Businesses are required to complete identity verification of a new user before onboarding them, as part of the KYC/AML compliance regulations. So basically: you onboard a new customer and verify their identity once and for all. But does it stop at that?

Is that enough to protect you from fraud?

Get this: data shows that 70% of fraud occurs after initial KYC (Know Your Customer) verification!

Businesses and government organizations are using customer reverification to confirm and authenticate the identities of individuals who have completed the verification earlier.

Let’s take a deeper look at what reverification is, when you need it, and the step-by-step process.

What is Reverification?

Customer reverification refers to reconfirming the customer information and risk profile periodically after the initial identity verification process. It is needed as a part of the risk-based approach and CDD (customer due diligence) to ensure that businesses or financial institutions have complete, up-to-date information about their employees and customers. Customer reverification helps employers track any changes in the risk profile of their employees. It also enables businesses and financial institutions to ensure regulatory compliance and mitigate risks.

The customer reverification process also includes biometric verification. It is a user-friendly, simple process that helps verify the different fields that confirm the identity of the user swiftly.

Reverification requirements depend on the specific needs of the business, the industry, compliance requirements, relevant regulatory guidelines or updates for the business, etc.

When do you Need Reverification?

Following are some instances where it is imperative to reverify customer information to prevent fraud, account takeover, and other financial crimes:

- When key account information is changed: Any change in critical information like passwords or contact information could indicate crimes like account takeover. Hence, it is necessary to review and reverify the customer data to prevent such crimes.

- When a document has expired: It is important to affirm the validity of documents that have been furnished during customer/employee onboarding. Hence, authorized personnel review and reverify the dates on the document to confirm that the documents are up-to-date and complete.

- When a user initiates a high-risk action: If a user makes a transaction, for example, transferring a large sum of money to another account, etc., that raises suspicion of financial crimes like money laundering, authorized personnel must reverify the details of the customer and ensure that the process is completed and up-to-date.

- When a borrower wants to apply for a new loan: Reverification is required when a borrower wants to apply for a new loan or refinance an existing loan. Reverification of certain details, for example, the borrower’s income and credit score will help ascertain if they qualify for the loan.

- When an account is reactivated after a period of dormancy: Customer reverification is required when a customer wishes to reactivate their dormant account. Reverification of the customer’s data, for example, their date of birth, in such cases, minimizes the risk of account takeover.

- When you detect suspicious activity: Activities like logging in from a different IP address or a different geolocation, etc., are suspicious activities that could indicate illegal transactions. Complete reverification of customer/employee details in case of such suspicious activities helps identify fraudulent transactions.

- If your business experiences a data breach or fraud: Your business may experience a data breach or fraud if your customer data is compromised. Reverification of customer data helps prevent attempts of account takeover or potential fraud.

- When laws and regulations change: Financial institutions and some businesses are subject to identity verification compliances like AML (Anti-money laundering) and KYC. Customer reverification is required to be completed to ensure that the customer data is compliant when there are any changes in the AML and KYC regulations.

Types of Verification

Based on the type of information being verified, different types of reverifications need to be carried out:

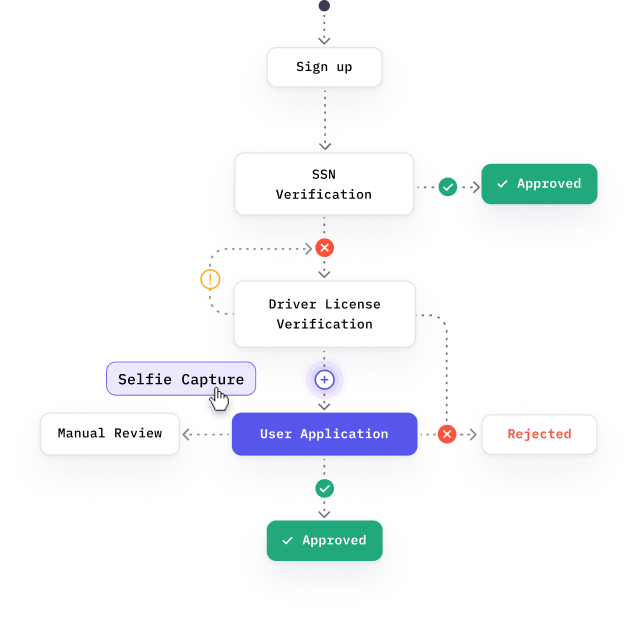

1. Document Reverification

Document verification is a vital aspect of the identity verification process. For identity verification, employees or customers might be required to furnish documents like proof of address, proof of income, proof of insurance, and many more.

A complete reverification is conducted to ensure that they conform to the updated customer/employee data. For documents that have expiry dates like insurance documents, the reverification is done on expiration date of the document or at a date close to the expiration date. The documents that do not have an expiry date are reverified according to the pre-set schedule of the business or financial institution. Document reverification is also required when a customer wants to make any change to their account details.

