The identity verification and KYC vendor landscape consists of several innovative players—Jumio is one of them.

However, it is possible that Jumio may not be suitable for all your unique needs and use cases. Various other Jumio competitors in the market can better align with your identity verification goals in terms of accuracy & speed and fit your Know Your Customer (KYC) process requirements.

Let’s check out each of its competitors in detail. But first, let’s understand why you’d want to consider other competitors to Jumio.

Why consider alternatives to Jumio?

Jumio has the first-mover advantage in the identity verification solution market. It aids numerous industries, such as healthcare, financial services, travel, and mobility.

The digital identity verification industry is estimated to grow from USD 27.9 billion in 2022 to USD 70.7 billion by 2027. With its rising use and growing market, multiple players offer similar or better features for online identity verification.

So, what should you consider when looking for alternatives to Jumio? Here are some key factors:

| Ensuring higher accuracy: You don’t want to take chances with the accuracy and avoid false positives altogether. Jumio provides a well-rounded digital identity verification tool that verifies and benchmarks accuracy metrics with other vendors. Finding budget-friendly options: For small businesses, Jumio can seem cost-intensive, and they may prefer moving towards a more pocket-friendly solution that meets their needs. Looking for personalized features: You may not need the extensive features that Jumio offers. Other competitors provide limited feature kits that match your budget, where you can pay for only what you need. |

Local compliance considerations:

Indian banks, NBFCs, brokerages, and fintechs need to evaluate vendors through a regulatory lens. Global capability alone is not sufficient, vendors must align with India-specific compliance and document complexity.

Local Compliance Considerations (2026)

- RBI Video KYC (V-CIP) compliance with audit trails and geo-tagging

- SEBI intermediary KYC norms for brokers and AMCs

- CKYC integration and record retrieval compatibility

- Aadhaar Offline XML handling (masked Aadhaar support)

- DigiLocker-based document fetch workflows

- Account Aggregator ecosystem compatibility for income verification

OCR Performance on Indian IDs

Indian BFSI onboarding heavily depends on accurate OCR across varied formats:

- Reliable PAN card parsing (legacy and new formats)

- Accurate masked Aadhaar number detection

- Handling Voter ID multi-layout variations

- Support for state-wise Driving License formats

- Stable capture in low-light / rural bandwidth conditions

For regulated Indian institutions, vendor selection often hinges less on global brand presence and more on demonstrable compliance depth and document-level accuracy within the Indian ecosystem.

How we evaluated the top alternatives and competitors to Jumio

We extensively analyzed the identity verification tools, the top features businesses seek in these tools, and the associated costs.

We researched nearly 50 Jumio competitors and meticulously assessed their features, pricing, and overall solution for identity verification. Based on that research, we narrowed the names down to 10 competitors of Jumio after analyzing their performance and reviews on listing sites like G2 & Capterra.

The aim was to give you a comprehensive overview of the leading tools and assist you in choosing the best solution for your needs.

Listing of top 10 Jumio competitors

Check out the top competitors at a glance.

| Solution providers | Standout features | Top industries |

| HyperVerge | Deepfake detection & biometric verification | Financial institutions, education, logistics, and online gaming |

| Trulioo | Watchlist screening & global identity platform | Banking, crypto, foreign exchange, & payment service providers |

| Onfido | Tailored workflows & smart capture | Telecommunications, retail, financial services, & online gambling |

| Veriff | Age estimation & fraud intelligence | Fintech, mobility, crypto, & HR management |

| SEON | Digital profiling & device tracking | iGaming, retail, payments, & fintech |

| LexisNexis | Predictive fraud analysis & identity verification | Law firms & law schools |

| ShuftiPro | AML screening & OCR for businesses | Fintech, forex, insurance, & eCommerce |

| SumSub | Transaction monitoring & non-doc verification | Trading, gaming, marketplaces, & crypto |

| Persona | Workflow builder & fraud detection | Digital health, eLearning, cryptocurrency, & fintech |

| iDenfy | Sanctions monitoring & fraud scoring | Blockchain, proxy networks, fintech, & transportation |

Below, we highlight key factors to consider when looking for a solution that ensures higher accuracy, fits your budget, offers personalized features, and allows quick implementation.

