Money laundering is one of the major issues in the US. According to recent reports, approximately $300 billion is laundered annually through the United States. AML compliance laws are regulations meant to detect and prevent money laundering and terrorist financing activities.

Companies must verify customers and monitor transactions to meet legal requirements. Non-compliance can lead to severe penalties and reputational damage. To avoid severe penalties, institutions must know about anti-money laundering laws in the US and effective AML solutions. Here’s a simple guide for you.

What is Anti-money Laundering (AML)?

Anti-money laundering (AML) is a regulation to prevent criminals from laundering money. It involves identifying and reporting suspicious financial activities to prevent money laundering and terrorism funding.

AML Laws affect many industries, but they hit financial institutions hardest. Banks, investment firms, credit unions, banking agencies, and other financial entities must verify customer identities. They must monitor transactions for suspicious activity and inform regulatory bodies.

Related:

- A Definitive Guide to AML Compliance

- Anti-Money Laundering Checks Explained: Everything You Need to Know

- What are the AML red flags?

Anti-money Laundering Laws and Regulations in the US

Here’s a list of AML laws and regulations applicable in the United States of America to combat money laundering:

1. Bank Secrecy Act (BSA)

The Bank Secrecy Act (BSA) is an important part of AML laws in the US. The BSA was established in 1970; its primary purpose is to detect and prevent money laundering and other financial crimes. The Bank Secrecy Act requires financial institutions to maintain records and file reports. Key provisions of the Bank Secrecy Act include:

- Financial institutions must file transaction reports for cash transactions over $10,000 within a single day. They must verify personal conducting transactions and maintain appropriate records of transactions. They should keep copies of checks over $100 and maintain records for international transactions and wire transfers for at least five years.

- The financial institution must file Suspicious Activity Reports (SAR) for any transactions (or pattern of transactions) that appear suspicious. It ensures continuous monitoring of transactions to report suspicious transactions.

- Customer Identification Program (CIP) must be implemented by a financial institution to identify its customers. It helps ensure true identity and monitor customer transactions more effectively.

2. USA Patriot Act

After the horrifying incident of Sept 11, 2001, the USA PATRIOT Act (Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act) was implemented in response to terrorist attacks.

It expanded law enforcement authority to combat terrorism and introduced measures to strengthen AML efforts. Here are some of the expanded provisions:

- Enhanced Surveillance and Monitoring: This section of the act expanded the ability of law enforcement and intelligence agencies to investigate financial transactions. The Treasury can demand “Special Measures” from financial institutions for countries whose financial transactions are seen as significant money laundering risks.

- Section 314 (Information Sharing across institutions): This provision had two important components.

- Section 314(a): It allowed financial institutions to share information regarding possible money laundering and terrorist activities with other financial institutions.

- Section 314(b): It allowed the information to be shared between government agencies and financial institutions.

- International money laundering abatement and financial anti-terrorism act: This specific section directly addresses the Anti-money laundering laws deficiencies.

- Customer Identification Program (CIP): Financial institutions must implement reasonable procedures to identify and verify their customers.

- Customer Due Diligence: To maintain customer relationships, financial institutions must verify customer identities, including those of legal entity owners, using Customer Due Diligence (CDD).

- Enhanced Due Diligence (EDD): Institutions are required to employ EDD for high-risk accounts (operated by a foreign bank).

- Suspicious Activity Reports (SAR): Reports should be filed against banks, broker-dealers, and other entities with suspicious activities.

Related reads:

- What is customer due diligence?

- What is enhanced due diligence?

3. The Money Laundering Control Act (MLCA)

It is a federal law introduced in 1986 in the US. It ensures that US financial institutions follow the right rules for counter-terrorism activities.

4. Anti-money Laundering Act (AMLA) 2020

One of the most important developments for AML laws in recent years is the Anti-money Laundering Act of 2020. AMLA made various changes in AML intended to strengthen the United States regulations. Here are the key provisions of AMLA:

- Ownership Reporting: US businesses must disclose their beneficial owners to the Financial Crimes Enforcement Network(FinCEN).

- Reforms to BSA Penalties: AMLA has introduced new criminal BSA violations to Title 31. It prohibits politically exposed persons(PEPs) from knowingly or attempting to hide, falsify, or misrepresent from or to financial institutions about ownership or assets involved in monetary transactions.

- Expanded Whistleblower Rewards: AMLA has expanded rewards and protections for whistleblowers. The reward amount depends upon information provided by the whistleblower, degree of assistance, and interest in deterring violation.

- Increased Information Sharing: Financial institutions can now rely on AML and BSA-related information. Three years of study are required on the impact of information sharing on AML/CFT by both FinCEN and Treasury.

- Expanded Regulations and Subpoena Powers: AMLA now permits financial institutions to exchange data-related money laundering and BSA regulation with their affiliates, including cryptocurrencies. AMLA has now expanded subpoena powers and allows law enforcement agencies to subpoena any information from foreign banks with financial accounts.

Recent Developments and Global Compliance Updates

In a recent update, the EU has introduced stricter measures to combat financial crime. Key changes include expanding the list of obligated entities to encompass the crypto sector, luxury goods traders, and professional football clubs, with requirements for due diligence on transactions exceeding €1000.

Additionally, enhanced due diligence measures are mandated for dealings with high-risk countries identified by the FATF. Cash payment limits are set at €10,000 across the EU, with flexibility for member states to impose lower limits, while supervision and AML risk assessment will be enforced through a risk-based approach. These measures aim to fortify AML efforts and curb money laundering activities within the EU.

The agreement also mandates enhanced due diligence for cross-border correspondent relationships in the crypto-asset sector and business dealings with high net-worth individuals handling significant assets.

