For a business owner, any of the following situations would be a nightmare:

• A single breach of regulations results in substantial financial penalties.

• Non-compliance news severely harms your brand image.

• Investigations and potential legal battles interrupt day-to-day operations.

To avoid such consequences, sanction screening is an important process.

As per the Financial Times, credit and financial institutions were fined almost USD 5 billion due to anti-money laundering (AML) issues, sanctions breaches, and KYC system deficiencies.

Having sanctions screening software helps automate checking your customer and transaction data with the sanction lists.

The real challenge arrives when looking for reliable software. Just to help you save your time and effort, read this blog highlighting the best sanctions screening software.

How do sanctions screening software work?

Sanction screening software is an important tool in financial compliance that scans vast datasets for any matches with international sanctions lists. This tool helps businesses accidentally engage with sanctioned entities or individuals to ensure adherence to global regulations and eliminates risks like penalties. Let’s look at the process involved with the sanction screening software.

- Gather data from several sources like government agencies, international bodies, and financial institutions.

- Normalize the collected data to ensure consistency and compatibility for successful analysis.

- Compare collected data with watchlists maintained by regulatory bodies like the Office of Foreign Assets Control (OFAC) and the United Nations (UN) to identify potential matches.

- Recognize the name variations with the advanced algorithms to improve matching accuracy.

- Identify entities that receive risk scoring based on the seriousness of violations and their activities.

- Generate alerts for matches surpassing risk thresholds to provide detailed data to compliance officers.

- Compliance officers then conduct further investigations to validate the matches. The overall screening process is documented for compliance and regulatory reporting.

After understanding the process involved with sanction screening, let’s discuss the process we follow to list the top sanction screening software.

How we analyzed and selected the best sanctions screening software

Here is the manual process we followed to evaluate the best sanction screening software:

- Evaluated over 20 sanction screening software solutions known for efficient capabilities.

- Compared reviews and ratings from trusted platforms such as G2 and Capterra.

- Shortlisted software based on coverage & accuracy, monitoring capability, integration, UI, reporting, and cost.

Following such an in-depth process ensures that the list provided involves the best sanction screening software that fulfills unique requirements.

A complete list of best sanctions screening software

Here is the table containing the overview of the best software for sanction screening.

| Sanctions Screening Software | Core Capabilities | Free Trial Availability |

| Updates every 7 minutes from major sanction lists like UNSC, OFAC, Interpol, and PEP databases. | 30 days free trial in a sandbox environment | |

| Advanced AI-powered screening and matching capabilities. | Free trial with 5 searches every week | |

| Filters out articles with non-criminal context-related records. | Free trial available | |

| A standalone system that easily integrates with the risk tech stack. | 30-day free trial available | |

| Quickly identify and mitigate compliance risks and update data every 15 minutes. | No free trial available | |

| Comprehensive due diligence on customers and connected parties. | No free trial available | |

| Save time on AML case management. | 14 days free trial available |

An in-depth explanation of the top 7 sanctions screening software

Here is an in-depth explanation of each of the sanction screening software.

1. HyperVerge

About HyperVerge

HyperVerge is a leading AML software company specializing in streamlining and automating multiple-sanction screening processes while ensuring AML compliance. The software’s advanced capabilities help perform detailed checks with major sanctions, such as the United Nations Security Council (UNSC), Office of Foreign Assets Control (OFAC), Interpol, and Politically Exposed Person (PEP) databases.

The software uses autonomous systems to refresh entity profiles 24/7 and updates PEP & adverse media every 7 minutes. This approach not only ensures real-time updates on global sanctions and PEP lists but also mitigates false positives. Custom filtering options complement these continuous updates to improve accuracy in large-scale data processing.

Here is why choosing HyperVerge as a sanction screening software is a reliable option:

- Conducts over 1000+ global sanctions and watchlist checks with 100% compliance.

- Covers and screens around 100% of PEP profiles globally for transparency.

- Analyzes 150M articles per month and updates 30k profiles daily for adverse media screening.

- Helps avoid fines worth $8 billion by enabling compliance through AML screening.

Key features of HyperVerge

- Integrated compliance screening: Provides exceptional compliance screening, including real-time checks against global sanctions and watchlists, verification for PEPs, and detailed analysis of adverse media.

- Comprehensive profiles: Offers detailed risk profiles of customers or entities, including date of birth, location, and media information to facilitate successful screening and risk assessment.

- Customizable filtering options: Allows customization of screening parameters like date of birth and country-based filtering to reduce false positives and improve AML screening accuracy.

- Real-time screening: Ensures continuous monitoring and screening of entities with sanctions lists, which minimizes the risk of non-compliance.

- AML review dashboard: Provide a user-friendly dashboard for AML review. This allows easy access to screening results, risk assessments, and alerts for further action.