1. HyperVerge

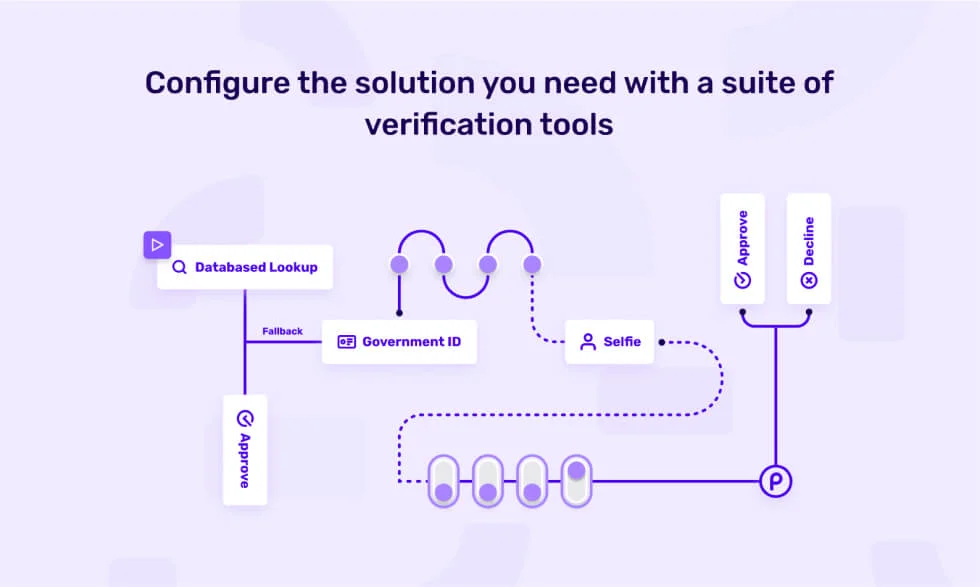

HyperVerge is an advanced identity verification tool that encompasses database identity verification, OCR detection of customer IDs, biometric verification, fraud detection, and Anti-Money Laundering (AML) checks. The HyperVerge ONE platform provides you with a no-code intuitive workflow builder to create and launch new journeys for customer identification.

HyperVerge provides quick deployment and has worked with notable clients like L&T, Vodafone, ICICI Securities, & HomeCredit. It has identified over 900 million identities globally with a 95% auto approval rate.

Best for

Banks, insurance companies, financial institutions, logistics, & small businesses.

HyperVerge ONE features better than Jumio

HyperVerge ONE platform: HyperVerge provides an all-around verification tool that includes liveness checks, face authentication, deepfake detection, and biometric authentication.

No-code workflow platform: The platform offers a no-code platform for users to create customer identity verification journeys using a drag-and-drop interface.

Biometric authentication: Provides best-in-class face recognition technology with a single image-based liveness detection.

Liveness check: Offers liveness checks, where they verify the authenticity of a biometric sample using dynamic qualities of the biometric data, such as facial expressions, for facial recognition checks.

Deepfake detection: Facilitates deepfake detection, which works by detecting image and video infections and performing liveness checks to ensure that the images and videos aren’t fraudulent.

KYC document verification: Allows users to extract data from customer IDs, driver’s licenses, residence permits, etc., with an OCR technology with a more than 95% accuracy rate.

HyperVerge pricing

HyperVerge offers the following pricing plans:

| Start plan (For startups) | Grow plan (For midsize companies) | Enterprise plan (For enterprise-level organizations) |

| This plan includes a free one-month trial and the benefit of seamless integration in less than four hours. | This plan includes all the features of the start plan. It allows businesses access to custom workflows and allows them to view and manage document processing. | This plan offers all the grow plan offerings, collaborative tools, a custom pricing structure, and dedicated support. |

What do HyperVerge users say?

