Digital identity verification and KYC are essential for customer onboarding and fraud prevention. Persona is a great solution provider for these needs, but it may not be the right fit for everyone. Fortunately, there are many Persona alternatives for you to choose from.

Missing features, process delays, poor customer support, or better suitability with the current workflow may be some reasons businesses could consider exploring alternatives to Persona to better suit their unique needs.

This blog covers the top Persona alternatives for your business.

| ⭐Our top picks for the best alternatives to Persona include: 1. HyperVerge – Best for real-time AI-powered identity verification, fraud prevention, AML compliance, Single Sign-On (SSO), and end-to-end user onboarding. 2. Onfido – Best for identity verification in the FinTech sector. 3. Socure – Best for fraud prevention and KYC. 4. Sumsub – Best for KYC and AML. 5. Ondato – Best for compliance solutions that cater to financial services. 6. Veriff – Best for user-friendly identity verification service. 7. Plaid – Best for fintech companies looking to integrate financial data and identity verification. 8. ID.me – Best for secure user verification, particularly in government and health sectors. 9. Trulioo – Best for identity verification on a global scale across multiple industries. 10. Jumio – Best for AI-based fraud prevention and customer verification. |

Why consider alternatives to Persona?

Persona is a consumer onboarding platform that uses AI-based identity verification with selfie-liveness and database checks. It boasts an average G2 rating of 4.5 stars out of 5 from 36 reviewers.

However, a better alternative may fit your company better in different ways. Here are 4 such examples:

| ⇒Versatile featuresPersona offers a decent identity verification solution. Though it may seem lacking compared to some of its competitors, it may be a better fit for your businesṣ. ⇒Flexible integrationPersona’s integration capabilities may not be as flexible as competitors on this list. However, this can be a crucial feature to ensure smooth operation once the solution is up and running. ⇒Better customer servicePersona has some low reviews on G2 due to its poor customer support. It’s better to opt for a solution provider that provides excellent customer support for optimal operation. ⇒Better accuracyUsers on G2 state frequent occurrences of false positives and process delays with Persona. As a result, it’s worth checking out competitors with higher accuracy and efficiency. |

These limitations can impede company growth. Therefore, it would make sense to check out some options other than Persona that offer superior AI capabilities, custom APIs, greater fraud detection, and more suitable pricing plans.

Elevate your ID verification game

Leverage a 13-year-trained AI model for OCR that has been exceptionally accurate and reliable in identity verification and KYC since day Get a free demoHow we analyzed and selected the most suitable Persona alternatives

We followed an extensive manual process that involved thorough market evaluation and detailed analysis to shortlist the most suitable Persona competitors. Here’s our process to identify and list the top alternatives to Persona.

- We evaluated 43 different competitors of Persona, specializing in identity verification, Know Your Customer (KYC), Know Your Business (KYB), AML screening, and fraud management.

- After that, we compared each company’s reviews and ratings on reliable platforms like G2 and Capterra.

- Ultimately, we shortlisted the provider based on features, pricing models, AI capabilities, data security measures, and customer support.

Following such a process ensures that you get a comprehensive overview of the leading tools and assists you in choosing the best solution for your unique needs.

Overview of the top 10 Persona alternatives

| Top competitors | Free trial availability | Standout features |

| ☑ | Customer conversion funnel analytics,Extensive onboarding APIs,no-code workflow automation | |

