiality is essential.

Read more: How to Mitigate Facial Recognition Bias

Standardized Verification Process

Digital identity offers a standardized approach to verifying individuals across platforms and borders. This uniformity ensures that regardless of the service or location, the identity verification process remains consistent and secure. For businesses, this means simplifying the onboarding of customers and employees, while for customers, it ensures a familiar and hassle-free experience.

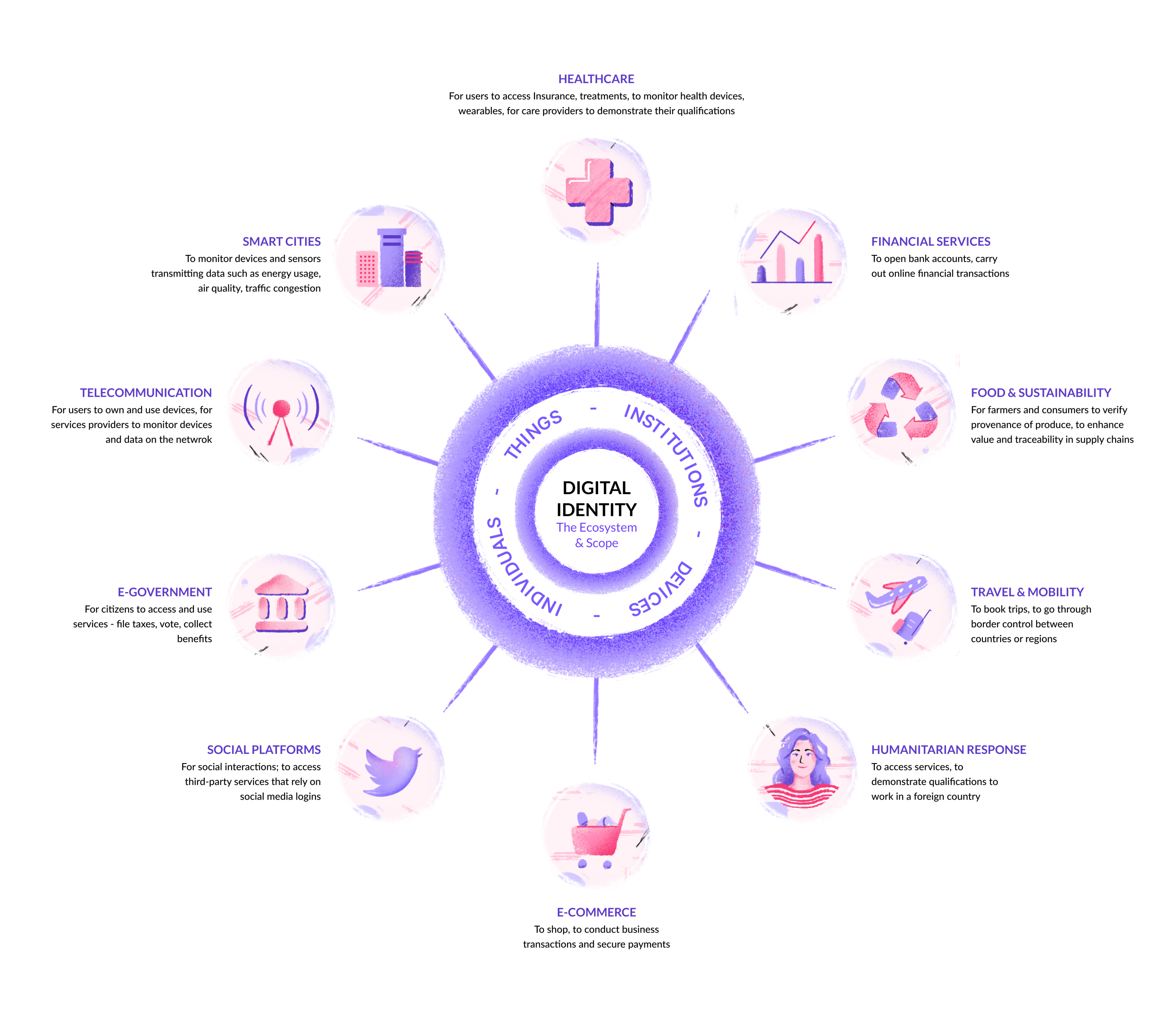

What is Digital Identity Used For?

Digital identity has become an integral component of the banking and financial ecosystem, providing a seamless and secure way to manage a range of services and operations.

Bank Account Verification

Digital identity is a game-changer in banking, especially for account verification. It’s streamlining processes that were once fraught with friction and abandonment. For instance, in the US, it’s reported that nearly a quarter of all financial applications are dropped due to complex registration processes—a challenge a digital identity solution can solve by enabling simplified authentication.

Read more: A step-by-step process for bank account verification.

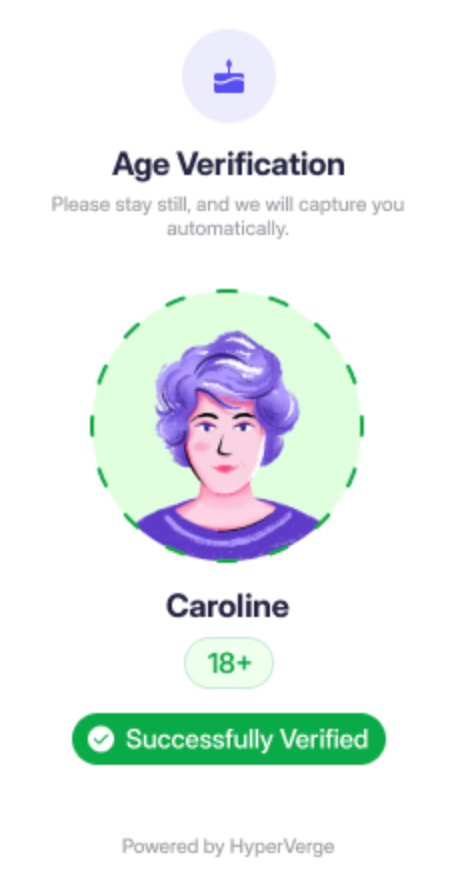

Age Verification

Safeguarding digital interactions requires robust mechanisms to authenticate users and verify their age, emphasizing the importance of a reliable digital ID infrastructure. Age verification ensures that only legitimate users gain access to your services and shields minors from harmful digital content.

