Between April and September 2024, Indian banks witnessed an eightfold increase in bank fraud value from the previous year, reaching a staggering ₹21,367 crore.

Among these, bust-out frauds—where borrowers take loans with no intention of repayment, often using falsified income documents—were among the most commonly reported by banks and fintech lenders.

With fraud at an all-time high, verifying a customer’s income with accuracy is no longer just a formality—it’s a necessity. Banks and fintechs need to be sure that an applicant actually earns what they claim and has the financial stability to repay the loan.

Form 16 is one such document that financial institutions rely on for income verification. But how can businesses ensure its authenticity and use it effectively in their lending process?

Let’s explore how you can leverage Form 16 as income proof for informed decision-making.

What is Form 16 & why is it crucial for income verification?

Form 16 is a TDS (tax deducted at source) certificate issued by the employer to its salaried employees in India. This document proves that tax was deducted from an employee’s salary and deposited with the government, in compliance with the Income Tax Act.

Form 16 is an indispensable proof of income, providing a clear breakdown of salary earnings and taxes paid during a financial year. It helps to file an ITR (income tax return) by offering all the details essential to report correct income, claim deductions, and calculate the final tax liability.

Now, Form 16 consists of 2 parts:

| Type of form | Details | Components |

| Part A of Form 16 | It contains information about the employer, employee, and deducted TDS. | Name and address of employer Name and address of an employee PAN and TAN of the employer PAN of employee Period of employment Salary summary Tax summary, i.e. tax deducted and deposited Acknowledgment number of the TDS payment |

| Part B of Form 16 | It contains a detailed salary breakup, applicable deductions, and net taxable income for the financial year. | Salary breakdown—basic salary, allowances, perquisites Exemptions under section 10, i.e. HRA, LTA, children’s education allowance, other special allowances Deductions under Chapter VI-ASection 80C – Investments (EPF, PPF, Life Insurance, ELSS, etc.)Section 80D – Health Insurance PremiumSection 80E – Education Loan InterestSection 80G – Donations to Charitable Organizations Other applicable deductions (e.g., 80TTA, 80U, etc.) Net taxable salary, i.e. gross income less total deductions |

That said, Form 16 provides lenders, credit agencies, and financial institutions with reliable insight into a borrower’s financial stability and tax compliance. With this document, businesses can accurately assess creditworthiness and streamline income verification without relying extensively on bank statements and salary slips.

Verify the customer’s income with over 99.5% accuracy

With Hyperverge’s automated income validation Schedule a DemoHow Businesses Use Form 16 for Loan & Credit Risk Assessment

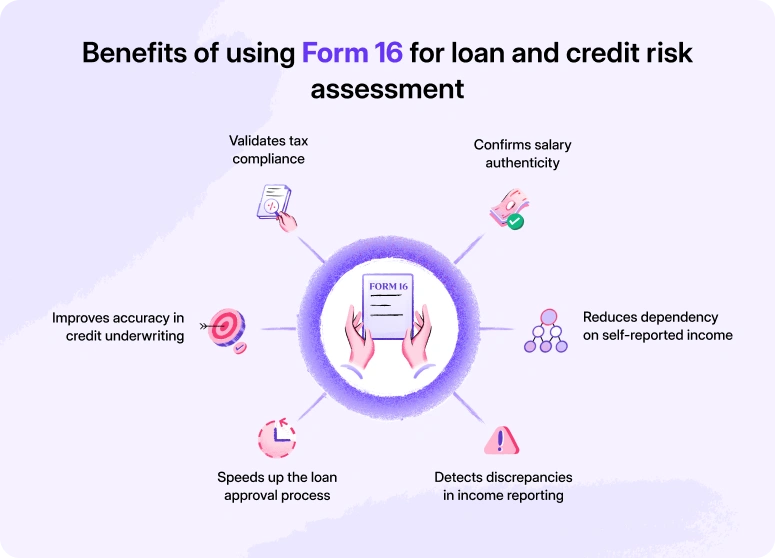

Banks and fintechs commonly use Form 16 for income verification, assessing tax compliance, and determining a borrower’s repayment ability. It provides a reliable basis for evaluating an individual’s financial stability and taxable income, helping businesses make informed lending decisions while minimizing risks.

Home Loans & Personal Loans

Lenders use Form 16 during the loan origination process to verify a borrower’s income stability, tax compliance, and repayment ability. Since home and personal loans require long-term financial commitments, businesses assess multiple factors in Form 16 Part A and Part B to reduce lending risks.

