Organizations like banks and e-commerce companies follow Know Your Business (KYB) and Know Your Customer (KYC) regulations to identify legitimate individuals or corporate entities. This safeguards their business from frauds who use them for financial crimes like money laundering.

With radical shifts in technology, the services of these organizations are far more easily accessible than before. But, it is also more vulnerable to sophisticated financial crimes like deepfake videos which have grown by 700% in 2023, according to a Deloitte report. In the same year, 1 million reports were filed with the Federal Trade Commission for identity thefts – India, US, and Japan topping the list.

With this burgeoning technological threat, organizations must update their KYB and KYC verification processes with the help of advanced tools. We have covered the entire process of how organizations can implement these tools and a detailed breakdown of the KYB vs KYC differences in this blog post.

KYC and KYB: A deep dive

If you’re new to these terms, here’s a quick explanation for each of them:

What is KYC

Know Your Customer (KYC) is a process that verifies customer identities. This process occurs when a business like a financial institution enters into a relationship with an individual. For example, when someone opens a bank account, the bank will verify their government-issued documents like a passport copy to corroborate the identity. Likewise, many gaming sites ask new users to enter their birth date to verify their age.

What is KYB

Similar to KYC, KYB is also an identity verification process. The biggest difference is that the process happens between two businesses when they enter into some kind of relationship. For example, when an e-commerce business applies for a loan to a bank, the bank will conduct thorough KYB checks.

KYB focuses on the actual existence of the business. It also checks the nature of the business to ensure they are not engaged in any illegal activities. In addition to that, the background of the owners, also known as the Ultimate Beneficial Owners (UBO), the ownership structure, incorporation documents, financial statements, and compliance regulations are also scrutinized to assess the overall financial risk of the relationship.

Key differences between KYC and KYB

With the definitions out of the way, let’s dive deeper into understanding the differences between KYB and KYC:

Purpose and scope of KYB vs KYC

The purpose of KYC is to check if the identity of the person matches the details mentioned in the government-issued identification documents. This ensures that the person is not an imposter and not trying to commit some kind of financial crime.

The purpose of KYB is to assess the legitimacy of the business and its owners. It ensures the business is not a shell company and exists in reality.

Target audience

The target audience for KYC is individuals whereas in the case of KYB, it’s corporate customers.

Regulatory requirements for KYC and KYB

In the US, KYC has to fulfill the requirements according to the USA PATRIOT Act. For financial institutions, they must follow the rules set by the Bank Secrecy Act and Customer Due Diligence Rule. In the EU it’s the Anti-Money Laundering Directive and in India, it’s the Prevention of Money Laundering Act.

The above norms also apply to KYB along with the regulations mentioned under Couter-Terrorist Financing (CTF).

Examples of industries that utilize KYC and KYB

Here is the list of industries that use KYC and KYB regulations:

Industries relying on KYC

- Retail Banking

- Insurance industry

- Online share trading

Industries relying on KYB

- Corporate banking

- Supply chain

- E-commerce

The role of KYC and KYB in AML

One of the biggest intentions of KYB and KYC regulations is to stop money laundering. In this part, we will tell you how.

