Protecting the financial system from illicit activities requires vigilance. United Nations statistics show $800 billion to $2 trillion, or 2-5% of global GDP, gets laundered yearly. Comprehensive identity verification and AML checks are key for these companies to shelter themselves and the monetary routes we all rely on.

In this blog, we will uncover everything you need to know about AML checks. We will discuss why they matter and how they can shape financial security going forward.

What are Anti-Money Laundering Checks?

Ensuring the legitimacy of financial dealings is crucial for upholding integrity in the monetary exchange. AML checks are a piece of a more extensive strategy against unlawful cash use, including various parts like client due steadiness, following exchanges, and hazard appraisal. Let me separate the destinations of examinations against illegal cash use into more clear subareas to improve comprehension.

Detecting and Reporting Suspicious Activities

An important goal for checking against anti-money and money laundering regulations is to find and report any suspicious financial activities. This means closely watching what customers do with their money to see patterns that are unusual, which may show money laundering. Financial groups use things like transaction monitoring to help with this process automatically.

Compliance with Legal and Regulatory Requirements

Financial institutions must comply with AML laws such as the Bank Secrecy Act (BSA) and adhere to guidelines set by bodies like the Financial Action Task Force (FATF). These regulations mandate the implementation of effective AML measures to prevent financial crimes. Non-compliance can result in severe legal consequences.

Customer Identity Verification

Verifying identity as part of anti-money laundering (AML) screening involves validating the authenticity of a customer’s documents and details. Correct identity verification is key to stopping criminals from employing false or taken identities for unlawful financial acts.

Read more: What is a customer identification program (CIP)?

Why are AML Checks Necessary?

For banking, financial services, and insurance companies, preventing money laundering is essential for keeping the financial industry running properly. Recent numbers and events in the United States emphasize just how crucial anti-money laundering measures are, especially for those in the BFSI sector. By screening for illicit cash flows, these checks uphold the trust and steadiness of monetary systems. Without such oversight, criminal enterprises could more easily exploit finances to further unlawful aims.

AML checks are crucial for several reasons:

- Money laundering inspections assist in finding and avoiding cash laundering acts, which can have far-reaching effects on the economy and public safety. In 2022, the United States saw substantial money laundering enforcement steps, showing the continuous initiatives to battle financial crimes.

- Regulatory Adherence: Financial establishments are obliged to follow rules like the Bank Secrecy Act (BSA), USA PATRIOT Behave, FATF Suggestions, and the Anti-Cash Laundering Act (AMLA). These rules necessitate distinct AML steps to find and report dubious activities.

Protecting the Financial System

AML checks are vital for protecting the financial system from being exploited for illicit activities. They help maintain the economy’s stability and safeguard society from the impacts of financial crime. Effective AML measures, including customer due diligence and transaction monitoring, are essential in this regard.

Enhancing Customer Trust

Implementing robust AML checks also enhances customer trust in financial institutions. Customers are more likely to engage with institutions that demonstrate a commitment to preventing financial crime, which is crucial for maintaining a stable customer base and attracting new business.

Are AML Checks Part of the KYC Process?

When it comes to banking and finances, recognizing how anti-money laundering (AML) examinations link to the know your customer (KYC) procedure is essential. Even though these are separate processes, AML and KYC are very much interrelated. AML reviews play a really important part in how KYC works overall.

KYC is the process through which financial institutions verify the identity of their clients. It’s a fundamental component of customer due diligence, ensuring that financial services are not misused. AML, on the other hand, encompasses a broader set of regulations and procedures aimed at preventing money laundering and terrorist financing.

AML Checks in KYC: A Closer Look

- Identity Verification: The first step in both AML and KYC is to verify the identity of the client. Identity verification solutions are employed to authenticate personal documents and information provided by the client.

- Risk Assessment: AML checks involve a thorough risk assessment of the client as part of the AML compliance process. Financial institutions analyze various factors such as the client’s occupation, transaction patterns, and geographic location to assess the level of AML risk they might pose.

