Businesses must employ Customer Due Diligence (CDD) as part of the Know Your Customer (KYC) process to combat money laundering and terrorist financing, prevent financial fraud, and comply with Anti-money laundering (AML) regulations. It is important to conduct CDD before establishing a business relationship or conducting a transaction on behalf of a new client.

Based on the risk-based approach, there are different types of customer due diligence processes: Simplified Due Diligence for low-risk customers, Standard Due Diligence for medium-risk customers, Enhanced Due Diligence for high-risk customers, and Ongoing Due Diligence.

This article will guide you through the Simplified Due Diligence process, explaining its steps, when necessary, and the best solutions for your business.

About Simplified Due Diligence

The simplified due diligence process is used for customers with lower risk factors for committing financial crimes like money laundering or fraud. Conducting simplified due diligence checks using a risk-based approach helps financial institutions and businesses save both time and money while complying with regulatory disclosure requirements and with anti-money laundering (AML) regulations.

It includes gathering essential information about the customer or transaction, such as their name and contact details. SDD may also take specific measures that involve verifying the customer’s identity and checking their name against sanction lists.It’s important to note that not every transaction or business relationship is suitable for Simplified Due Diligence. Organizations need to be cautious to avoid taking on extra risks by using this method.

Here are some examples of when Simplified Due Diligence measures might be used:

- Checking New Partners: Before working with a new company or partner, SDD helps make sure they’re legit and following AML regulations.

- Verifying Customers: When a new person or business wants to use a service, SDD helps verify customer identity and check if they’re trustworthy and not involved in any financial crime.

- Investment Checks: Before investing money into a new project or company, SDD helps identify red flags or risks.

When Do You Need Simplified Due Diligence?

Simplified Due Diligence (SDD) is typically required in situations where the risks associated with a particular transaction or business relationship are considered to be low.

The Financial Action Task Force (FATF) recommends that due diligence measures should be undertaken when:

- Establishing a business relationship.

- Suspicion is raised about money laundering or terrorist financing.

- The financial institution questions the adequacy of previously obtained customer identification data.

- Carrying out occasional transactions above the designated threshold (USD/EUR 15,000).

The FATF provides a non-prescriptive list of instances when simplified due diligence (SDD) may be required:

- A financial activity (other than the transferring of money or value) is carried out by a natural or legal person on an occasional or very limited basis.

- A financial product or service provides appropriately defined and limited services to certain types of customers.

- A household has an average monthly income of less than a predetermined amount.

SDD vs. CDD vs. EDD

Understanding the differences between Simplified Due Diligence (SDD), Customer Due Diligence (CDD), and Enhanced Due Diligence (EDD) is necessary for implementing effective risk management and compliance measures. Here’s a comprehensive comparison:

Customer Due Diligence (CDD)

CDD aims to assess and understand the customer’s risk profile, including their identity, nature of business, source of funds, and potential involvement in money laundering or other illicit activities.

CDD involves collecting and verifying customer data and information through various means, such as identity documents, business records, and financial statements. It requires a standard level of surveillance and a detailed verification process to understand the risk level of the customer or transaction.

Simplified Due Diligence (SDD)

The primary objective of SDD is to streamline the standard customer due diligence process for both very low-risk clients and no-risk transactions or business relationships. SDD are due diligence measures that involve a simplified or reduced set of verification procedures compared to CDD or EDD. It typically requires less documentation and fewer checks because the risk associated with the simplified customer or transaction is considered to be low. It also involves decreasing the level of ongoing monitoring based on the reasonable monetary threshold.

Enhanced Due Diligence (EDD)

Enhanced due diligence involves conducting more in-depth analysis and checks compared to CDD. This may include additional documentation, deeper analysis of financial transactions, and improved surveillance of high-risk customers such as politically exposed person (PEP). EDD is typically applied in situations where there are high concerns about the high risk of money laundering, terrorist financing, or other serious financial risks.

Steps Involved in SDD

The Simplified Due Diligence (SDD) process offers a streamlined approach to risk management and compliance, particularly for low-risk customers and low-risk products or transactions. Here’s a detailed breakdown of the fundamental steps in enforcing SDD:

1. Obtain Basic Information

The first step in the SDD process is to gather basic information about the customer or transaction. This may include their name, address, contact details, and any other relevant identifying information. It’s essential to have a clear understanding of who you’re dealing with and how much risk is before proceeding further.