AML Authorities of the US

In the US, many government agencies handle the AML/CFT process. These agencies monitor, report, and regulate transactions to ensure transparency and security. Some of the primary AML authorities in the US include:

- Financial Crimes Investigation Network (FinCEN): FinCEN is a part of the US Treasury. FinCEN makes sure that banks and other financial institutions follow the rules. It helps financial institutions like banks, insurance companies, and brokerages monitor, screen, and report transactions.

- Office of the Comptroller of the Currency (OCC): The OCC supervises national banks and federal savings associations, ensuring they follow regulations. It enforces the BSA and oversees AML/CFT measures in financial institutions.

- Financial Action Task Force(FATF): The FATF Recommendations help countries worldwide fight organized crime, corruption, and terrorism by tracking criminals’ money from activities like drug trafficking and human trafficking. They also work to cut off funds for weapons of mass destruction.

- Office of Foreign Assets Control (OFAC): OFAC is a US government agency that oversees and enforces economic and trade sanctions against specific foreign countries, individuals, and organizations.

- Specially Designated Nationals (SDN): The SDN list comes under the regulations of the OFAC. It is an individual, entity, or organization considered harmful to the security of the United States. An SDN may be involved in criminal activities such as terrorism, narcotics trafficking, or weapons proliferation.

How to Remain Compliant?

A good compliance program is important for businesses to follow AML regulations and avoid financial crimes like money laundering and terrorist financing. Here are the key components of good AML compliance programs:

Risk Assessment

Risk assessment involves identifying, assessing, and mitigating potential risks to a business. This process includes several steps, including PEP screening, adverse media checks, and sanction screening.

- PEP Screening: Screen customers against PEP lists to identify persons who may pose higher risks due to political connections.

- Adverse Media Screening: Monitor news sources and reports for negative information about specific customers with higher risk.

- Sanctions Screening: Regularly screen customers and transactions against sanction lists to ensure compliance with economic and trade sanctions.

Developing Internal Policies and Controls

Developing internal policies and controls ensures business operations follow AML laws and helps understand program effectiveness. This involves implementing procedures such as customer identity verification, transaction monitoring, and periodic evaluations of the AML process.

- Customer Identity Verification: Create a procedure to identify and verify customers using a reliable source of information.

- Transaction Monitoring: Implement a real-time transaction monitoring system to monitor suspicious activities.

- Periodic Evaluations: Regularly review and update your AML processes and controls to address evolving risks. It may involve conducting internal audits or assessments.

Recordkeeping and Reporting

To remain compliant, businesses must prioritize recordkeeping and reporting, especially concerning Suspicious Activity Reports (SARs). When suspicious transactions or activities are detected that may indicate potential money laundering or terrorist financing, must file SARs with the appropriate authorities, such as FinCEN.

What Happens if You Fail to Follow AML Regulations?

Failing to be compliant with AML regulations can lead to significant penalties. There are two types:

Criminal Penalty

The maximum criminal penalty for BSA-related violations is $250,000 and imprisonment for up to five years. However, if the violation is part of a repeated pattern involving over $100,000 in a year and also breaches another US criminal law, the penalty increases to $500,000 and imprisonment for up to 10 years.

Civil Penalty

The maximum civil penalty for BSA-related violations can vary. For instance, federal banking regulators can impose penalties ranging from $5,000 per violation to $1,000,000, or 1% of the assets of a financial institution, whichever is greater, for each day the violation continues.

Read more about money laundering:

- What are the three money laundering stages?

- What is layering in money laundering?

- What is a money mule?

- What is Trade Based Money Laundering (TBML)?

- What is Smurfing and How You Can Prevent it Proactively

Stay Compliant with Effective AML Solutions

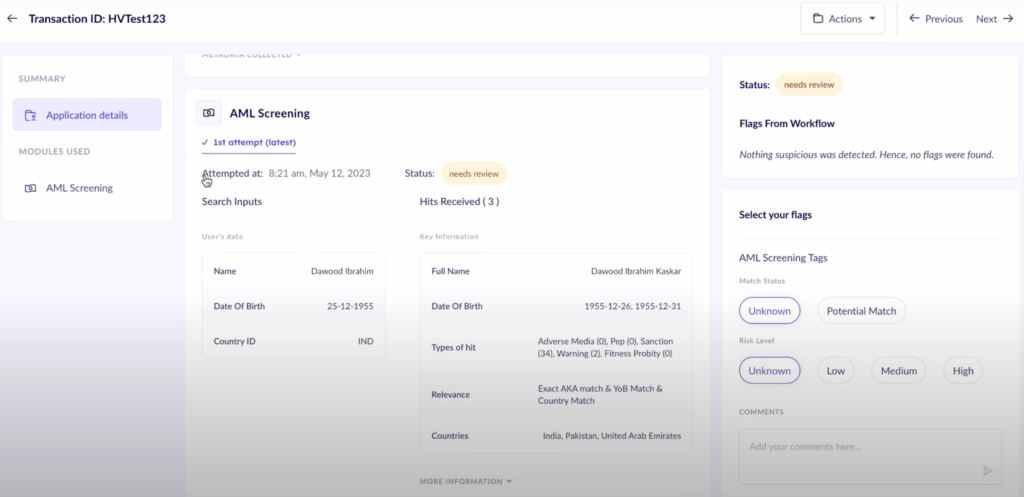

We’ve got you covered with our AML software! At HyperVerge, We help businesses stay safe from financial crime and meet regulations. With features like customer identification, transaction monitoring, global sanctions checks, PEP screening, and adverse media checks, we take away all your AML compliance headaches.

Visit HyperVerge to discover how we can help your business stay compliant. Ready to see our solutions in action? Sign up for a demo today.