Risks are prevalent, shadowing almost every other transaction in today’s fast-paced financial systems. Adverse media screening is vital for financial institutions and banks as they enable high security and compliance. They also aid in protecting assets and ensuring adherence to AML laws.

Adverse Media Checks help identify potential risks and involvement in illegal activities, reduce the risks associated by doing business with unsafe companies, secure the reputation of companies, and avoid penalties for non-compliance.

We will look at the concept of the adverse media screening process in detail and showcase how it is a vital cog in the wheel for risk management.

Understanding Adverse Media Screening

Adverse media screening shields banks, financial institutions, and businesses from potential risks while keeping them in line with the regulations and protocols.

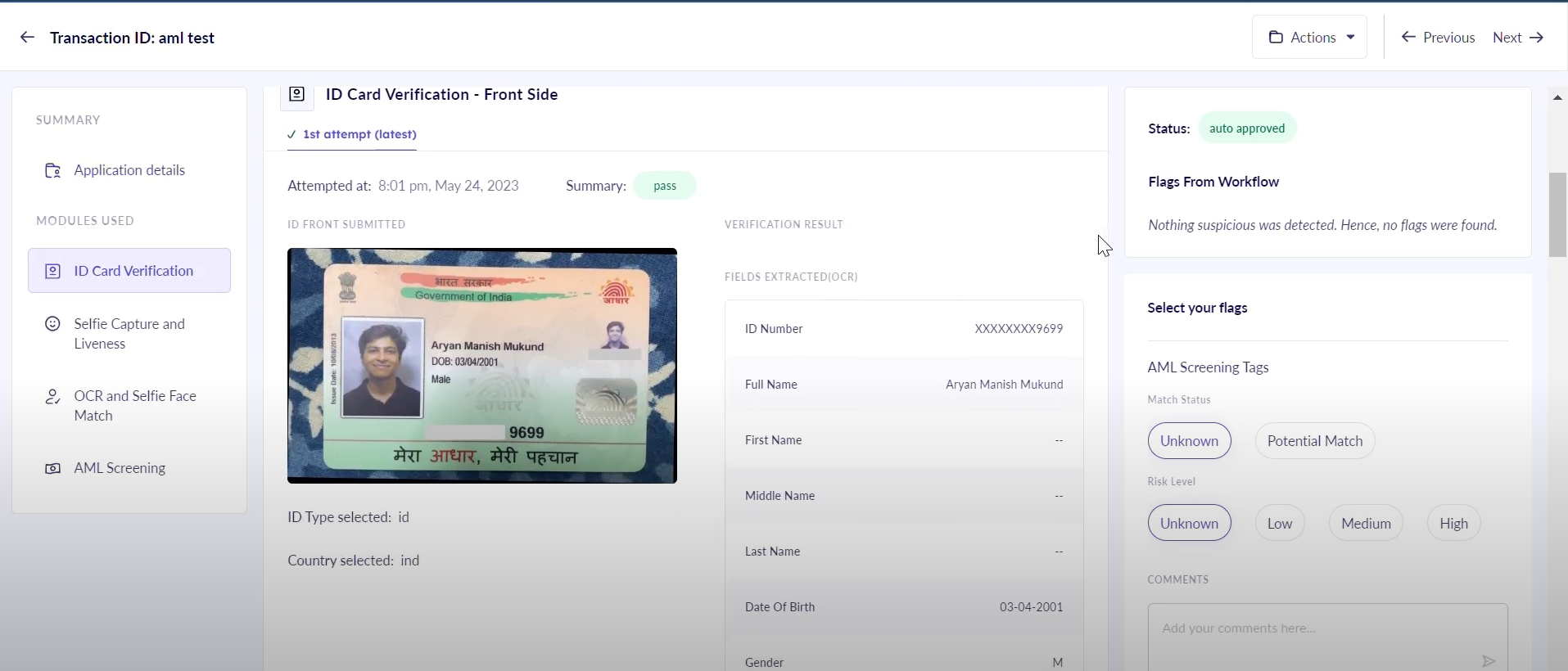

Adverse Media refers to bad press or negative information about an existing or prospective customer. Adverse media screening involves a systematic process involving data collection and negative news screening, where specific and potential information is obtained using the Know Your Customer (KYC) facility. Consequently, a thorough analysis is carried out by screening algorithms by scouring news sources, social media feeds, and regulatory databases for signs of risk.

When onboarding a new customer, there may be deep-rooted layers of potential risks from various sources including sanctioned organizations, financial misconduct, or ill-gotten funds gathered from illegal activities like money laundering or some other crime.

Financial institutions cannot overlook these potential issues, lest they face repercussions. If these anomalies or red flags are not timely identified during the onboarding of clients, banks and financial systems can face significant losses due to sanctions, legalities, and trust too.

Adverse media screening is an underlying part of a concrete risk management framework for banks and financial institutions- it leverages the power of data and technological advancements to protect the trust factor of the financial system, thereby safeguarding customer assets in sync with the compliance obligations.

Challenges of Adverse Media Screening

Adverse media screening is a complex process. A humongous data mine overawed even the most potential AI algorithms, leading to erroneous outcomes.

In addition, the dynamic nature of media in today’s digital era calls for continuous and consistent vigilance. Many factors like demographics and diverse situations need to be considered to realize an effective result in adverse media screening.

Further, absolute precision and reliability of screened data are paramount. Therefore, Advance Media Screening has to ensure the proper distinction between appropriate sources and spurious claims.

Read more about money laundering:

- What are the three money laundering stages?

- What is layering in money laundering?

- What is a money mule?

- What is Trade Based Money Laundering (TBML)?

- What is Smurfing and How You Can Prevent it Proactively

How is Adverse Media Screening Done?

