Whether you are a growing startup or an established enterprise, a reliable identity verification solution is important to streamline user onboarding and maintain regulatory compliance.

While Trulioo is a trusted option, users face the following challenges with its current identity verification software.

- Difficulties in integration due to compatibility issues and complex processes.

- Incurs upfront investment and ongoing maintenance expenses.

- Fails to ensure compliance with standards like GDPR and HIPAA.

If you are facing any of the above challenges and looking for an alternative, this guide on Trulioo competitors will help you compare features, integration, compliance, and pricing options.

Let’s get started.

Why consider Trulioo competitors?

Trulioo is a reputable identity verification platform that supports over 5,000 types of IDs across 200 countries and territories. However, staying updated with competitive alternatives is crucial for businesses to use the latest technologies for accurate identity document verification. Considering Trulioo alternatives is necessary to stay updated with specialized features, cost efficiencies, enhanced customization, and superior customer support.

Here are a few of the reasons why you should choose Trulioo competitors.

| Specialized feature sets: Competitors offer the latest and advanced features that better align with niche requirements, like industry-specific compliance needs. Customization: Alternatives come with more flexible customization options that allow customized solutions per their operational workflows and customer experience needs. Superior customer support: Certain competitors are well prepared to maintain customer support. These competitors excel at offering responsive services with personalized assistance compared to Trulioo’s support framework. |

How we analyzed and selected the Trulioo competitors

We carried out a manual process to shortlist Trulioo’s competitors. This process involved detailed market evaluation and thorough analysis to identify the best competitors. Check out the process we followed to list the top 10 competitors of Trulioo.

- Researched around 65 alternatives that excel at offering efficient identity verification solutions.

- Evaluated each competitor’s reviews and ratings on popular review platforms like G2 and Capterra.

- Shortlisted the competitors based on several factors like features & functionalities, pricing structure, clientele, customer support, and scalability.

Following such a process ensures you get a provider that offers an ideal identity verification service. Here are the shortlisted Trulioo alternatives.

- HyperVerge – Best for AI-powered identity verification and AML complaint

- Onfido – Best for advanced digital identity solutions

- iDenfy – Best for customizing identity verification service

- Socure – Best for financial institutions

- SEON – Best for preventing account takeover and synthetic identity fraud

- Sumsub – Best for smooth and secure verification for user onboarding

- Ondato – Best for real-time compliance monitoring

- Persona – Best for global compliance and user conversion

- Jumio – Best for real-time fraud detection and prevention

- Veriff – Best for advanced biometric authentication

An overview of the top 10 Trulioo alternatives to look for

Here is a table that contains an overview of the top Trulioo competitors.

| Trulioo competitors | Targeted industries | Free trial availability |

| • Financial services • Education • Gaming • Remittance • Crypto • Marketplaces • Logistics and eCommerce | A 30-day free trial is available with a sandbox environment | |

| • Financial services • Remittance • Gaming • Transport • eCommerce • Healthcare • Telecommunication | No free trial is available | |

| • Fintech • Crypto • Blockchain • Online gambling • eCommerce • Gaming • Transportation | A free trial is available | |

| • Financial services • Marketplaces • Gaming • Sharing economy • Crypto • Public sector | No free trial is available | |

| • Financial services • Gaming • Retail • Payment fraud • Fintech | A 30-day free trial is available | |

| • Fintech • Gaming • Trading • Crypto • Transportation • Marketplaces | A 14-day free trial is available | |

| • Financial services • Insurance • Legal • Gambling • Cryptocurrency • Telecommunications | No free trial is available | |

| • Fintech • Digital health • eLearning • Cryptocurrency • Public sector | A 60-day free trial is available | |

| • Financial Services • Gaming • Healthcare • Travel • Mobility • Education | No free trial is available | |

| • iGaming • Dating • HR management • Crypto • Education • Healthcare | A 15-day free trial is available |