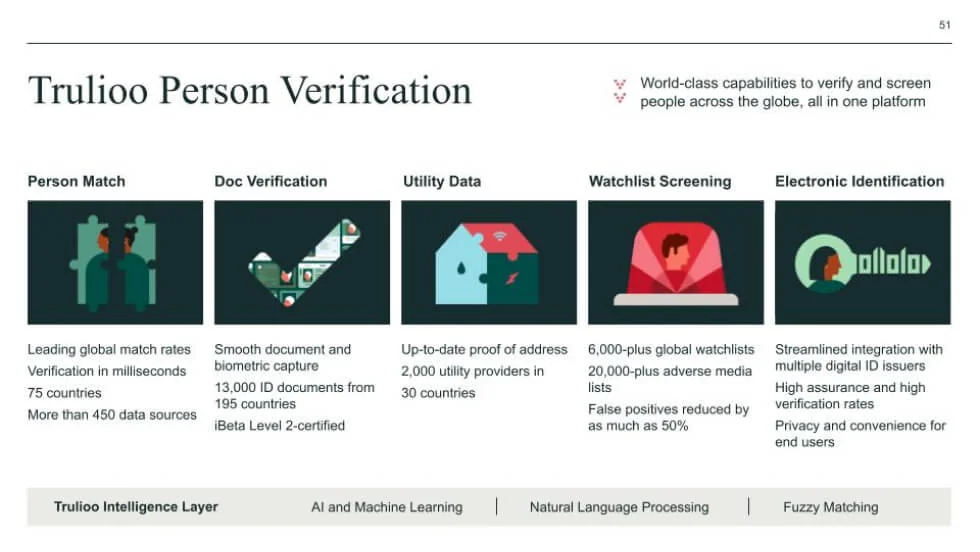

2. Trulioo

Trulioo provides identity verification solutions and instant online identity proofing across different markets and countries. Users can identify customer IDs and build workflows for different regulations by mixing and matching state-of-the-art verification tools and global and local data sources.

In a single automated platform, you can build, launch, and optimize onboarding journeys and even tailor them to meet market requirements.

Pricing

Trulioo provides customized pricing.

Key features of Trulioo

Watchlist screening: Allows you to screen customers and businesses against over 6000 global watchlists for powerful AML protection.

Global identity platform: Facilitates users to build workflows for identity verification using drag and drop interface and deploy them using a single line of code.

Onboarding verification: With Trulioo, you can accurately verify digital identities by matching PII to global and local data sources.

Pros

✓ Trulioo provides an easy-to-use platform with great API integration. This creates numerous customization opportunities for different types of firms.

✓ Users have the flexibility to switch between multiple data sources and tune matching criteria to optimize the onboarding process.

Cons

X According to tool reviews on G2 & Capterra, some users are experiencing false positives in watchlist screening, especially when customers have common names.

X Some users also feel that the match rates for identity verification in some countries are consistently poor.

| Trulioo Vs. Jumio Users felt Trulioo meets the custom integration requirements for businesses better than Jumio. |

