What Is AML Screening and Ongoing Monitoring?

Safeguarding your business and maintaining compliance requires conducting customer risk assessments. AML screening and ongoing monitoring are crucial components of this process.

AML screening matches customer data with watchlists to detect red flags, while ongoing monitoring detects suspicious behavior, ensuring financial security and legal adherence.

Why Are AML Screening and Ongoing Monitoring Important?

Effective anti-money laundering (AML) screening and ongoing monitoring play pivotal roles in maintaining a robust compliance program within the financial sector. AML screening processes, such as AML watchlist screening and customer screening, are essential components of a diligent verification process. With AML name screening and continuous monitoring, financial institutions can identify known or suspected criminals, ensuring compliance with regulations like the Foreign Assets Control.

Moreover, ongoing monitoring helps mitigate risks associated with adverse media coverage, emphasizing the significance of due diligence processes. A meticulous approach to AML screening and monitoring is imperative for safeguarding against illicit financial activities and maintaining the integrity of the financial system.

Below are the factors that make them important in the financial space:

1. Prevention of Fraud and Financial Crimes

- Robust anti-money laundering (AML) screening and monitoring systems prevent illegal financial activities like money laundering, insider trading, and embezzlement. They are designed to identify suspicious transactions and patterns that indicate criminal behavior.

- AML regulations help businesses and financial institutions promptly flag suspicious activities through authentication of customer identities and continuous transaction monitoring.

2. Regulatory Compliance

- Governments and regulatory institutions impose strict AML regulations to identify and prevent financial crime and promote transparency.

- Effective screening and monitoring of financial transactions are essential in a robust AML compliance program in order to avoid legal penalties.

Read more in our complete guide to AML compliance and AML laws.

3. Safeguarding Brand Reputation

- Businesses or financial institutions, if found associated with money laundering or financial fraud, can severely damage their market standing, leading to customer loss and missed growth prospects.

- By having strong anti-money laundering (AML) measures in place, businesses can reduce the risks to their reputation and finances. This also helps protect them from regulatory penalties, legal fees, and damage to their public image.

How Are AML Screening and Ongoing Monitoring Conducted?

AML screening and monitoring involve a multifaceted approach that combines manual and automated processes with specialized software.

The AML screening processes involve examining and verifying customer information. This includes checking government IDs, documents, and databases (e.g., sanctions screening, watchlist screening, negative news screening, and crime lists) against customer information to identify any existing or potential customers with red flags.

Here’s how businesses and financial institutions conduct AML screening:

