Are you facing problems with customer identity verification while meeting regulatory standards? Nowadays, compliance with Know Your Customer (KYC) requirements is important.

Therefore, choosing a reliable KYC provider is an effective solution you need. However, the challenging part is to find an efficient provider from the numerous options available in the market.

Let’s help you simplify your search and save valuable time by providing a curated list of the top 10 KYC providers.

Before understanding each provider’s expertise and offerings, first, let’s understand the brief about KYC technology.

What is KYC technology?

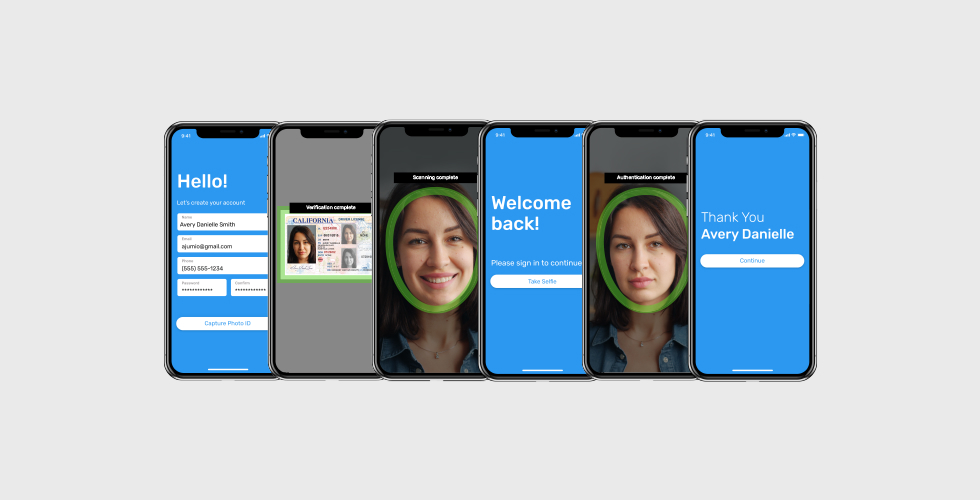

KYC technology is a process that financial institutions use to verify a customer’s identity. The entire process of identity verification service is important for compliance with regulatory requirements and assists in eliminating the risks of financial crimes and fraud.

Here are the core components of KYC technology:

- Identity verification: Helps confirm the customer’s identity by authenticating government-issued IDs, using biometric verifications (facial recognition, fingerprint scanning) for customer authentication, and electronic verification methods.

- OCR-based document verification: Uses advanced technologies like Optical Character Recognition (OCR) to extract and validate data from reliable sources like government databases and national identity registries.

- Due diligence and risk assessment: Performs complete due diligence by analyzing customer data like history of financial transactions and geographical locations. Such a process ensures compliance with Anti-Money Laundering (AML) regulations and detects suspicious activities.

- User experience and integration: Delivers a smooth onboarding experience by integrating with CMS platforms and payment gateways. This integration improves operational efficiency and maintains a better approach to customer management.

After understanding the KYC technology and its components, let’s check out the process we follow to list the top providers of identity verification software.

How we analyzed and selected the top KYC providers for identity verification

Our research process included thorough market evaluations and in-depth analysis to select the top-tier user verification providers. Here is the manual process we followed to identify and list these leading providers.

- Our team evaluated 20+ providers who specialize in providing identity verification software with advanced capabilities.

- We compared every review and rating on reliable platforms like G2 and Capterra.

- We shortlisted the providers based on several factors, like compliance with local and international regulations, verification accuracy, integration capability, and pricing models.

By following such an evaluation process, we ensure that the list includes providers that fulfill your identity verification requirements.

A complete overview of the 10 best KYC providers

Here is the table containing a complete overview of the top KYC solution providers.

| KYC Providers | Free Trial Availability | Best For |

| 30-day free trial in a sandbox environment | • Startups • Small-scale businesses • Mid-sized companies • Enterprises | |

| No free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | |

| 14-day free trial | • Small-scale businesses • Mid-sized companies | |

| 30-day free trial | • Startups • Mid-sized companies | |

| A free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | |

| No free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | |

| A free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | |

| A free trial is available | • Startups • Mid-sized companies | |

| 7 days free trial is available | • Small-scale businesses • Mid-sized companies | |

| No free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises |

List of top 10 KYC providers for identity verification

Here is a list of the top KYC providers with detailed explanations.

1. HyperVerge

About HyperVerge

HyperVerge is a global identity verification company known for Know Your Customer (KYC) and AML solutions. The platforms simplify and accelerate the identity verification process with video KYC to ensure businesses from various sectors securely verify customers’ identities. This is made possible by the unmatched expertise in digital identity verification, having verified over 750 million identities.

Why choose HyperVerge as a reliable KYC provider?

- Uses advanced AI technology to automate the KYC process and verify users in 3 seconds.

- Maintains a 95% auto-approval rate using AI-driven solutions to ensure rapid and accurate user verification.

- Reduces user drop-offs by 50% to carry out a smoother customer verification journey.

- Earns a Net Promoter Score (NPS) of 72, indicating high customer satisfaction.

- Serves clients in 195+ countries by providing customized identity verification solutions.

- Offers scalable pricing options with almost 50% cost savings.

HyperVerge uses AI technology to protect businesses from fraudulent activities and ensures compliance with AML regulations. As a part of the KYC process, HyperVerge also screens users with global local databases, PEP, watchlists, & adverse media. This helps businesses prevent risks related to financial crime and maintain trust with regulatory authorities. HyperVerge continues to lead the market as an identity verification solution, serving all types of businesses, from startups to enterprises.

