Ever worked with clients or partners who asked for detailed financial proof, like bank statements or tax returns? That’s income verification.

For businesses, this process is crucial to assess financial reliability, but traditional methods can be time-consuming and prone to errors. Manual checks, extensive paperwork, and long delays can leave both sides waiting and frustrated. Fortunately, with the rise of automated income validation solutions, businesses can modify the whole process, ensuring faster, more accurate, and more secure assessments, ultimately enhancing efficiency and customer satisfaction.

In this blog, we guide you through what is income validation and how it works, benefits, challenges, and much more!

What is income verification?

Income verification is the process of confirming an individual’s income to assess their ability to meet financial obligations. This is an essential step in various scenarios, such as loan approvals, rental agreements, and employment checks.

The primary aim of income verification is to ensure that individuals can manage additional financial commitments responsibly. By confirming income details, institutions can make informed decisions, reducing the risk of defaults.

Income verification is also a prerequisite across multiple industries to help assess an individual’s financial stability. For instance, in the lending sector, verified income data helps lenders evaluate a borrower’s capacity to repay loans (ensuring they make responsible lending decisions). In the insurance industry, income validation is important to determine appropriate premiums or coverage limits based on an individual’s earnings.

Why is income verification essential?

That’s a valid question. Income verification is crucial for the following reasons–

Regulatory compliance

- RBI

The Reserve Bank of India (RBI), mandates banks to adhere to prudential norms on income recognition and asset classification. Banks are required to create realistic repayment schedules based on borrower’s cash flows when granting loans and more.

- SEBI

The Securities and Exchange Board of India (SEBI) enforces strict regulations to promote transparency, responsible trading, and compliance with Anti-Money Laundering (AML) norms under the Prevention of Money Laundering Act (PMLA), 2002. The focus is on:

- Preventing misuse of borrowed funds or undisclosed income for illegal activities like market manipulation, money laundering, or tax evasion.

- Ensuring trading with borrowed funds is declared, and the sources are legitimate to meet regulatory standards.

- Income Tax Act, 1961

The Income Tax Act outlines penalties for non-compliance:

- Section 271(1)(c): Penalties for failing to file returns, non-compliance with notices, or concealing income can reach up to 300% of the evaded tax.

- Section 276C: Willful tax evasion can lead to prosecution, with imprisonment ranging from 6 months to 7 years.

Brokers may also request Income Tax Returns (ITRs) in the following situations:

- High trading activity: Heavy trading in Futures & Options (F&O), commodities, or currency derivatives.

- Audit reviews: Internal or external audits may necessitate ITR reviews for financial assessment.

- High leverage: Accounts with significant leverage or consistently high trade exposure.

- Audit reviews: Internal or external audits may necessitate ITR reviews for financial assessment.

- Increased exposure: Clients seeking higher trading limits or credit may need to provide updated financial documents.

- Prevention of Money Laundering Act (PMLA), 2002

As per Section 3 of the PMLA Act:

- Any involvement in the proceeds of crime, including concealment, possession, or projection as legitimate property, constitutes money laundering.

- Offenders face rigorous imprisonment of 3 to 7 years and may also incur fines.

- Enhancing trust between parties

Accurate income verification builds trust between financial institutions and clients, ensuring transparency and reliability in financial dealings.

- Fraud prevention and risk management

By confirming income sources, institutions can detect discrepancies that may indicate fraudulent activities. The Reserve Bank of India has emphasized the need for robust financial audits to identify and address such risks.

Ensure accurate, real-time assessments, and reduce manual errors

with HyperVerge’s AI-driven platform Book a demo nowMethods of income validation

Income verification has undergone a tectonic shift, courtesy of tech integration. Let’s quickly scan how income verification was done pre-tech era and how it works today –

Traditional methods

- Pay stubs and salary slips: Employers provide pay stubs or salary slips detailing an employee’s earnings, deductions, and net pay. These documents serve as direct evidence of income.

- Net worth certificates: Issued by Chartered Accounts (CA), net worth certificates summarize an individual’s assets and liabilities, offering a snapshot of their financial standing.

- Income certificates: An Income Certificate serves as proof of a person’s or family’s total annual earnings from all sources. Its issuance is managed by state-appointed authorities, which can differ across regions. Commonly, Village Tehsildars handle this responsibility, though in some states, officials like District Magistrates, Collectors, or Sub-Divisional Magistrates are also authorized to issue it.

- Employment letters: Employers may provide letters confirming an individual’s employment status and salary details, serving as proof of income.

Modern digital methods

- Bank statement analysis: Analyzing bank statements helps verify income by reviewing deposits and transactions. Automated tools can extract and analyze this data efficiently.

- Automated document analysis: Advanced AI technologies can process documents like pay slips and tax returns, extracting relevant data swiftly and accurately.

- Form 16, ITR, payslips: Digital platforms can extract and validate information from Form 16, ITR, and payslips

- Digital consent-based mechanisms: Systems like account aggregators allow individuals to consent to sharing their financial data securely, enabling real-time income verification.