| ☑ | Document and biometric verification | |

| ☑ | Fully-automated risk decisions | |

| ☑ | Transaction monitoring & non-doc verification | |

| ☑ | Video KYC and Risk assessment tools | |

| ☑ | Age estimation & fraud intelligence | |

| ☑ | Financial data aggregation and bank account linking | |

| ⌧ | Secure digital wallet for verified customers | |

| ☑ | Watchlist screening & global identity platform | |

| ⌧ | Multi-channel verification (mobile and web) |

A detailed list of the 10 best Persona alternatives for identity verification

1. HyperVerge

About HyperVerge

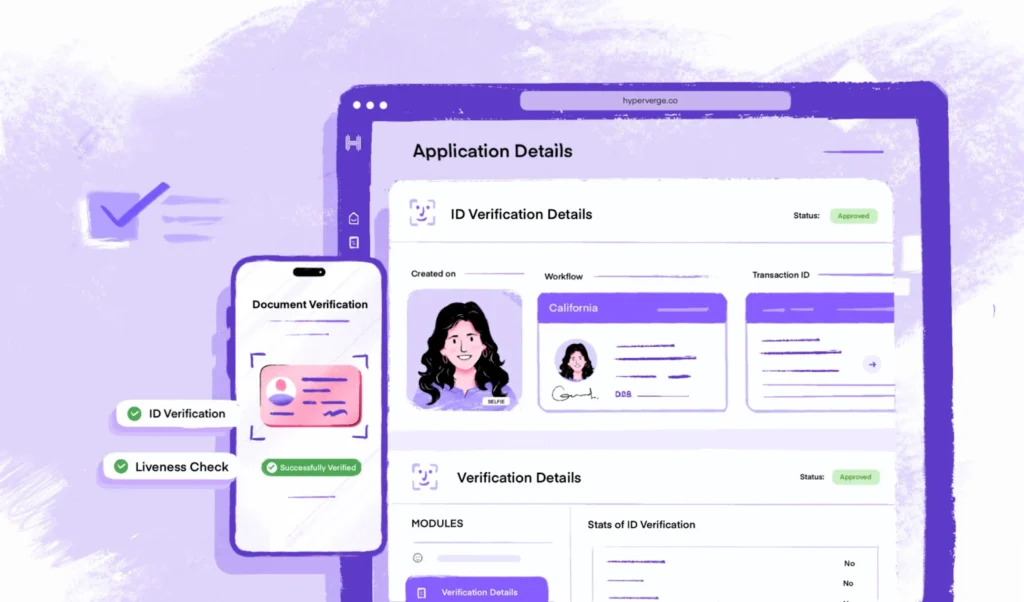

HyperVerge ONE is a leading AI-powered identity verification platform streamlining the end-to-end customer onboarding journey.

The HyperVerge ONE platform enables you to go live within 4 hours with web & mobile Software Development Kits (SDKs) for swift deployment. Moreover, HyperVerge’s identity verification solution involves plenty of features, such as:

- Liveness detection

- Deepfake detection

- OCR for document verification

- Face de-duplication

- AML checks (global sanctions and watchlists, Politically Exposed Person, adverse media)

HyperVerge boasts a 98% completion rate, a 99% auto approval rate, and a 50% decrease in user drop-offs. HyperVerge has you covered with a highly trained AI that is highly accurate, efficient, and minimally false positive.

Moreover, to ensure optimal infusion with your existing company, HyperVerge offers 100+ onboarding APIs that cover a wide array of industry use cases, such as those in the financial services, education, crypto, and gaming sectors.

Features better than Persona

Here are some significant features of HyperVerge:

- Biometric authentication: Offers best-in-class AI-powered face authentication and ID validation for secure and accurate biometric authentication.

- Address validation: This process matches user-provided address information with reliable databases to ensure accuracy and detect potential fraudulent activities using fake addresses.

- Fraud monitoring: Integrates real-time AI-driven fraud detection to identify and prevent suspicious activities during the entire verification process.

- End-to-end journey automation: Provides comprehensive workflow automation solution to cover all grounds of consumer onboarding from day 1.