Key features of HyperVerge

Here are the features of the HyperVerge KYC.

- Multi-layered identity checks: Performs detailed verification processes like facial recognition, PAN verification, Aadhaar eKYC, and biometric checks.

- Optical Character Recognition (OCR): Extracts and verifies data automatically from scanned documents like PAN cards, IDs, and other proofs to ensure accuracy and reduce manual entry errors.

- Advanced fraud detection: Detects and prevents fraud using AI algorithms for name matching, date of birth verification, and Aadhaar authenticity checks.

- AML checks: Uses AI-driven algorithms to screen customer data with global AML databases and sanctions lists. In addition, performs PEP screening to detect high-risk customers.

- Geo-location verification: Verifies customer’s locations with geo-tagging features to ensure compliance and reduce financial risks.

- Deepfake detection: Uses the most advanced AI technologies to detect deepfake attempts during the video verification process.

- Customizable workflows: Allows flexibility in operational processes by customizing workflows to specific business needs.

HyperVerge pricing

HyperVerge offers a variety of pricing plans to help you choose the plan that benefits you the most. Here are the details of each pricing plan.

| Start plan – Suitable for startups The Start plan includes a 1-month free trial in a sandbox environment. Also, offers tools to view and manage verifications. | Grow plan – Suitable for mid-size companies The Grow plan covers all the offerings from the Start plan, along with access to AML checks, central database checks, and customized business workflows. | Enterprise plan – Suitable for enterprises The Enterprise plan covers everything offered in the Grow plan, along with a custom price structure, dedicated support, and collaborative tools. |

What people say about HyperVerge

Client video testimonial

HyperVerge serves all types of businesses, from startups to enterprises, across various sectors like financial services, gaming, crypto, eCommerce, and education. Recently, HyperVerge partnered with Mobile Premier League (MPL), which is an esports giant with 90 million users.

MPL integrated HyperVerge’s Digital KYC stack to prevent fraud and maintain a smooth and secure user onboarding. Our collaboration improved MPL’s document validation accuracy by 30-32% and enabled the processing of 700 KYCs per minute. Here is a testimonial of our client.

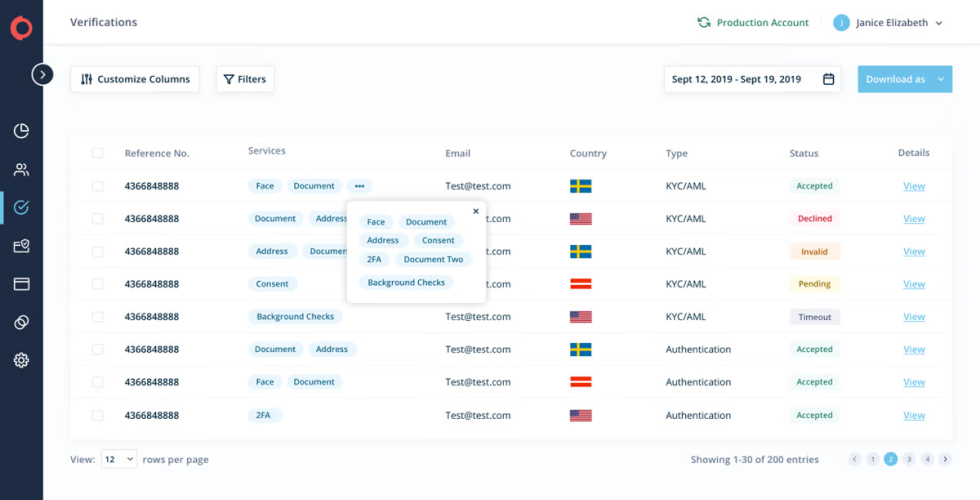

2. Ondato

About Ondato

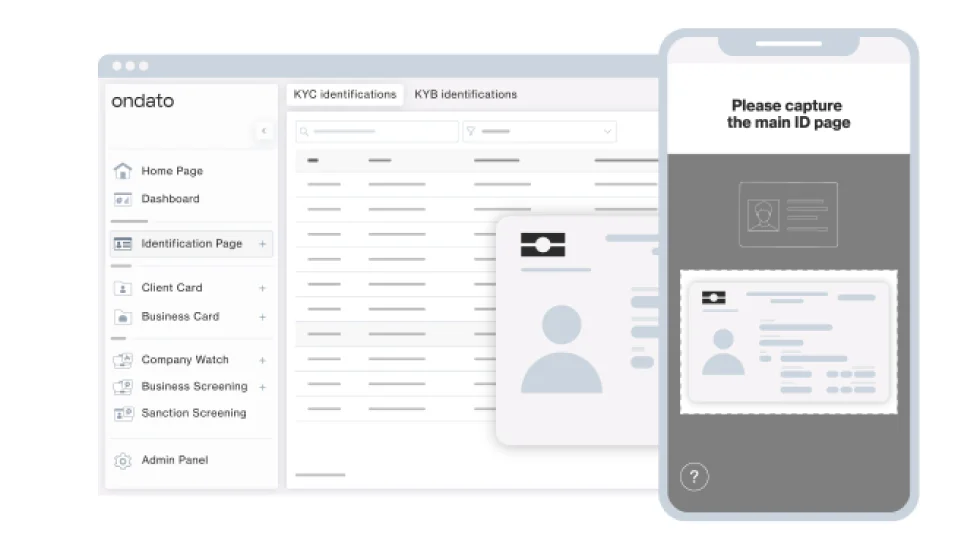

Ondato is a well-known KYC provider specializing in providing AI-powered identity verification solutions. The platform supports 10,000+ document templates and ensures compliance with advanced biometric and face-match technologies that deliver industry-leading accuracy. Ondato excels at serving businesses of all sizes, from startups to enterprises, by facilitating effortless integration and high conversion rates. The provider also prioritizes data protection, fraud mitigation, and operational efficiency throughout onboarding.