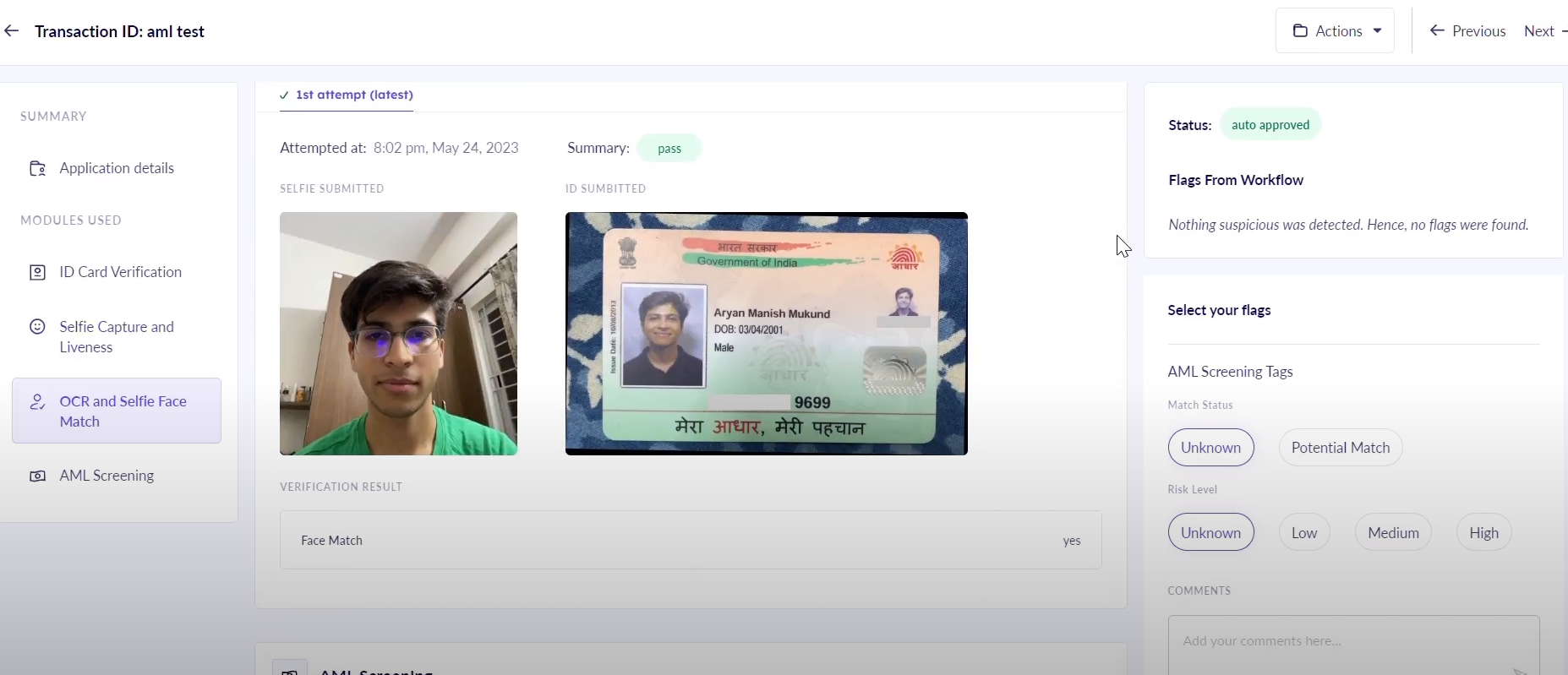

1. Sanction Screening

Sanctions screening enables businesses to check customer details against official lists maintained by governments. This helps them comply with regulations that impose restrictions or penalties on certain people, organizations, and businesses.

While these lists feature those directly named, they also enlist individuals connected to these entities, such as business partners or family members.

This approach helps identify and classify people involved in illegal activities, even if they are not specifically listed on the sanctions lists. This makes the screening process more comprehensive and effective.

2. PEP Screening

PEP screening is the process of identifying individuals with significant political or public roles (e.g., politicians, government officials, etc.). Its primary goal is to ensure compliance and to prevent businesses from engaging with such individuals, who may pose potential risks due to their exposure to corruption and embezzlement schemes. Screening for PEP status can help agencies protect their integrity and public reputation.

3. Adverse Media Screening

Adverse media screening examines news sources to find out if clients may be engaged in illicit activities. Although it can be performed manually, many organizations use automated systems because of the massive amount of data involved.

Automated systems quickly search for mentions of the individual and keywords, which helps identify individuals and entities that pose financial or legal risks, such as politically exposed persons (PEPs) and those subject to sanctions.

4. Risk Assessment

Risk assessment in financial fraud detection involves analyzing the risk associated with clients, transactions, or relationships. It considers factors like client information, location, past transactions, and business connections to identify high risk customers determine the level of scrutiny and customer due diligence and enhanced due diligence.

By identifying high-risk levels, resources can be allocated accordingly, improving the effectiveness of money laundering (AML) screening measures.

Read more about enhanced due diligence here.

5. Risk Management and Control

Risk control involves implementing strategies and measures to monitor, identify, and reduce the risks that are linked with financial fraud.

Here’s a breakdown of how companies can implement risk management and control:

- Identifying Risks: This involves identifying potential risks linked to customers, transactions, and business relationships.

- Risk Assessment: The next step is predicting the likelihood and potential impact of identified risks. It helps you prioritize resources and efforts towards higher-risk areas.

- Risk Mitigation and Management: It deals with enforcing measures to minimize the impact of identified risks that include implementing transaction monitoring systems, enhancing customer due diligence procedures, and more.

- Monitoring and Review: Continual monitoring and review processes include regularly reviewing risk assessments, evaluating any changes in risk profiles, and updating risk control strategies as needed.

AML Screening Process Best Practices

To perform aml screening effectively, the following practices should be observed:

1. Use an Advanced Automated Screening Tool

Automated screening tools can rapidly analyze massive amounts of data, eliminate human error, and deliver real-time monitoring facilities.

Business owners enjoy customizations, scalability, seamless integration with existing systems, and comprehensive reporting features, all of which boost efficiency while ensuring adherence to regulatory standards.

Be sure to regularly update and improve the screening tool to match the changing rules and new dangers in finance.

2. Employ a Risk-Based Approach

A risk-based approach involves resource prioritization depending on the risk involved, customization of due diligence procedures, and achieving greater AML compliance efficiency.

This approach allows institutions to shift efforts towards higher-risk areas, adapt to changing risk profiles, and allocate resources effectively, which boosts their ability to detect and mitigate financial crime risks.

3. Use Comprehensive Data Resources

This practice involves leveraging multiple sources, including watchlists, customer data, and public records, to improve the efficiency of customer risk assessment, a thorough screening process, and flagging suspicious activities.

Data analysis from multiple sources can help financial institutions gain valuable insights into customer behavior and spending patterns, which helps boost the effectiveness of anti-money laundering processes.

4. Establish Effective Monitoring and Alert Systems

Advanced monitoring and alert systems include introducing transaction monitoring systems that analyze customer transactions in real time, applying behavioral analysis techniques to detect anomalies, generating automated alerts for suspicious activities, and managing ongoing investigations using a case management platform.

Regular monitoring and fine-tuning of these systems are necessary to stay compliant with evolving risks in the financial space.

Make Your AML Screening Processes Effective with Automation

Automated AML solutions like HyperVerge provide robust compliance programs that incorporate advanced features to effectively combat money laundering activities and terrorism financing. AML screening software employs a sophisticated process that works by continuously monitoring transactions and screening customers against global regulatory databases, AML watchlists, politically exposed persons lists, and other sources of adverse media data. With cutting-edge technology, these solutions aim to minimize false positives while identifying unusual or suspicious activity indicative of potential money launderers or suspected criminals.

Read more: Top AML software and how to choose one

This approach not only helps financial institutions achieve compliance with regulatory bodies but also mitigates reputational risks and the possibility of regulatory fines. Through comprehensive verification processes and due diligence measures, such software enables organizations to tailor their risk assessment and apply appropriate measures based on the risk level associated with each customer or transaction.