What is Identity Spoofing? How to Prevent it?

Identity spoofing is a malicious technique used by cybercriminals to impersonate a real person or entity.

Identity spoofing is a malicious technique used by cybercriminals to impersonate a real person or entity. The main objectives are typically to:

- Gain unauthorized access to sensitive information, accounts, or systems

- Commit fraud by using the stolen data or access for financial gain

- Spread malware by tricking the victim into installing malicious software

- Damage reputations by sending fake communications in the victim’s name

Recent reports suggest that the most common form of fraud involving new accounts was credit card fraud, which saw 381,122 incidents, making up 42.0% of the top five categories. Following closely behind was miscellaneous identity theft, with 279,221 cases, accounting for 30.7% of the total.

Main causes of identity spoofing

Identity spoofing is a real concern for businesses and there are several causes of this type of fraud. Attackers use many deceptive techniques to spoof organizations or people. Some of these techniques include:

Phishing attacks: One of the prevailing occurrences of identity security breaches in 2024 is phishing, accounting for 69% of reported incidents, representing an increase from 62% in 2023. A phishing attack is a type of fraud. Fraudsters send phony emails from false addresses. Email spoofing is when the attacker sends an email that appears to be from a legitimate sender, but it’s all a big deception. Enforcing frequent installation updates and deploying SPAM filters and firewalls can help control phishing attacks.

Weak passwords: Weak passwords often lead to identity spoofing attacks. Automated programs can crack or guess these passwords, granting hackers access to personal data and enabling them to steal personal information.

Malware: Malicious software damages systems and steals personal information and passwords. Cybercriminals frequently construct a fraudulent website seeded with malicious software to carry out a successful spoofing attack that deceives victims into revealing sensitive information or installing malware.

Data breaches: When a data breach occurs, attackers often gain access to sensitive personal information such as names, addresses, social security numbers, and financial details. Criminals can use this stolen data to create fake identities and impersonate legitimate individuals.

How does identity spoofing work?

Identity spoofing typically involves the following steps:

- Gathering information: Attackers collect personal details about the target individual or entity, such as their name, email address, and other identifying information.

- Creating a fake identity: Using various techniques, such as creating fake websites, altering email headers, or generating deepfake videos, the attacker replicates the identity of the trusted source.

- Initiating contact: The attacker reaches out to the victim, often through email, text messages, or phone calls, posing as the impersonated entity.

- Exploiting trust: Believing the communication to be from a legitimate source, the victim is more likely to trust the attacker’s requests and provide sensitive information or perform actions that benefit the attacker.

- Gaining access or stealing data: Once the victim falls for the deception, the attacker can gain unauthorized access to systems, networks, or accounts, or obtain sensitive information for malicious purposes.

Fraudsters use this false identity to gain unauthorized access to secure systems and sensitive data or conduct fraudulent financial transactions (such as “card not present fraud“). This can involve illegally manipulating bank accounts, making purchases, or taking out loans in the victim’s name. The hacker’s goal is to cause financial harm to the victim and potentially damage their reputation through these malicious activities conducted under the guise of the spoofed identity.

Identity spoofing can take various forms, including:

Email spoofing: An attacker sends emails that appear to be from a legitimate source. But they use a fake email address. If the email seems to be from a company, check the sender’s email address. Make sure its domain name matches the company’s official one.

Caller ID spoofing: The Spoofers forge caller ID information. They use false names or numbers. They assume the identity of certain people or groups. Public networks and Voice over IP (VoIP) networks make this more possible.

IP spoofing: A hacker sends network communication from a spoofed IP address to launch denial-of-service attacks or avoid detection by security systems.

Website spoofing: Creating fake websites that appear real to trick users into providing personal information.

Facial spoofing: Using altered images or videos to trick facial recognition systems. They use fraudulent websites, spam calls, or phishing emails. These tricks deceive people into giving personal information or access to private resources.

Why is identity spoofing a concern?

Identity spoofing poses serious risks to individuals and organizations alike. Consequences of spoofing include stealing personal or company information, financial details, and credentials. Attackers use these credentials to commit fraud, spread malware, and gain unauthorized network access.

Here are a few examples of how fraudsters use spoofed identities:

- An attacker may attempt to impersonate another user by using their private key or login credentials. Since blockchain relies on cryptographic keys for user identification and transaction validation, if someone gains unauthorized access to another user’s private key or credentials, they can effectively pretend to be that user.

- In a Sybil attack, a malicious actor creates multiple fake identities to pretend to be different users, making it difficult to distinguish between genuine and fake personas.