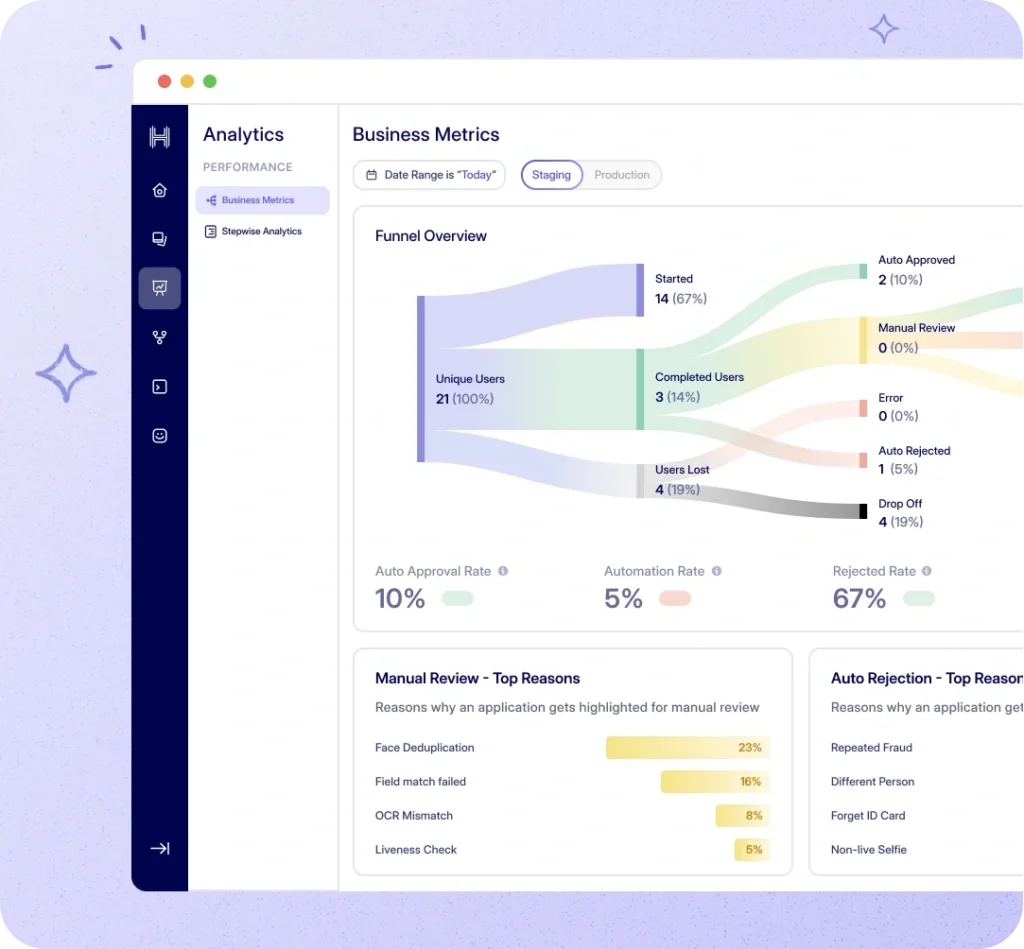

- Analytics Dashboard: HyperVerge ONE has a robust analytics dashboard that allows businesses to boost profits with clear business metrics and helpful insights to increase conversion rates.

HyperVerge pricing

| Start plan (Startups) | Grow plan (Mid-sized companies) | Enterprise plan (Enterprise-level organizations) |

| The Start plan includes a free trial and easy integration within 4 hours. It also offers identity verification tools to view and manage verification for one month. | The Grow plan involves everything the Start plan covers, including an end-to-end identity verification suite, access to AML checks, central database checks, and customized business workflows. | The Enterprise plan involves all the features and offerings from the Grow plan, along with a custom price structure and collaborative tools. |

What do HyperVerge users say?

Leverage AI to boost your business

Utilize a 13-year-trained AI model for identity verification with exceptional accuracy and reliability in customer onboarding from day 1. Get a free demo2. Onfido

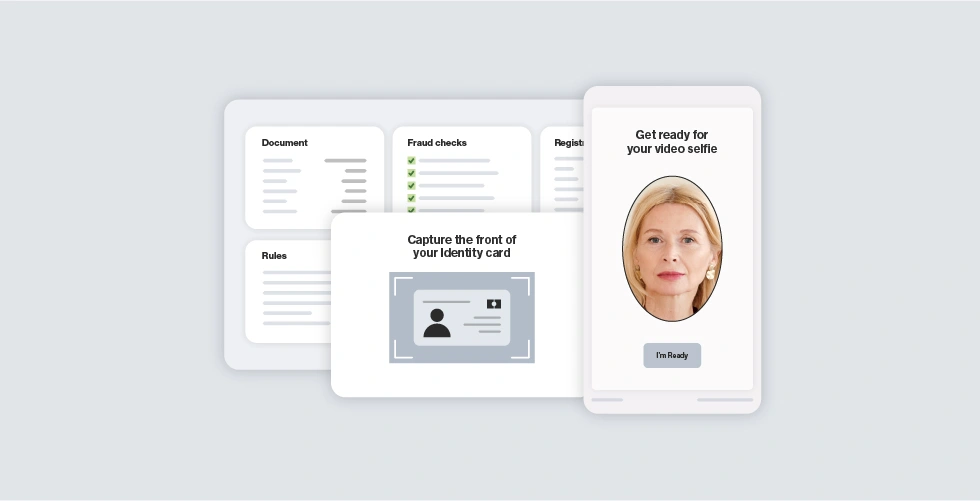

About Onfido

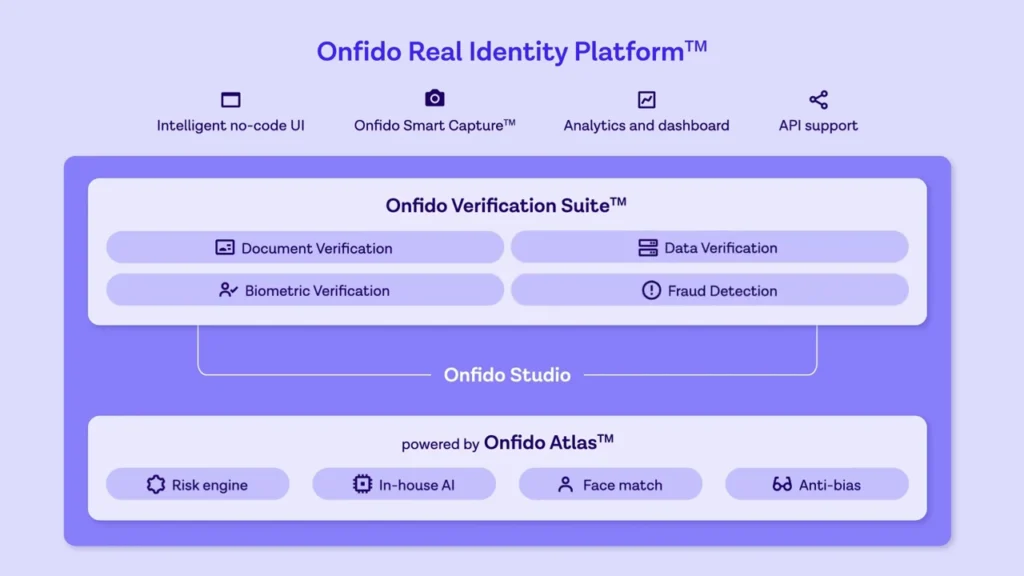

Onfido is a reliable platform that offers a complete suite of digital identity verification solutions. Onfido’s Verification Suite also involves Know Your Customer (KYC) and Anti-money Laundering (AML) compliance services for a complete user onboarding process. The platform helps businesses verify customers at scale and mitigate risks associated with identity theft.