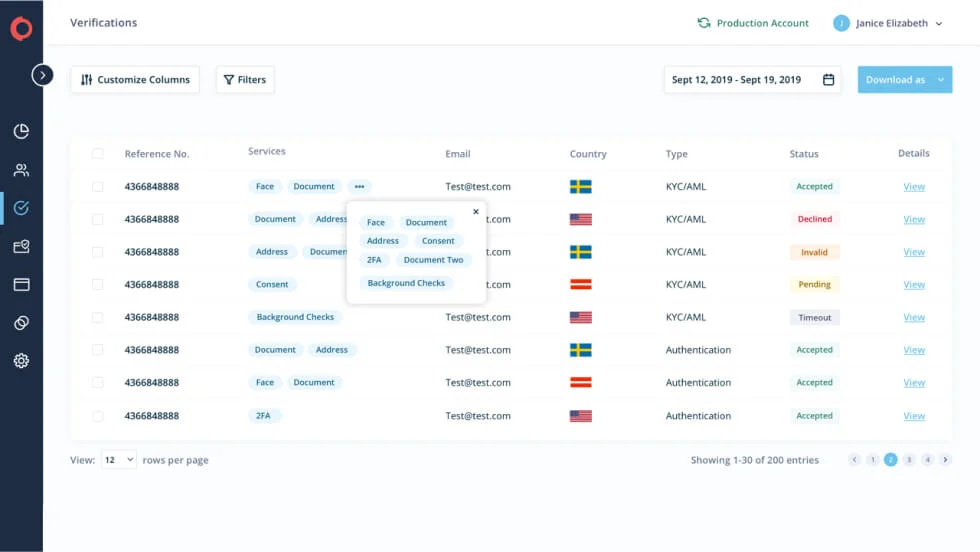

3. Onfido

Onfido is a leading name in the automated identity verification industry. It helps businesses automate their verification process with an end-to-end, AI-powered solution for customer onboarding.

The verification suite includes biometric verification, ID verification, and document and data verification services. The solution is designed for businesses to verify customers at scale, mitigate risks associated with identity theft, and meet AML and other regulatory requirements.

Pricing

Onfido provides custom pricing.

Key features

Real identity platform: Provides a verification suite that encompasses different verification processes, including document verification, biometric assessments, and AML compliance.

Smart capture SDK: Uses geolocation and network intelligence that help users get real-time feedback for blurred images, multi-frame image capture, and fraud detection signals.

Tailored workflows: Offers a platform where you can create no-code workflows to expand into new geographies, align them with internal policies, and adjust the workflow for risk tolerance.

Real-time analytics: Provides a real-time overview of onboarding journeys to analyze workflow performance.

Pros

✓ Users enjoy the stability of the solution. It has a well-operating and validated identity verification model that effectively detects false documents and has low false positive rates.

✓ Users also like that Onfido provides numerous integration options with well-prepared API documentation.

Cons

X Some users experience a complex onboarding process, where the process of going live gets significantly delayed.

X Some users also witness delays in the document verification process, especially when the documents are long.

| Onfido vs. Jumio Onfido’s API offerings are more extensive than Jumio’s, where Onfido provides integration with AWS and ForgeRock. |

4. Veriff

Veriff is an identity verification and KYC solution with an AI-driven technology that helps businesses comply with AML regulations. Businesses can onboard customers, identify bad actors, and identify fraudulent activities.

Veriff has a library of more than 11,500 document specimens from more than 230 territories. It boasts a 98% check automation rate and verifies 95% of users on the first try. It offers reinforced learning from human feedback and manual validation if required.

Pricing

Veriff’s pricing plan starts at $49 per month. It offers a plus plan for $99 per month and a premium plan for $209 per month.

Key features

Biometric authentication: Provides biometric verification with AI and facial biometric analysis. This helps users securely authenticate and grant instant access to products and services.

Fraud intelligence: Offers a risk score and signals to detect different types of financial fraud during the identity verification process.

Pros

✓ The platform is easy to use with optimization of the general flow.

✓ Users especially appreciate that Veriff offers great value for money.

Cons

X Based on experiences from review sites, users feel that the UI is complicated and can be improved.

