Fraudsters now use technology as effectively as any tech team.

Cybercrime damage in 2025 is projected to cost the global economy approximately $10 trillion, driven by sophisticated scams and the use of generative AI.

Manual reviews and simple rule engines simply cannot keep up. Ironically, old legacy and anti-fraud systems are now creating bottlenecks and blind spots for your team. Businesses need solutions that move past these limitations.

This guide helps exactly with this, breaking down the top 6 fraud detection solutions. Bonus: Check out a concrete selection checklist to help you choose the right platform for your business.

What is a fraud detection solution?

A fraud detection solution is an advanced technological system designed to identify and alert on suspicious activities that indicate fraudulent intent before they result in financial loss.

As part of the risk management stack, these solutions analyze data from user interactions, transactions, and external sources to differentiate between legitimate customers and threats.

Modern fraud detection solutions address a complex array of fraud types:

- Payment fraud: Unauthorized use of payment instruments, including card testing and stolen credentials

- Account takeover: Bad actors gaining access to legitimate user accounts

- Application fraud: Submitting false information during sign-up for services or credit

- Identity fraud: Synthetic identity creation or impersonation using stolen details.

- Scams: Social engineering attacks like authorized push payment (APP) fraud

- Mule networks: Using legitimate accounts to launder illicit funds

- Chargebacks: Fraudulent disputes leading to revenue loss and operational penalties

Types of fraud detection solutions

No single approach fits all. The right mix depends on your business model, volume, and risk tolerance.

- Rule-based systems

These are the foundational layers. You define ‘if-then’ logic (e.g., ‘flag transaction > $10,000 from a new country’). They are simple to implement and transparent, but are highly reactive. They struggle with novel attack patterns and can create high false-positive rates, blocking good customers.

- Anomaly detection and transaction monitoring

This method establishes a behavioral baseline for ‘normal’ activity, like typical login times, device usage, or spending patterns, and flags significant deviations. It’s more adaptive than static rules but can be noisy without fine-tuning.

- ML/AI-driven fraud detection

Machine learning models analyze millions of data points to identify subtle, complex patterns invisible to humans. They continuously learn from new data, adapting to evolving fraud tactics. A study by McKinsey notes AI can improve fraud detection rates by up to 90% while reducing false positives.

- Graph and network-based detection

This maps relationships between entities: users, devices, IP addresses, and bank accounts to uncover hidden fraud rings. It can identify mule networks or coordinated application fraud by revealing suspicious connections.