Understanding the top 10 Trulioo alternatives and competitors in detail

1. HyperVerge

About HyperVerge

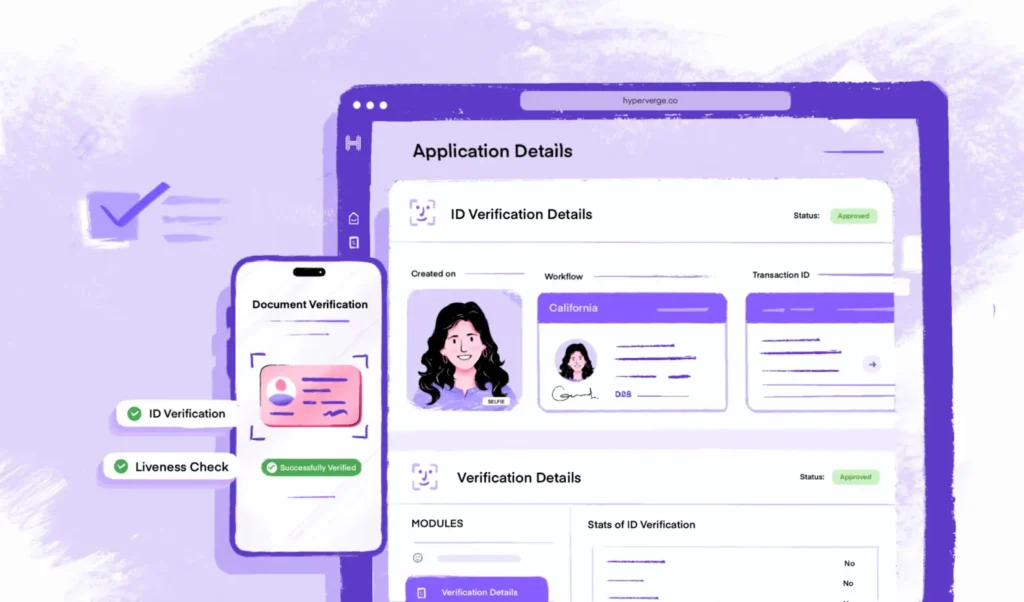

HyperVerge ONE is a leading AI-powered platform that streamlines the customer onboarding process. The platform excels at providing industry-leading conversion rates and stringent AML compliance. HyperVerge serves 200+ global businesses, from startups to enterprises, using its advanced AI solutions to minimize fraud risks and optimize customer conversion funnels.

Why choose HyperVerge ONE for identity verification?

- Maintains a high average pass rate of 96% in the United States.

- Enables you to go live within 4 hours with web & mobile SDKs for rapid deployment.

- Offers 100+ onboarding APIs to serve diverse industry use cases like the financial services sector and EdTech.

- Boasts a 99% auto-approval rate for verified identities, and reduces user drop-offs by 50%.

- Adheres to global regulations like GDPR, ISO 27018, and AICPA SOC2 to ensure data security and compliance.

HyperVerge provides users a no-code workflow builder to complete customized onboarding journeys in minutes. The software also provides a complete view of customer risk identification to help businesses make better decisions and fulfill the AML compliance requirements. With global coverage, flexible pricing options, and 24/7 technical support, HyperVerge stands out as a reliable and secure identity verification software.

HyperVerge features better than Trulioo

- Biometric authentication: Offers advanced AI-powered facial recognition and ID validation for secure and accurate biometric authentication.

- Age verification: Uses the latest algorithms to verify age with precision. This is important for compliance in industries like gaming and retail.

- Fraud monitoring: Integrates real-time AI-driven fraud detection to identify and prevent suspicious activities during the entire verification process.

- Transaction monitoring: Provides tools for real-time monitoring of user transactions to ensure compliance with regulatory standards and minimize financial risks.

HyperVerge pricing

HyperVerge offers a variety of pricing plans for startups and enterprises. Check out each pricing plan in detail and select the plan that suits your business requirements.

| Start plan (Startups) | Grow plan (Mid-sized companies) | Enterprise plan (Enterprise-level organizations) |

| The Start plan includes a free trial and easy integration within 4 hours. It also offers identity verification tools to view and manage verification for one month. | The Grow plan involves everything covered in the Start plan, including an end-to-end ID verification suite, access to AML checks, central database checks, and customized business workflows. | The Enterprise plan involves all the features and offerings from the Grow plan, along with a custom price structure and collaborative tools. |

What do HyperVerge users say?

Client video testimonial

HyperVerge serves more than 100 clients worldwide including AngelOne, L&T Finance, HomeCredit, Freo, ZestMoney, and Slice. Check out the feedback from one of our leading clients on how HyperVerge became a pillar of the customer onboarding journey of PDAX.