Pricing

The pricing for Onfido’s services is not readily available on the internet.

Key features of Onfido

1. Document verification: Onfido supports several document types, such as passports, visas, driving licenses, and work permits. It uses AI to authenticate the documents swiftly and accurately.

2. Biometric verification: Onfido’s advanced biometric capabilities, like facial recognition and liveness detection, enhance identity verification accuracy and security.

3. Fraud detection: During the identity verification process, Onfido’s solutions adapt to businesses’ needs and protect against fraud attempts, like synthetic ID fraud, with high accuracy.

Pros and cons of Onfido

| Pros✓ Users find Onfido, a very easy-to-use software with a user-friendly interface that doesn’t require a complex learning process.✓ Businesses find Onfido’s SDK easy to integrate into a mobile app. This makes the onboarding process seamless for developers. Cons✕ User reviews suggest that Onfido’s customer service is lacking and not up to industry standards.✕ Onfido’s software also suffers from delayed processes and inaccuracies. This creates a hindrance for customers and businesses during the identity verification process. |

Onfido compared with Persona

Compared to Persona, Onfido offers a more flexible integration capability with multiple custom APIs for diverse use cases.

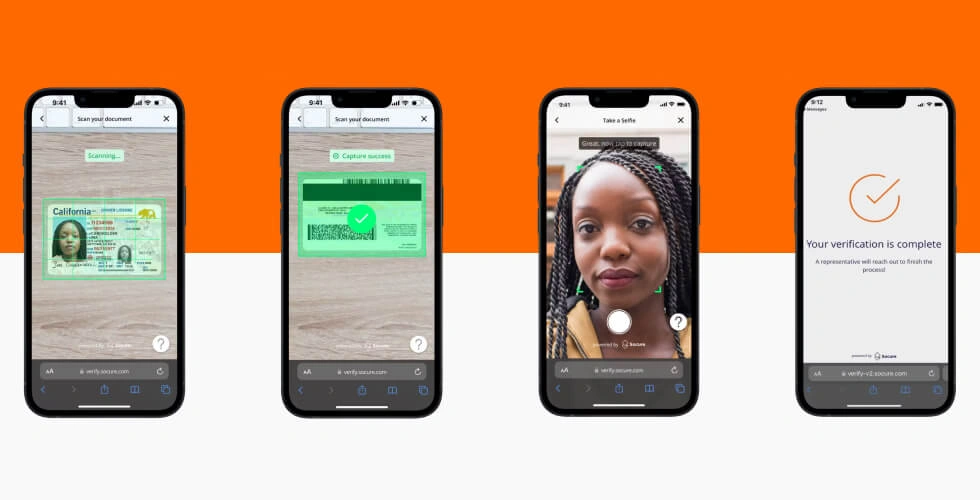

3. Socure

About Socure

Socure is a highly capable identity verification company that helps businesses with customer onboarding regardless of size. Socure ID+ is an extensive identity verification platform that uses advanced AI and Machine Learning (ML) to achieve unparalleled accuracy. One of its notable services is simplifying the KYC process while combating identity fraud or enhancing compliance.

Pricing of Socure

The pricing for Socure’s services is not readily available on the Internet.

Key features of Socure

- Synthetic ID fraud detection: Socure uses advanced AI and ML algorithms to detect patterns and anomalies that might indicate synthetic identity fraud.

- Document and selfie verification: Authenticates customer identities with document and selfie verification to ensure compliance with KYC regulations and enhance onboarding.

- Watchlist screening: This process performs real-time screening against global watchlists to detect and flag suspicious activities, such as financial fraud and money laundering.

Pros and cons of Socure

| Pros✓ Socure ID+ includes strong compliance features, including KYC and AML. This helps businesses adhere to regulations easily.✓ Users appreciate the ability to set custom values for risk thresholds and verification workflows for more personalized software. Cons✕ Some smaller businesses and startups find Socure a pricier option for their ID verification needs.✕ Users feel that the available documentation can be more comprehensive. This can help businesses better understand the services and utilize their full potential. |

Socure compared with Persona

Compared to Persona, Socure’s identity verification software offers better integration options, including customized APIs and documentation training for new customers.

4. Sumsub

About Sumsub

Sumsub is a reliable and popular identity verification platform offering comprehensive user journey software. Sumsub offers user verification, transaction monitoring, company verification, and fraud prevention in a single package with a unified dashboard. This allows businesses to manage all their user journey-related needs, such as ID verification, customer onboarding, KYC, fraud, management, and regulation compliance, in one place.