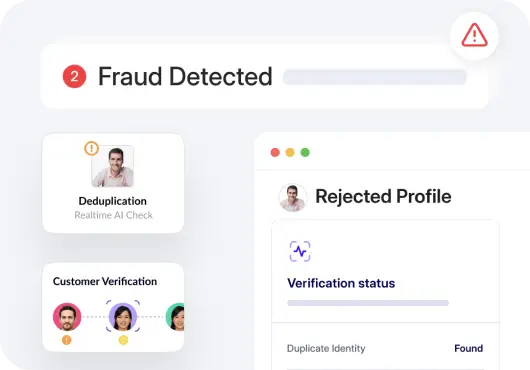

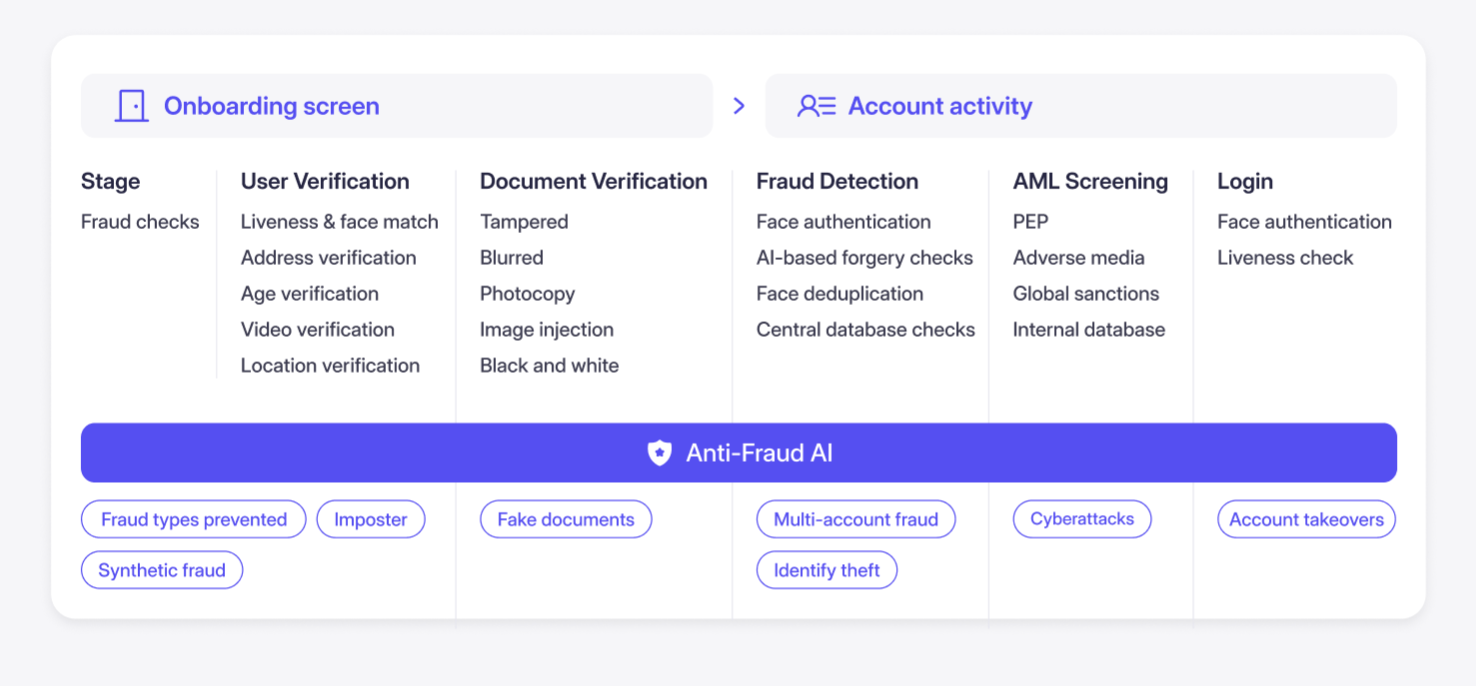

- Identity-first fraud detection (IDV + dedupe + deepfake)

This approach makes verifying the genuine existence of a user the first and most critical checkpoint. It combines identity verification (IDV), deduplication checks across your database, and deepfake detection for biometric spoofing.

- Behavioral, device, and session intelligence

This layer analyzes how a user interacts with your platform. It looks at mouse movements, keystroke dynamics, device fingerprinting, and session replay to detect bots or impersonators, even if they have stolen correct login credentials.

- Fraud orchestration platforms

These platforms integrate multiple fraud detection techniques and tools (rules, ML models, vendor scores) into a single platform. They automate the decisioning workflow, routing alerts for review and enabling a holistic risk assessment.

Buying checklist for fraud detection software

Evaluating vendors? Move beyond marketing claims. Here is your essential checklist:

Coverage and use cases

- Does it support your specific channels (web, mobile app, APIs)?

- Can it address the fraud types most critical to you (e.g., first-party chargebacks for eCommerce, synthetic identity for lending)?

Data and intelligence

- What first-party data does it analyze (transaction, user)?

- Does it integrate third-party intelligence (credit bureaus, threat feeds, consortium data)?

- How robust is its identity, device, and behavioral data network?

Detection capabilities

- Can you easily configure custom rules?

- How sophisticated are the pre-built ML models? Are they customizable?

- Does it offer graph analysis or behavioral biometrics for layered defense?

Operational capabilities

- How are alerts presented? Is there a built-in case management system for investigators?

- Can you create automated workflows to handle different risk scores (e.g., auto-approve, challenge, block)?

Platform, governance, and compliance

- What is the decision latency? It must be near-instant for customer experience.

- Does the vendor offer clear SLAs for uptime and support?

- Is the AI ‘explainable’? Can you understand why a transaction was flagged for audits and regulations (like GDPR’s ‘right to explanation’)?

- Is it built with relevant compliance (PCI DSS, SOC 2) in mind?

RFP questions to ask vendors

- ‘What is your average time-to-decision for a login or transaction?’

- ‘Can you share benchmark false-positive and fraud catch rates for businesses in our industry?’

- ‘How do you handle model retraining and adaptation to new fraud trends?’

- ‘Walk me through your platform’s case management and investigator workflow.’

- ‘Describe your implementation process and typical time to value.’