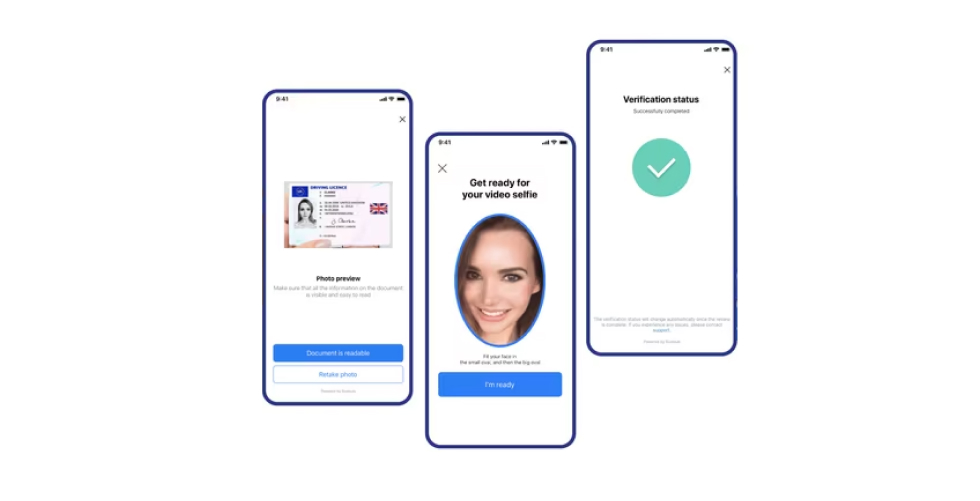

2. Onfido

About Onfido

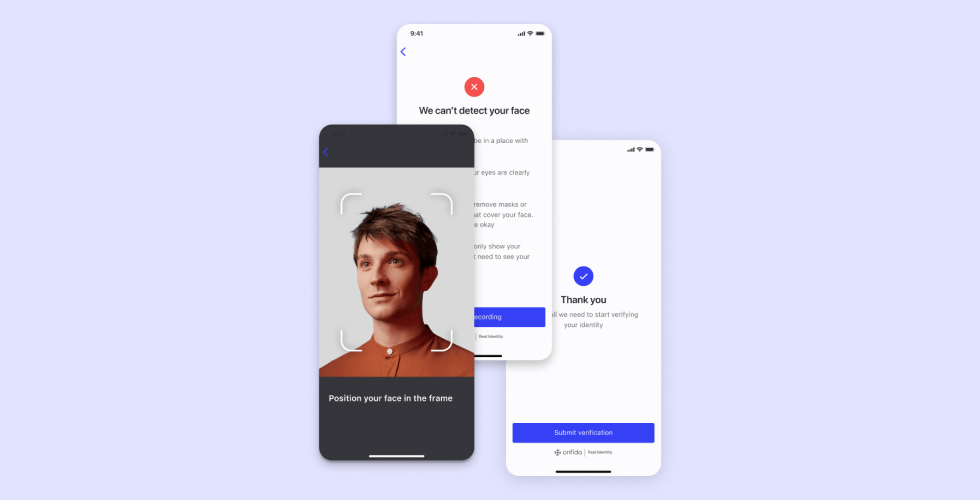

Onfido is a reliable digital identity verification solution that helps simplify and secure the customer onboarding process. Using AI technology, Onfido ensures accurate and automated identity verification, which helps businesses meet global Know Your Customer (KYC) and Anti-money Laundering (AML) compliance requirements. The platform enhances customer acquisition by reducing identity verification costs and providing strong detection mechanisms to protect from identity fraud.

Onfido Pricing

Contact Onfido for current pricing.

Key features of Onfido

- Document verification: Verifies customer identities using a library of award-winning document verification techniques. This helps authenticate global identity documents like passports and driver’s licenses.

- Biometric verification: Matches customer selfies with ID documents. This process enhances security and accuracy in digital identity verification and also reduces the risk of fraudulent activities.

- Fraud detection: Uses passive fraud signals and AI-driven analytics to identify and prevent identity fraud, protecting businesses from fraudulent attempts.

| Pros of Onfido✓ Some users praise the effective detection of false documents and low false positive rates by Onfido.✓ Offers integration options that help easily integrate identity verification into existing workflows.✓ Users find the stability of the software to be exceptional. Cons of Onfido✕ Users feel that the software lacks reporting options. ✕ Several users feel the onboarding process to be complex and take longer than expected. |

Onfido compared with Trulioo

Onfido excels at providing advanced solutions like biometric authentication and Customer Identity and Access Management (CIAM). In contrast, Trulioo does not offer these capabilities.