Pricing of Sumsub

Sumsub pricing starts at $1.85 per verification with a monthly commitment. Sumsub also offers a custom plan with extra features like custom integration, Single Sign-On (SSO), and reusable KYC.

Key features of Sumsub

- Identity verification: Sumsub boasts smooth online identity verification worldwide to ensure compliance with local and international regulations.

- Business verification: Sumsub allows businesses to expand their client onboarding scalability by conducting registry screening, automating UBO verification, and checking ownership structure.

- AML Screening: Sumsub’s ID verification software checks customers with PEP lists, global sanctions, and adverse media to minimize financial risks and ensure regulatory compliance.

Pros and cons of Sumsub

| Pros✓ Users appreciate the single platform with extensive KYC and AML Compliance services.✓ Users praise Sumsub’s strong and effective fraud prevention capabilities while onboarding customers. Cons✕ Some businesses find the price unaffordable or too complex for their ID verification requirements. ✕ Some users find limitations in Sumsub’s customizability and mobile SDK’s versatility. |

Sumsub compared with Persona

While Persona is a web-based solution, Sumsub offers its services on multiple platforms. Moreover, Sumsub offers a transparent pricing tier for small-time use cases, unlike Persona.

5. Ondato

About Ondato

Ondato is a popular and trustworthy provider of KYC, KYB, and AML solutions. Its solutions include a Customer Data Platform (CDP), age verification, and transaction monitoring services.

Hence, Ondato excels at streamlining ID verification, customer onboarding, and managing the customer identity lifecycle. Its scalable solution is accessible to small businesses and large enterprises.

Pricing of Ondato

Ondato offers multiple plans starting at $0.99 per verification, with a monthly license fee according to the plan. The software also provides custom pricing for enterprises.

Key features of Ondato

- Biometric verification: Ondato’s software uses top-level biometric and face authentication technologies to provide rapid and accurate identity verification.

- Document verification: Ondato’s AI-powered document verification checks for alterations, tampering, or inconsistencies to ensure valid documents.

- Modular ID verification methods: To serve diverse customer preferences, Ondato offers various verification options, such as automated photo eKYC, NFC-based identity verification, and agent-assisted calls.

Pros and cons of Ondato

| Pros✓ Users praise Ondato’s customer support as responsive and helpful in sorting out any issues✓ Ondato’s integration into an existing workflow is efficient and quick. Hence, it helps businesses save time and resources during implementation. Cons✕ Users find that Ondato’s risk-scoring feature is not flexible enough and needs some revisions.✕ Ondato users also go through data inaccuracies and occasional false positives. |

Ondato compared with Persona

Compared to Persona, Ondato offers a more extensive onboarding solution that covers the complete user journey lifecycle.

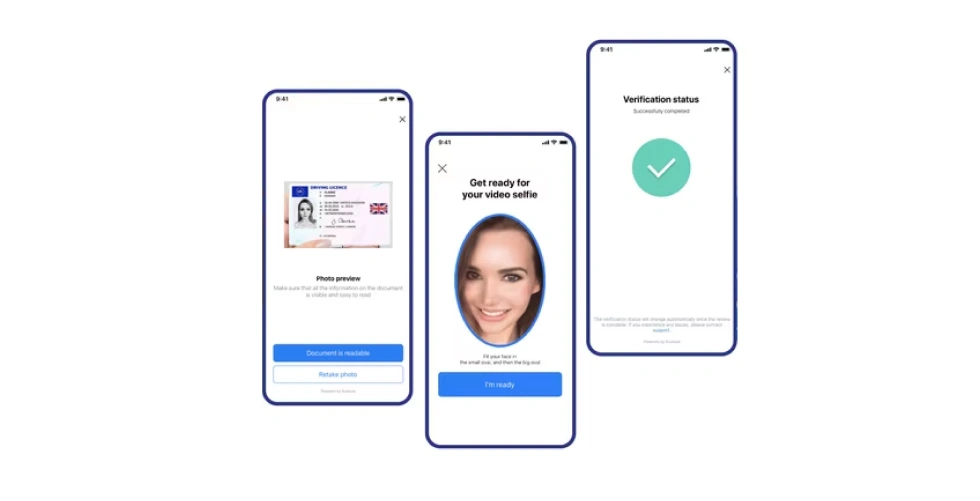

6. Veriff

About Veriff

Veriff provides a unified platform for ID verification, KYC, and fraud management. Veriff specializes in tackling risks such as identity fraud and financial scams.

The Veriff IDV Platform is a consolidated solution that uses artificial intelligence for accurate document verification for customer onboarding.

Veriff allows businesses to stick to regulations regarding AML and KYC without losing new or existing customers.

Pricing of Veriff

Veriff’s Self-serve plan starts at $0.80 per verification with a $49 minimum monthly commitment. Veriff also offers an enterprise plan with custom pricing.

Key features of Veriff

- Biometric authentication: Provides biometric verification with AI and facial biometric analysis. This helps users securely authenticate and grant instant access to products and services.