Top 6 fraud detection solutions to consider

Below, we’re exploring the top 6 fraud detection solutions in 2026 through their strengths, features, limitations, and more:

| Platform | Primary Focus | Best For | Limitations |

| HyperVerge | Automating small business lending workflows and risk decisions. | Lenders needing to automate pre-screening, underwriting, and compliance to cut decision time. | No limitations have been reported by users so far. |

| SEON | Providing modular, API-first fraud prevention with real-time data enrichment. | Startups and digital businesses seeking lightweight, customizable fraud tools for onboarding and transaction monitoring. | Complex setup and learning curve make it hard for new users to fully configure advanced fraud rules |

| ComplyAdvantage | Delivering financial crime intelligence and screening for regulatory compliance. | Enterprises in finance that require integrated AML, KYC, and ongoing risk monitoring on a single SaaS platform. | Users report occasional delays in data updates; a cluttered alert display that slows decision-making. |

| FICO (Falcon) | Detecting transactional fraud across payment channels and card networks. | Major banks and card issuers needing a proven, industry-standard system for card and digital payment fraud. | Integration with legacy systems is tricky, and the platform has a steep learning curve for new users. |

| Sify | Offering managed cybersecurity services for hybrid IT infrastructure. | Organizations needing OEM-agnostic, outsourced security operations to protect data centers, networks, and cloud assets. | Heavy infrastructure costs and limited global recognition strain finances and slow expansion outside India. |

| FeedZai | Preventing financial crime across banking channels using explainable AI. | Retail and commercial banks wanting a unified AI platform for fraud, scam prevention, and AML compliance. | Powerful features add complexity that can be hard to manage without expert administrators. |

- HyperVerge

HyperVerge is a proprietary AI platform that automates identity verification and risk analysis for lenders.

As a top fraud detection solution for banks, HyperVerge consolidates essential checks, including document parsing, liveness detection, and deepfake analysis, into one unified workflow. This integration allows financial institutions to process small-business loan applications and reach secure, automated credit decisions in minutes.

Built entirely in-house, HyperVerge’s AI technology supports rapid customization, helping more than 400 organizations reduce manual review, improve approval accuracy, and meet global compliance standards.

Strengths:

- Detects sophisticated digital forgery by analyzing image and video files for artificial manipulation, protecting against deepfake-based identity fraud.

- Verifies genuine physical presence using liveness detection to ensure a real person is applying, not a photograph or recorded video.

- Parses unstructured data from sales PDFs and bank statements with high accuracy, handling hundreds of format variations without manual templates.

- Delivers instant risk intelligence by automatically surfacing critical data like UCC liens, fraud indicators, and criminal records from complex documents.

- Orchestrates these technologies into a single, no-code workflow, letting teams deploy and modify secure onboarding processes independently.

Ready to see HyperVerge’s fraud detection in action? Book a HyperVerge demo to watch how this top fraud detection solutions in India automatically uncover hidden risk signals and cuts approval times to under five minutes!

- SEON

via G2

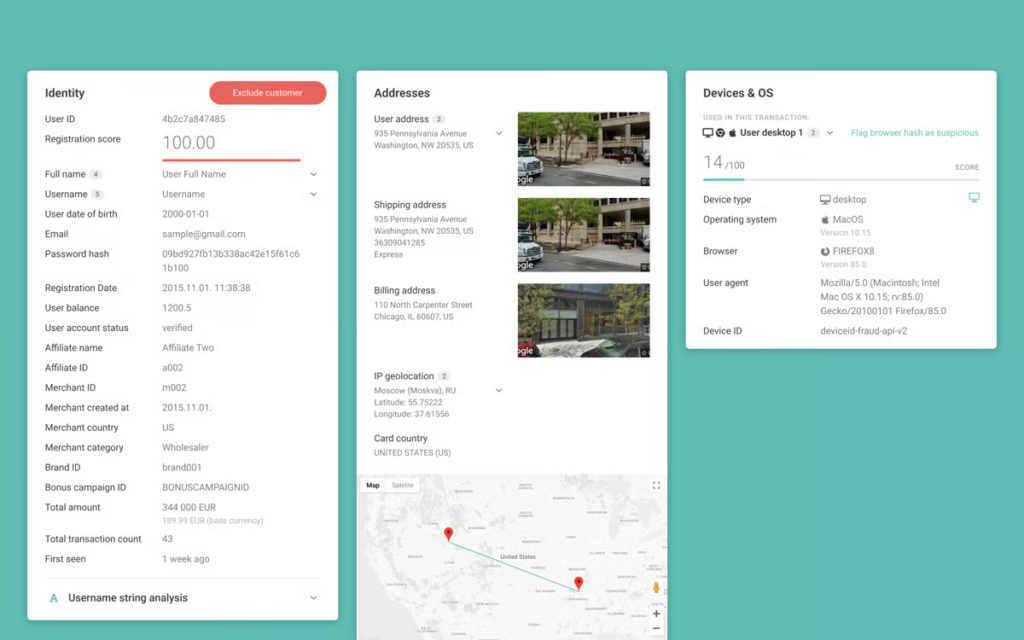

SEON offers an API-first platform that consolidates fraud prevention and AML compliance into a single system. It specializes in real-time risk scoring by aggregating and analyzing over 900 unique signals from a user’s email, phone, IP, and device. This method creates a detailed, real-time risk picture, allowing teams to customize rules and take action from one cohesive system.