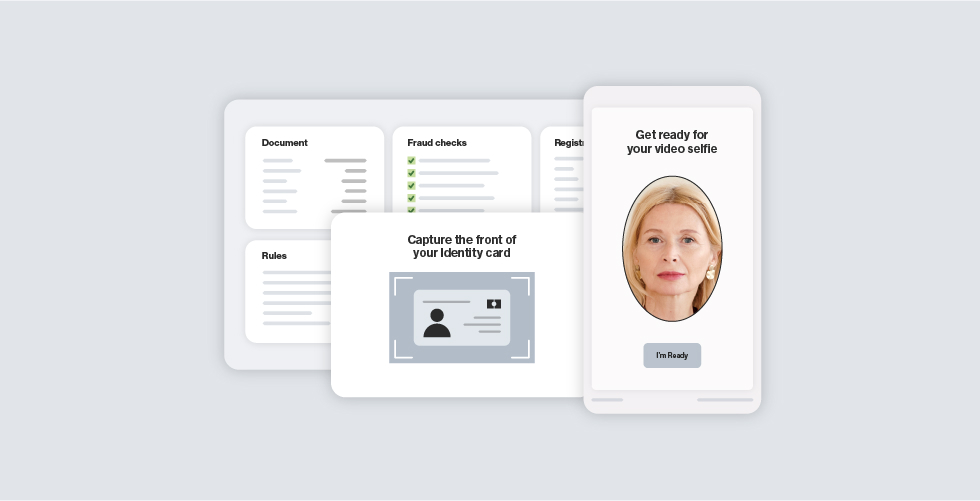

3. iDenfy

About iDenfy

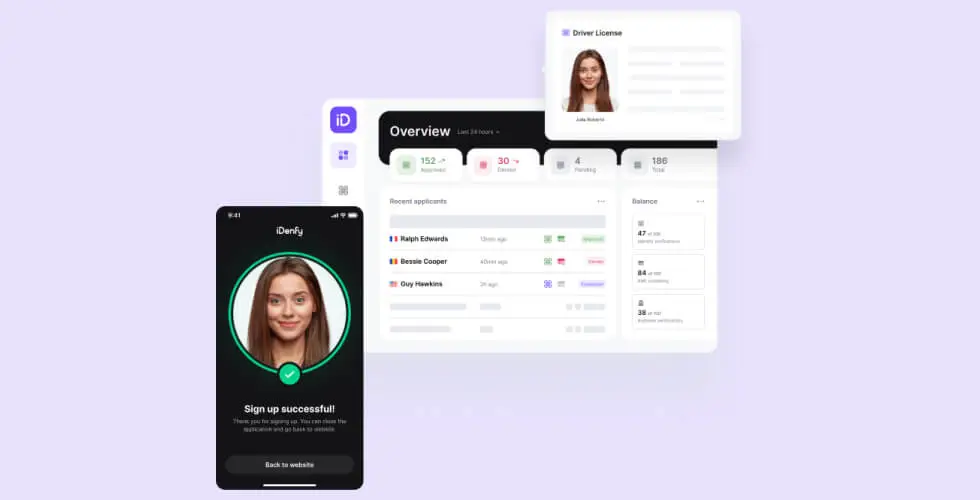

iDenfy is an all-in-one identity verification platform that assists in onboarding users while tackling security challenges like identity theft and fraudulent activities. The solution integrates capabilities like digital identity verification, business verification, and fraud prevention to optimize the user onboarding process. Using AI-powered biometric recognition and 3D liveness detection, the software provides an accurate and reliable identity verification solution.

iDenfy Pricing

Contact iDenfy for current pricing.

Key features of iDenfy

- Biometric recognition: Uses AI technology to compare customer IDs with their biometric data which helps reduce the risk of fraudulent accounts.

- PEPs and sanction screening: Provides comprehensive screening with politically exposed persons (PEPs) and sanctions lists. This process helps stay compliant with regulatory requirements and avoid risks.

- 3D liveness detection: Uses patented 3D liveness detection technology to detect fraudulent verification attempts. This assists in maintaining the integrity of the seamless identity verification process.

| Pros of iDenfy✓ Certain users say that iDenfy makes remote customer verification easier.✓ Offers detailed and straightforward API documentation which makes integration easier and faster.✓ The customer support is responsive with consistent follow-ups. Cons of iDenfy✕ Users experience instances where the documents failed to pass the check.✕ Some users encounter false positive results with the platform and require additional checks. |

iDenfy compared with Trulioo

iDenfy fraud detection, phone verification, and PEP & sanctions screening solutions set it apart from Trulioo, which does not offer these options.

4. Socure

About Socure

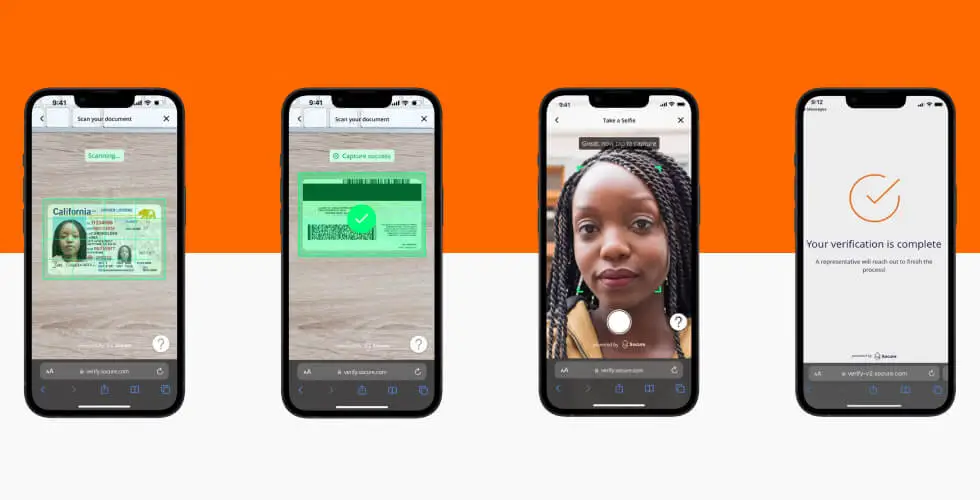

Socure is a top-tier identity verification solution that helps onboard new customers quickly and scale faster. The platform uses advanced AI and machine learning to deliver unparalleled accuracy in verifying identities. The software boasts 98% auto approvals to meet strong regulatory standards. One of its notable features is simplifying KYC processes, whether you combating identity fraud or enhancing compliance.

Socure Pricing

Contact Socure for current pricing.