Ondato pricing

Ondato offers pricing plans starting at around $0.99 per verification, with monthly license fees varying by different plans. Custom pricing options are also available for enterprises.

Key features of Ondato

- Advanced biometric: Provides unmatched accuracy in verifying customer information which is important for maintaining strong security measures and regulatory compliance.

- Verification options: Offers flexible verification methods from automated eKYC to NFC-based identity submissions and agent-assisted video calls.

- Fraud prevention: Protects from identity fraud with measures like liveness detection, spoofing checks, and governmental registry verifications.

Pros of Ondato

✓ Users say that the platform provider helps streamline onboarding by providing access to complaint tools like identification and age verification.

✓ Businesses benefit from Stoplist features to block document submissions from known fraudsters.

✓ Users like how the provider ensures data integrity by performing detailed cross-checking of the data.

Cons of Ondato

✕ Some users report that Ondato’s sanctions/PEP checks are restrictive. This issue is particularly faced when documents are rejected without complete reasons.

✕ Businesses find the integration support for documents in Italian and Greek is limited.

3. Sumsub

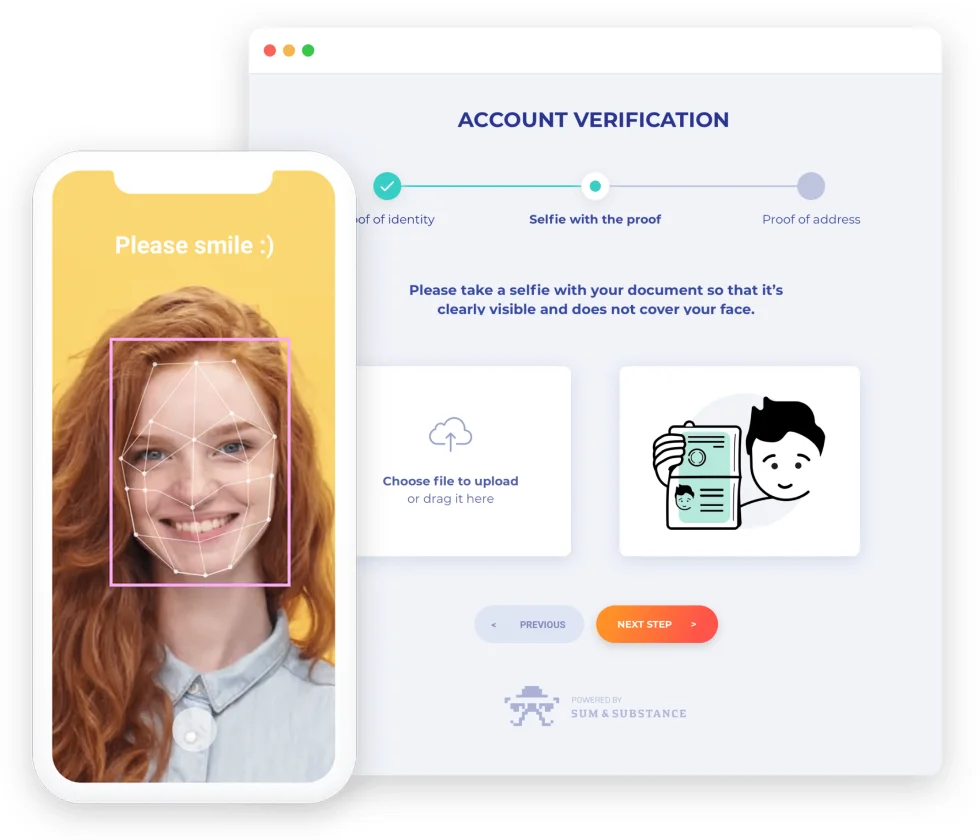

About Sumsub

Sumsub is one of the best providers offering advanced KYC software for accurate verification without requiring document uploads. Using reliable databases and geolocation, Sumsub ensures complete address verifications. Also, the software’s customizable KYC/AML flows ensure high pass rates and regulatory adherence. Sumsub simplifies KYC compliance without compromising the user experience, whether you are a fintech startup or a global enterprise.

Sumsub pricing

Sumsub offers pricing plans starting at $1.35 per verification, with monthly commitment and custom pricing options available for enterprises.

Key features of Sumsub

- Customizable verification flow: Automates decision-making process with no code to develop custom verification flow.

- Payment method verification: Securely verifies users’ payment methods to prevent fraud and ensure complete compliance. This feature checks the legitimacy of credit cards, bank accounts, and other payment options.

- AI-driven fraud protection: Protects from fraud with an advanced AI engine specializing in detecting document tampering, behavioral anomalies, and fraudulent networks.

Pros of Sumsub

✓ Businesses rely on Sumsub services for easy integration with detailed documentation.

✓ Users find the verification process easy and fast, offering flexibility for compliance levels, and document requests.

✓ Many users praise the UI of Sumsub’s web access.

Cons of Sumsub

✕ Users receive late responses from the customer support team. The answers also lack technical depth or details.

✕ Certain users report that Sumsub’s compliance team rejects KYC applicants for unfair reasons.