HyperVerge pricing

HyperVerge provides different pricing plans for various businesses, from startups to enterprises. Let’s examine each plan in detail.

| Start plan (Startups) The Start plan includes a free trial and easy integration within 4 hours. It also offers tools to view and manage verification for a one-month period. | Grow plan (Mid-size companies) The Grow plan involves everything covered in the Start plan, and it also includes an end-to-end ID verification suite, access to AML checks, central database checks, and customized business workflows. | Enterprise plan (Enterprise-level organizations) The Enterprise plan involves all the features and offerings from the Grow plan, along with a custom price structure and collaborative tools. |

What people say about HyperVerge

Client testimonial

Recently, WazirX, India’s largest cryptocurrency exchange, chose HyperVerge for KYC and AML solutions. With regulatory hurdles and the necessity for rapid sanction screening, WazirX needed a partner who could enable simple user onboarding while adhering to compliance standards. This collaborative alliance allowed WazirX to swiftly develop while adhering to regulatory requirements and protecting against financial risks.

| Looking for sanction screening software for AML compliance? Get a free demo |

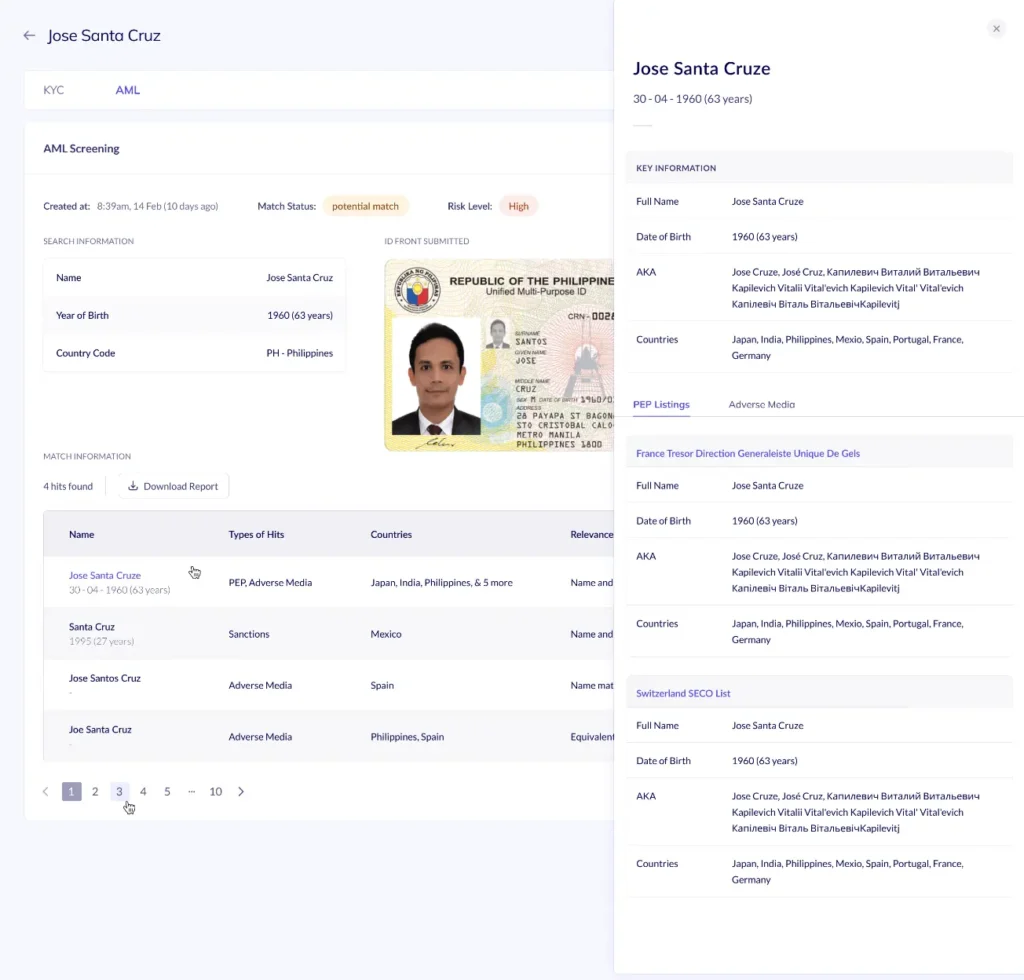

2. ComplyAdvantage

About ComplyAdvantage

ComplyAdvantage provides advanced solutions to streamline complaint processes and eliminate risks with financial crimes. Using AI-powered algorithms, this software identifies and evaluates clients’ risk profiles with sanctions, PEPs, watchlists, adverse media, and enforcement data. Its integration with the ComplyAdvantage Mesh ensures accurate and up-to-date risk assessments.

ComplyAdvantage’s user-friendly interface and customizable screening solutions help compliance officers, team leaders, and analysts handle customer screening. The software reduces manual tasks and screening backlogs with detailed audit trails and optimized workflows.

ComplyAdvantage Pricing

Contact ComplyAdvantage for current pricing.

Key features of ComplyAdvantage

- Customizable screening: Provides flexibility by allowing businesses to customize the screening process to meet specific risk and compliance needs.

- Risk data integration: Combines risk screening solutions with proprietary data on their Mesh platform.

- Audit trails: Provides a thorough record of every screening event and decision. This enables compliance teams to maintain transparency and readiness for audits.

