For the past few years, incidents of identity theft have been on the rise. It is worrisome for businesses—in addition to financial losses, customer loyalty and brand reputations are also at stake.

Fraudsters are using ever-evolving techniques to commit fraud, fraud detection and prevention are more critical than ever.

We’ve compiled the most important identity theft statistics and trends to know this year. We’ve also included specific advice to help you overcome the looming threat of identity fraud.

Common types of identity theft

Identity theft occurs when someone obtains and uses another person’s data, such as their name, Social Security number, credit card number, or other identifying information, without their permission, typically for financial gain or to commit fraud.

This stolen identity can be used to open fraudulent credit card accounts, apply for ghost loans, make unauthorized purchases, criminal identity theft, or engage in other criminal activities.

Identity and synthetic identity theft is a major problem worldwide, and it’s not getting better. Fraud reports show that the number of identity theft-related fraud cases worldwide keeps increasing.

After doubling between 2019 and 2020, reports of identity theft kept rising in 2021, affecting almost 1.4 million people. In 2022, it was reported that the Federal Trade Commission (FTC) received about 1.1 million reports of identity theft complaints, and in 2023, there were 1 million reports filed.

Identity theft takes many forms, with credit card fraud being the most common. In 2023, there were about 426,000 reported identity theft cases reported because of credit card fraud to the FTC, a 5% decrease from the previous year in 2022 but still 53% higher than in 2019.

Government documents fraud surged in 2023 with 102,000 cases, a 68% increase from 2022. It was the most common type of identity theft in 2021 but dropped in 2022 as pandemic-related government benefits fraud also slowed down. Only government documents or benefits fraud and phone or utilities fraud saw an increase in reports in 2023.

Other identity theft, including email and social media scams, credit reports and insurance fraud, and online shopping scams, was the second most common type of identity theft. Within this category, email and other social media account fraud and credit reports increased, while medical services fraud dropped significantly from 45,000 cases in 2020 to 14,000 in 2023.

Bank fraud decreased because there were fewer reported cases of new account fraud and fraud involving payment cards like debit and gift cards. However, existing bank account fraud slightly increased, with 19,000 fraudulent charges reported on existing accounts in 2023 compared to 17,000 in 2022.

Types of data stolen

Identity thieves aim to collect as much valuable information as possible to profit or use. They typically target basic identity and existing account details, personal identifiers, biometric data, account logins, and physical or electronic access tokens.

With this data, they engage in various other financial identity theft crimes, including creating new identities or taking control of existing ones, such as government, financial, or medical identity theft, identity fraud, and other personal bank accounts, all in the victim’s name.

Data breaches serve as a key route for criminals to steal money and commit identity theft and credit card fraud. Hackers who produce these breaches often sell the stolen data on the dark web, where buyers utilize it for various fraudulent activities.

In 2023, data breaches surged to 3,205 from 1,801 in 2022. Yet, as reported by The Identity Theft Resource Center, the number of affected individuals decreased by 17%, dropping from 422 million to 352 million.

Why will the rise in data breaches, alongside a decline in identity theft reports, affect individuals? The Identity Theft Resource Center suggests that cybercriminals now target specific personal information, optimizing for more identity theft reports, fraud, and scams rather than broad-scale attacks.

In 2021 and 2022, breaches exposed various types of very sensitive personal data or financial data. The number of breaches containing each type of sensitive personal information or very sensitive data taken over the two years. For example:

- Name: 1,603 data breaches, in 2021, 1,560 breaches in 2022

- Full Social Security Number: 1,136 breaches in 2021, 1,143 breaches in 2022

- Date of Birth: 686 breaches in 2021, 633 breaches in 2022

- Current Home Address: 681 breaches in 2021, 565 breaches in 2022

- Medical History/Condition/Treatment/Diagnosis: 464 breaches in 2021, 465 breaches in 2022

- Driver’s License/State ID Number: 447 breaches in 2021, 499 breaches in 2022

- Bank Account Number: 402 breaches in 2021, 443 breaches in 2022

- Medical Insurance Account Number: 361 breaches in 2021, 370 breaches in 2022

- Phone Number: 218 breaches in 2021, N/A in 2022

- Payment Card Full Number: 211 breaches in 2021, N/A in 2022

- Undisclosed Records: N/A in 2021, 226 breaches in 2022

- Medical Provider Account/Record Number: N/A in 2021, 196 breaches in 2022

Cyberattacks appear as the primary cause of data breaches, impacting the largest swath of individuals overall. While data compromises from human and system errors occur less frequently, they tend to affect more people on average. In 2021, a cyberattack affected an average of 117,000 people, while each human and system error impacted roughly 586,000 people.