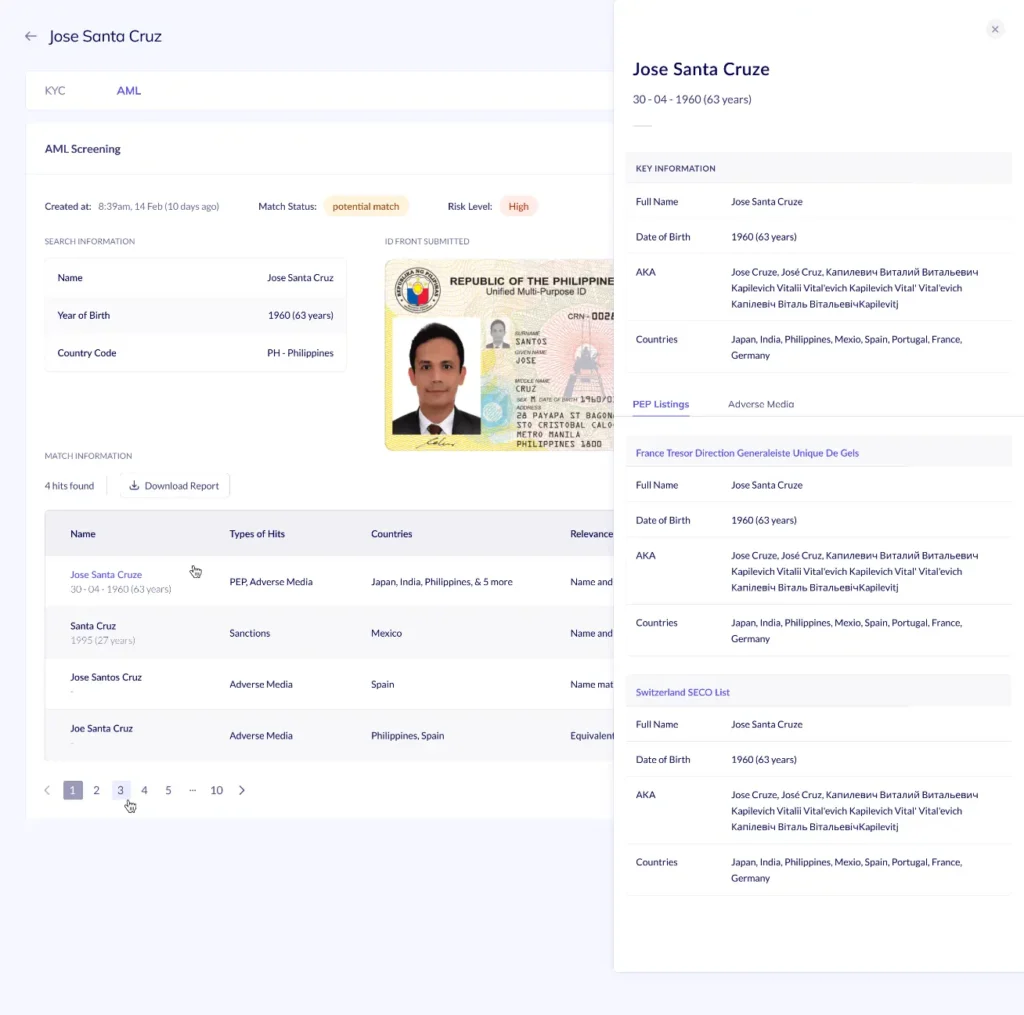

How KYC and KYB contribute to AML efforts

Money laundering occurs when money derived from illegal means is disguised as legitimate. With the KYC and KYB checks, banks and other organizations are prudent to identify such accounts early on. For example, when someone tries to create multiple accounts using fake documents, the process will flag down such users. Similarly, during the KYB compliance checks, banks will know if business entities exist for real or are here only to mobilize illegal money.

Regulatory frameworks governing KYC and KYB

These are the most popular regulatory frameworks followed by businesses worldwide:

Financial Action Task Force (FATF)

FATF sets global standards for AML and Counter Financing of Terrorism (CFT). Member countries follow the FATF’s 40 recommendations, which focus on different customer due diligence practices.

European Union (EU)-6th Anti Money Laundering Directive (6AMLD)

The 6AMLD consists of strict measures that organizations in the EU region have to abide by to prevent money laundering and financing terrorist activities.

FinCEN (Financial Crimes Enforcement Network)

The FinCEN comes under the US Department of Treasury to guide financial institutions in implementing KYC measures under the Bank Secrecy Act and the USA Patriot Act.

Prevention of Money Laundering Act (PMLA)

PMLA are set of directives issued by the Reserve Bank of India (RBI) to mandate the KYC verification process for financial institutions and payment service providers. Banks are required to verify the customer identities through PAN or Aadhar card and continuously monitor the transactions.

Case studies highlighting the impact of KYC and KYB on fraud prevention

Any loophole in KYB and KYC checks puts your business at risk of paying a huge penalty. We have covered two notable incidents in this section that highlight this risk:

$1.9 billion fine for HSBC (2012)

This happened more than a decade before, but it’s a reminder of how even multinational banks can fall prey to ineffective KYC procedures. The US division of HSBC bank unknowingly allowed Mexican drug cartels to launder $881 million. Stricter KYC measures by the bank could have helped in mitigating risks by identifying such illegal financial transactions early on.