X Veriff also falls back on support as users feel the support team is hard to reach and unreliable.

| Veriff vs Jumio Veriff supports more than 11000 government-issued IDs in Latin-based, Cyillic, and Arabic formats. Jumio provides a limited range that includes ID proofs, utility bills, bank statements, and credit card statements |

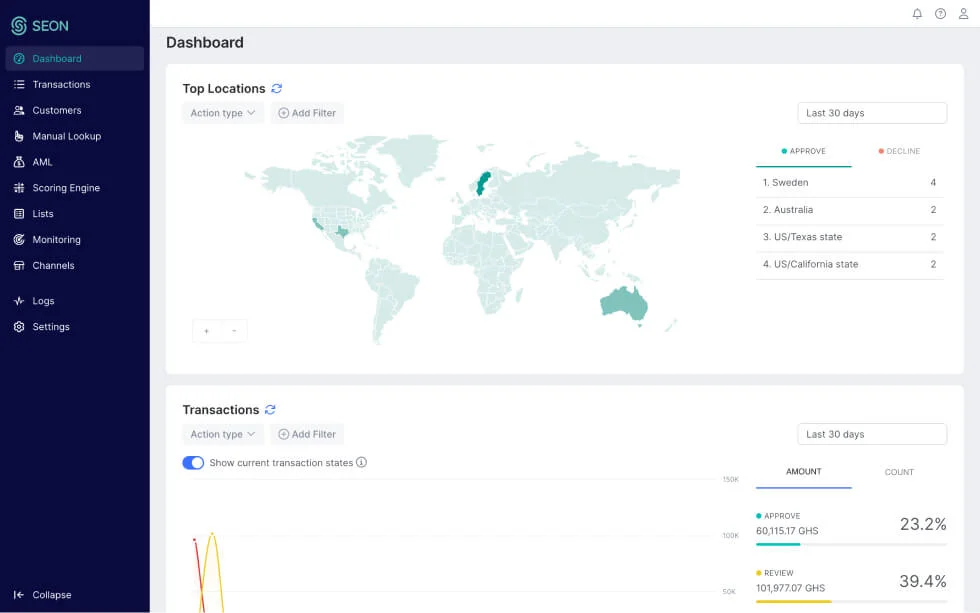

5. SEON

SEON is a fraud detection solution for industries that primarily face issues such as account takeovers, payment fraud, fake accounts, and chargebacks. It provides a data enrichment tool that takes information at the sign-up and onboarding stages to verify a person’s identity. With its digital footprint solution, SEON aims to onboard authentic users with less friction and improve identity fraud prevention accuracy.

Pricing

SEON provides a free plan, a monthly starter plan for $599, and a professional plan with custom pricing.

Key features

Digital profiling for identity verification: Uses customer information such as email addresses, phone numbers, and IP to verify user identity and onboard customers.

Fraud detection: Enables users to analyze data pulled in real-time to sharpen user and customer risk profiling.

Real-time monitoring: Users can detect unusual activity using geolocation, IP address information, and behavioral device data.

Device tracking: Allows you to flag and block suspicious tools, setups, and settings across mobile devices and desktops.

Pros

✓ SEON offers a user-friendly interface for digital identity verification. Users like that they can easily set custom rules, and it also provides AI-generated rules based on your response to the transactions.

✓ SEON is built for enterprises. The tool can easily monitor high-volume transactions without human intervention.

Cons

X Some users on G2 experience multiple false positives, leading to increased manual review efforts.

X Users also experience a slow loading time, especially when simultaneously opening multiple cards.

| SEON vs Jumio Jumio offers Fountain, KYC portal, Microsoft 365, Nok Nok S3 Authentication, and OneSpan identity verification integration that are absent in SEON. |