- Proof of address: Checks the user’s address by comparing the details with trusted databases. This helps meet KYC rules and prevents fraud.

- Age estimation: Veriff’s biometric authentication feature estimates the user’s age without the user’s identity document. This feature is useful for businesses operating in age-restricted sectors such as gaming and trading.

Pros and cons of Veriff

| Pros✓ Veriff users highlight the responsive and effective customer service that helps with any issues and enhances the optimization of the process.✓ One of Veriff’s key benefits is its rapid verification time. This becomes more effective for businesses as the number of onboarding users increases. Cons✕ Users find that Veriff’s initial integration is a difficult and time-consuming process. This leads to delays during the software’s initiation.✕ Users find that Veriff’s ID verification platform is not customizable enough. This can obstruct Veriff from being versatile for businesses in different sectors such as finance, education, and legal. |

Veriff compared with Persona

Persona offers a comprehensive solution for ID verification that includes fraud detection. Conversely, Veriff claims to reduce fraud by 20% within 6 months with a payback guarantee.

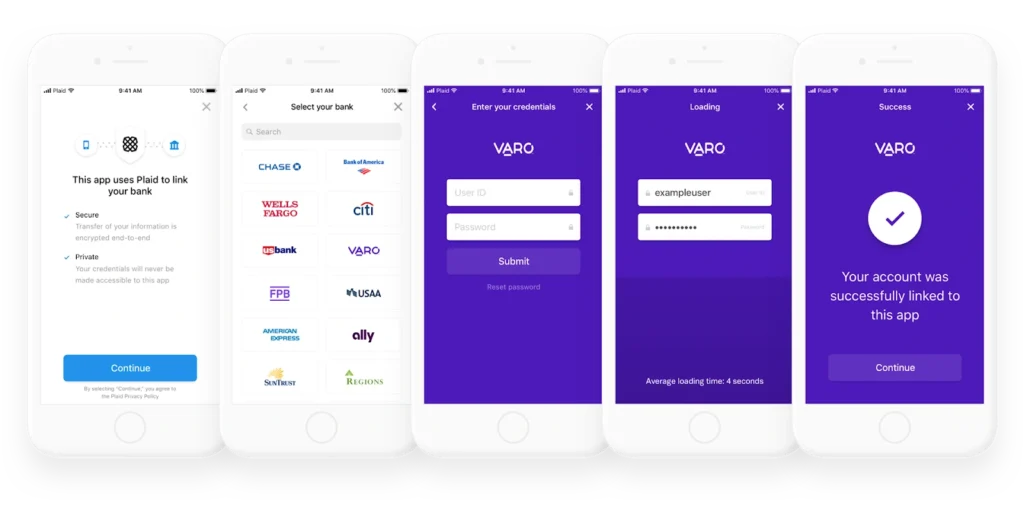

7. Plaid

About Plaid

Plaid is primarily a services provider that allows developers to build financial apps. However, Plaid also offers ID verification, fraud management, and compliance software for financial sector businesses.

Plaid provides features like real-time balance checks, transaction categorization, and bank-to-bank payment optimization. Plaid also allows users to create custom apps that sync with their bank accounts to track and manage funds and transfers.

Pricing of Plaid

Plaid offers a free trial, a pay-as-you-go plan with no monthly commitment, and a custom plan that starts at $500 per month.

Key features of Plaid

- Financial integration: Plaid offers a highly versatile financial integration of its services catering to finance sector businesses.

- Fraud prevention: Plaid offers products that deal with financial transactions and bank accounts. Hence, it offers robust and effective fraud prevention software. This allows Plaid to tackle various types of fraud, such as payment fraud, card-not-present fraud, synthetic ID fraud, and document fraud.

- Regulation compliance: One of Plaid’s strong features is its ability to help businesses easily adhere to global KYC and AML regulations.

Pros and cons of Plaid

| Pros✓ Users dealing in the financial sector find Plaid to be one of the most dependable platforms in terms of fraud prevention.✓ Users praise the effortless API and SDK integration into their business. Cons✕ Since Plaid focuses primarily on the finance sector, businesses in other sectors, such as health and legal, find it lacks versatility and extensiveness.✕ Small-time businesses that require Plaid’s custom pricing plan find it too expensive. |

Plaid compared with Persona

Persona offers general-purpose ID verification software for businesses in different industries, such as government, education, and gaming. Plaid’s primary focus is businesses in the FinTech sector.

8. ID.me

About ID.me

ID.me is a leading identity verification platform that simplifies how users prove and share their digital identity online. ID.me has partnerships with 30 states, 10 federal agencies, and more than 500 name-brand retailers in the US.

The software offers identity authentication, identity proofing, and community verification for individual organizations.

Pricing of ID.me

The pricing for ID.me’s services is not readily available on the internet.

Key features of ID.me

- Digital wallet: ID.me offers a digital wallet feature for verified users of certain professions, such as military personnel, nurses, teachers, medical providers, and first responders.