- An attacker may steal another user’s identity by gaining access to their private keys or personal information, allowing them to perform transactions and purchase counterfeit items.

- An attacker might create false or counterfeit documents or records.

Identity spoofing causes:

Financial losses and damaged credit for victims: Identity theft is a major risk across various domains. Once scammed, individuals often face financial losses which can also ruin their credit profiles. Criminals often use the stolen information for unscrupulous activities, leading to reputation damage.

Risks to businesses include fraud and regulatory non-compliance: Identity spoofing scams can cost businesses millions. Intrusion into accounts and breached data can eventually result in lawsuits when they fail to accurately verify the identities of individuals. Failing to properly verify identities and prevent unauthorized access to sensitive data can result in hefty fines and penalties from regulatory bodies.

Related read:

How to prevent identity spoofing scams?

To guard against such an attack, use complex procedures for identity verification. To maintain integrity and to protect against identity theft, it’s necessary to invest in sophisticated fraud detection systems. A few of them are:

Document Verification:

- Verifying provided documents, ID proofs, and all other relevant documents is crucial in preventing spoofing attacks.

- HyperVerge’s advanced AI technologies and machine learning algorithms help ease the detection of fake documents effectively.

- HyperVerge rigorously checks for the authenticity of the documents and aids in effective verification procedures.

Biometric Verification:

- Verifying photographs in the documents with a live presence is important to ensure the genuineness of the provided credentials.

- Providing a selfie picture in addition to the documents is all it takes to conduct HyperVerge’s powerful biometric data verification procedures and enhance security by minimizing fraud.

Face authentication and liveness check:

- This non-invasive method of identity verification improves accuracy which is crucial in areas like banking and law enforcement, reducing the risk of identity spoofing attacks.

- Face checks during High-Risk customer activities, including registration, Transaction, and Logins, to prevent imposters from account takeover.

- HyperVerge offers best-in-class AI face recognition solutions that are both innovative and reliable.

OCR verification:

- Optical character recognition (OCR) recognizes texts in the provided documents and checks if the details match with the government-issued documents.

- This layer of verification ensures the integrity of the documents and improves fraud prevention strategies.

Conclusion

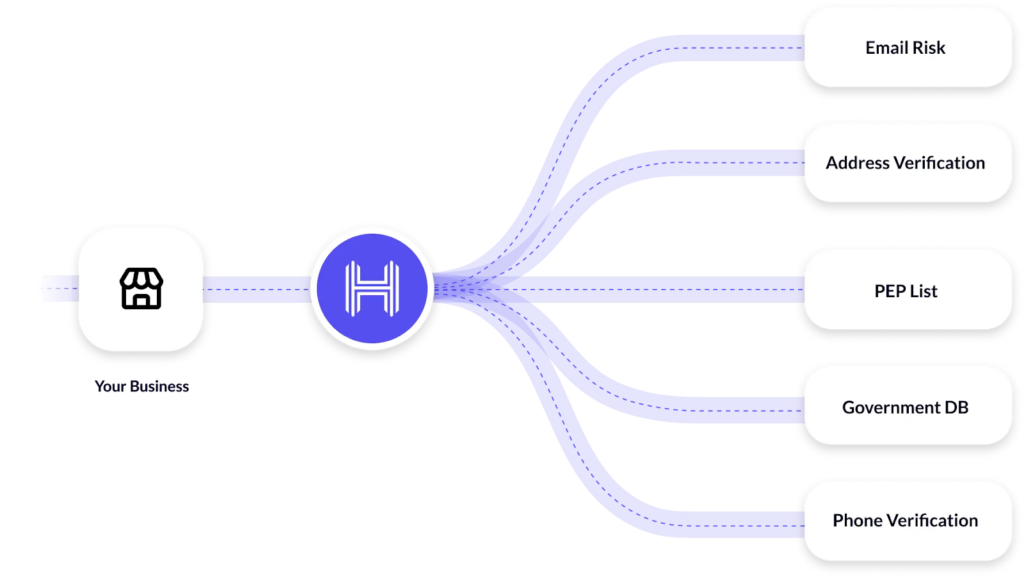

Discover how HyperVerge’s technology can empower your business to operate with confidence safeguarded against the threats of spoofing attacks. HyperVerge provides effective identity verification solutions to mitigate these risks. Identify fraudulent behavior in real-time with best-in-class AI tech and receive tailored solutions that perfectly fit your unique needs, request a demo today.