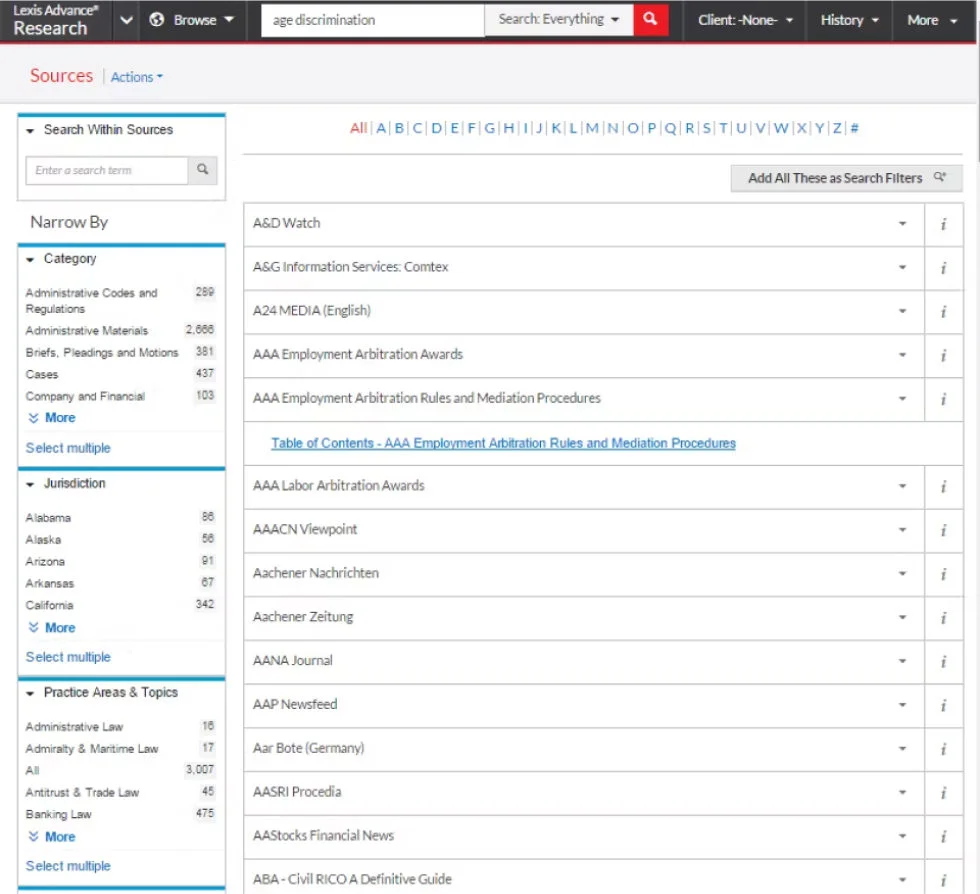

6. LexisNexis LexID

LexID provides comprehensive risk solutions to financial institutions, law firms, insurance companies, and healthcare firms. The platform helps businesses prioritize fraud prevention and personalize the customer experience with a complete view of risk and identity.

The solution covers both physical and digital identities, such as devices, behavioral biometrics, and credit-seeking insights. The complete set of fraud management and identity verification tools allows you to enable security methods such as predictive risk scores and fraud analytics across the customer lifecycle for fraud prevention.

Pricing

LexisNexis LexID provides custom pricing.

Key features

Fraud intelligence: Enables users to automate risk assessment with a scorecard, which is available for various industries like banks, retailers, and telecom providers.

Identity verification & authentication: Provides end-to-end identity verification with biometric solutions, identity document authentication, and advanced analytics that provide perceptive insights.

Predictive fraud analytics: Offers advanced machine learning modeling technology that analyzes fraud signals and improves accuracy in identity verification.

Device assessment: Provides a global network of billions of transactions by more than 4000 institutions that help with instant verification of device identity and location attributes, VPN, and malware.

Pros

✓ LexID provides a detailed background of the individual, showing their address, profession, and criminal history and providing highly accurate verification results.

✓ Users experience that the tool is user-friendly and allows easy access to verified client information.

Cons

X Customers feel that the pricing was higher than other products in the market.

X Some users also experience delays in downloading documents as the software takes a while to process.

| LexisNexis LexID vs Jumio LexID has a stronger customer base in industries like law and insurance, and its offerings are directed to these industries. Jumio has major customers in financial institutions and has better features for user journeys in these industries. |

7. Shufti Pro

Shufti Pro is a digital identity verification solutions provider that offers KYC and AML tools in more than 200 territories. Its feature toolkit includes facial recognition, liveness detection, and anti-spoofing techniques that are used for fraud prevention, swift customer onboarding with KYC regulations, and risk prevention.