- Employment stability: Lenders assess Part A of your Form 16 to confirm whether you have a stable job to pay your loans

- Debt to Income ratio: Lenders evaluate net take-home salary after deductions to determine whether the borrower can manage loan repayment

- Income and TDS stability: Lenders assess financial stability by checking if the Form reports a stable salary with consistent TDS deductions

Credit Card Issuance & Credit Limit Decisions

Since credit cards involve revolving credit with no fixed repayment schedule, lenders need to confirm that the applicant has a stable salary and sufficient disposable income to handle monthly payments. They use Form 16 to:

- Assess creditworthiness: Credit card issuers compare net taxable income (available in part B) with their declared income to confirm financial stability

- Determine credit limit: Evaluate gross salary, TDS deductions, and financial commitments to determine credit limit. Individuals with higher salaries, consistent deductions, and low financial commitments can be entitled to high credit limits

Business Loans for Salaried Professionals

When a salaried professional plans to transition into self-employment or startup, banks use Form 16 to assess their past earnings and financial reliability.

- Loan repayment capacity: Banks check gross salary trends and deductions to ensure the borrower has a sufficient disposable income buffer to sustain repayments during the business setup phase

- Investment capability: If the borrower claims to fund their business partly with savings, lenders assess past tax-saving investments to confirm financial discipline

- Proof of stable income: The net taxable income in your Form 16 helps verify if you had a consistent salary and tax compliance before switching careers

Digital Lending & Instant Loan Approvals

Digital lending organizations can extract and verify details from Form 16 to customize loan approvals, minimize risk, and streamline the lending process.

- Quick income verification: Digital lenders cross-check net taxable income (Available in Part B of Form 16) with loan eligibility criteria to determine approval within minutes

- Automated underwriting: Fetch income, deductions, and TDS details from Form 16 to validate the borrower’s financial profile in real time

- Customized loan offers: Form 16 helps lenders personalize loan amounts, tenure, and interest rates based on salary consistency

Read more: OCR in the Finance Industry: Benefits, Use Cases, and Best Solutions

Form 16 vs. Other Income Proof Documents for Businesses

By now, you have a distinct understanding of what is form 16. However, how does Form 16 compare to other income-proof documents used by businesses for loan approvals, credit assessment, and financial verification?

Let’s understand with this table:

| Document | Best for | Key Benefit |

| Form 16 | Salaried employees with taxable income | Annual income proof with verified TDS recordsConfirms tax compliance under the Income Tax ActUsed for loan origination & quick credit assessment |

| Salary Slips | Verifying recent salary and employment | Shows monthly income consistencyValidates variable pay, i.e. bonuses, commissionsDemonstrates recent earning trends |

| ITR Acknowledgement | Self-employed, freelancers, high-income professionals, and business owners | Confirms ITR (income tax return) filing historyShows declared income over multiple yearsTax compliance proof for non-salaried individuals |

| Bank Statements | Everyone, i.e. salaried as well as self-employed | Bank statement analysis helps track actual salary credits & cash flowIdentifies hidden liabilities, i.e. EMIs, loans, expensesCan detect irregular or undisclosed income |

Business Takeaway

As the table outlines, Form 16 is sufficient proof of Income, specifically for salaried individuals. However, instead of using it as a standalone mode for income validation, lenders should cross-verify it with bank statements and salary slips to ensure accuracy. This helps identify actual salary credits, hidden liabilities, and financial inconsistencies that may not be reflected in Form 16.

Besides, Form 16 isn’t applicable to non-salaried applicants. In such cases, adopting a multiple verification approach is essential to using ITR acknowledgments, bank statements, and other financial records.

Automating Income Verification Using Form 16

While Form 16 is a reliable income proof for salaried individuals, businesses cannot rely on manual verification alone for income validation—especially at scale. Imagine reviewing hundreds of Form 16 documents manually every single day. This would not only be inefficient for banks and fintech lenders but it will also lead to errors, delays, and potential fraud risks.

Automated document verification is the only way to streamline, standardize, and accelerate the income validation process without overburdening your teams.

Challenges businesses face in manual verification

Here are some common challenges businesses face when they choose the path of manual verification:

- Form 16 alteration and fraud: Some applicants may manipulate salary figures, deductions, or employer details so convincingly that an assessing officer may not detect discrepancies without deeper verification

- Time-consuming: Reviewing and verifying each detail of Form 16 takes significant time. This won’t only slow down the process, but the delays may cause customers to drop off in between

- Inconsistent formatting: Varied formats by different companies make it difficult to standardize and extract key income details from Form 16 efficiently

- Data extraction errors: Human accessors may find it difficult to read illegible text, interpret misaligned figures, or verify missing details in scanned or low-quality copies of Form 16

- Dependency on Supporting Documents: Businesses must manually cross-check Form 16 details with bank statements and salary slips which would further delay approvals

As we said, manual verification is slow, error-prone, and inefficient. It increases cost, keeps your staff occupied in mundane tasks, and impacts the overall customer experience.