2. Determine the Risk and Level of Due Diligence

Once you have basic information, the next step is to assess the risk associated with the customer or transaction. This involves evaluating factors such as the nature of the business, the source of funds, and any potential red flags that may indicate higher risk. Based on this assessment, you can determine the appropriate level of due diligence required.

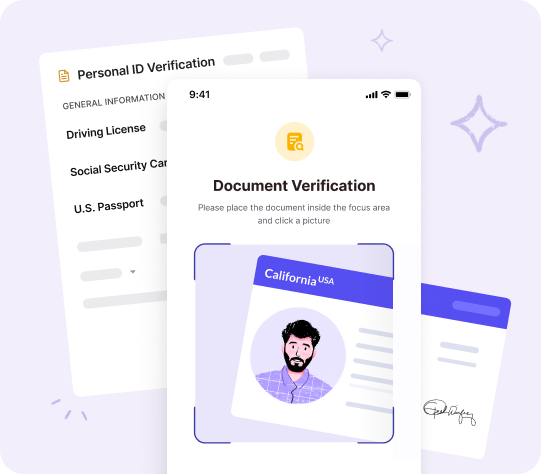

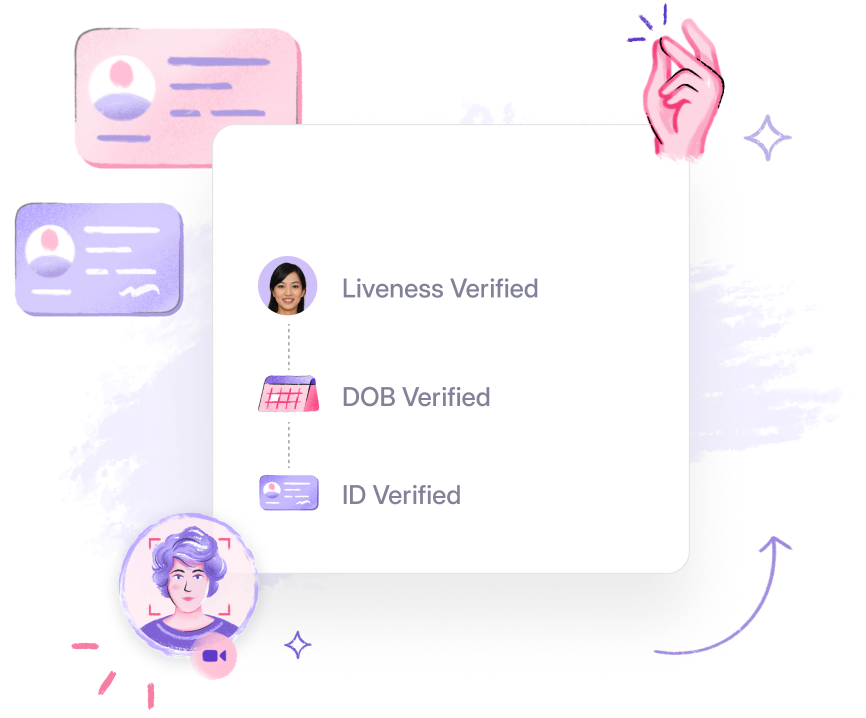

3. Identity Verification

In this step, in the detailed identity verification process, you verify the identity of the customer or parties involved in the transaction. This may involve requesting official identification documents such as passports, driver’s licenses, or government-issued IDs. The goal of the customer identification process is to identify the individuals involved and to mitigate the AML risk of identity theft or fraud.

4. Documenting and Reporting

As part of the simplified due diligence measures, it’s important to document all relevant information and keep detailed records of the due diligence procedures and activities conducted. This includes maintaining records of identity verification, risk assessments, and any other relevant documentation and diligence needed.

Additionally, if any suspicious activity is identified during the process, it must be reported to the appropriate government entity or authorities, such as the Financial Crimes Enforcement Network (FinCEN), in compliance with regulatory requirements.