Pros of ComplyAdvantage

✓ Filters out false positives, providing relevant matches to increase compliance efficiency.

✓ Allows tailoring risk scoring models based on client-specific risk appetites.

✓ Offers auditable compliance reports for transparency and ease of internal reviews.

Cons of ComplyAdvantage

✕ Users say that the transaction monitoring tool needs improvement to match the screening tool’s standard.

✕ Lacks integration for filing SARs with GoAML.

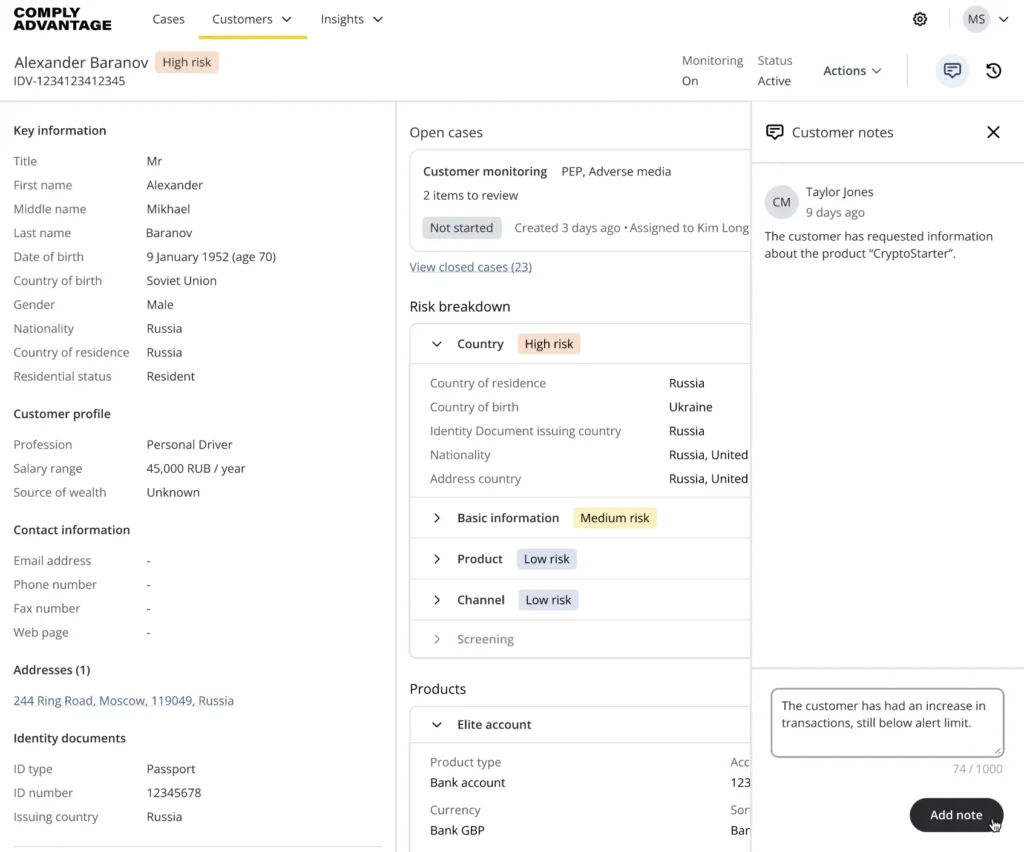

3. iDenfy

About iDenfy

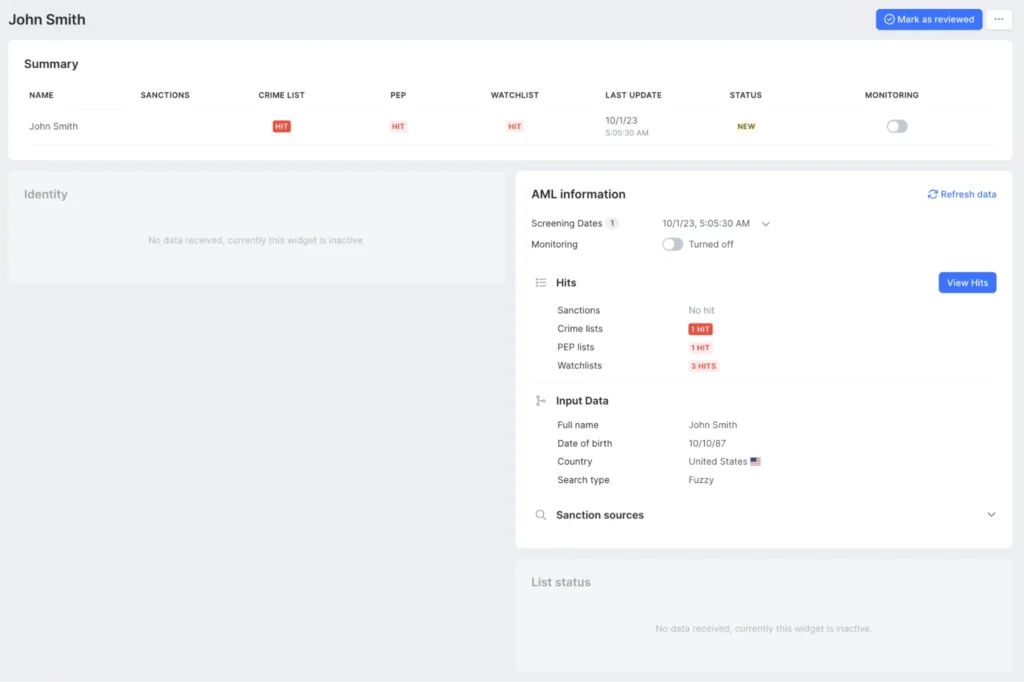

iDenfy is one of the best sanction screening software to manage anti-money laundering (AML) and Know Your Customer (KYC) compliance processes. This powerful tool helps scan and monitor customers with sanctions, PEPs, and watchlists. The platform also ensures prompt detection of any new suspicious activities with its strong ongoing monitoring services.

The software easily integrates with the existing identity verification services to offer instant notification when any AML risk database hit occurs. iDenfy also ensures that the compliance requirements are met. The tool offers real-time results and can conduct AML checks manually or by API integration.

iDenfy Pricing

Contact Sanction Scanner for current pricing.

Key features of iDenfy

- Sanctions and PEPs monitoring: Scans customers with multiple sanction lists and politically exposed persons, including local and global databases.

- Adverse media screening: Includes a proprietary filtering algorithm that automatically excludes non-criminal context-related articles.

- Instant alerts: Scans for suspicious activities and quickly notifies users of any hits in the database. This ensures that the business remains compliant with AML regulations.

Pros of iDenfy

✓ The setup process is smooth and well-documented, which helps with quick implementation.

✓ Offers strong technical support, including assistance with API integration.

✓ Users found the pricing competitive as they noted monthly cost savings due to the pay-per-approval model.

