Tax-related identity theft has increased to such a level that the FTC received almost 1,108,609 complaints in the United States in 2022. It leads to financial and legal losses for both entities and individuals.

It is quite dangerous for financial institutions, fintech companies, and e-commerce businesses, especially for organizations that deal with enormous amounts of sensitive information about their clients or users online. Their inner mechanics make them a hot target for criminals who intend to induce tax identity theft by stealing personal information.

You can defend yourself and your future finances—even just as an individual or an organization dealing with online transactions—by simply making yourself conversant with what tax identity theft is and how you can fight it.

In this primer, we will define what tax identity theft means, notice the warning signs, outline steps if you think you are a victim, and provide prevention measures that keep your information and financial accounts safe.

What is tax-related identity theft?

Tax-related identity theft happens when someone like criminals and fraudsters use your personal information, like your Social Security number (SSN), to file a tax return and claim a fraudulent refund. In addition, these criminals may use your stolen identity to get a job or claim government benefits under your name. This can lead to owing taxes on income you never received, thereby disrupting your finances and taking up valuable resources to resolve it eventually.

This is how tax identity theft affects various businesses involved in online transactions:

- Financial Institutions and Fintech Companies: Since they collect a lot of personal information and financial data, financial institutions and Fintech firms are one of the primary targets of fraudsters. If these cybercriminals successfully execute tax identity theft by misusing customer information, it can result in significant financial losses for these institutions. This can subject them to legal liabilities and damage their reputation immensely. Additionally, state tax agencies and regulators may scrutinize security processes more closely if negligence is a prime factor in how customer information is not protected properly.

- E-Commerce Businesses: E-commerce companies usually gather and store sensitive customer information, including credit card details, financial data, and personal information like Social Security Number. A single data breach could expose this important information to criminals filing fake tax returns. This, in turn, leads to financial losses and affects the customer trust factor significantly. Moreover, e-commerce companies may need to bear the cost of an investigation or even penalties if they cannot safeguard customer information appropriately.

- Online transaction processing organizations: Merchants, payment processors, and online service providers are equally vulnerable. Vulnerabilities in their systems can enable cybercriminals or identity thieves to obtain personal information/customer data and file false tax returns. That places the targeted company at risk of financial losses, damage to its reputation, and possible regulatory penalties. Those organizations must implement adequate safety measures to protect customer data and prevent tax identity theft.

Understanding these risks, organizations that process online transactions can operationalize safeguards to protect themselves as well as their clients against tax identity theft.

Fraud Alert! Secure your financial future.

Learn how to prevent tax identity theft and protect your personal information. Schedule a DemoWarning signs of tax-related identity theft

Recognizing the warning signs of identity tax fraud can help you act quickly and minimize the damage. The following describes common red flags for individual taxpayers to watch for in such an occurrence:

Individual taxpayers

- E-Filed Tax Return Rejection: The IRS (Internal Revenue Service) rejects your e-filed tax return with a message informing you that your Social Security number already has a return filed under it—well, that is a critical indicator that someone has stolen your digital identity and claimed a fraudulent refund.

- Unrequested tax documents: Here, you may receive tax transcripts, IRS notices, or other forms from the IRS that you did not request. That may be a strong indicator that someone has filed a return in your name.

- IRS Contact Regarding Suspicious Returns: If the IRS contacts you about a suspicious tax return, it often points toward identity theft. This means your personal information could have been used to file fraudulent returns (to obtain fraudulent refunds).

- Additional Tax Liability or Offset Refunds: If you get a notice stating that you have additional taxes due or your refund was offset for a debt without your knowledge, this could be due to identity theft fraud.

Financial institutions:

- Monitoring Customer Accounts for Suspicious Activity: Financial institutions and fintech companies must monitor customer accounts for illegal or suspicious activity, such as repeated requests for sensitive information and sudden account changes. This can help them detect digital identity fraud or some illicit activities that can be detrimental to their operational workflows.

- Increase in Complaints of Fraudulent Filing of Taxes: Financial institutions and fintechs must also look for some abnormal surge in customer complaints regarding fraudulent tax filings, which may indicate potential data breaches. This will help them proactively identify illicit activities like false claims.

E-commerce merchants:

- High Chargeback Rate or Disputes: If there are excessive cases of chargebacks or disputed transactions, there is a high possibility that these may be linked to fraudulent tax filings using stolen customer data.

- Unusual patterns: E-commerce companies must look out for unusual patterns of access to data as well as any unauthorized access to customer information that may indicate a possible security breach.