Adverse media screening must be meticulous to derive actionable insights from the ever-growing volumes of digital data. Some of the key facets like Data Collection, Adverse Media Checks, Assessment of Risk, and Alerts and Actions are explained as follows:

Data Collection

adverse media screening obtains and analyzes data from diverse sources like news articles, legal and regulatory filings, and social media portals to realize potential risks and hazards.

The Data Collection stage helps identify risks by gathering data from various factors like demographics, diverse geographies, and the history of customers’ financial transactions. KYC empowers financial institutions and banks with the most recent information and their respective risk profiles of the clients.

Financial institutions can then take timely action to reduce or eliminate risks in line with the regulatory requirements if they proactively implement adverse media screening.

Read more about what is a customer identification program (CIP).

Adverse Media Check

Using this massive amount of information, AI algorithms complete comprehensive Adverse Media Checks. Some of the sources of adverse media include news articles, online or broadcast news, social media feeds, legal filings, and regulatory information for detecting significant risks. NLP (Natural Language Processing) and Keyword Searches are a few attributes that help uncover suspicious activities and reduce risks associated with them. Therefore, leading-edge technologies are a must to process huge data mines effectively.

Risk Assessment

The stage of assessing risk is where the detected risks undergo hardcore evaluation. Potential threats identified via adverse media screening are reviewed for probability and possible impact against the regulatory thresholds. Thorough analysis using statistical modeling, manual screening, and data analytics are some key facets that help identify and single out risk profiles. The probability of risks and the repercussions associated with them help in informed decision-making and crafting appropriate risk management techniques.

Read more about risk assessment and AML checks here.

Alerts and Action

Financial systems should take rapid action when they come across AML red flags or anomalies during adverse media Screening checks. Suspicious Activity Reports (SARs) are initiated in line with the compliance regulations to address those risk concerns (and financial crime) in a timely way. This helps reduce operational vulnerabilities and emerging threats and strengthens the financial systems.

Best Practices for Adverse Media Screening

Effective adverse media screening depends on adherence to certain guidelines, though not limited to the following ones:

Check a Variety of Sources

Information for screening adverse media must be sourced from diverse data channels, including various news sources, social media platforms, broadcast news, regulatory filings, and legal archives, to mention a few.

This reduces the biasing nature of datasets and enables a sense of generalization to provide accurate and efficient results. In addition, this also aids in proactively detecting emerging threats and vulnerabilities that can adversely affect their operations.

Apply Media Categorization

Data gleaned from screened adverse media must be classified into specific categories to enable effective risk management and realize risk mitigation tacks. By efficient data categorization, financial systems can generate tangible responses and ensure proper resource allocation. This helps streamline the screening procedures for adverse media, leading to concrete analysis and precise action.

Continuous Customer Screening

Continuous Customer Screening involves real-time monitoring of customer data and transactions. This leads to holistic risk management. A blend of automated monitoring systems and manual review processes empowers organizations to proactively detect factors like negative news, suspicious activities, unauthorized transactions, and changes in customer behavior, among others. This agile response proficiency streamlines operational adaptability while considerably reducing the degree of potential risks and regulatory violations.

Read about the customer due diligence process here.

Maintain a Comprehensive Record

Documentation and records are vital assets that ascertain transparency, accountability, and compliance throughout the screening process. Records of all screening processes, ranging from collecting data of adverse media, assessing risk, reviewing analytics and updates, and gathering actionable insights, should be maintained systematically. This way, government agencies, regulatory and legal authorities, and relevant staff can access an audit trail leading to due diligence undertakings.

Screen for Ultimate Beneficial Owners (UBOs) and Politically Exposed Persons (PEPs)

High-risk individuals, their associated entities, and individuals, such as Ultimate Beneficial Owners (UBOs), business partners, and Politically Exposed Persons (PEPs), should be considered with due diligence and always screened for adverse media beforehand.

UBOs and PEPs are usually influential factors and must be detected promptly, as financial systems can reduce relative risks such as concealed ownership structures, regulatory exposure, money laundering, financial fraud, terrorist-related crimes, and potential illicit activities (drug trafficking, human trafficking, etc.). Enhanced Due Diligence (EDD) procedures and ongoing transaction monitoring measures are important to identify and address risks due to UBOs and PEPs.

Organizations grow resilient and can strengthen their defenses against detrimental vulnerabilities, increase their resilience, meet AML compliance obligations, and maintain their reputation in the ever-increasing risk landscape.

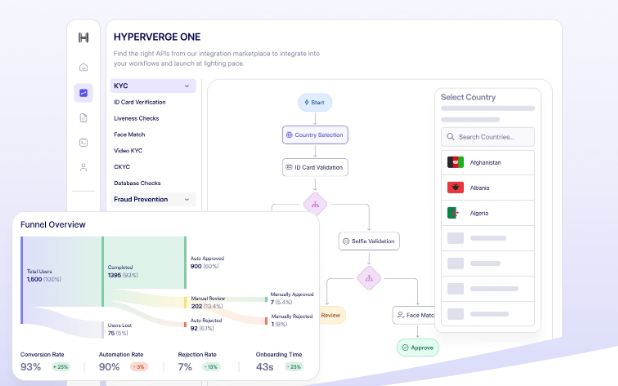

Automate Adverse Media Screening Process with Effective AML Solutions

Adverse Media Checks play a crucial part in Anti Money Laundering (AML) programs with leading banks and fintech companies leveraging it to identify clients and their business partners for possible money laundering, terrorist financing risk, and organized crime among other criminal activities.

Our AML solution includes features like sanctions screening, global watchlist checks, PEP screenings, and end-to-end KYC, taking care of all your regulatory needs. Shield your bottom line and mitigate risks while being one step ahead of financial crimes with our AML software. To learn more, get a demo.