Cons of iDenfy

✕ A few of the users found that several AML features lack clarity.

✕ Users say that the integration requires some technical expertise, and that is challenging.

4. SEON

About SEON

SEON is a top-notch anti-money laundering software offering sanctions screening solutions. It helps businesses block financial criminals and sanction individuals by identifying suspicious behavior. The software allows businesses to create custom rules based on AML screening results to simplify their anti-financial crime efforts into one centralized platform.

SEON excels at pre-screening customers through social media profiling. Verifying the authenticity of customer identities and detecting inconsistencies becomes easier by analyzing the digital footprints. Suspicious prospects are automatically flagged for further investigation, minimizing the risk of inadvertently serving fraudulent individuals. Also, the software facilitates blocking suspicious prospects with advanced device fingerprinting and IP analysis tools.

SEON Pricing

SEON starts at free with 2 users and goes up to $599/month for 10 users, or contact for custom pricing.

Key features of SEON

- AML screening: Monitors PEP, relatives or close associates (RCA), sanctions, and crime lists to block high-risk customers.

- Social media profiling: Pre-screen customers with 90+ platforms to spot inconsistencies and flag suspicious individuals for investigation.

- Block suspicious connection: Declines transactions made using suspicious devices or connections to improve fraud prevention capabilities.

Pros of SEON

✓ SEON’s user-friendly interface allows for eBay navigation and efficient operations.

✓ Users appreciate SEON’s ability to provide fraud prevention tools like the ability to ban users, gather information, and create automatic rules to prevent fraud trends.

✓ Integration with existing systems is seamless and hassle-free.

Cons of SEON

✕ New users find the process of creating rules to be complex.

✕ Users also report that SEON is slower at times when multiple cards are opened simultaneously.