5. Conduct Ongoing Monitoring

Finally, SDD involves ongoing monitoring of the customer’s identity or transaction to ensure continued compliance with regulations and to detect any changes or anomalies that may indicate increased risk. This may include routine reviews of customer information, transaction monitoring, customer identification updates, and updates to risk assessments as necessary.

Key Takeaways:

- SDD simplifies verification for low-risk transactions, ensuring compliance with regulations like AML. It saves time and resources by checking customers with low-risk transactions for financial crimes. It’s important for mitigating risks and staying compliant.

- SDD involves a simplified set of verification procedures compared to Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD), which are employed for higher-risk situations requiring more thorough checks.

- The key steps in SDD include obtaining basic information, determining risk levels in order to lower risk, verifying identities, documenting and reporting findings, and conducting ongoing monitoring. These steps ensure a systematic approach to risk mitigation and compliance.

In Summary

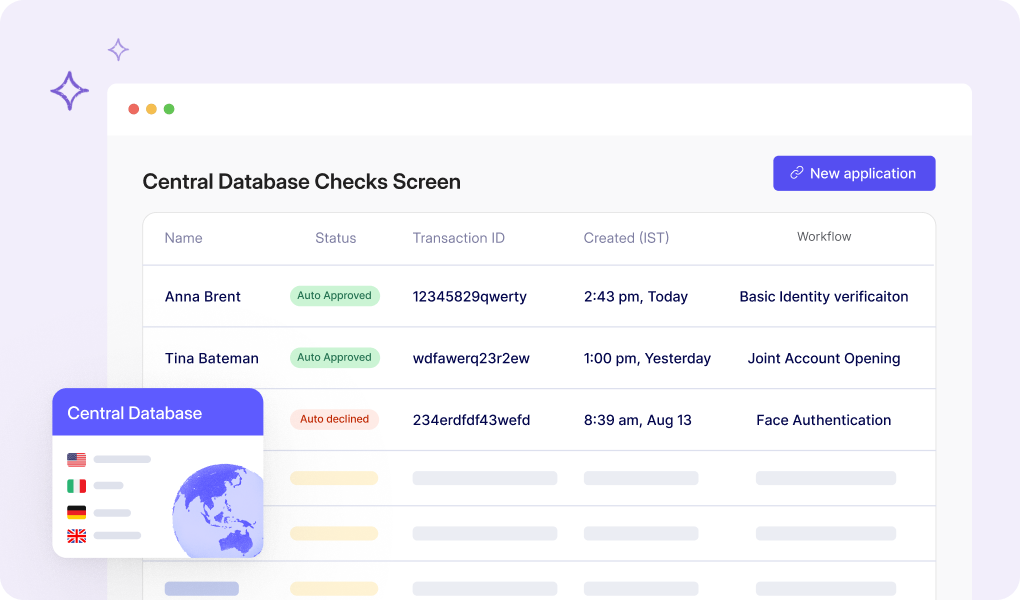

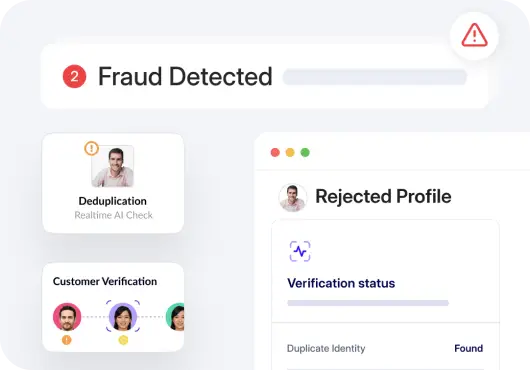

At HyperVerge, we offer various KYC/AML tools that help you automate the SDD process and help your organization stay compliant and secure. With advanced technology, our tools streamline processes by automating data collection, verification, and risk assessment.

With robust identity verification features including facial recognition and document checks, we mitigate identity theft and fraud risks. Our comprehensive compliance reporting and ongoing monitoring capabilities ensure regulatory compliance and proactive risk management, empowering businesses and financial institutions to maintain compliance and guard effortlessly.

Understanding simplified customer due diligence is essential for effective risk management, regulatory compliance, and maintaining trust with customers and partners.

Learn more about how HyperVerge’s AML Screening & Monitoring Solution can help your business stay compliant and secure. Sign Up for a demo now.