Key features of Socure

- Synthetic ID fraud detection: Uses advanced machine learning algorithms to detect and prevent synthetic identity fraud.

- Document and selfie verification: Authenticates customer identities with document and selfie verification to ensure compliance with KYC regulations and enhance onboarding.

- Watchlist screening: Performs real-time screening against global watchlists to detect and flag suspicious activities like financial fraud & money laundering.

| Pros of Socure✓ The speed and accuracy of identity verification are remarkable.✓ Users find Socure to be ideal as it detects fake IDs as well, not just recognizing the faces and IDs.✓ Socure’s API integration stands out with its strong functionality. Cons of Socure✕ Users don’t like the software due to the lack of facial recognition.✕ Some users face problems with scanning the back of an ID. |

Socure compared with Trulioo

Socure offers advanced capabilities like customer risk assessment and fraud detection, which Trulioo fails to provide.

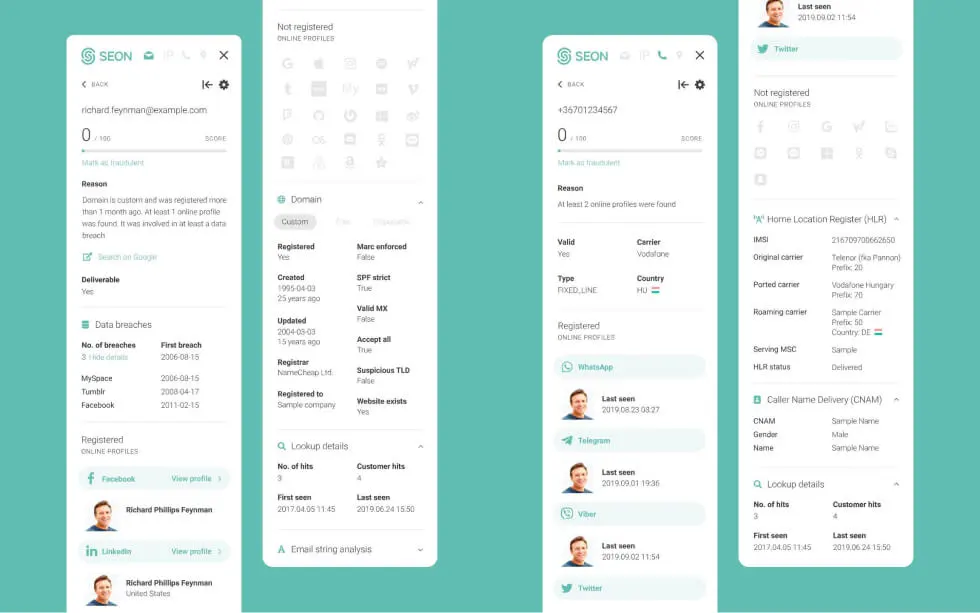

5. SEON

About SEON

SEON is one of the leading fraud prevention platforms to protect businesses from fraud and money laundering. The platform ensures protection from the initial user interaction to ongoing account activity. Also, SEON excels at providing valuable outcomes by using advanced digital footprint, device intelligence, ID verification, and real-time monitoring. It’s an essential tool that enhances fraud detection accuracy, reduces manual reviews, and optimizes complex processes.

SEON Pricing

Contact SEON for current pricing.

Key features of SEON

- Rule-based fraud detection: Enhances fraud detection by deploying machine learning -suggested rules or allowing businesses to develop their own with a codeless rule builder.

- Activity monitoring: Monitors user activities in real-time by enabling rapid transaction validation and ensures a smooth & secure user experience.

- AML compliance: Consolidates AML screening, case management, and regulatory reporting into a single platform to optimize compliance tasks and improve operational efficiency.

| Pros of SEON ✓ Several users praise the speed of the software in checking transactions.✓ Users appreciate the software design, which makes it easy to integrate it with existing systems.✓ Even if the users have simple inquiries or more complex queries, the support from the SEON team is superior. Cons of SEON ✕ Some users feel the setup process is a bit complex and time-consuming.✕ Users sometimes encounter issues where the software generates false alarms. |

SEON compared with Trulioo

SEON surpasses Trulioo with strong identity fraud prevention, easy email lookups, and integrated AML features.

6. Sumsub

About Sumsub

Sumsub is a trusted identity verification platform that specializes in securing every step of the user journey. Using a single and intuitive dashboard, businesses can handle their identity verification needs, whether it’s verifying customers or businesses or monitoring transactions. The software assists in streamlining identity verification checks without any coding required to ensure top-notch anti-fraud protection and compliance with regulatory requirements.

Sumsub Pricing

Sumsub provides pricing plans that start at $1.35 per verification, along with a monthly commitment, and go up to custom pricing for enterprises.

Key features of Sumsub

- Liveness and face match: Confirms that the user is physically present during verification by matching the live image with the photo ID. This adds a layer of security and prevents identity fraud.