4. SEON

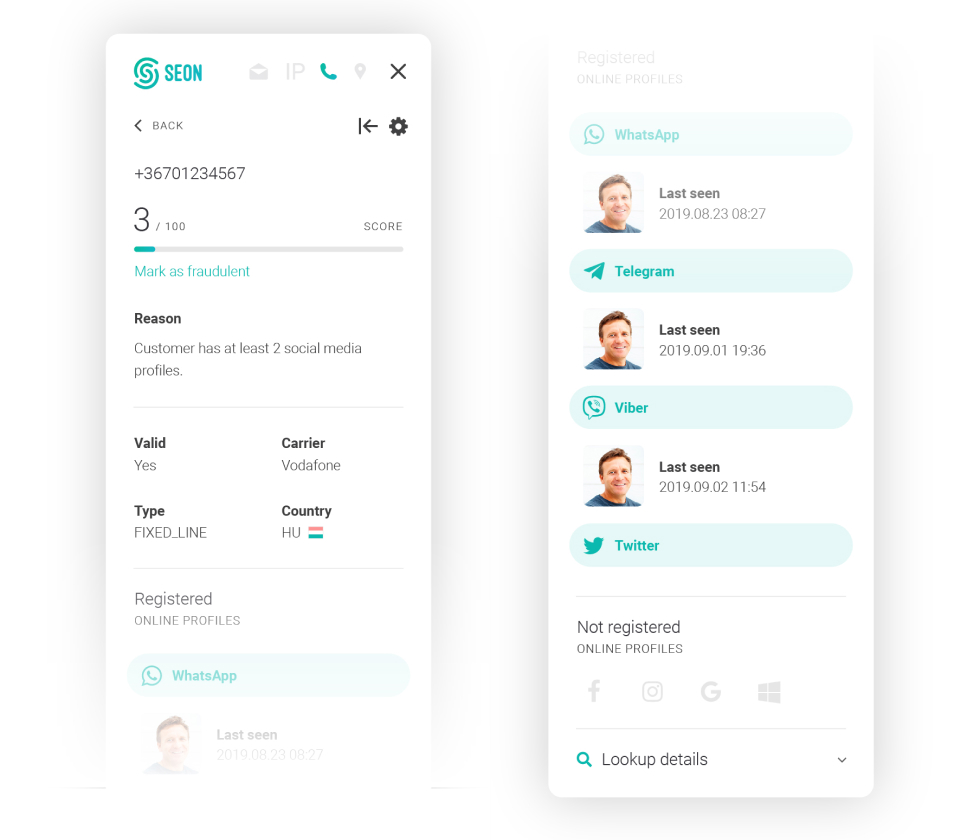

About SEON

SEON is one of the leading KYC providers that revolutionizes identity verification procedures by offering advanced fraud prevention and risk-scoring tools. The platform conducts instant analysis using real-time data from various online platforms and social media sources. SEON reduces operational costs by identifying the fraudsters before KYC checks. Such an innovative approach makes it easy for users by only requiring basic contact details like email addresses and phone numbers.

SEON pricing

Contact SEON for current pricing.

Key features of SEON

- Transactional data analysis: Conducts instant analysis using data from 90+ online platforms and social media sources to provide immediate insights into user behavior and associated risks.

- Cost-effective fraud prevention: Minimizes the need for expensive full KYC checks by filtering out fraudsters early in the verification process.

- REST APIs integration: Facilitates easy integration with REST APIs to ensure better connectivity. Also, provides complete developer documentation for easy implementation.

Pros of SEON

✓ Users find that the accuracy of the identity verification is exceptional.

✓ Users appreciate the rapid search functionality with email and access to search history.

✓ Businesses appreciate the quality of customer support SEON provides, with timely answers to diverse queries.

Cons of SEON

✕ Users report that the dashboard is not responsive enough.

✕ Certain users observe that the platform often indicates an account is linked to an email or phone number but doesn’t permit direct access.

5. iDenfy

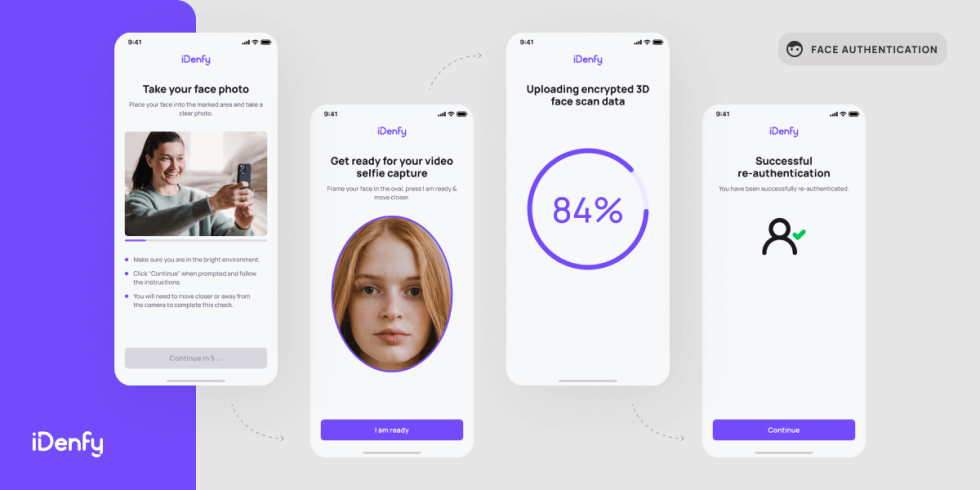

About iDenfy

iDenfy is a reliable KYC provider known for streamlining customer onboarding, backed by 24/7 human supervision. The platform provides numerous solutions like KYC, KYB, AML screening, and fraud detection. iDenfy’s easy integration and customizable workflows optimize operations and ensure regulatory compliance. With advanced AI and biometric technologies, the platform streamlines identity verification while reducing costs and improving user experience.

iDenfy pricing

Contact iDenfy to get current pricing.