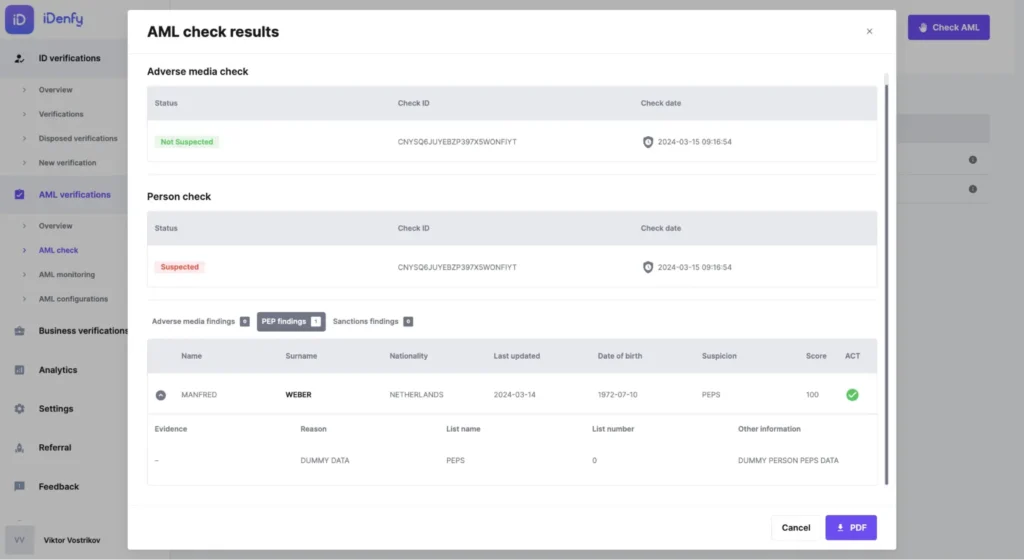

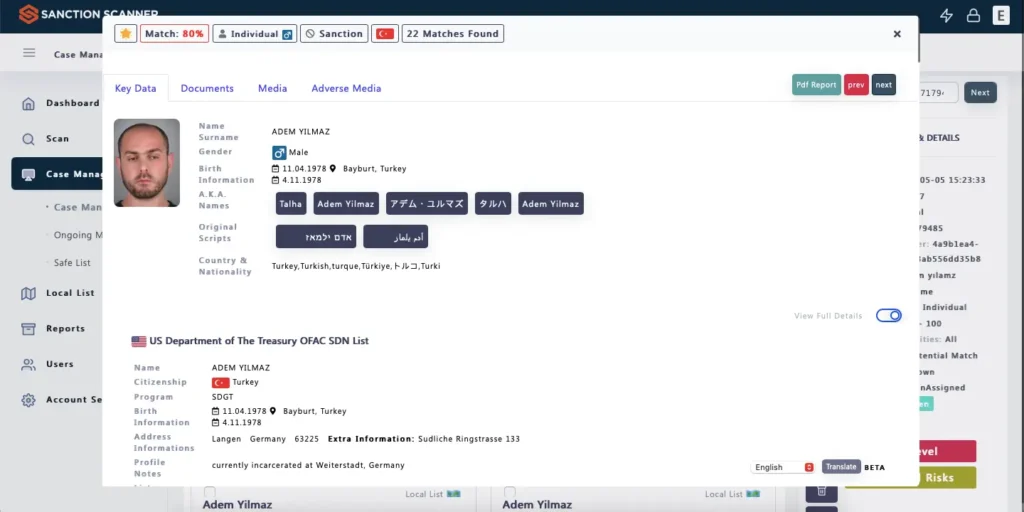

5. Sanction Scanner

About Sanction Scanner

Sanction screening is a reliable sanction screening software known for its reliability and efficiency in anti-money laundering compliance. The software’s comprehensive AML data screening capabilities ensure exceptional accuracy in identifying potential risks.

With coverage across 220 countries and continuous updates every 15 minutes, Sanction Scanner checks over 3000 global sanctions lists, PEP lists, and adverse media data points. This expertise helps businesses get up-to-date insights to navigate complex compliance landscapes. The platform’s easy API integration facilitates swift adoption into existing projects, automating AML control processes and reducing manual workload.

Sanction Scanner Pricing

Contact Sanction Scanner for current pricing.

Key features of the Sanction Scanner

- Accurate screening: Advanced screenings, such as PEP, sanction, remittance, payment, vessel, and aircraft screenings, enable in-depth risk assessment.

- API integration: This feature supports all AML solution features, such as webhook-powered automation, which facilitates integration into existing projects and reduces manual workload.

- Customizable monitoring settings: Offers customizable parametric settings that assist in selecting lists for scans and adjusting match rates to ensure compliance.

Pros of Sanction Scanner

✓ Offers precise monitoring capabilities and real-time alerts to ensure prompt detection and response to compliance issues.

✓ Users can quickly adopt the software and use features with its intuitive interface.

✓ Provides proactive risk management with automated daily checks and planning control periods based on customer risk levels.

Cons of Sanction Scanner

✕ Users found the documentation and tutorials to be limited.

✕ Reporting functionality could be more useful and integrated within organizational applications for streamlined monitoring.

| Want to ensure AML compliance with sanction screening software?Get a free demo |