2. Government ID Reverification

As a part of the reverification process, the accuracy of customer or employee data in government-issued IDs is confirmed. These include documentation like passports, US military cards, permanent resident cards, driver’s licenses, and more. Complete reverification confirms that the identity of the customer or employee data aligns with the updated information on record.

Government ID reverification may be done under various circumstances, for example, when an expired ID is detected, if a customer wants to regain access to their blocked account, or if there are sudden changes in the personal data of the customer.

3. Selfie Reverification

Selfie reverification is done to prevent fraudulent activities like deep fakes, manipulated photos, masks, or any other illusive techniques used to evade the reverification process.

In selfie reverification, the customer or employee is asked to submit photographs like a standard profile selfie or a selfie with the user looking to the right. Selfie reverification confirms the real-time presence of the customer/employee during the reverification process using selfies. The selfies provided by the customer/employee are compared with a previously submitted selfie or with the picture in the photo ID of the customer.

Selfie verification is especially helpful if there is a suspicion that the user account has been compromised. It is required by law when there is a sale of age-restricted products. Selfie verification is conducted to confirm the legal age of the buyer to assess their eligibility to procure the product.

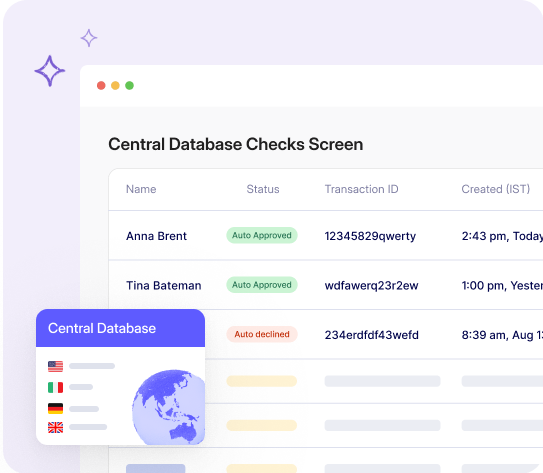

4. Continuous Rescreening and Monitoring

According to KYC/AML compliance requirements, whenever a new customer or employee is onboarded they are screened against certain lists and reports. These work authorization tasks include watchlists, sanction lists, PEP(politically exposed persons) lists, etc.

However, these lists are not constant but are updated to include new conditions. Hence, customers need to be reverified periodically to review their status to verify their eligibility in the present.

Authorized personnel carry out customer or employee rescreening and monitoring to scrutinize the risk levels of both, the customers/employees and their transactions. It helps ensure accurate risk profiles and ongoing compliance.

Challenges in Reverification

Regulated industries like finance, healthcare, online marketplaces, gaming platforms, etc., need to ensure the authenticity of their user’s identities while ensuring compliance with legal requirements. Customer reverification ensures compliance and eliminates bad actors and prevents fraud.

However, the customer reverification process is not popular among all customers because of the inconvenience it causes. Many customers look at customer reverification as an unnecessary hassle. They do not understand the reason why they are being asked to reverify their identity. Besides, it is tedious and time-consuming work for the personnel who reverify customer details.

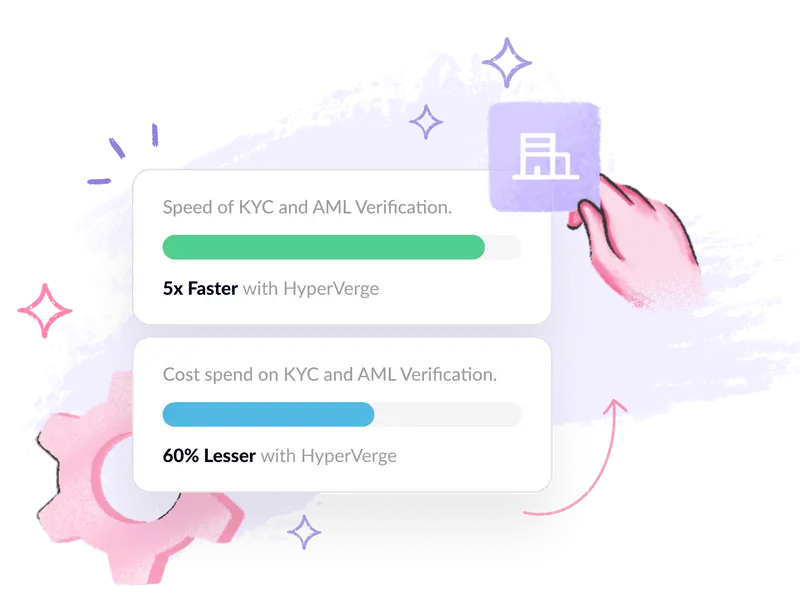

Fortunately, the new automated systems make it easy to reverify customer/employee details. Automation makes the process seamless causing the least inconvenience to users. Automation tools overcome the shortcomings of manual processes and provide several benefits. Automated AML and KYC tools leverage emerging technologies like artificial intelligence to automate routine tasks so that they are completed in seconds with minimal errors.