Key features of iDenfy

- Global coverage: Supports identity verification from 200+ countries and territories and processes data from 3500+ government-issued documents in milliseconds.

- AML compliance: Facilitates smooth AML compliance by screening customers with global watchlists, sanctions, and PEPs.

- Advanced fraud prevention: Identifies and blocks compromised or expired documents instantly. Also, helps mitigate fraud risks with strong security measures like 3D liveness detection.

Pros of iDenfy

✓ Some users find the platform’s supportive team outstanding for helping out with the technical documentation and onboarding.

✓ Users choose iDenfy for the fully customizable approach it offers.

✓ Businesses find iDenfy’s KYC process to be quick, verifying identities in 3 minutes.

Cons of iDenfy

✕ There are instances where users face issues like documents failing to pass the checks.

✕ Users find that sometimes the systems accept identification that does not meet requirements like other people are visible when the verification process is carried out.

6. Onfido

About Onfido

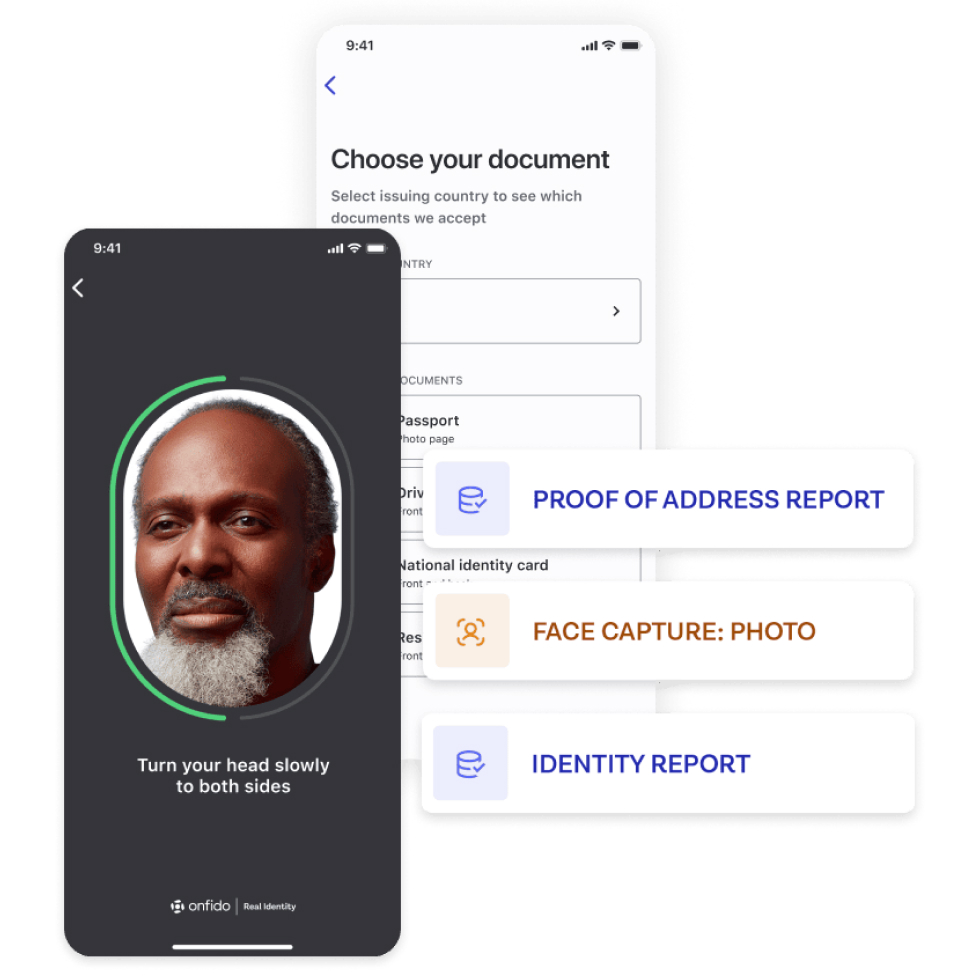

Onfido is a trusted provider known for transforming Know Your Customer (KYC) and Anti-Money Laundering (AML) processes with advanced automation. The software simplifies complex KYC requirements across 160+ countries and serves various industries, including financial services, banking, gaming, and transport. Onfido easily integrates into your workflow, from verifying identities and performing PEPs & sanctions screening to ongoing monitoring.

Onfido pricing

Contact Onfido for current pricing.

Key features of Onfido

- AI-powered identity verification: Accurately authenticates identities using intelligent algorithms for successful biometric data and carries out document verification.

- Customizable KYC workflow: Directs applicants through customized verification journeys based on risk profiles. This approach allows low-risk customers to proceed while subjecting high-risk cases to strict checks.

- Regulatory compliance suite: Ensures compliance with standards like ETSI TS 119 461 and eIDAS regulations. This supports diverse verification methods from document checks to biometric verification, without geographical limitations.

Pros of Onfido

✓ Users appreciate the stability of the solutions and the effective detection of false documents.

✓ Users find Onfido to be a better choice for KYC solutions due to easy integration of API.

✓ Some users say that the solution’s pricing is competitive.