Shufti Pro provides document verification services in over 150+ languages and fraud prevention solutions for eCommerce, the financial industry, and educational and healthcare platforms.

Pricing

Shufti Pro offers custom pricing.

Key features

Identity verification engine: Offers high-accuracy AI-powered identity verification. Its global database includes millions of IDs across more than 200 territories.

OCR for businesses: Provides an OCR feature that allows users to process multi-lingual identity documents and extract data from scanned copies and images.

AML screening: Facilitates AML compliance services for successful risk management while ensuring global compliance.

Pros

✓ Shufti Pro offers a built-in video verification that allows users to accurately execute the identity verification process.

✓ The businesses also like that it offers easy integration with custom solutions.

Cons

X According to user reviews on G2, users face occasional issues with the verification process.

X They also experience less flexibility when uploading documents such as a driver’s license.

| ShuftiPro vs Jumio Shufti Pro is widely used by small businesses for identity verification as compared to Jumio, which has more enterprise-level customers. |

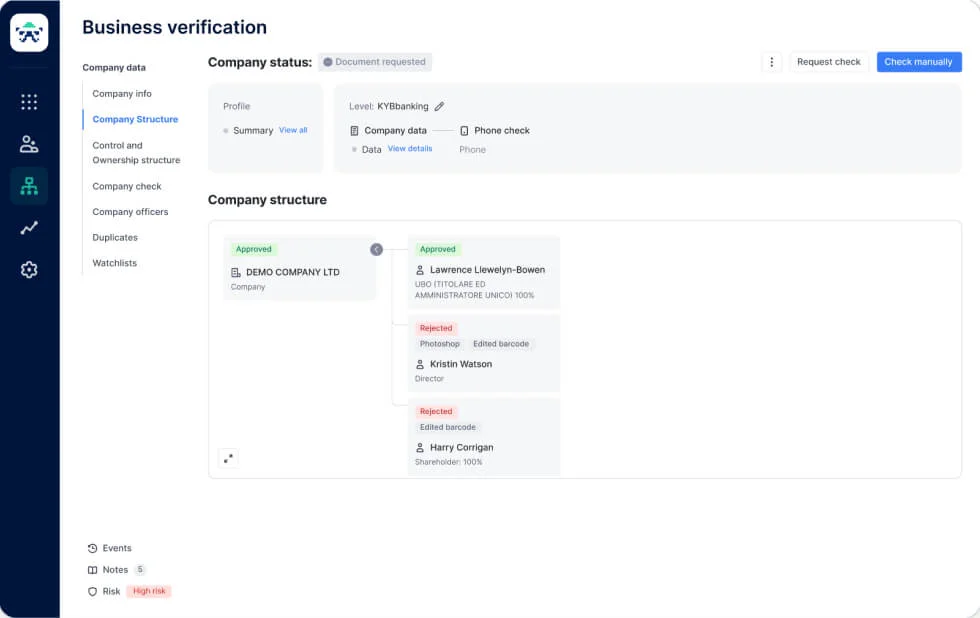

8. Sumsub

Sumsub is a one-verification platform for onboarding and user journey. It provides services such as Know Your Business (KYB), transaction monitoring, and KYC/AML. It aids you in automating your verification process, welcomes customers easily, and meets compliance requirements. Sumsub also provides fraud prevention solutions for various industries like fintech, crypto, online gaming, transportation, and trading.

Pricing

Sumsub provides a basic plan starting at $149 per month, a compliance plan starting at $299, and custom pricing for enterprises.

Key features

Transaction monitoring: Offers a transaction monitoring tool where users can detect suspicious transactions, improve transaction risk scoring, and maintain regulatory compliance.

User identification: Allows users to build unique identity verification flows, onboard legit users faster, and add multiple verification steps for risky cases.

Business verification: Provides business verification services where businesses can speed up the onboarding of clients by conducting registry screening, automating UBO verification, ownership structure checks, and AML watchlist screening.