- Ongoing Monitoring: Financial institutions continuously monitor client transactions for any suspicious activities as part of their AML transaction monitoring systems. This ongoing monitoring is essential to ensure that any potential risks are identified and addressed promptly.

Read more: KYC and AML: Key Differences and Best Practices

When is it Necessary to Perform AML Checks?

In the United States, the necessity to perform Anti-Money Laundering (AML) checks is not just a best practice but a legal requirement in certain situations. Understanding when these checks are mandatory is crucial for financial institutions and other entities to ensure compliance with AML regulations.

Here are some situations mandating AML Checks:

- Welcoming New Customers: For financial institutions, bringing on fresh patrons requires important security checks. This comprises recognizing your client (KYC) procedures where the organization affirms the customer’s character and evaluates their risk. Throughout the KYC interaction, establishments ensure they welcome every new face properly while shielding present clients and themselves from potential issues.

- Substantial Financial Exchanges: Under the provisions of the Bank Secrecy Act (BSA), monetary foundations should direct Anti-Money Laundering (AML) checks for exchanges surpassing a particular edge. Normally, this includes exchanges exceeding $10,000 if led utilizing hard money. The law necessitates that budgetary foundations very much dissect exchanges of a huge worth and report any dubious movement to shield law implementation.

- Suspicious Activity Reporting: When a financial institution notices strange or questionable behavior in a customer’s account, they are required to conduct anti-money laundering reviews. This kicks off the steps involved in submitting a Suspicious Activity Report (SAR) to the Financial Crimes Enforcement Network (FinCEN), also known as SAR Reporting. The reviews are meant to determine if the activities match any illicit patterns and require disclosure.

- International Transactions: For transactions involving foreign entities or cross-border transfers, AML checks are necessary. This is in line with the FATF recommendations and the USA PATRIOT Act, which require enhanced due diligence for international transactions.

- At-Risk Individuals: Financial institutions need to conduct anti-money laundering reviews on clients considered high-probability for issues. This incorporates politically presented people, those with a past filled with monetary wrongdoings, or citizens from nations known for corruption or cash laundering. Careful screening is essential to assure assets are from genuine wellsprings and to forestall any debasement or criminal designs.

- Continuous Customer Relationship Tracking: Money laundering checks are not a single event need. Financial organizations must carry out ongoing observation of their customer relationships to recognize any modifications in habits that could point to cash laundering or other financial offenses.

What Information is Required for AML Checks?

Getting key facts from customers is important for checking that money is not dirty. Wrong or missing facts can mess up the money checking steps. This could cause problems following rules like the Bank Secrecy Act and the USA PATRIOT Act. It also raises the risk that bad people use the bank to clean dirty cash. Let’s take a closer look at the important facts usually needed.

- Identifying Customer Information: This includes the customer’s full name, date of birth, and home address. Identity checks frequently need official records like passports, driver’s licenses, or other IDs released by the government to confirm these important specifics. A person’s job and how they earn money are important to know. This information can help determine how risky a customer might be and if they could be using money in illegal ways. Understanding an individual’s occupation and income source is key when assessing situations fully.

- Understanding Business Dealings: Companies working with financial institutions must comprehend the nature of their operations. This incorporates recognizing the kind of exchanges typically made. Such data is fundamental for observing monetary exchanges and guaranteeing they stay inside anti-illegal tax avoidance directions.

- Banking and Financial Records: Details of the customer’s banking history, including account numbers and the history of previous transactions, are collected to monitor any unusual or suspicious activities.

- Purpose of the Account or Transaction: Financial institutions also inquire about the intended use of the account or the purpose of specific transactions. This is part of customer due diligence.

- Politically Exposed Persons (PEP) Status: Customers are asked whether they are or are closely associated with a PEP. This is because PEPs are considered higher risk for potential involvement in money laundering due to their position and influence.