Cons of Onfido

✕ Users face speed issues when the uploaded documents are too big.

✕ Some users get frustrated due to the limitation of supporting all the document types and repeating simple errors.

7. Trulioo

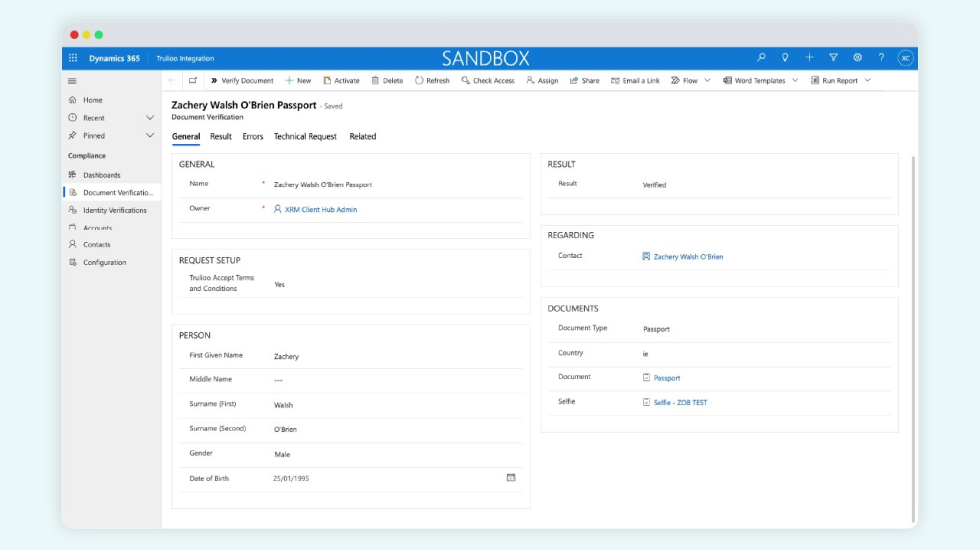

About Trulioo

Trulioo is one of the well-known providers that elevate KYC identity verification processes with its global identity verification services. The platform integrates with numerous data sources to meet diverse regulatory requirements and operational demands. Trulioo ensures high match rates and compliance without any additional contracts or resources when expanding into new markets. With a focus on security, the platform delivers a streamlined onboarding experience to develop customer confidence.

Trulioo pricing

Contact Trulioo for current pricing.

Key features of Trulioo

- Global data integration: Verifies identities globally by accessing data from 450+ partners across 195 countries to ensure in-depth coverage and compliance with local regulations.

- ID verification: Authenticates various types of documents to improve security and ensure accuracy during customer onboarding and risk management processes.

- Electronic Identification (e-ID) verification: Verifies customers using e-IDs from government and private issuers with a single integration.

Pros of Trulioo

✓ Users praise Trulioo’s identity verification in 65+ countries, which is ideal for onboarding individuals from diverse countries.

✓ Users appreciate the easy integration of Trulioo into onboarding workflows.

✓ Specifically, certain users of Canada and the USA find the software effective at providing identity verification solutions.

Cons of Trulioo

✕ Some users report the provider to be on the expensive side when compared to similar KYC products.

✕ There are instances where users encounter issues with the API documentation.

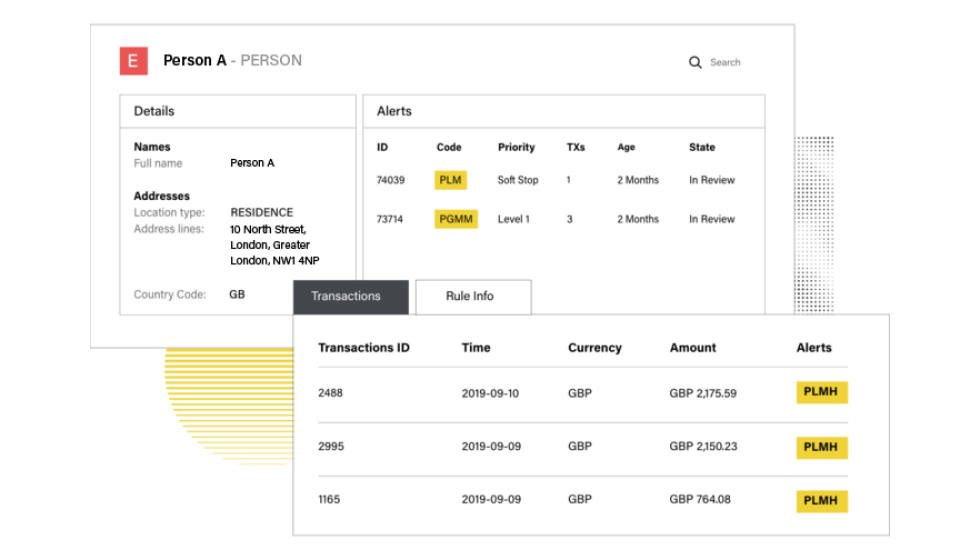

8. ComplyAdvantage

About ComplyAdvantage

ComplyAdvantage is a top-notch KYC screening solutions provider that helps mitigate financial crime risks. The platform excels at identifying PEP (Politically Exposed Person) statuses and performing risk-based monitoring. ComplyAdvantage ensures accurate data aggregation with minimal false positives by automating labor-intensive processes and using machine learning. With customizable risk profiles and dynamic alert management, the solutions help businesses make better decisions.

ComplyAdvantage pricing

Contact ComplyAdvantage for current pricing.