- AML screening: Checks users with PEP lists, sanctions, and adverse media to avoid financial risks and ensure regulatory adherence.

- Device intelligence: Uses advanced device intelligence to assess the risk related to user devices. This analyzes device behavior and characteristics to detect and prevent fraud earlier.

| Pros of Sumsub ✓ Provides a rapid and easy verification process that minimizes drop-outs.✓ Integrates easily with the current workflows with no time.✓ Offers superior customer support, providing swift and accurate responses to queries. Cons of Sumsub ✕ Users feel that the speed of analyzing and processing data is taking a lot of time.✕ Some users encounter constant errors, like passports that are already approved are shown with the status “rejected.” |

Sumsub compared with Trulioo

Sumsub excels over Trulioo with several solutions like crypto compliance, deepfake detection, liveness detection, and PEP & sanctions screening.

7. Ondato

About Ondato

Ondato is one of the reliable providers when it comes to providing KYC, KYB, and AML solutions. This platform excels at streamlining identity verification, business onboarding, and customer identity lifecycle management. Ondato ensures adherence to the latest regulatory standards to mitigate risks, prevent identity fraud, and improve operational efficiency. From customer onboarding to real-time transaction monitoring, Ondato offers scalable solutions customized to meet diverse industry needs.

Ondato Pricing

Ondato offers multiple plans starting at $0.99 per verification, with a monthly license fee that varies depending on the plan. The software also provides custom pricing for enterprises.

Key features of Ondato

- Biometric verification: Deploys industry-leading biometric and face match technologies for accurate and swift digital identity verification.

- Compliance monitoring: Uses AI-driven transaction monitoring and ongoing due diligence to detect suspicious activities. This feature helps protect from financial crimes like money laundering and digital fraud.

- Flexible identity verification methods: Offers a range of verification options like automated photo eKYC, NFC-based identity verification, and agent-assisted calls to serve diverse customer preferences.

| Pros of Ondato✓ Users find it helpful to conduct AML screening where they get the option to choose between natural and legal screening.✓ The speed and precision of the identification and verification procedure are ideal.✓ The customer support team is very responsive and always available when needed. Cons of Ondato✕ Users face problems with the processing of Italian and Greek paper IDs.✕ Certain users find it difficult to review adverse media or sanctions details after a rejection. |

Ondato compared with Trulioo

Ondato excels at offering several capabilities like digital signature, facial recognition, Multi-Factor Authentication (MFA), and risk-based authentication that Trulioo lacks to offer.

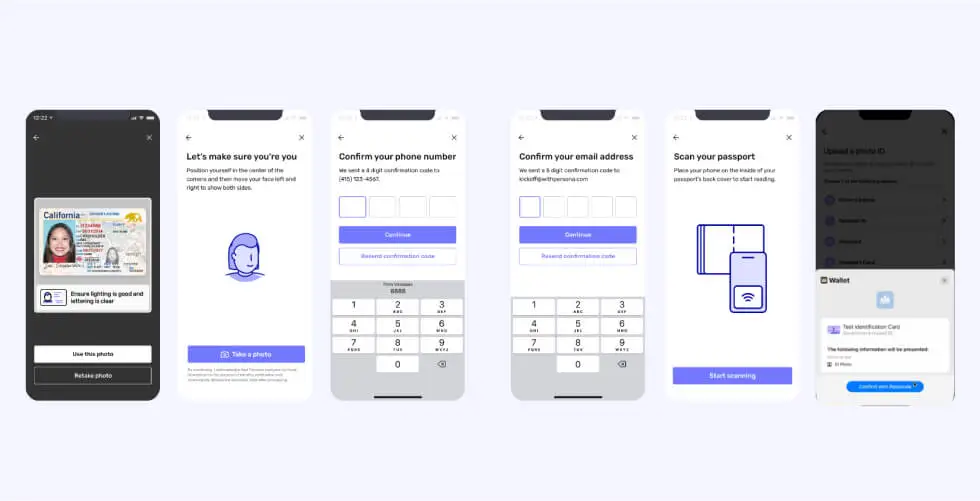

8. Persona

About Persona

Persona is a reliable digital identity platform that enables easy collection, verification, and orchestration of customer identities. The platform provides access to several international data sources spanning 200+ countries and territories. This facilitates detailed KYC checks that adhere to local regulatory standards. The solutions improve user journeys by adjusting the friction levels to boost conversion rates while preventing fraud.

Persona Pricing

Persona provides different plans to suit all types of businesses. The Essential plan starts at $250 per month with volume discounts. Custom pricing is also available for Growth and Enterprise plans.

Key features of Persona

- Dynamic identity verification flow: Creates customized identity verification processes that adapt in real-time based on risk signals to optimize the user experience and fraud prevention capabilities.

- Automated complaint operations: Optimizes KYC/AMC compliance with automated screening against watchlists and adverse media reports.