The solution?

Automating Form 16 verification with OCR and data extraction tools that promises faster processing and accuracy without manual intervention.

Read also: A Complete Guide to Bank Statement OCR

Challenges faced with automation without AI

While automation removes manual inefficiencies, it still isn’t enough. Rule-based automation poses the following challenges:

- Fails to detect evolving fraud patterns: Automation rules alone cannot detect the latest fraud patterns such as tampered signatures, salary inflation, or employer’s identity fraud

- No Context Awareness: Traditional automation extracts numbers but lacks analytical capabilities essential to assess salary consistency, financial anomalies, and tax compliance risks

- High Error Rates in Data Extraction: OCR can easily capture data from structured forms. But when it comes to unstructured and semi-structured forms, OCR struggles with inconsistent data placement, missing labels, and unpredictable formatting

- Rigid formatting rules: Variations in Form 16 formats across employers disrupt data extraction and require manual intervention

- High response times: Response times of as long as 5 minutes, resulting in customer drop-offs

AI-powered income validation makes up for these challenges with its intelligent fraud detection, contextual data analysis, and adaptive document processing. Automated tools with AI can,

- Detect template fudging and manipulated document structures

- Identify unusual deductions and hidden financial risks

- Extract data accurately from structured and unstructured forms

- Automate bulk verification for high-volume processing

- Reduce turnaround time with real-time verification

Read also: OCR for Forms: Applications and Use Cases

Handling Cases Where Form 16 Is Unavailable

Not all salaried individuals receive Form 16, especially those earning below the taxable income threshold. Even Individuals working in unorganized sectors where TDS isn’t deducted don’t get Form 16. In such cases, businesses can use alternative methods to verify the income of their customers:

- Salary slips + bank statements: Cross-verify monthly salary credits with salary slips to establish income consistency

- ITR filings (if applicable): Can be used to confirm declared income, deductions, and tax compliance as per the income tax department records

- Employer-issued salary certificates: A signed salary certificate by an employer can be used to validate earnings, employment status, and official payroll details

These methods individually and in conjunction with others can be used to verify an Individual’s income in the absence of Form 16.

Common Pitfalls Businesses Should Avoid When Using Form 16 for Loan Approvals

Now, before you start using Form 16 as a part of your income validation process, here are a few things you should keep in mind.

- Always cross-verify Form 16 with bank statements, salary slips, and tax filings to confirm actual salary credits and tax payments

- Don’t over-rely on Form 16, especially for applicants that have multiple sources of income, i.e. rental income, freelancing money, side business gigs

- Dive a little deep and verify if the PAN, employer details, and personal details are legit. Also, keep an eye on inconsistencies that may reflect on TDS records

How HyperVerge Simplifies Income Verification

Form 16 offers sufficient insight into earnings, deductions, and TDS deposits, making it a reliable tool for businesses to assess an individual’s financial stability. And, while there are challenges such as document fraud, formatting inconsistencies, and incomplete income assessments, these can be easily navigated through Hyperverge.

Hyperverge’s income validation suite can

- Fetch user’s data from AA, bank statement, salary slip, ITR, and Form 16/16A without any downtime

- Extract salary details, TDS, and employer data from reliable sources in real-time

- Cross-check Form 16 data with bank statements and ITR filings

- Run advanced analytics to spot inconsistencies

- Detect advanced and sophisticated frauds in an instant

All these with an easy plug-and-play module that integrates seamlessly into your existing workflows and has a response time of microseconds.

FAQs

1. What is the purpose of Form 16 for a loan?

Form 16 serves as proof of income and tax compliance. It helps lenders evaluate the applicant’s earnings, deductions, and TDS records, ensuring that the borrower has the financial capacity to repay the loan.

2. Why do banks ask for Form 16?

Banks request Form 16 to verify an applicant’s steady salary, tax deductions, and history of tax compliance. This allows them to make informed lending decisions, minimizing the risk of income misrepresentation and loan defaults.

3. Is Form 16 proof of income?

Yes, Form 16 is a valid proof of income as it provides a detailed record of salary earnings, TDS deductions, and tax compliance. Issued under the provisions of the Income Tax Act, it helps verify taxable income and is essential for filing your income tax return. Employers can head to the TRACES portal to download Form 16.

4. Can Form 16 be faked? How to detect fraud?

Yes. There are recorded instances where people have tampered with TDS details, faked salary information, and forged employer credentials. The most efficient way to detect such fraud is by using AI-powered income verification tools like HyperVerge

5. How to download Form 16?

Employees can download Form 16 from their employer, as it is issued by the organization deducting TDS. Alternatively, employers can access and generate Form 16 from the TRACES portal of the Income Tax Department.