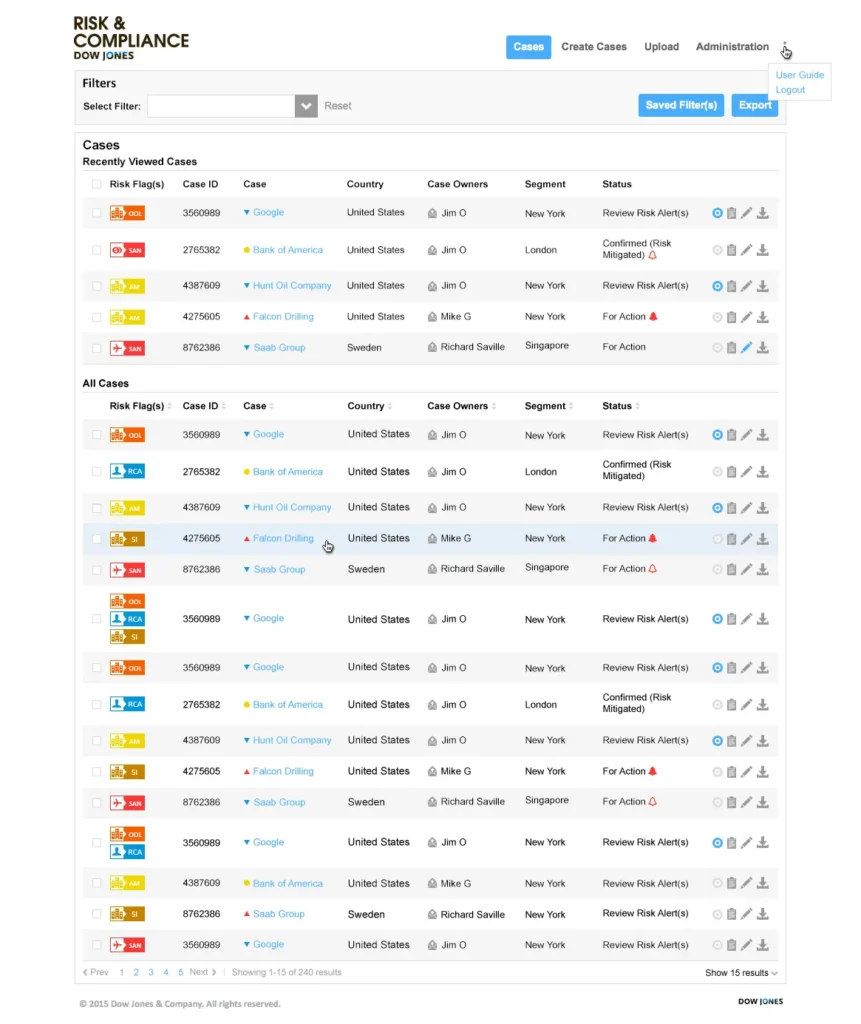

6. Dow Jones Risk and Compliance

About Dow Jones Risk and Compliance

Dow Jones Risk and Compliance is a well-known software providing advanced screening and monitoring solutions. Using its ISAE 3000-compliant sanctions data and Ripjar technology, this solution ensures the highest speed, quality, and coverage in identifying potential risks.

The software is exceptional when it comes to detection and flagging alerts in real time by constantly monitoring the structured and unstructured data. This provides the compliance team with a detailed view of the client’s risk at all times. Also, users must be assured to meet international and domestic regulatory standards with independently audited global sanctions lists like PEPs and state-owned companies (SOC).

Dow Jones Risk and Compliance Pricing

Contact Dow Jones Risk and Compliance for current pricing.

Key features of Dow Jones Risk and Compliance

- Advanced identity resolution: Conducts identity resolution in multiple languages and scripts using Natural Language Processing (NLP) to improve precision and reduce false positives.

- Risk category classifier: Classifies news articles into risk categories with supervised machine learning.

- Easy integration: Integrates easily into existing IT exosystems with an open architecture and various APIs.

Pros of Dow Jones Risk and Compliance

✓ Users find the ability to conduct multiple searches with one query particularly helpful.

✓ The flexibility of subscription plans is something that users appreciate.

✓ The quick turnaround time for risk reports is a positive aspect that indicates efficient processing and delivery of results.

Cons of Dow Jones Risk and Compliance

✕ Some users face technical issues like auto log-off or site downtime. This interrupts workflow and requires manual re-login.

✕ The absence of a transparent audit trail for updated alerts makes it challenging to track changes.