That is to say, knowing these red flags will allow individuals and businesses to all do their part to help protect their personal information and detect possible tax-related identity theft at a very early stage.

Steps to take if you suspect tax identity theft

If you know or think you’re a victim of ID theft for tax purposes, you must act swiftly to protect your information and mitigate any damage. Here’s what you need to do :

Individual taxpayers

- Initiate contact with the IRS: Contact the IRS Identity Protection Specialized Unit. Respond Immediately so that state tax agencies are aware of it. Next, follow their instructions to authenticate your identity.

- Report the Identity Theft: You should notify the IRS of the ID theft by submitting an Identity Theft Affidavit IRS Form 14039. This allows for fraud investigation and helps them take corrective measures. Report the identity theft to the Federal Trade Commission at www.identitytheft.gov and get help making a recovery plan.

- Protect Yourself: Consider a credit freeze to stop fraudulent accounts. You can explore credit monitoring to alert you to suspicious activity. Additionally, try to file your return early next year to prevent scammers or identity thieves who might try filing a false return in your name using your Social Security Number (SSN). File an early tax return as it allows the Internal Revenue Service officials to verify your legitimate return first, making it easier to identify and reject any duplicate filing.

Financial institutions and fintech companies

Establish Response Protocols: Set procedures for reporting and handling cases of tax identity theft. This includes training personnel to recognize anomalies and red flags, secure channels for reporting suspicious activity, and cooperation with law enforcement and regulators in investigations.

E-commerce businesses

Improve the security of information: This might involve advanced encryption methodologies, security audits, and customer education in online safety. An actionable response plan should be put in place after a breach or fraudulent tax returns are filed.

Following these steps will help the individual or business take control of situations and work through to resolve tax identity theft.

Preventing tax identity theft

Taking proactive steps to secure your personal information helps prevent tax identity fraud threats. Here are some effective measures you can take:

For everyone

- Secure Your Personal Information: Keep your Social Security Card and other sensitive documents safe. Before disposing, shred any documents containing personal information or your important data.

- Avoid Phishing Scams: The IRS, tax administration officials, or major credit bureaus will never reach out to you through methods, such as mail, calls, or text, to request personal or financial information. Never respond to such illicit activities and report them quickly.

- Strong Passwords and Multi-Factor Authentication: Track your online accounts with unique and robust passwords, especially those connected with taxes and finances. When possible, enable multi-factor authentication.

- Reputable Tax Preparers: Choose a reputed Tax preparer with efficient data security measures to keep your data secure from scammers, fraudsters, or criminals.

Financial institutions and fintech companies

Protect sensitive data under proper care by making viable data security policies and procedures. Among these are the adoption of advanced encryption technologies, regular training on the best practices about data security for employees, and regular security assessments to spot vulnerabilities and patch them.

E-commerce businesses

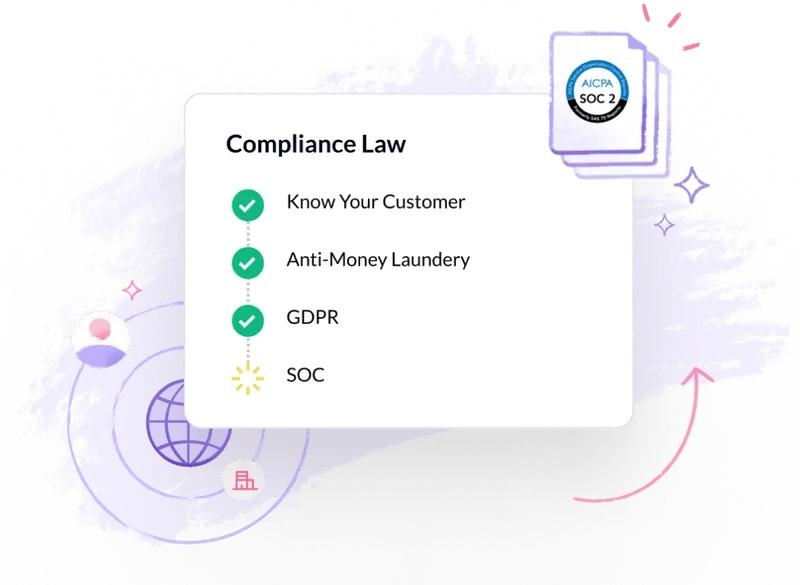

Be vigilant against the misuse of your data. This could be in terms of developing secure payment processing systems, using Secure Sockets Layer certificates on websites, particularly on transaction pages, and adhering to various legislation on data protection, such as the GDPR and PCI DSS.