- Strong security: ID.me provides a strong enough security system in its identity verification to partner with federal agencies, such as the Internal Revenue Service (IRS) and Social Security Administration (SSA).

- ID verification: ID.me features a powerful system that excels at identity verification and onboards users quickly and securely.

Pros and cons of ID.me

| Pros✓ Businesses can leverage ID.me’s discount offers to attract new customers to enroll in their services.✓ Users praise the accuracy and security of ID.me’s identity verification system during consumer onboarding. Cons✕ Some users report that ID.me’s software suffers from technical problems such as glitches and connection issues.✕ Users requiring more comprehensive identity verification software find ID.me’s limited functionalities to be an issue. |

ID.me compared with Persona

Persona is a full-scale solution for end-to-end user journey validation. ID.me, on the other hand, focuses more on identity verification.

9. Trulioo

About Trulioo

Trulioo is a dependable identity verification platform. It supports more than 5,000 types of IDs, such as driver’s licenses, VISAs, passports, and voter IDs, on a global scale.

Trulioo offers a single automated platform that allows users to create, launch, and optimize customer onboarding journeys. Businesses can also customize the journey to align with their objectives.

Pricing of Trulioo

The pricing for Trulioo’s services is not readily available on the internet.

Key features of Trulioo

- Watchlist screening: Allows you to screen customers and businesses against over 6,000 global watchlists for powerful AML protection.

- Global coverage: Trulioo facilitates users from over 200 countries to build and deploy workflows to onboard customers.

- Flexible integration: Trulioo allows businesses to start using its software through one of its custom APIs. Businesses can also use Trulioo’s no-code workflow builder to create a custom verification process.

Pros and cons of Trulioo

| Pros✓ Trulioo gets praise from its users due to its easy-to-use platform, even for new users.✓ Users commend the ability to shift between data sources and tweak the matching criteria. This results in an efficient onboarding process for businesses as well as users. Cons✕ Users notice that Trulioo’s software emits false positives during AML and other screening processes for users with common names.✕ Some users report that Trulioo faces some issues with the rural addresses of customers, especially those with PO boxes, legal land descriptions, or rural route addresses. |

Trulioo compared with Persona

Compared to Persona, Trulioo offers online documentation training for new users, as well as more integration options.

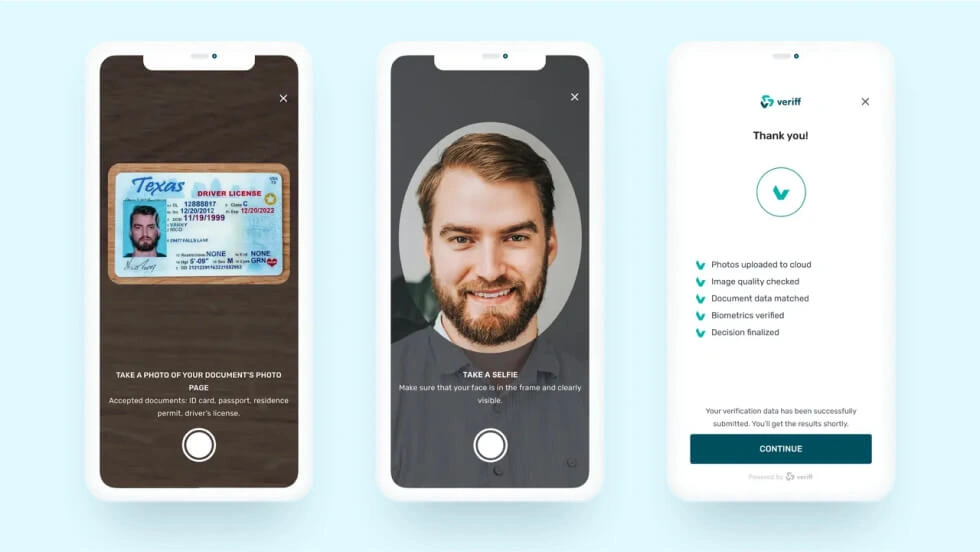

10. Jumio

About Jumio

Jumio provides an identity verification platform that utilizes AI and ML modules for powerful user verification solutions. Leading brands like Uber and HBSC use Jumio’s solution for identity verification and fraud mitigation.

Moreover, Jumio offers fraud management and a seamless consumer onboarding experience for maximum business growth. The strong fraud prevention capabilities and fast verification increase customer trust in businesses.

Pricing of Jumio

Jumio provides an online ‘total cost of ownership’ calculator that displays the price based on the company’s requirements.

Key features of Jumio

- Vigorous data checks: Jumio’s software uses data from more than 500 top-tier global data sources for verification.

- Dynamic risk scoring: Jumio’s customizable risk scoring model uses data analytics to provide insights. These insights helps businesses make better decisions and adjust workflows according to evolving fraud patterns.

- Biometric authentication: Jumio uses facial recognition and fingerprint matching to verify identities accurately.