- Continuous re-verification: Ensures ongoing identity verification throughout the customer lifecycle with scheduled re-verification to maintain security standards over time.

| Pros of Persona✓ Verifies individual IDs within seconds and extracts details like data and code with ease and precision.✓ Users appreciate the easy implementation of Persona API.✓ Offers a simple and intuitive dashboard along with superior customer support. Cons of Persona✕ Some users encounter drop-offs due to issues with the OCR feature✕ Users experience latency and error pop-ups with a weak internet connection. |

Persona compared with Trulioo

Unlike Trulioo, Persona offers adverse media screening to ensure thorough risk assessment and compliance measures.

9. Jumio

About Jumio

Jumio is an AI-driven identity verification platform trusted by leading global brands to combat identity fraud. The software uses data from 500+ best-in-class global sources, with billions of transactions processed. Jumio integrates advanced AI and ML models to deliver powerful customer verification solutions. This platform enables businesses to boost customer trust through optimized onboarding processes and strong fraud detection capabilities.

Jumio Pricing

Contact Jumio for current pricing.

Key features of Jumio

- Biometric authentication: Uses advanced technologies to verify identities through facial recognition and fingerprint matching.

- Watchlist screening: Performs constant checks with global watchlists and sanctions databases to identify and mitigate risks related to individuals or entities.

- Dynamic risk scoring: Offers customizable risk scoring models based on data analytics to empower businesses to make better decisions and adapt workflows based on evolving fraud patterns.

| Pros of Jumio✓ Users find the scanning interface to be intuitive and smooth. ✓ The software works faster when uploading images or videos to the cloud for verification.✓ Even with a blurred image, the software excels at extracting the details from the ID.Cons of Jumio✕ Some users experience that the software proxies false/positive results.✕ Users do not like the face-matching functionality due to its inaccurate results. |

Jumio compared with Trulioo

Jumio delivers advanced solutions like age verification and biometric authentication, capabilities that Trulioo does not currently offer.

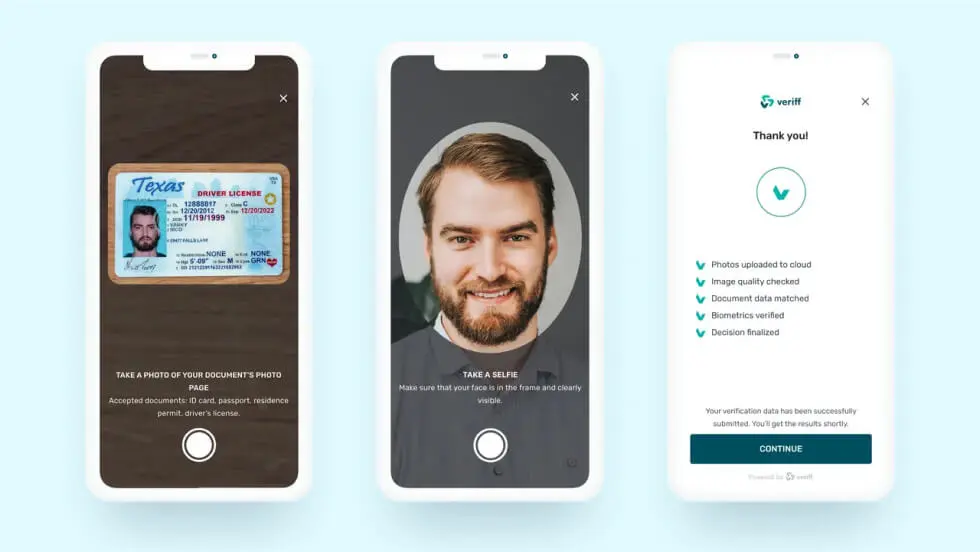

10. Veriff

About Veriff

Veriff’s identity verification platform specializes in combating fraud like identity fraud & financial scams. The software employs AI-driven technology to accurately verify different identification documents. Veriff assists businesses in creating secure digital ecosystems, improves the user experience, and drives sustainable growth. The software offers unparalleled global coverage and accuracy in identity verification, with support for numerous government-issued IDs.

Veriff Pricing

Veriff provides diverse pricing plans, starting at $0.80 per verification with a $49 monthly commitment and custom pricing is also available.

Key features of Veriff

- Proof of address verification: Reduces friction in user verification processes by verifying proof of address documents, which allows businesses to approve more users.

- KYC onboarding solutions: Streamlines KYC processes with Veriff’s intuitive solutions to ensure compliance and improve operational efficiency.

- Biometric authentication: Enhances security measures with biometric verification to allow for passwordless and secure account access through facial recognition and age estimation technologies.

| Pros of Veriff✓ Users experience a reduction in manual review time and fraud risk.✓ The software supports multiple languages, making it easy for users across the globe to navigate and use effectively.✓ Users benefit from the rapid verification processes and complete automation that Veriff provides. Cons of Veriff✕ Some users face problems when reaching out to customer support.✕ Many users claim that the UI/UX of the software is complicated. |

Veriff compared with Trulioo

Veriff excels at providing solutions, including passwordless authentication and crypto compliance, whereas Trulioo fails to provide such offerings.

