Payment fraud happens when someone illegally uses someone else’s payment information to get money or buy things. This financial fraud hurts both people and businesses. Criminals take stolen payment information to buy things without permission, empty bank accounts, or steal someone’s identity.

On the one hand, individuals who are victims of this crime face huge losses in money and harm to their credit ratings. Stolen payment information can also lead to identity theft.

On the other hand, businesses, too, face problems due to payment fraud. They lose money directly because of chargebacks and lost goods or services. They also face operational disruptions because they have to spend time and resources looking into fraud cases.

It’s important to spot and stop these frauds early. Below, we discuss how robust fraud prevention strategies enable businesses to prevent payment fraud.

What is payment fraud?

Payment fraud is essentially when someone uses dishonest methods to obtain payment information to steal money or make purchases without actually paying. It can happen with both card-present (physical swipe of a card or digital wallet) and card-not-present (when the card’s magnetic strip is not provided with the transaction) payment types.

This could happen in several ways. For example, fraudsters can get your credit card or bank account details via phishing if someone finds a lost credit card and uses it to buy things. Sometimes, they get access to a merchant account. There are also fake online stores. There are many more ways tricksters get and use payment information for their gain. All these actions are different ways people commit payment fraud, using sneaky methods to use others’ money.

Almost half of American adults have encountered fraudulent transactions on their credit or debit cards, with over one-third experiencing such fraud multiple times (Credit Card Fraud 2021 Annual Report). Card fraud is projected to cause global industry losses totaling $408.50 billion over the next decade (Nilson Report).

Types of payment fraud

The variety and complexity of payment fraud are increasing every day. Understanding the different types of payment fraud is important for creating effective defenses. Here are the common types:

Phishing

Phishing occurs when fraudsters pretend to be a trusted organization to fool you into giving away your sensitive information. You may receive an email or text that looks like it is from a real company. This message has logos and branding and asks you to click a link. The link goes to a fake website where you enter your personal details, such as passwords or credit card details.

Triangulation fraud

Triangulation fraud involves three parties – the unsuspecting customer, the fraudster, and a real online store. The fraudster creates a fake online store that offers low-priced, attractive items. Customers buy these items and give their payment details. The fraudster then uses these details to buy from a real store using another stolen credit card. The goods go to the customer, but the fraudster takes the money in this online payment fraud.

Clean fraud

Clean fraud is when someone uses stolen credit card information to buy things in a way that looks normal.

The types of clean fraud include friendly fraud, first-party fraud, fraud by false claim, and account takeover fraud. These methods make fraudulent purchases look real and hard to catch. The fraudster chooses a fraudulent transaction that probably won’t set off any alarms.

Wire transfer fraud

Wire transfer scams are when someone tricks you into wiring money under false pretenses.

Scammers might pose as:

- Legal entities

- Loved ones in distress, or

- Trusted partners issuing fake invoices.

It is common for the criminal to move the money you give to foreign bank accounts away from your reach, making it next to impossible to get the money back even after the crime is discovered.

Merchant identity fraud

Fraudsters create fake merchant accounts to take payments from stolen credit cards. They use stolen business details to look real, often copying real businesses. They quickly take money from these transactions before anyone notices the fraud.

Pagejacking

Pagejacking is when fraudsters take over part of a real website’s visitor traffic. They copy the website’s content to a fake site. This trick redirects users to fake sites, where they might enter personal and financial information without knowing it.

Refund fraud

Refund fraud is when someone tricks a store or company into giving them money back for items they never bought. They might return stolen items, use fake receipts, or cheat the store’s return process in other ways. Fraudsters also take advantage of easy return policies to get cash or store credit. They then use this money or sell the credit.

Authorized push payment fraud

Authorized Push Payment (APP) fraud is when someone deceitfully convinces you (individual or business) to send a large amount of money to bank accounts they control. In this payment fraud, the fraudster pretends to be someone you trust, like a company boss or a regular supplier who asks for payment on a bill. You send the money thinking you are paying for something real.

Knowing about these types of fraud helps businesses and people make better defenses and responses.

How can businesses prevent payment fraud?

In an age where digital transactions are the norm, banking and financial services, as well as other businesses at risk, must implement security measures to protect against various types of payment fraud actively. This menace can lead to significant financial losses and reputational damage. Below are several robust fraud detection and prevention strategies to minimize payment fraud risk effectively.