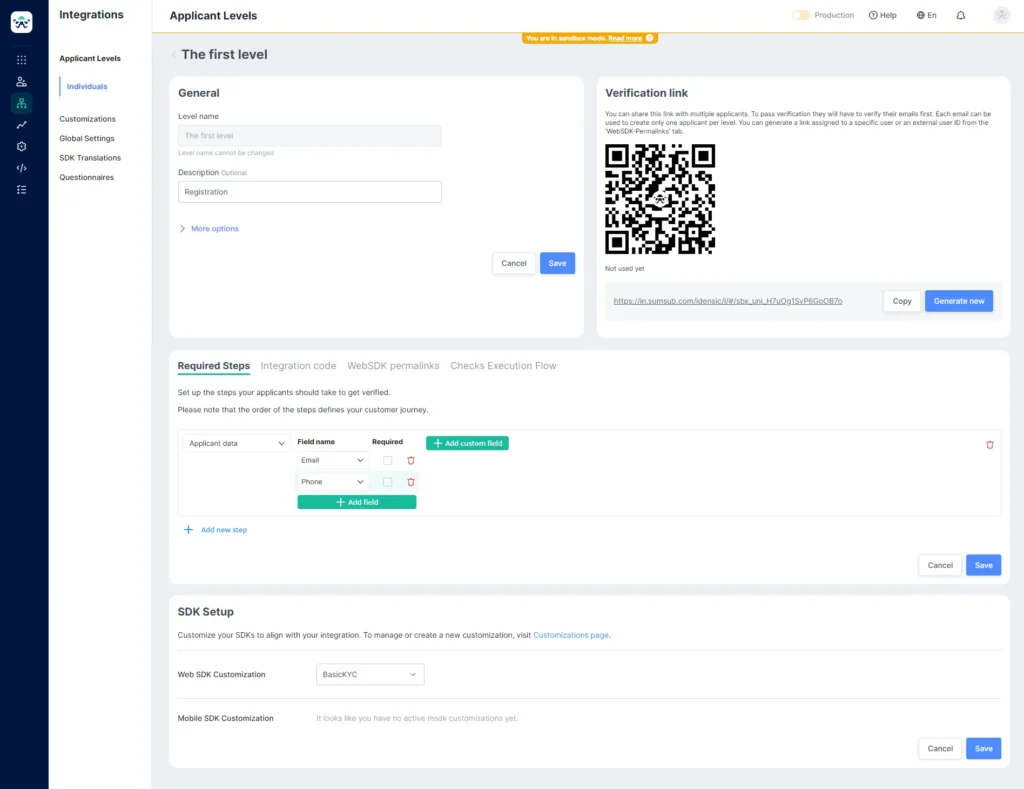

7. Sumsub

About Sumsub

Sumsub is a top-notch sanction screening software that helps identify and mitigate AML risks. The software offers real-time AML monitoring from 11,000 independent and reliable data sources across 220+ countries and territories. Using AI-powered screening and ongoing monitoring, Sumsub detects high-risk users by screening against global watchlists for sanctions, PEPs, and adverse media.

By complying with global and local AML regulations, Sumsub allows businesses to protect their reputations, reduce losses, and ensure adherence to compliance standards. Its solution also boosts operational efficiency by lowering false positives and optimizing the screening processes.

Sumsub Pricing

Sumsub’s Basic plan starts at $1.35 per verification, and the Compliance plan is $1.85 per verification.

Key features of Sumsub

- Detection and restriction: Enables the detection and restriction of individuals on sanctions and watchlists like OFAC, UN, Her Majesty’s Treasury (HMT), European Union (EU), and Department of Foreign Affairs and Trade (DFAT) lists.

- Sanctions & PEPs monitoring: Monitors local and global lists including multiple sanction lists and PEPs. It covers all four levels of PEP risk with a weekly updated schedule.

- Adverse media analysis: Analyzes adverse media by monitoring various media sources for negative mentions and aggregating data into customer profiles for easy review.

Pros of Sumsub

✓ Users can easily understand and use Sumsub’s comprehensive documentation.

✓ Sumsub’s self-service nature allows for smooth integration and scalable usage.

✓ The interface of Sumsub simplifies navigation. It streamlines the verification process and improves the overall efficiency.

Cons of Sumsub

✕ Some users find Sumsub’s customization options to be limited.

✕ Certain information, like mail deliverability, is not available in CSV exports.

7 Benefits of using sanctions screening software for your business

Just as a receipt scanner app simplifies expense tracking and financial record-keeping, effective sanctions screening software ensures seamless compliance by automating the identification of high-risk entities. Here are the 7 key benefits of using sanctions screening software for your business.

1. Ensures regulatory compliance and adherence

Sanctions screening software allows businesses to comply with regulations like the Office of Foreign Assets Control (OFAC) in the U.S., the European Union’s Consolidated List of Sanctions, and the United Nations Security Council Sanctions List. This ensures your business adheres to legal requirements and avoids hefty fines and penalties for non-compliance.

2. Mitigates financial and legal risk

The software reduces the risk of inadvertently engaging with sanctioned entities by automatically screening against up-to-date sanctions lists like the Financial Action Task Force (FATF) recommendations and the UK’s HM Treasury Sanctions List. Such a proactive approach protects businesses from legal actions and financial losses.

3. Enhances operational efficiency and accuracy

With the automation of the screening process, sanction screening software reduces the time and effort required compared to manual methods. The software also minimizes human errors, which ensures more precise results and allows the compliance team to focus on higher-value tasks.

4. Supports comprehensive due diligence and KYC

Using due diligence and KYC processes, you can automate the vetting of customers, suppliers, and partners with global sanctions lists and watchlists. This ensures you only engage with compliant and legitimate entities. It streamlines KYC procedures by cross-referencing customer data with international sanctions and PEP lists. Such automation safeguards your business and simplifies compliance documentation and reporting.

5. Facilitates business scalability and adaptability

The volume of transactions and customer interactions increases with your business growth. Sanctions screening software scales with your operations, handling larger datasets efficiently and adapting to new regulatory requirements like updates to the International Emergency Economic Powers Act (IEEPA). This approach ensures continuous compliance without a proportional increase in manual workload.

6. Reduces operational and labor costs

Automating the sanctions screening process reduces the requirement for extensive manual checks, reducing labor costs. The software helps optimize the workflows, which leads to cost savings and allows your compliance team to be more productive and strategic with their workflow.

7. Improves detailed reporting and auditing

The software generates detailed reports and maintains audit trails of all screening activities. This facilitates easy access to records during internal audits and regulatory reviews. Also, it enhances the transparency and accountability in your business. Compliance with audit requirements from the Financial Crimes Enforcement Network (FinCEN) and the Financial Conduct Authority (FCA) becomes more manageable.

| Require AML-compliant sanction screening software?Get a free demo |

How to choose the right sanctions screening software

Here is the entire process of selecting the right sanctions screening software.