After covering each competitor in detail, let’s help you provide the process to choose the right Trulioo competitor for your business.

A step-by-step process to choose the right Trulioo alternative

Here is the step-by-step process for choosing the right Trulioo alternatives.

Step 1. Define your business needs for identity verification

Start by pinpointing the exact challenges or gaps you face with your existing identity verification process. Make sure you are clear about your requirements. Are you looking for software that better complies with specific regulations? Or are you looking for stronger fraud detection capabilities? Here are a few aspects to consider when defining your business needs.

- Determine your daily and peak verification volume requirements.

- Identify regulatory compliance needs like GDPR or CCPA.

- Assess integration requirements with existing systems like CRM.

- Evaluate current fraud prevention capabilities and identify gaps.

- Consider scalability to accommodate future business growth.

Step 2. Research diverse identity verification solutions

Begin researching various identity verification solutions available in the market. Carry out thorough research and evaluation to find a provider that aligns with your requirements. Here are some basic factors to look for.

- Evaluate available verification methods, like document or biometric verification.

- Confirm global coverage and support for a wide range of ID types across different countries.

- Research the industry’s reputation and gather client feedback to gauge the reliability and performance of each solution.

- Assess customization options and flexibility of each solution.

- Verify compliance with security standards like SOC 2 and ISO 27001.

Avoiding such factors while evaluating leads you to a provider that does not fit into your workflow and ends up with operational inefficiencies.

Step 3. Compare key features, pricing, and integration

After thorough research, check out the factors you need to consider for this step.

- Compare features like API flexibility, scalability options, and the ability to customize verification workflows.

- Evaluate pricing models to ensure cost-effectiveness relative to your verification volume and operational scale.

- Assess the ease of integration with your existing systems, like CRM or customer portals.

All of these three factors determine the suitability of an identity verification solution for your business needs.

Step 4. Request a trial or detailed product demo

The most important part is before making a final decision, you must request trials or detailed product demonstrations from the prospective vendors. Having such an experience allows for evaluation of the user interface, ease of implementation, and the entire user experience of the identity verification solution. During these trials or demos, test the software in real-world scenarios to gauge accuracy, speed, and reliability in diverse operational environments.

Step 5. Assess customer support and security compliance

Assess the quality of customer support and security compliance. Having weak customer support leads to issues like delays in issue resolution and security vulnerabilities. Consider the following factors with this step.

- Evaluate the responsiveness of the customer support team to queries, including the availability of technical expertise during implementation and ongoing operations.

- Verify the software adheres to industry standards and regulations like GDPR or PCI DSS. This helps ensure compliance and eliminate data risks.

Following these steps in sequence helps identify and select the right Trulioo alternative that meets the current business needs and supports long-term growth.

Optimize identity verification with the best Trulioo alternative

Identity verification is important for businesses to ensure security, comply with regulations, and build customer trust. Trulioo, being an online identity verification company, excels at providing KYC and AML solutions. However, as businesses have varying needs and priorities, exploring Trulioo alternatives becomes imperative.

Trusted by 200+ global clients, HyperVerge can help you out with your needs and priorities. HyperVerge ONE is exceptional at providing identity verification solutions that maximize customer onboarding with high customer conversion rates. The software enables you to expand globally without regulatory barriers with a 96% average pass rate in the United States.

Frequently asked questions about Trulioo alternatives

1. What does Trulioo offer?

Trulioo offers an AI-powered global identity verification platform. The platform provides solutions for verifying identities and businesses across 195 countries. The platform also integrates with 450+ data sources to ensure compliance with regulations like KYC, KYB, and AML.

2. Who are Trulioo’s main competitors?

There are several competitors of Trulioo. Each competitor offers similar identity verification solutions that enhance online security and compliance with global regulatory standards. Check out the main competitors.

- HyperVerge

- Onfido

- iDenfy

- Socure

- SEON

- Sumsub

- Ondato

3. Which industries does Trulioo serve?

Trulioo serves various industries like banking, cryptocurrency, financial services, marketplaces, online trading, payments, remittance, and wealth management. Trulioo’s solutions serve businesses that require reliable identity verification to prevent fraud and ensure regulatory compliance worldwide.

4. Is Trulioo’s pricing competitive, considering its advanced features?

Trulioo verifies identities using features like AI-enabled document verification and biometric face matching. While Trulioo offers such advanced capabilities, the cost of the software is expensive for several users. However, HyperVerge provides a more cost-effective solution with free trials and custom pricing options, featuring AI-driven fraud detection, precise document verification, and customizable onboarding workflows.

5. Is Hyperverge easier to integrate than Trulioo?

Yes, Hyperverge provides a streamlined integration process that is easier for all types of businesses, from startups to enterprises. However, the ease of integration depends on specific IT environments and technical requirements. Trulioo also provides flexible integration options, including API access and a no-code workflow studio to ensure businesses easily integrate it into their existing infrastructure.