The automated reverification process balances user experience while ensuring compliance to prevent fraud.

Make your Reverification Process Seamless with Automated Tools

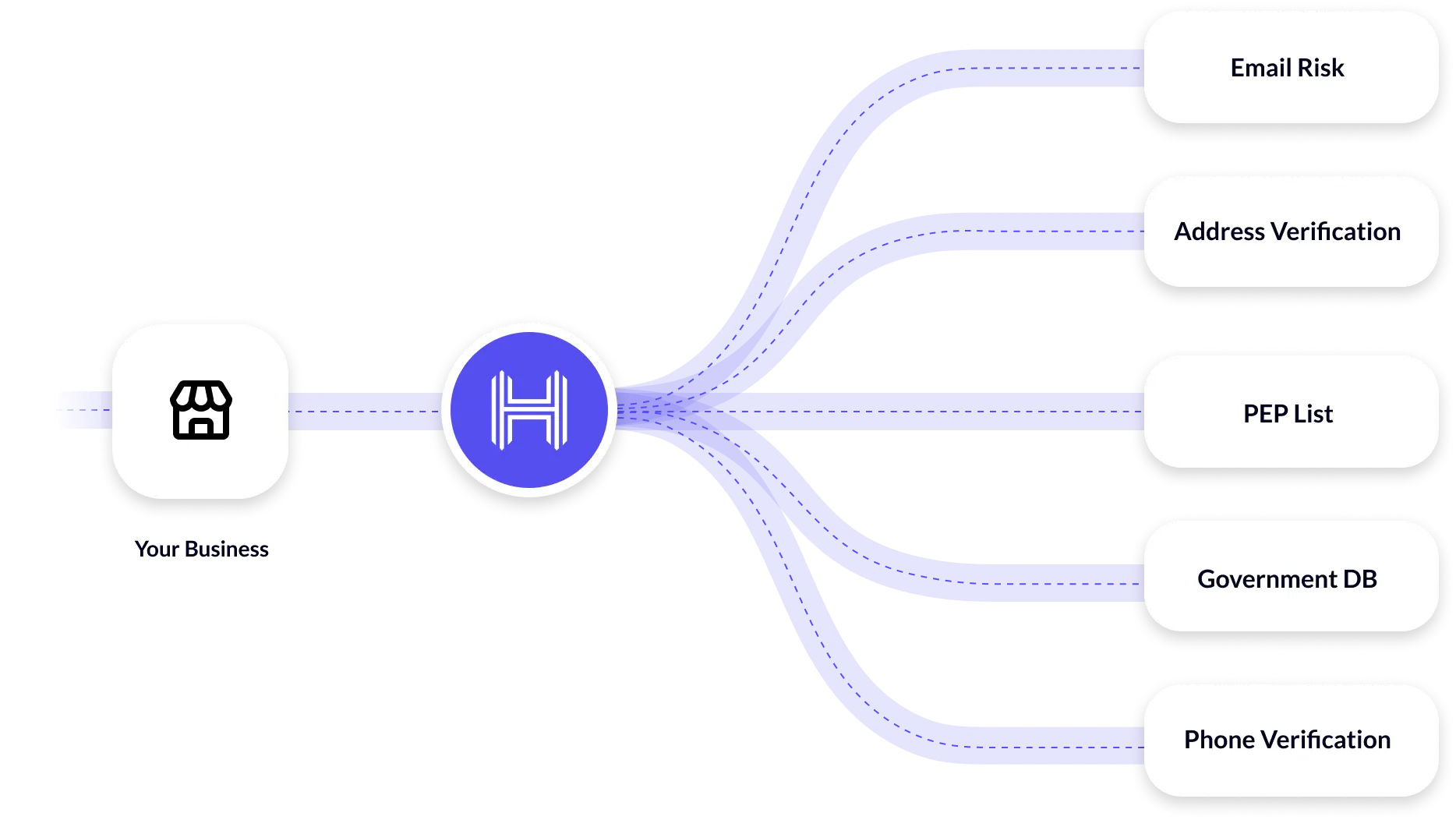

HyperVerge is one of the leading identity verification service providers that provide bespoke KYC/AML tools that automate the re-verification process and offer a host of benefits to our clients.Our AI-based models work seamlessly in real time even in low-bandwidth environments.

HyperVerge conducts all the required checks to ensure that you meet all the compliance standards. It provides alerts in case of failure to meet the compliance standards. We offer end-to-end customer verification that streamlines customer onboarding and reverification. Our user-friendly platform helps you provide a great user experience to your customers.

Connect with our experts now for customized identity verification solutions!