The 1MDB Scandal (2015)

The 1MDB (1Malaysia Development Berhad) scandal is regarded as one of the largest financial frauds in the world committed by perpetrators globally. While then Prime Minister of Malaysia, Najib Razak was accused of embezzling $700 million into personal accounts, the mastermind Jho Low moved money internationally by setting up shell companies and offshore accounts. The lack of proper KYB procedures raised no suspicion when such transactions were conducted in broad daylight.

Implementing KYC and KYB solutions

This section is broken down into three parts, starting with the best practices for KYC and KYB. It is followed by choosing technology solutions for running the process and the importance of choosing the right vendor for identity verification.

Best Practices for Businesses in the US

These three steps will give you the right push to start implementing KYC and KYB solutions:

Develop a clear policy

Your KYC and KYB policy clearly explains how the potential customers must be onboarded, their documents should be verified, and an ongoing monitoring process should be established. To ensure that your policy is airtight, keep it aligned with local regulatory requirements like the USA PATRIOT Act, the Bank Secrecy Act (BSA), and FinCEN’s anti money laundering regulations.

If you own a financial business, you must consider including eKYC as a part of your policy. eKYC is a digital identification process that can be conducted remotely. Many financial companies are using advanced AI tools like HyperVerge to automate KYC compliance through eKYC. For example, INDMoney, a wealth management platform switched to a complete digital KYC process with HyperVerge in a record 9 days and saw 4X business growth.

Regular training

KYC and KYB compliance keeps changing according to the dynamic regulations of the regulatory authorities. Therefore, it’s critical to train your team to update them about the latest laws and AML norms. As fraudsters use advanced means to dupe the system, your team also must know how to combat financial crime. This will empower them to identify inconsistencies in documents and abnormal patterns early on.

Risk-based approach

A one-size-fits-all KYB and KYC checks might make your organization more vulnerable to risks. Instead, build a risk-based approach for risk assessment. This approach adjusts the risk according to the perceived risk of an individual or a company. If your team perceives high risk from an individual or a business, they should perform deeper due diligence. On the other hand, they should use simple checks for low-risk clients.

Coinbase uses a risk-based approach to exercise higher due diligence for high-risk individuals. This builds an extra layer of protection for them from fraudsters looking to use their platform to commit crimes.

Technology solutions for efficient KYC and KYB processes

If you have always imagined how technology can play a key role in improving the KYC and KYB process, this section will be useful to you

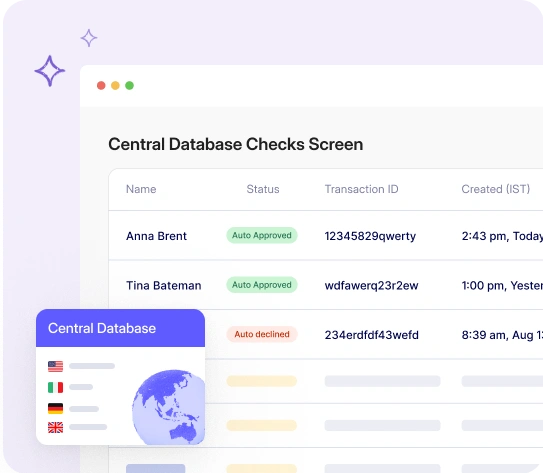

Automated verification tools

Performing KYC and KYB verification process is mostly handled manually. Automation is the key to improving efficiency which can be achieved through Artificial Intelligence (AI) and Machine Learning (ML). AI and ML can analyze vast amounts of data in real time like an individual’s details on official documents and cross-check with the database for authenticity. This entire process will be automatic which will make it faster, error-free, and cost-efficient.

Blockchain technology

Blockchain has a highly transformative ability to empower businesses to assess risk. It uses a distributed ledger that keeps the record of your customers tamper-proof. Once it has been entered, it cannot be altered or manipulated.

Shared KYC solutions and decentralized storage are the other two assets of this technology that will be highly useful for risk management, especially in financial activities. Once customer data has been entered and authenticated, it will be shared with other financial institutions for them to use. This common database will allow banks to verify customer data quickly and offer a better experience to their existing customers.