Strengths:

- Supports any analysis method, from granular rules to AI models, with fully transparent and customizable decision logic.

- Achieves full operational implementation quickly, often within days, via a single API and pre-configured rules, avoiding lengthy middleware setups.

- Integrates sanctions screening, transaction monitoring, and case management to simplify compliance workflows.

- ComplyAdvantage

via G2

ComplyAdvantage, a SaaS platform for financial crime risk management, modernizes compliance by integrating customer, company, and transaction screening with ongoing monitoring.

The platform uses proprietary global intelligence data, including sanctions lists, PEPs, and adverse media, to help enterprises proactively manage anti-money laundering (AML) and other financial crime risks on a single system.

Strengths:

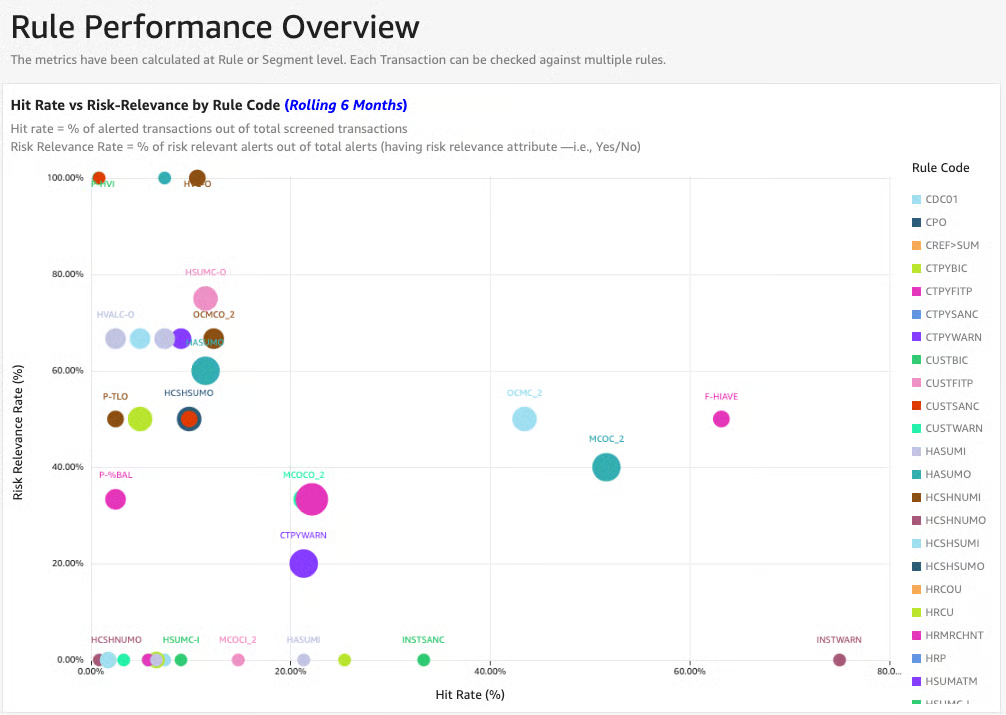

- Applies machine learning and graph analysis to transaction monitoring, identifying complex, evolving suspicious patterns that rules alone might miss.

- Leverages natural language processing to monitor adverse media in multiple languages, broadening risk detection from news and other public sources.