Identity theft trends and statistics to watch out for in 2024

Here are some of the common Identity theft, related fraud, online fraud, identity theft statistics, trends, and statistics to watch out for in 2024:

1.Identity Theft Statistics 2024 states that, around the globe, there has been more than a 50% increase in crimes contributing as follows: APAC (50%), EMEA (50%), LATAM (52%), and North America (55%).

India is ranked first among researched countries worldwide by the number of identity theft cases with an estimated 27.2 million adult and fraud victims, during the period. The United States followed, with approximately 13.5 million consumers having encountered an identity theft victim or fraud victim that year. Japan followed, with 3 million annual identity theft victims. Here is a protective tip for businesses to stay safe.

💡 HyperVerge Pro Tip: Use a reliable AI fraud detection solution to stay safe from being a victim of identity theft criminal. AI-powered fraud detection solutions offer advanced capabilities to detect suspicious activities, anomalies, and patterns that may indicate fraudulent behavior.

2.Most identity theft cases occur in the banking and fintech industries, affecting 94% of organizations.

Smaller banks are particularly vulnerable to identity fraud compared to larger ones. Forbes suggests that this is because smaller financial institutions often lack the necessary data infrastructure and resources to effectively prevent fraud.

💡 HyperVerge Pro Tip: When it comes to identity verification, a comprehensive solution that includes multiple layers of verification is essential for detecting identity theft and fraud. Make sure you implement document verification, biometric verification with liveness checks, and robust compliance measures to ensure a multi-layer verification process.

3.The Federal Trade Commission’s (FTC) Consumer Sentinel Network took in over 5.39 million reports in 2023, of which 48 percent were for fraud and 19 percent for identity theft.

Credit card fraud accounted for 40.2 percent of identity thefts, followed by various identity thefts at 25.1 percent, which includes online shopping and payment account fraud, email and social media fraud, and other identity theft. Georgia, Florida, and Nevada had the most identity theft reports.

💡 HyperVerge Pro Tip: Effective transaction monitoring best practices include a robust framework, risk awareness, real-time tracking, and the use of advanced AML tools. Reporting and record-keeping fulfill regulatory requirements and demonstrate compliance by filing Suspicious Activity Reports (SARs) with authorities, including details of the investigation and rationale for suspicion and maintaining records of alerts, investigations, and decisions.

4.Government ID card is the most common form of identity theft in 2021, as had been the case in 2020, as was government documents or benefits fraud.

This came in the wake of FTC consumer warnings and enforcement efforts targeting criminal exploitation of confusion and anxiety over the COVID-19 pandemic. Government documents or benefits fraud drew 396,012 complaints in 2021.

💡 HyperVerge Pro Tip: To counter document forgery, the tip recommends employing the best OCR solution to verify the authenticity of the ID card. However, choosing the right OCR software is crucial. The software should be able to handle a wide range of data inputs and maintain high accuracy.

Secure your business from identity theft

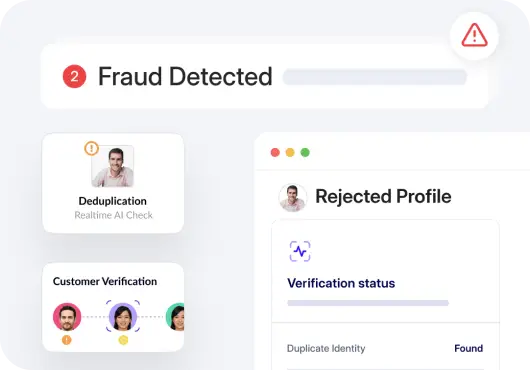

Companies must understand that various identity theft have been increasing over the years and it’s affecting businesses.HyperVerge’s identity verification solutions play an important role in this scenario.HyperVerge’s ID verification solution helps prevent identity theft by accurately confirming the identity of individuals before granting access to services or transactions.

Our solutions use advanced AI technologies such as biometric recognition, document verification, and facial recognition to authenticate users’ identities securely and efficiently. By implementing identity verification solutions, businesses can significantly reduce the risk of ID theft and fraudulent activities and protect themselves from financial losses from identity fraud and theft and their customers from identity theft.

Prevent identity theft with identity verification solutions. These tools confirm identities securely, reducing identity theft numbers and fraud risks. Learn more about HyperVerge’s identity verification solution and sign up for a demo today!

US

US

IN

IN