Authenticating Transactions

Digital banking has evolved significantly. Innovations in traditional identification methods like self-service identity verification, passwordless access, and risk-based multi-factor authentication (MFA) have emerged, significantly enhancing the trust and convenience in customer-bank interactions.

What is the Digital Identity Verification Process?

Digital identity verification is an essential component in establishing and maintaining trust in the digital age. It ensures that individuals are who they claim to be, which is vital across various industries, from online banking services, to healthcare. The process typically involves several key steps:

ID Record Checks

This involves the verification of official identity documents such as passports, driver’s licenses, or government-issued IDs. It assesses security features, verifies any alterations, and checks that the information is consistent with the individual’s personal details.

Proof of Address Checks

Usually required to confirm an individual’s stated residence, often through utility bills, bank statements, or government correspondence that bears the person’s name and address.

Read more: How to validate a Proof of Address (PoA)

Document Verification

The actual documents are evaluated for authenticity, checking for security features like watermarks and holograms to ensure they haven’t been tampered with or forged.

Read more: Complete guide to document verification

Biometric Verification

This step uses unique physical or behavioral characteristics, such as fingerprints, face authentication, voice recognition, and voice patterns, to confirm an individual’s identity. These traits are nearly impossible to replicate, providing a high level of security.

Read more: Everything you need to know about biometric verification

AML Verification

To prevent financial crimes, the Anti-Money Laundering (AML) verification is included, where the individual’s background is checked against watchlists and involved in financial crime.

The process starts with the collection of the necessary personal information or documents, followed by various verification procedures tailored to the context, industry, and required security level.

How to Choose a Digital Identity Verification Service

When selecting a digital identity verification service, there are several factors to consider ensuring that the solution meets your business needs effectively and securely. Here’s what to look for in a vendor:

- Technology and Accuracy: Opt for services that offer advanced AI models to ensure high accuracy and real-time verification. Look for proprietary technology that enables fast innovation and the addition of custom checks as new needs arise.

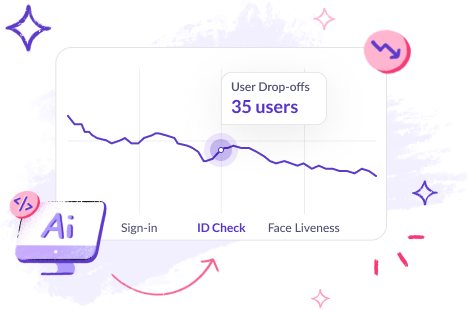

- User Experience: The service should minimize friction during the onboarding process. Technologies like single image passive liveness checks can make the process seamless, even on low-bandwidth connections or low-end devices, which helps in reducing drop-offs and improving conversion rates.

- Inclusivity: Choose a solution that works well across all races, ages, and genders. The AI models should be trained on diverse datasets to ensure accurate results regardless of demographic variations.

- Fraud Prevention: With the rise of sophisticated ID frauds, ensure that the service has robust measures to defend against various types of fraudulent activities.

- Global Reach: If you’re operating internationally, it’s crucial to have a service that can connect to multiple databases worldwide and verify identities globally.

Read more: How to choose a digital identity verification service

How HyperVerge Accelerates the Process and Minimizes Errors

HyperVerge stands out as a digital identity verification service provider by offering:

- Proprietary AI Models: Their in-house AI technology is engineered to function effectively even in challenging conditions, ensuring seamless onboardings and the flexibility to quickly innovate and add custom AI checks.

- Single Image Passive Liveness Technology: This technology improves customer experience by verifying liveness with selfie verification, without complex gestures or videos, thus accelerating the verification process and minimizing errors.

- Diverse Data Training: HyperVerge’s AI models are extensively trained on diverse facial variations, promoting inclusivity and delivering highly accurate results across all demographics.

- Fraud Defense: The evolving AI technology is tailored to counter innovative ID fraud tactics, ensuring a robust defense mechanism against identity-related frauds.

- Global Connectivity: With the capability to connect easily to databases around the world, HyperVerge facilitates global business expansion in a hassle-free manner.

In our complete guide to identity verification, we cover everything you need to know and how HyperVerge can help.

Conclusion

When selecting a digital identity verification service, prioritize a solution that delivers accuracy, efficiency, inclusivity, and global reach. HyperVerge’s in-house AI technology sets a high standard with real-time, highly accurate verification processes that cater to a diverse clientele. Our single image passive liveness technology ensures a user-friendly experience, while extensive training on varied facial features guarantees fairness and accuracy across all demographics. With robust defenses against ID fraud and seamless global database connectivity, HyperVerge offers a comprehensive, end-to-end solution for businesses looking to secure their operations and expand internationally.

Ready to enhance your user onboarding process, reduce fraud and security risks, and streamline your global operations?Explore HyperVerge’s Identity Verification service or get a demo to see how our cutting-edge technology can empower your business today.