How does digital income verification work?

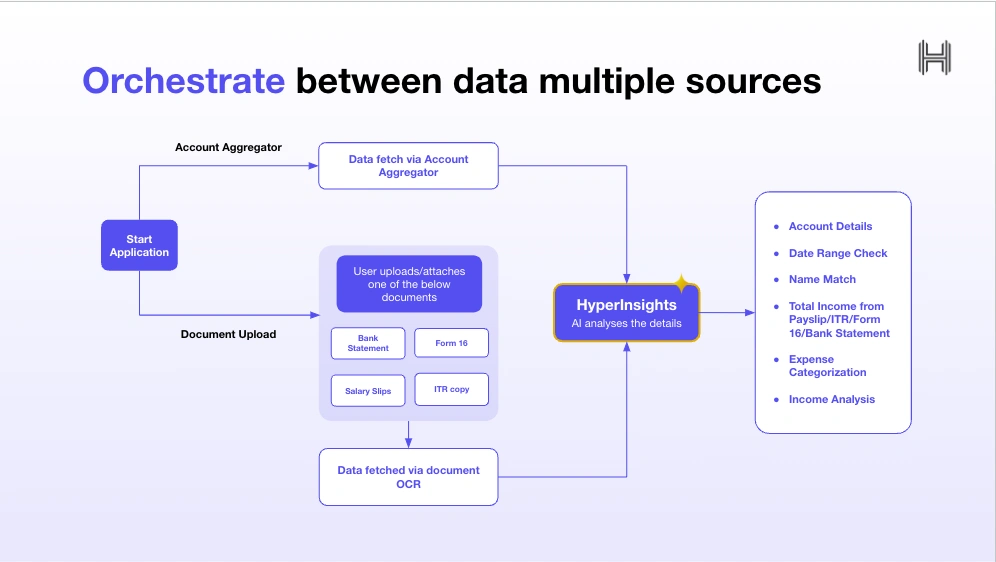

HyperVerge streamlines the process of income verification with a highly efficient, automated workflow.

Here’s how it works step by step:

1. Initiating the application

The user begins the process by either linking or de-linking their bank accounts via an account aggregator. Using their registered phone number, they receive an OTP (One-Time Password) to fetch financial data securely.

2. Consent to share information

HyperVerge emphasizes user control over data. The user grants explicit consent for the system to retrieve their financial information through a secure workflow, ensuring compliance with privacy regulations.

3. Document upload

HyperVerge supports a variety of documents to validate income, offering flexibility for users to upload their preferred proof. Accepted documents include:

- Bank statements: Users can either upload a PDF of their bank statement or fetch it via account aggregators. For optimal results, at least 3–6 months of consistent salary deposits are required.

- Salary slips: Payslips provided by the employer can be uploaded or captured. Users typically submit three months of payslips, which undergo OCR (Optical Character Recognition) and rigorous validation.

- Form 16/16A: Taxpayers can upload their TDS/TCS certificates, typically downloaded from the Income Tax website, for verification.

- ITR copy/Acknowledgment forms: Users can provide acknowledgement letters from the Income Tax Department as proof of filing. These are also downloaded from the IT website and can be uploaded to HyperVerge’s workflow for processing.

- Additional documents: Demat account holding statements and net worth certificates are also supported.

All uploads can be in PDF, PNG, or JPEG format, ensuring accessibility across platforms.

4. AI-automated advanced analysis and validation

HyperVerge’s income validation suite employs OCR and AI-powered validations to analyze uploaded documents efficiently. Advanced technology performs OCR on the uploaded documents to extract and analyze the data.

5. Income proof validation

After analyzing the document, HyperVerge verifies the user’s income proof. This process ensures the authenticity and accuracy of the data, minimizing manual intervention and reducing turnaround time.

6. Approval

Once the income proof is successfully validated, the application is approved, enabling the user to proceed with their intended financial activity.

Benefits of digital income verification

1. Speed and accuracy

HyperVerge, by allowing integration of multiple document types like bank statements, payslips, and Form 16/16A ensures quick validation. By utilizing automated OCR technology and real-time validation, businesses can remove the need for manual data entry, reduce human error, and drastically cut down processing times.

2. Efficiency

HyperVerge’s comprehensive set of tools allows businesses to validate income from multiple angles, ensuring that all forms of documentation are considered. This end-to-end validation process significantly increases efficiency, automating a typically time-consuming and error-prone task.

3. Cost-effectiveness

HyperVerge’s real-time feedback ensures higher conversion rates by immediately flagging issues with documents, like mismatches or missing details, resulting in lower operational costs.

Moreover, the system’s automated nature reduces the need for human agents, leading to further reductions in labor costs.

4. Enhanced customer experience

HyperVerge’s cross-platform capabilities allow it to work seamlessly across mobile and web SDKs, ensuring it’s accessible on any device. This level of customization for different devices ensures that businesses have a smooth experience, whether they are submitting documents from a desktop or mobile device.