Takeaways

Tax identity theft is a serious threat. You can safeguard your financial well-being by staying informed about the risks and taking actionable steps in case of a theft apart from implementing precautionary measures. Financial institutions, e-commerce businesses, and fintech companies must incorporate robust security protocols to combat tax identity theft and safeguard their financial space.

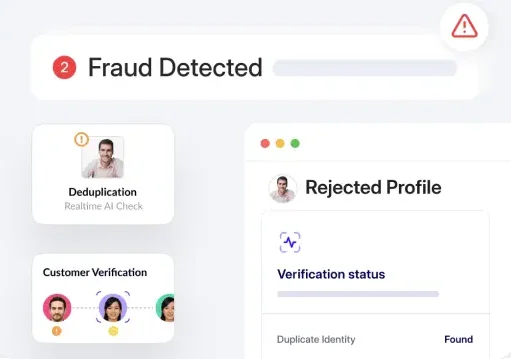

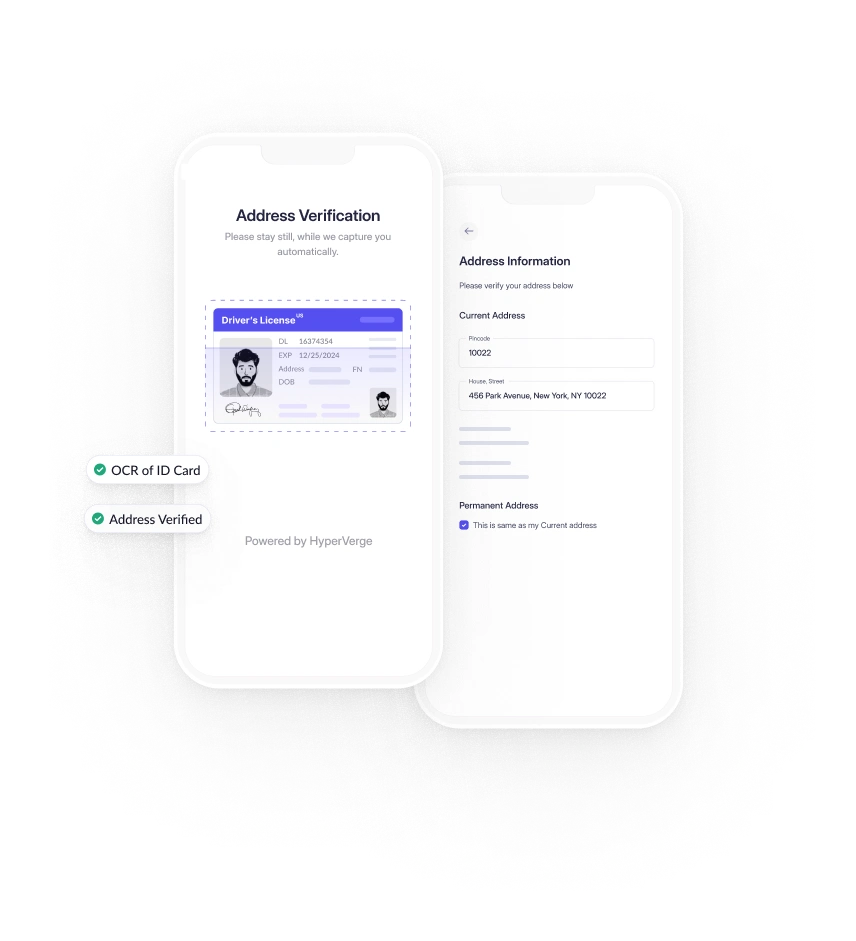

For an extra layer of security, consider HyperVerge’s identity verification solution. Our single-image passive liveness technology works seamlessly even on low bandwidths and low-end devices, reducing drop-offs during customer onboarding. Our powerful AI models operate in real time, allowing for quick innovation and the addition of custom AI checks as new needs arise.

These Machine Learning models are extensively trained on diverse facial variations, ensuring accuracy regardless of race, age, or gender, and meet all compliance standards. Additionally, HyperVerge’s evolving AI technology rapidly adapts to stop rising ID frauds, providing robust protection against identity theft.

By taking proactive steps and leveraging digital identity verification tools by HyperVerge, you can significantly reduce the risk of tax identity theft and secure your financial future.

Explore HyperVerge and check how we can protect your digital identity.