Pros and cons of Jumio

| Pros✓ Users complement Jumio’s ability and effectiveness to extract details from a blurry image✓ Users also praise Jumio’s innovative and streamlined scanning interface. This increases the customer relationship at the first step of the onboarding process. Cons✕ Jumio’s users occasionally encounter false positives during screenings. These false positives hinder the customer as well as the company during onboarding.✕ Users dislike the inaccuracy of Jumio’s face-matching feature. |

Jumio compared with Persona

Compared to Persona, Jumio provides a more comprehensive identity verification service, including transaction monitoring, age estimation, and biometrics verification.

How to choose the best alternative to Persona for your business

Of all the options we have shown you, choosing the best fit for your business can take time and effort. Fortunately, there are ways to choose the right service provider for your business.

Here are 5 steps to get you started.

Step 1: Identify the alternatives and research options

This blog already covers the top Persona alternatives. However, to choose the most suitable option for your company, you must conduct detailed research to select the best fit. Here are a few pointers that you can keep in mind:

- Explore other leading identity verification solutions besides Persona.

- Check out the latest industry reports for any effective emerging solutions.

- Ask industry peers or forums for recommendations on reliable solutions.

- Analyze customer reviews and client testimonials to measure user satisfaction.

- Explore niche solutions that might cater better to your specific business needs.

- Assess the pricing structure to weed out unaffordable solutions.

Step 2: Compare key features and capabilities

After preparing a list of possible alternatives for Persona, analyze the features of those solutions and see how they compare with Persona. Consider the following factors during this step:

- Research and evaluate the effectiveness of the core attribute of Persona alternatives, which in this case is document processing.

- Evaluate the alternatives’ key features, such as verification accuracy and speed, integration flexibility, and AI capabilities.

- Assess how easily the service merges with your existing systems.

- Determine if the service’s scalability matches your company’s growth.

- Check each alternative’s level and quality of customer support to ensure a fruitful, long-term relationship.

Step 3: Evaluate suitability for your business needs and ease of integration

Once you evaluate the objective efficiency of the alternatives to Persona, you should assess how each feature of each service provider satisfies your business requirements. Factors such as customer onboarding time, the level of security, ease of regulation compliance, and accuracy of face authentication come into play here.

You should measure how each service provider matches your current and projected business requirements to find the right fit.

Step 4: Assess pricing structures and potential ROI

Understanding each service’s financial aspects and potential Return On Investment (ROI) is important. Take the following factors into account during this step:

- Cost transparency: Ensure clarity in pricing structures like setup fees and ongoing costs.

- ROI potential: Evaluate potential savings in fraud prevention and operational efficiencies.

- Scalability costs: Understand how pricing scales with your business growth.

Step 5: Request demos, gather feedback, and decide

Once you narrow down the suitable alternatives, you should contact the service providers directly. Request any free demos if they offer them, ask your IT department, compliance officers, and customer service representatives for any feedback, and take usability and ease of integration into account.

Following these steps can help you choose the best customer onboarding service provider for your company.

Improve your identity verification and KYC processes with the best Persona alternative

User identity verification is integral to onboarding new users to your company. It is also one of the first processes that creates customers’ first impressions of the company. Hence, choosing the right customer onboarding platform to boost your company is essential.

HyperVerge One can take care of your identity verification requirements with easy and quick implementation thanks to 100+ custom APIs.

HyperVerge comes with a 13-year-trained AI model that is highly proficient in ID verification and face authentication using tools such as:

- Single image-based liveness detection

- Face de-duplication technology

- AI-based forgery checks

- Deep image analysis

HyperVerge’s verification feats include a 95% auto-approval rate, a 50% reduction in drop-offs, and more than 800 million IDs verified.

KYC integration, AML screening, and fraud mitigation are important parts of the user onboarding journey. HyperVerge ONE considers all those unique needs and presents useful insights in a robust analytics dashboard.

The insights allow businesses to plan customer journeys accordingly, thanks to a fully customizable, no-code workflow builder that maximizes customer onboarding rates.

Streamline your ID verification process

Learn how HyperVerge can help your business completely automate and streamline the customer onboarding process. Get a free demoFrequently asked questions about Persona alternatives

1. Who are the competitors of Persona?

Persona’s competitors include service providers HyperVerge, Onfido, Sumsub, and Veriff.

2. Is Persona suitable for businesses of all sizes?

Persona’s lowest-tier pricing plan starts at $250 monthly, suitable for medium-sized or larger businesses. A Startup Program also charges businesses according to the services they use. However, the rate for Persona’s startup program is not available online. On the other hand, service providers such as Sumsub, Ondato, and Veriff offer transparent pricing plans that are more suitable for small businesses.

3. What are the drawbacks of Persona’s AI-led fraud detection?

Persona uses AI to detect the most notorious fraud attempts with decent effect. However, businesses can leverage services with best-in-class AI modules such as HyperVerge ONE to protect against fraud.

4. Is Persona easy to integrate with other software and platforms?

Persona allows users to change the parameters of its workflow. Though, it is not as easy to integrate as some of the other service providers such as HyperVerge, Socure, and Ondato.