Use a reliable AI solution for fraud detection

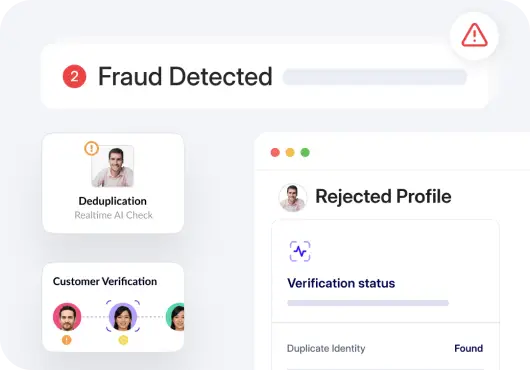

Using a reliable AI solution helps detect suspicious activities early. AI systems analyze patterns and flag anomalies in real-time. They include steps like the customer identity verification process and other identity verification methods.

This approach offers businesses a powerful tool against fraudulent transactions. For example, AI can detect unusual spending behaviors based on historical data. It blocks transactions until they can be verified.

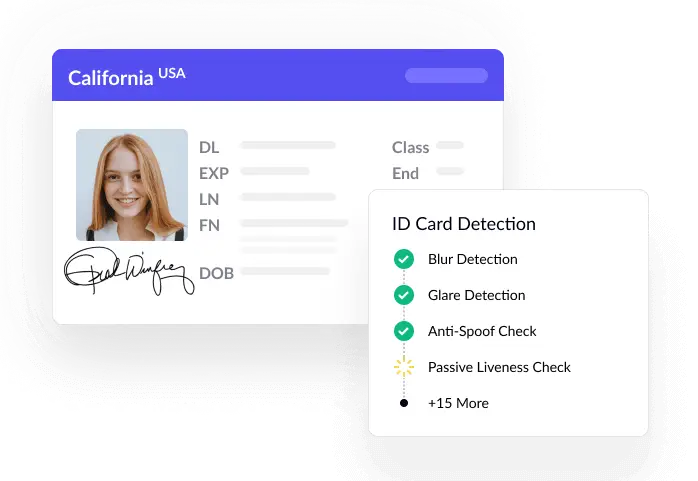

Implement document verification

Businesses should integrate advanced document verification software to catch fraudulent transactions. This software confirms the authenticity of documents presented during transactions. It uses technology to check the validity of government-issued IDs and other critical documents. All documents are scanned thoroughly and matched against secure databases. This adds a layer of security to transactions and reduces potential fraud.

Read more about document fraud.

Perform biometric verification

Biometric verification uses unique biological traits to verify identity. This includes checking fingerprints, facial recognition, and sometimes iris scans. This adds an extra layer of security to transactions. Biometric data is harder to replicate or fake compared to passwords or PINs. This enhances the integrity of payment processes and stops payment fraud.