Key features of ComplyAdvantage

- Automated identity verification: Simplifies customer onboarding with automated verification of identity documents like passports, driver’s licenses, and national IDs.

- PEP screening: Verifies PEP status and screens for adverse media using dynamic data sources. This feature also supports customer due diligence to ensure compliance with global regulations.

- Customizable risk profiles: Adjusts risk assessment profiles to match business needs and risk levels. This feature easily integrates into your workflow to ensure efficient client risk evaluation.

Pros of ComplyAdvantage

✓ Users find the product easier to use compared to other tools available for carrying out each check at once.

✓ Users appreciate how quick their customer support team is when it comes to responding to queries.

✓ Certain users say the product is easy to integrate into your existing workflow.

Cons of ComplyAdvantage

✕ Users report that the software lacks dynamic profile settings for the same user.

✕ Sometimes, users find duplicate screening profiles appearing in the system.

9. Shufti Pro

About Shufti Pro

Shufti Pro redefines global identity verification practices through AI-powered KYC tools. These tools ensure unmatched security and efficiency in identity verification processes. The platform provided by Shufti Pro supports 150+ languages to ensure a smooth onboarding experience through real-time verification and strong security with synthetic identity fraud. Shufti Pro simplifies the KYC process with its no-code verification builder to verify identities with accuracy and stands out with a 98% customer satisfaction rate.

Shufti Pro pricing

Contact Shufti Pro for current pricing.

Key features of Shufti Pro

- Real-time verification: Provides instant identity verification results that help reduce onboarding time and improve the overall user experience.

- Synthetic identity fraud prevention: Protects from synthetic identity fraud by employing strong security measures to ensure data integrity and regulatory compliance.

- Multilingual OCR data extraction: Extracts and verifies data from identity documents to serve a global customer base.

Pros of Shufti Pro

✓ Several users appreciate the built-in verification feature to verify customer identity accurately.

✓ Users benefit from Shufti Pro’s responsive portal, which eliminates verification delays.

✓ Users consider the platform to be faster and more accurate in terms of KYC.

Cons of Shufti Pro

✕ Some businesses face issues where they have to retry verification because the system fails to accept photos on the first try.

✕ Users experienced a lag while integrating Shufti Pro’s service with other applications.

10. Jumio

About Jumio

Jumio is one of the trusted KYC providers known for its accuracy in identity verification. The platform integrates with AI and machine learning models to ensure strong fraud detection and identity verification solutions. To provide comprehensive insights and analytics for preventing fraud, the solution processes 1 billion transitions with access to 500+ global data sources. Jumio is a reliable option to streamline compliance processes, from initial onboarding to ongoing monitoring.

Jumio pricing

Contact Jumio for current pricing.

Key features of Jumio

- AI-driven identity verification: Uses advanced AI algorithms to verify identities accurately to detect fraudulent activities like deepfakes.

- Risk analysis: Obtains predictive insights into fraud risks based on behavioral data and recognized fraud patterns to ensure risk management.

- Dynamic workflow: Offers customization for risk-based workflows to facilitate faster decision-making and improve overall operational efficiency.

Pros of Jumio

✓ Users get results back in under 3 minutes using Jumio’s API.

✓ Businesses find Jumio valuable as it provides detailed status and reasons for non-validated identities.

✓ Users globally rely on Jumio for comprehensive ID verification services.

Cons of Jumio

✕ Users report that the platform provides false positive results or delivers two different results on the same ID.

✕ Some users feel that the accuracy of Jumio’s face-matching functionality is not up to the mark.

After discussing each KYC provider in detail, the important part is how you would select the right provider who aligns with your specific requirements. Let’s now discuss the entire process.

How to choose the right KYC provider

Here is the entire process of how to choose the right KYC provider.

Step 1. Define specific requirements and objectives

Understanding your specific business requirements and objectives is essential to select a provider that aligns with your goals. Here is what you need to determine.

- Define the type of KYC verification, like customer identification, enhanced due diligence, or ongoing monitoring.

- Assess the current and future volume of verifications and how the provider handles scalability.

- Specify the regions or countries where you will need identity verification services.

- Set acceptable timelines for the customer verification processes.

- Clear out the specific regulatory requirements for your industry and region.

Defining these requirements helps you choose an identity verification provider that meets your long-term needs and regulatory compliance.

Step 2. Research and shortlist reputable providers

Once you have defined your requirements, research and shortlist reputable KYC solution providers who can meet those needs. Consider the following factors when narrowing down your choices:

- Look for providers with a strong track record in your industry and assess user experiences to understand satisfaction levels.

- Evaluate the provider’s expertise in handling KYC processes that are similar to your specific requirements.

- Consider the type and size of clients the provider serves, and request case studies that reflect their expertise and solutions relevant to your requirements.

- Assess the provider’s use of advanced technologies like AI and machine learning for robust identity verification solutions.

- Check the availability and responsiveness of their customer support team.

- Verify any industry certifications or awards that indicate a provider’s credibility and reliability.

Ignoring such factors results in partnering with a provider who lacks the experience and capability to support your business.

Step 3. Evaluate regulatory compliance and security measures

Considering the different laws and regulations that govern data protection and privacy across diverse regions is essential. You must verify that the provider complies with all relevant regulations, like Anti-Money Laundering (AML) laws in the United States, the General Data Protection Regulation (GDPR) in the European Union, and the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada.

Also, evaluate the data protection policies and measures that the provider takes to protect customer’s sensitive data. Providers must have clear protocols for data encryption, access control, and incident response to protect them from data breaches and cyber threats.