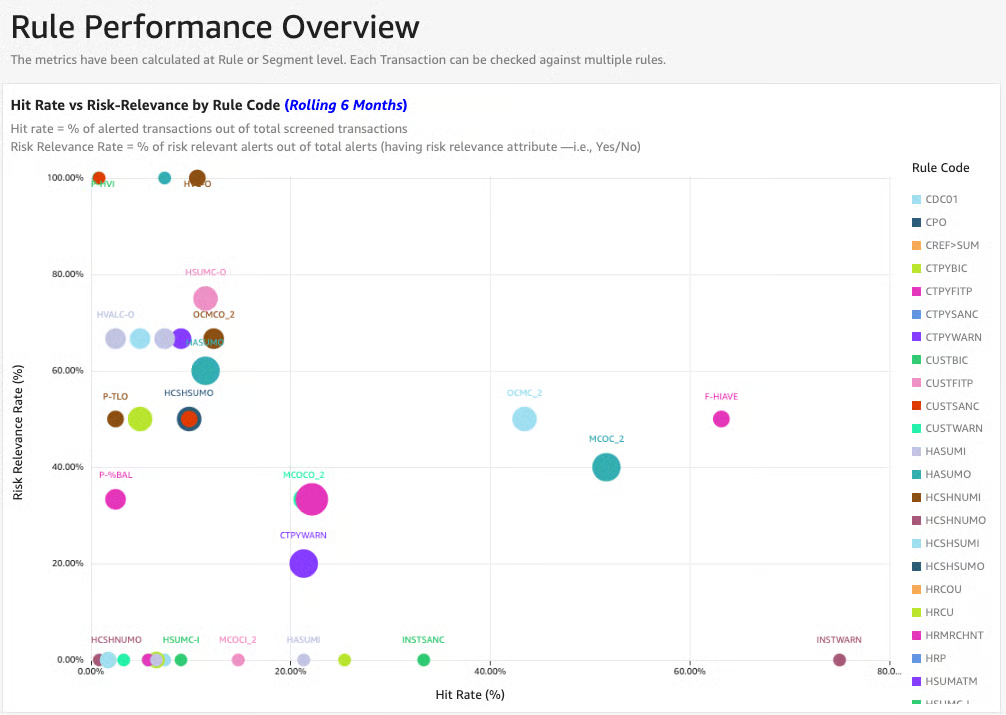

- FICO

via FICO Falcon Fraud Manager

FICO Falcon Fraud Manager is an enterprise-grade fraud detection platform. It processes billions of transactions daily, using a global consortium of data from over 10,000 financial institutions to power its machine learning models.

This payment fraud detection solution is a recognized category leader, directly protecting a majority of the world’s payment card accounts from a single, integrated platform.

Strengths:

- Offers a library of ready-to-deploy, adaptive AI models tailored for specific portfolios, regions, and emerging payment channels, such as P2P apps.

- Provides a flexible business rules engine and a configurable case management interface for analysts to define strategies and investigate alerts quickly.

- Enables proactive customer engagement through multichannel, interactive fraud resolution workflows during the transaction process.

- Sift

via Sify

Sify provides cybersecurity and managed IT services, focusing on securing modern, distributed enterprise environments. With over 20 years of experience, this fraud detection solution includes 24/7 security monitoring, vulnerability assessments, and incident response.

Strengths:

- Operates a 24/7 security operations center (SOC) with SOC 2 Type 2 certification for continuous monitoring and maintenance.

- Delivers managed detection and response (MDR) with proactive threat hunting across networks, endpoints, and multi-cloud setups.

- Performs comprehensive vulnerability assessments and penetration testing for applications, infrastructure, and cloud assets.

- FeedZai

via G2

Feedzai is an AI-driven platform focused solely on financial crime prevention for banks, payment processors, and government agencies. It uses machine learning to analyze behavioral and transactional data, aiming to block fraud, scams, and money laundering in real-time.

The platform is designed to secure various payment types and channels while minimizing disruption to legitimate customer activity.

Strengths:

- Employs graph-based machine learning and behavioral biometrics to build individual customer risk profiles.

- Provides explainable AI (XAI) outputs to maintain transparency for compliance and auditing requirements.

- Unifies detection for transaction fraud, scams, and anti-money laundering (AML) on a single operational platform.

How to choose the right fraud detection solution for your business

Choosing the right anti-fraud solution is not as easy as it may appear. It’s truly about re-engineering your risk processes to be both secure and efficient.

Now, most legacy systems struggle with manual PDF reviews, slow risk report analysis, and disjointed checks that let fraud slip through. HyperVerge addresses this by functioning as an all-in-one AI-powered risk intelligence platform; here’s how:

- At onboarding: Its identity verification and deepfake detection ensure the applicant is real, performing instant KYC and deduplication checks.

- During analysis: The platform automatically parses bank statements and sales PDFs (regardless of format) to detect hidden risk patterns, inconsistencies, and fraudulent financial documents.

- In risk assessment: It surfaces critical fraud signals, criminal records, and more from complex risk reports using LLMs, moving beyond simple rule-based flagging.

- Across the workflow: HyperVerge orchestration layer unifies these checks into a single, no-code workflow. This means fraud detection is uninterrupted from application to disbursal.

The data speaks to the impact: businesses using HyperVerge have seen fraud rates drop by 89% while boosting auto-approval rates by 340%, because the system accurately separates good applicants from bad. It reduces the manual review burden by over 50%, allowing risk teams to focus on truly complex cases.

Want to test HyperVerge’s system for your business? Click here to book a quick demo.