- Geographic Information: Information about the customer’s country of residence and other geographic details related to their activities can be relevant, especially in the context of the FATF travel rule.

- Expected Account Activity: Financial institutions often require information about the expected level and nature of activity in the account to establish a baseline against which to identify suspicious activities.

Step-by-Step Process for AML Checks

Anti-Money Laundering checks have several stages. Let’s review briefly each main part of the process.

1. Developing a Robust AML Program

First, create a thorough plan to prevent money laundering. This means writing rules and processes that follow laws like the Bank Secrecy Act and USA PATRIOT Act. Consider things like who the customers are, what services are offered, and where it is located. A strong plan to stop money laundering is key for all later anti-money laundering work.

2. Customer Due Diligence (CDD)

CDD means making sure we understand details about customers like their name, business, and why they want an account. This helps us find customers who might be more risky. It also helps us watch customers to spot anything strange. Customer due diligence is how we set up what is normal for each customer’s actions.

3. Enhanced Due Diligence (EDD)

For higher-risk customers, Enhanced Due Diligence (EDD) is necessary. EDD involves deeper scrutiny of the customer’s activities and is particularly important for those with higher risk profiles, such as politically exposed persons (PEPs) or individuals from high-risk countries. EDD measures may include more detailed background checks and closer monitoring of transactions.

4. Suspicious Activity Reporting

Financial institutions must remain watchful for questionable behavior when overseeing customer accounts. If any suspicious conduct is noticed during continuous supervision, these organizations are obliged to submit a Suspicious Activity Report (SAR) to the appropriate administration. Submitting a SAR is a legitimate necessity and a pivotal advance in cautioning law authorization about potential money laundering or terrorist subsidizing exercises.

5. Ensuring Compliance with Legal and Regulatory Requirements

Money laundering checks have to make sure everything follows the law and rules. This means obeying the rules made by groups that watch money like FinCEN. It also means following the standards made around the world by groups like the Financial Action Task Force.

6. Periodic Audits

Periodic audits assess the adequacy of the AML policies and procedures, the effectiveness of the CDD and EDD processes, and the efficiency of the transaction monitoring systems. Regular audits help in identifying areas for improvement and ensuring ongoing compliance with AML regulations.

Solutions to Implement AML Checks

Implementing effective Anti-Money Laundering (AML) checks is crucial for financial institutions to comply with regulations and prevent financial crimes. Here are some key solutions that can be integrated into AML strategies.

Transaction Monitoring

Financial organizations keep a close watch on customer transactions to spot unusual or suspicious activities. This monitoring solution tracks suspicious transactions, as they occur in real-time or on a periodic schedule. It flags any deals that differ from a customer’s normal spending patterns, allowing for early identification of possible money laundering or terrorist financing. Staying aware of transaction patterns helps ensure lawful use of accounts.

Risk Assessment

Gaining a comprehensive understanding of potential money laundering risks is essential for recognizing and addressing issues connected to clients, offerings, and activities. This requires reviewing elements like customer history, transaction kinds, and geographic areas to decide the degree of money laundering risk and apply suitable preventive actions.

Read more:

- AML risk assessment process: a step by step process

- What are the AML red flags?