Step 1. Assess regulatory requirements and compliance needs

Start by understanding the specific regulatory requirements and compliance needs of your business. Consider the following points when assessing your regulatory requirements.

- Identify the relevant local and international regulations that your business must adhere to, such as OFAC, EU sanctions, and UN sanctions.

- Then, comprehend the specific obligations under these regulations like due diligence, record-keeping, and reporting requirements.

- Engage your legal and compliance teams to capture all regulatory nuances.

Assessing these requirements ensures that the software you opt for aligns with your compliance obligation and reduces the risk of non-compliance.

Step 2. Evaluate software features and capabilities

When opting for sanction screening software, consider features that align with your compliance needs. Here are some of the features to consider.

- Comprehensive sanctions lists: Ensure the software includes all relevant sanctions lists and updates regularly.

- Advanced screening algorithms: Look for software that uses advanced algorithms to minimize false positives and ensure accurate matches.

- Customizable workflows: Must offer the ability to customize workflows to fit your organization’s processes.

- Real-time monitoring: Opt for solutions that offer real-time monitoring and alerts for new sanctions.

- Detailed reporting: Ensure the software provides comprehensive reporting capabilities to support compliance audits and reviews.

Step 3. Consider integration with existing systems

Integration with your current systems is essential to maintain a smooth and error-free workflow. Verify that the software is compatible with your current IT infrastructure including databases, CRM, and ERP systems. Having strong APIs facilitates easy integration, which allows systems to communicate and share data. Also, data synchronization is carried out to update and retrieve information without interruptions.

Step 4. Review vendor reputation and support

Selecting a reputable vendor with strong support is important for long-term success. Research the vendor’s track record, such as their industry experience and customer reviews. High-quality customer support is critical when it comes to timely and knowledgeable assistance. Also, look for an active user community or forums that provide additional resources and peer support. You can also request case studies and references from the vendor to understand how they are assisting businesses with similar needs.

Step 5. Analyze cost and return on investment (ROI)

Finally, upfront costs and ongoing maintenance or subscription fees should be considered. You can perform a cost-benefit analysis to weigh these costs against benefits like reduced risk of non-compliance while enhancing operational efficiency.

Estimate ROI by considering efficiency gains, reducing manual efforts, and avoiding potential fines. Make sure that the software fits your budget constraints. Evaluating the financial impact helps you select a solution that offers the best value for your organization.

Pick the right sanction screening software for your business

Having trusted sanction screening software helps you avoid financial penalties, reputational damage, and the operational chaos caused by regulatory breaches. Now that you have an entire list of software choose wisely from the top options highlighted in this blog to secure your operations and maintain your company’s integrity.

Choosing HyperVerge provides a complete view of customer risk identification to help you make better decisions. With global sanctions and watchlist checks, we ensure 100% compliance. Book your demo here.

Frequently asked questions

1. What is sanction screening?

Sanction screening is a process of identifying and eliminating the risk of engaging with individuals, entities, or countries that are subject to economic sanctions or trade restrictions. Screening includes cross-referencing customer or transaction data with several sanctions lists to ensure compliance with regulatory requirements and avoid penalties.

2. Which sanctions lists are used for screening?

Here are the sanctions lists that are used for screening purposes.

- UN Security Council consolidated list

- Office of Foreign Assets Control (OFAC) Specially Designated Nationals (SDN) list

- The Bureau of Industry and Security (BIS) entity list

- European Union External Action Service (EU EEAS) list

- Office of Financial Sanctions Implementation (OFSI) consolidated list

- Consolidated Canadian Autonomous Sanctions list

- Department of Foreign Affairs and Trade (DFAT) consolidated list

3. When do you need sanctions screening?

Sanctions screening is necessary whenever an organization engages in transactions involving parties or countries subject to sanctions. Here are the scenarios when you require sanction screening.

- Onboard new customers or clients.

- Process payments or conduct financial transactions.

- Screening suppliers, vendors, or business partners.

- Conduct periodic reviews of existing relationships to ensure ongoing compliance.

4. What are the best practices for conducting successful sanctions screening?

Here are the best practices for conducting successful sanctions screening.

- Implement strong screening processes that cover all relevant sanctions lists.

- Automate screening software is used to improve efficiency and accuracy.

- Conduct regular training for employees involved in screening to ensure understanding of regulations and procedures.

- Establish clear escalation and resolution protocols for potential matches or hits.

- Maintain comprehensive audit trails and documentation to enhance compliance efforts.

5. Is sanctions screening software only for financial institutions?

While financial institutions have historically been the primary users of sanctions screening software due to regulatory requirements, the need for compliance is not just for the financial sector. Businesses that are engaged in international trades, cross-border transactions, or dealing with customers and suppliers from different jurisdictions benefit from a sanctions screening solution.

6. Is sanctions screening software suitable for small businesses?

Yes, sanctions screening software is suitable for small businesses. Many providers offer scalable solutions that serve all types of businesses, allowing small enterprises to access the same level of compliance technology used by larger organizations. Integrating a sanctions screening solution helps small businesses reduce risks and avoid costly penalties for non-compliance.