ING is a fitting example of how a leading financial institution uses blockchain technology to protect the data privacy of its customers. Their Zero-Knowledge Set Membership (ZKSM) solution, allows to share customer information without revealing contextual details.

API integrations

API integrations allow you to connect your platform with other advanced identity verification tools. This integration enables seamless data transfer, enhances automation, and reduces the dependency on multiple tools.

Scalability is the biggest advantage of using API integration. As your business and customer database grows, your system will be well-equipped to handle the pressure without adding extra workload on your staff. An example of API integration is AML screening API offered by HyperVerge that lets you search user information through major sanction lists like UNSC, OFAC, Interpol and PEP database from a single screen.

Importance of Choosing the Right Vendor for Identity Verification Solutions

Choosing the right vendor is making the right investment. Follow the next three steps to ensure you’re making the right investment:

Vendor reputation

A vendor with a strong reputation will tell you how reliable their services are and their experience in handling the requirements of other businesses. Check their reviews on various platforms like G2. Visit their website to check customer testimonials and case studies. We also suggest checking out if they have received any form of industry recognition or certifications like SOC2 that will build more trust in their solutions.

Compliance and security

The vendor that you tie up with will be the custodian of your customer’s details. Therefore global compliance with security standards will ensure how secure and private the information will be in their database. They should adhere to data protection laws like GDPR and CCPA.

Scalability and flexibility

The right vendor should be able to meet your current and future business needs. As the AML regulations are updated, you will need a trustworthy vendor to help you be compliant at all times. It should also offer customization options for you to develop unique solutions that match your business needs.

Common challenges faced by businesses in KYC and KYB implementation

As you prepare to make your business more compliant, these are the three challenges that you must be aware of to stay ahead at all times:

Regularity complexity

KYC and KYB processes store private information about individuals and businesses. Therefore, you always have to operate within the purview of the laws and regulations. To make it even more challenging, these regulations keep changing. For a small business, this means spending significant resources on meeting these regulations.

Data privacy concerns

There are two concerns about data privacy that you have to be careful about: collecting minimal information from your clients and taking strong measures to secure that information. Minimal information means collecting only what is necessary for your business. While securing customer data, pay attention to where you store them. If you’re operating in different countries, your customer details might need to be maintained in the same country. In 2023, Facebook was slapped with a hefty fine of $1.3 billion by Ireland’s Data Protection Commission for sending user data from the EU region to the US servers without proper safeguards.

Resource allocation

Businesses often have limited resources and it’s always a challenge to allocate them efficiently. The ever-changing regulations of KYC and KYB requirements add to this pressure. There is a need for more tools to automate the identity verification process, but that means higher financial investment upfront. These investments are not cheap and according to a Thomson Reuters report, companies spend $60 million on average to meet the KYC regulations.

Conclusion

KYB and KYC processes are necessary for curbing money laundering activities and mitigating risks related to financial crimes. But for companies to set up a more robust and efficient process, they need to take a step-by-step approach to implement technologically advanced solutions.

They should start with developing a clear policy, followed by training the staff and setting up a risk-based approach. Once that is done, they can start analyzing automated verification tools that use AI and ML to analyze customer profiles at scale. There are many options to choose from, therefore, the most logical way to settle for the best is by checking the vendor’s reputation. But don’t stop there – also check how compliant the tool is and how capable it is to handle your business growth.

HyperVerge offers a diverse set of tools and features to help you follow KYC and KYB regulations automatically. To get all the details, check the digital identity verification page.

FAQs

What is the difference between KYC and KYB?

KYC stands for Know Your Customer. It is a due diligence process that verifies the identity of individual customers by comparing their details with government-issued identification documents. KYB stands for Know Your Business. It confirms the actual existence of a business, and checks the ownership structure, and nature of the business.

What information is typically collected during a KYB process?

Following is the list of information typically collected during KYB processes:

- Business registration number

- Business type and structure

- Ultimate Beneficial Owners

- Bank account information

- Certificate of incorporation

- Shareholder agreements

What does KYB mean in banking

For banking, KYB processes ensure that the bank is following the AML regulations and doing its best to avoid financial crimes. Banks collect the business registration details and financial statements for risk assessment. The main goal is to prevent illegal business customers from using the bank as a medium for money laundering.