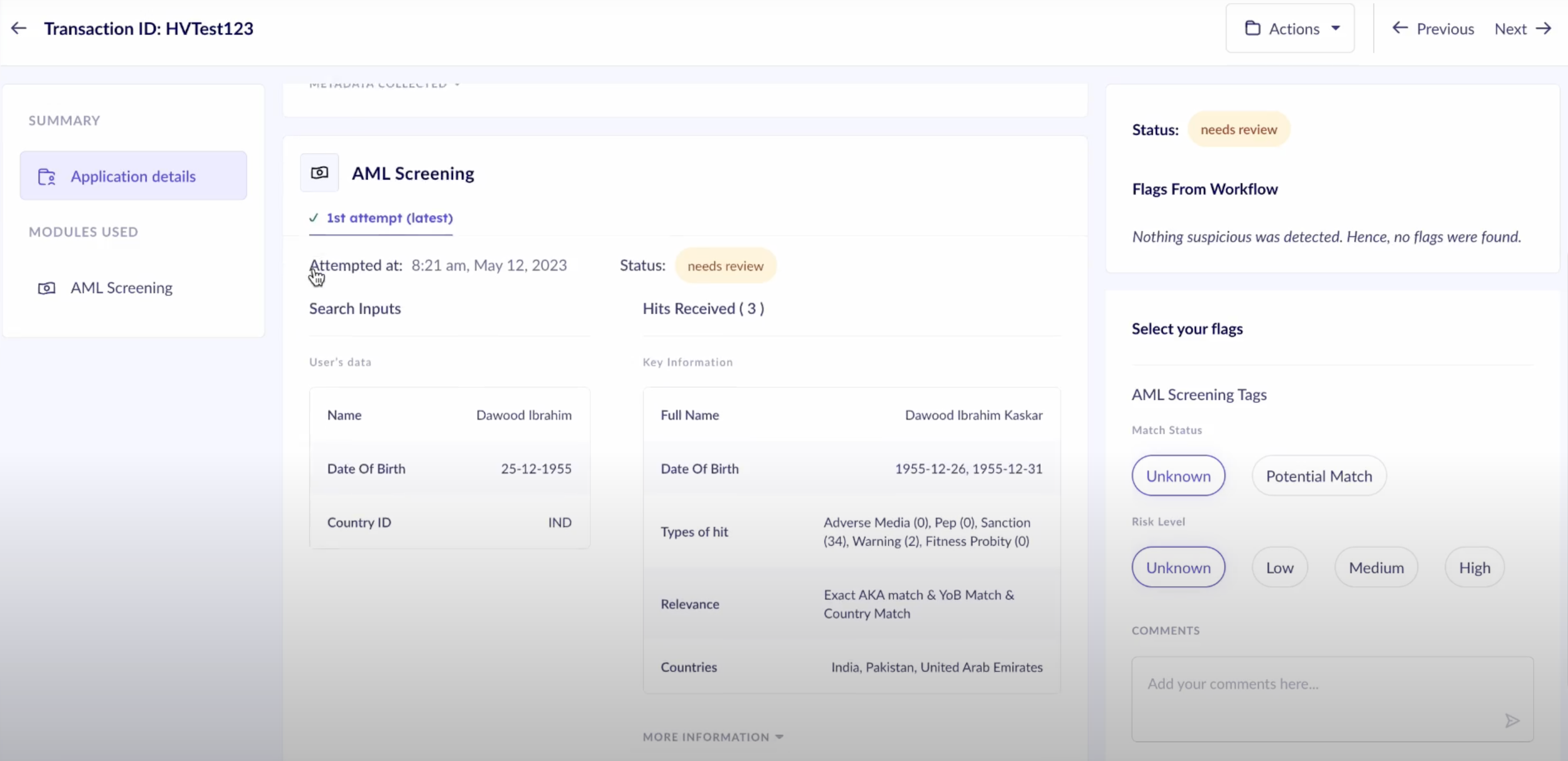

Screening and Watchlists

Looking at customer details and matching them with different local and global lists is what screening and watchlist checks are about. These lists can have names of people with sanctions, PEPs, and other risk-prone groups. Doing these checks helps make sure the organization doesn’t unknowingly help people or groups that take part in financial wrongdoings.

Read more:

- What is Sanctions Screening?

- What is PEP screening?

- What is Adverse Media Screening: A Step-by-Step Process

Elevate Your AML Compliance with HyperVerge

HyperVerge’s advanced AML solutions provide an unparalleled blend of efficiency and compliance, revolutionizing the way financial institutions approach AML checks. With cutting-edge AI and machine learning technologies, we automate AML compliance seamlessly.

Sign Up to tread the first step towards a safe, compliant future.