5. Improved user understanding

With access to HyperVerge’s analytics and case management tools, businesses can gain valuable insights into user behaviour, such as document submission patterns and common validation issues. This data empowers businesses to make more informed decisions and improve service delivery.

6. Security and privacy compliance

HyperVerge’s digital income verification offers robust security features, prioritizing user privacy and compliance. By eliminating the need for agents to collect documents via unsecured methods like email or WhatsApp, it ensures that sensitive personal information (PII) remains protected throughout the verification process.

By leveraging HyperVerge’s platform, businesses can deliver faster, more accurate, and cost-effective income validation, all while ensuring a secure and user-friendly experience.

Challenges in income verification in India

Data privacy concerns

The rapid digitization of data has raised significant data privacy issues. Instances of data breaches, such as the leak of over 5 million customer records from Star Health, one of India’s top insurers, highlight the vulnerabilities in data security.

While the Digital Personal Data Protection Act (DPDPA) 2023 aims to strengthen data protection, its implementation faces challenges in balancing user privacy with the need for data accessibility.

Achieve 100% DPDPA Compliance and simplify your compliance journey

with HyperTrust Consent Management Platform. Schedule a DemoVariability in document formats and availability

Income verification often relies on documents like payslips, bank statements, and tax returns. However, these documents vary widely in format and availability across different sectors and regions. For example, informal workers may not have formal payslips, and small businesses might lack standardized financial statements, complicating the verification process.

Lack of digitization in certain sectors

Digitalization is spreading rapidly across India without a doubt, yet certain sectors, especially informal and rural economies, have limited digital infrastructure.

Workers in agriculture or small-scale manufacturing may not have access to digital records, making income verification methods ineffective. This lack of digitization hinders the accurate assessment of income for a significant portion of the population.

Solutions and emerging trends to address these challenges

To address these challenges, several solutions and trends are emerging:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML technologies are being employed to analyze unstructured data, such as scanned documents or images, improving the accuracy and speed of income verification processes.

- Mobile-first solutions: With the widespread use of smartphones, mobile applications are being developed to collect and verify income-related data, making the process more accessible, especially in rural areas.

- Financial inclusion programs: Indian government initiatives such as Pradhan Mantri Jan Dhan Yojana (PMJDY) aim to bring unbanked populations into the formal financial system, providing them with digital records that can be used for income verification.

Future of income verification in 2025

Income verification in India is expected to undergo a 360° transformation, driven by advancements in technology and artificial intelligence (AI).

Traditional methods are being replaced by AI-powered solutions that offer faster, more accurate assessments. These technologies can analyze diverse data sources faster, without human error to determine income levels with greater precision.

The rise of account aggregators is another positive bet, especially for the finance industry. These platforms securely collect and consolidate financial data from various institutions, enabling smooth and quick sharing with authorized entities.

The integration of AI and account aggregators is also predicted to advance financial inclusion. By providing accurate income assessments, these technologies can facilitate access to financial automation and services for underserved populations in the remotest corners of the country

How HyperVerge simplifies income verification?

HyperVerge offers a powerful income validation solution that speeds up processes with automated data validation, reducing turnaround time and fraud. Its AI-driven tools ensure fast and accurate assessments, making it ideal for businesses needing efficiency.

The platform features re-engagement tools like WhatsApp nudges to bring back users who dropped off during validation. Additionally, the analytics dashboard provides insights into user behaviour, helping businesses identify and address drop-offs.

With access to both income validation and bank statement analysis modules, HyperVerge supports a thorough approach to financial verification.

FAQs

1. What documents are required for income verification in India?

Common documents include:

- Salary statement: Last 12 months from the Drawing and Disbursing Officer (DDO) for government employees.

- For rural areas: Certificate from Block Development Officer (BDO):

- For individuals with income from agriculture, horticulture, or veterinary sources: Certificate from District Agricultural Officer (DAO), District Horticulture Officer (DHO), or District Veterinary Officer (DVO):

- Income Tax Return (ITR) or Form 16: For non-government employees.

- Proof of Address: Such as an Aadhaar Card, Passport, Voter ID, or utility bills.

2. How does digital income verification work?

Digital income verification uses electronic data to confirm an individual’s income. Businesses access information from banks, payroll services, and financial institutions to verify income levels.

3. Why is income verification necessary for loans?

Income validation ensures that loan applicants have the financial capacity to repay. It helps lenders assess the risk of default and determine appropriate loan terms.

4. What are the challenges of traditional income verification methods?

Traditional methods are slow, require manual checks and extensive paperwork, and vary in format. This can lead to delays and errors.

5. Which industries benefit the most from income verification?

Industries such as banking, finance, insurance, and real estate benefit significantly from income verification. It helps them assess creditworthiness and financial stability.

6. Is digital income verification secure in India?

Yes, digital income verification in India is secure. HyperVerge uses advanced encryption and authentication methods to protect sensitive financial data.