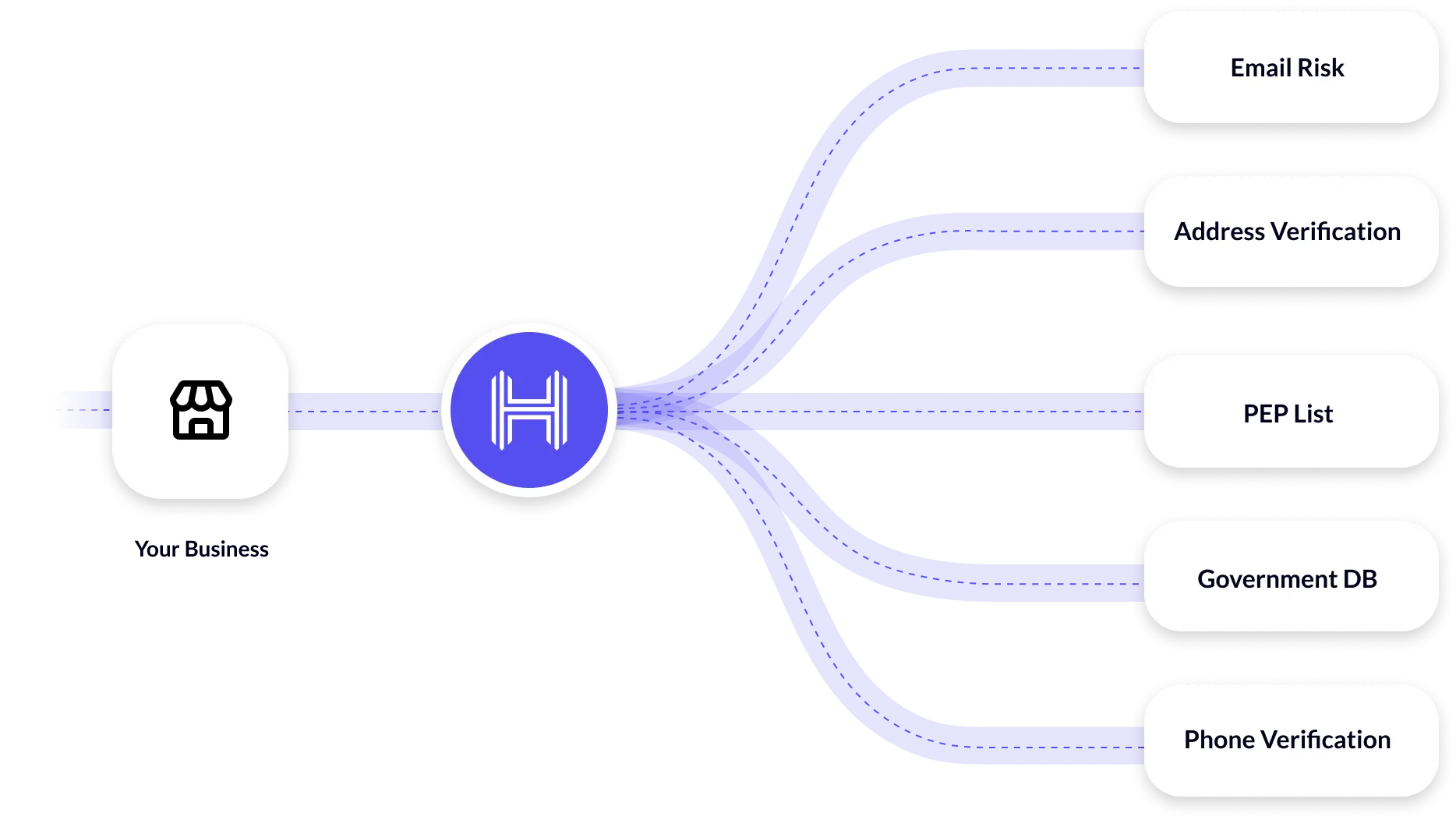

Employ an address verification system to verify the billing address

Using an Address Verification System matches a customer’s billing address with the address on file at the credit card company. It verifies zip code, street address, and such data.

By verifying the address, the business can make sure that the customer placing an order is the same as the real cardholder. It is especially useful in e-commerce where physical card verification is not possible.

Monitor transactions

It is important to check transactions regularly to catch fraud early before it spreads. Companies need to set up alerts for strange transaction patterns, like very expensive purchases or many transactions happening fast. They should also look at transaction reports every day to quickly spot any odd or unusual activities.

Read more about transaction monitoring.

By putting these steps in place, companies can greatly cut down their risk of different types of payment fraud. They keep their money safe and keep their customers’ trust. Each action they take makes their defense stronger and makes it tougher for thieves to take advantage of the transaction processes.

How can Individuals Protect Themselves from Payment Fraud?

You can protect your money from fraud risks and even stop identity theft by taking some practical steps. This section shows four main ways to keep your money safe.

Use strong passwords

Creating strong passwords is an easy yet effective way to stop payment fraud. Follow these tips to make your password more secure.

- Mix letters, numbers, and symbols to make complex passwords.

- Choose random combinations instead of common words and phrases.

- Change your passwords often.

- Do not use the same password for different accounts.

Restrict access to confidential information

It’s important to keep your personal and financial information safe.

- Only share sensitive data when you must. And only with people you trust.

- Be careful about where and how you keep personal details and login credentials.

- Do not post photos on social media of any document that contains confidential details.

- Do not speak aloud such details in public.

Be aware of the red flags

Knowing what to look for in fraud risks is key. Watch out for these signs:

- Do not entertain unexpected requests for money or personal information.

- You may often get too good to be true offers. It can be a large return for very less investment, or a large money for a small work.

- Be aware of texts or phishing emails that say you have to talk about something quickly. Fraudsters try to scare you to part with information so they can steal your money.

- Inform authorities if you suspect phishing attacks.

Being aware is the first step in protecting yourself from tricksters.

Use malware protection for your devices

To protect your information, make sure your devices have the required tools to fight against malware.

- Install trusted antivirus and anti-malware software on your electronic devices to protect them from malicious software.

- Regularly update your operating systems and apps.

- Regularly scan your devices for malware.

Keep educating yourself about fraud awareness. By following these steps, you can really strengthen your protection against payment fraud and keep your money safe.

Stay ahead of fraudsters and safeguard your business

Identity verification tools are essential for fighting payment fraud. This protects businesses from losing money and harming their reputation.

Identity verification solutions make sure the person paying is who they say they are. These solutions use technology to match the personal information provided by the user with the records they have. Verification processes include biometric checks, like fingerprints or face recognition, which are tough to fake.

Real-time checks spot fraudsters before they finish a scam transaction. Identity verification tools use smart algorithms to spot odd patterns that might suggest fraud. This proactive method stops fraud quickly, preventing big losses for businesses. Users feel safer knowing their transactions are secure, which helps them trust the platform more.

To learn more about how identity verification can help secure your business against payment fraud, visit HyperVerge’s identity verification solutions. Ready to enhance your security measures? Sign up today and take a proactive step towards safeguarding your transactions.