Step 4. Assess technology platform and integration compatibility

To ensure that the provider easily integrates with the existing workflows, you must examine the technological capabilities. The ideal KYC solution supports easy integration with CRM, ERP, or other business tools. Also, ensure you evaluate the platform’s scalability, user interface, and automation capabilities. Such features help improve operational efficiency and easily adapt as your business evolves.

Step 5. Compare pricing models and support services

Both pricing and support are important elements that can impact your decision. Consider the following factors when evaluating pricing and support services.

- Understand if the provider offers per-transaction pricing, subscription-based models, or custom pricing plans.

- Look out for any extra fees for setup, integration, or premium support.

- Evaluate whether the pricing aligns with the available features and services.

- Check the availability of customer support, like 24/7 support options.

- Assess if the provider offers adequate training and resources for onboarding your team.

These factors influence the initial and ongoing costs of using a KYC solution provider.

| HyperVerge pro tip: Before making a full commitment, consider testing the KYC solution through a trial or pilot. This allows you to check if the solution aligns with your specific requirements and integrates smoothly into your existing systems |

Step 6. Finalize decision and plan implementation

After thoroughly evaluating and comparing potential KYC providers, it’s time to finalize the provider and start the implementation process. Ensure you have a detailed plan that includes timelines, responsibilities, and key milestones for integrating the provider’s solutions into your operations. Proper planning and a clear strategy help you maximize the benefits of the new identity verification solution and ensure compliance in your customer verification processes.

Now, let’s check out each of the benefits of using advanced KYC technology.

5 Key benefits of using advanced KYC technology

Here are the key benefits associated with advanced KYC technology.

1. Enhances security against identity theft

Advanced KYC technology ensures strong identity verification measures like biometric authentication, AI-powered facial recognition, and document analysis. These technologies improve security by making it harder for identity thieves to impersonate legitimate customers. Businesses reduce the risk of fraud and protect sensitive customer data by validating identities with high accuracy.

2. Automates and accelerates customer verification

One of the primary advantages of advanced KYC technology is its ability to automate the customer verification process. Identity verification solutions verify customers’ identities by analyzing documents, matching biometric data, and checking against global databases through AI algorithms and machine learning. This automation speeds up the customer onboarding process and improves the customer experience by reducing wait times and preventing manual errors.

3. Ensures regulatory compliance

Compliance with regulatory requirements like Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is important for financial institutions and other regulated industries. Advanced KYC technology integrates compliance checks into the verification process to ensure all the documentation is followed. Businesses can avoid fines and legal repercussions by automating compliance tasks and maintaining audit trails.

4. Reduces manual processing expenses

Traditional KYC processes involve manual labor, which leads to high operational costs and delays. Advanced KYC technology streamlines these processes by automating repetitive tasks like data entry, document review, and verification. Strong identity verification helps businesses reduce labor costs, allocate resources, and improve operational scalability without compromising on accuracy or compliance.

5. Speeds up account handling processes

Uses advanced KYC technology to accelerate account opening and management processes. Businesses can onboard new customers while ensuring prompt completion of all necessary checks. This speed enhances customer satisfaction by providing a smooth experience. Also, this helps businesses capitalize on opportunities faster, like launching new products or expanding into new markets.

Pick the best KYC provider for your business

HyperVerge excels at providing customer verification solutions and is equipped with AI technologies. The platform easily integrates within 4 hours with your existing systems or applications and carries out single verification within 3 seconds. This ensures compliance with regulatory requirements while minimizing manual efforts and customer drop-offs.

Frequently asked questions

1. What exactly is a KYC provider?

A Know Your Customer (KYC) provider offers technology solutions that help businesses verify the identity of their customers. These solutions involve using advanced AI and machine learning algorithms to authenticate identities, validate documents, and ensure compliance requirements.

2. What is the role of KYC in the FinTech industry?

KYC plays an important role in the FinTech industry by helping financial institutions and other FinTech companies verify customer identities. This verification process is necessary to mitigate risks like fraud and money laundering. Identity verification also helps build trust with customers and regulatory authorities by demonstrating compliance with legal and regulatory standards.

3. Which features to look for in KYC software?

Here are the features to look for in KYC software:

- Automated identity verification: Uses AI and machine learning for accurate and rapid identity verification.

- Document authentication: Offers capabilities to authenticate and validate identity documents like passports, IDs, and utility bills.

- Compliance integration: Easily integrates with regulatory databases to ensure compliance with AML and KYC regulations.

- Audit trail: Provides a complete audit trail for all KYC activities to ensure transparency and compliance.

- Customization: Provides flexibility to customize workflows and verification processes to fit specific business needs.

- API access: Offers APIs for smooth and fast integration with existing systems and applications.

- Data security: Uses strong data encryption and security measures to protect sensitive customer information.

4. How can businesses tackle challenges related to user verification?

Businesses can tackle user verification challenges by adopting innovative technology solutions that automate and streamline the identity verification process. This includes leveraging AI and machine learning for faster verifications, implementing strong data security measures to protect customer information, and staying updated with regulatory changes through continuous monitoring and compliance audits.

5. What are the market trends and projections for the KYC industry?

Here are the market trends and projections for the KYC industry:

- AI and Machine Learning adoption: Increasing use of AI for faster and more accurate identity verification.

- Remote onboarding expansion: Growing demand for error-free identity verification processes in digital banking and remote customer interactions.

- Biometric technologies integration: Rise of biometric methods like facial recognition for enhanced security in KYC.

- Blockchain exploration: Exploration of blockchain for secure data storage and verification to ensure transparency and efficiency in identity verification processes.