Pros

✓ Sumsub allows users to verify data with minimum data requirements and cross-check data from authorized sources.

✓ Users feel Sumsub provides immediate & reliable support.

Cons

X Based on reviews on listing sites, some users prefer having more customization options for configuration, such as colors, fonts, and buttons, which are currently lacking.

X A few users witness delays in the analysis and processing of the documents.

| Sumsub vs Jumio Sumsub offers solutions in identity verification flows to manage risks, while Jumio uses AI and biometrics. |

9. Persona

Persona offers a world-class infrastructure for businesses to design and manage customizable KYC, KYB, and AML identity verification programs across 200+ countries. Persona’s identity verification platform is designed for companies to meet compliance standards, fight fraud using advanced identity verification methods, and build trust.

Pricing

Persona offers custom pricing.

Key features

Workflow builder: Provides a dynamic workflow builder where users can design a collection flow without coding and launch it on any web or mobile platform.

Identity verification: Persona provides an identity verification suite where users can verify customer identities using OCR document scanning and selfie checks.

Fraud detection: Allows users to check risk signals using devices and IP addresses and see which users have already appeared in your customer base to catch fraud rings.

Pros

✓ Persona provides comprehensive and easy-to-use APIs with detailed documentation, making it easy for firms looking for custom integration.

✓ Users find the pricing model to be very fair and straightforward.

Cons

X Persona users on G2 experience glitches with the OCR automation feature, which sometimes produces inaccurate results or doesn’t work at all.

X Users also report that the location detection feature isn’t always accurate.

| Persona vs Jumio Jumio provides a more comprehensive identity verification solution as compared to Persona with transaction monitoring, age estimation, and biometrics verification. |

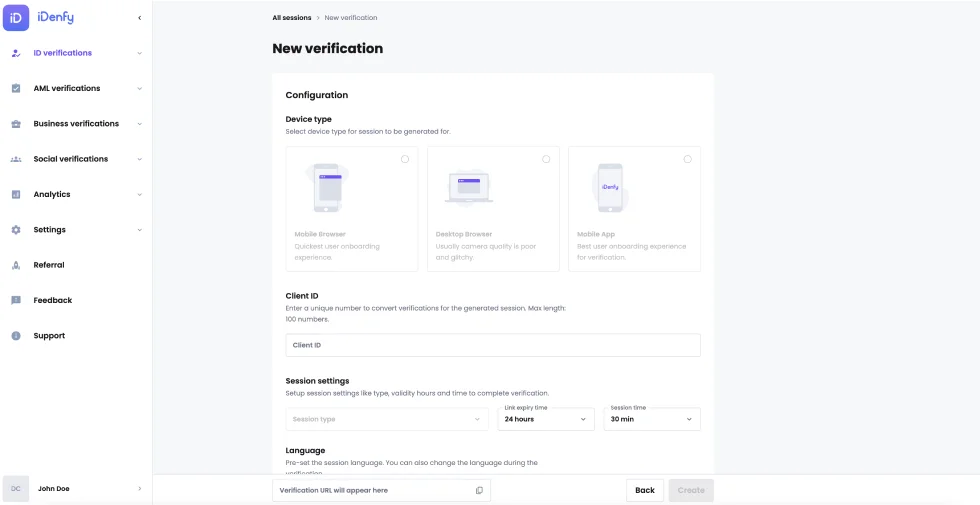

10. iDenfy

iDenfy is an end-to-end identity verification, fraud prevention, and compliance solution. It leverages AI and biometric technology, along with an in-house team of KYC experts, to help businesses meet in the verification process. Its solution is used by various industries, such as eCommerce, fintech, crypto, and online gambling. Recently, iDenfy also introduced its KYB service, a customizable business verification solution.

Pricing

iDenfy offers custom pricing.

Key features

Sanctions monitoring: Helps businesses scan customers with multiple sanctions lists and politically exposed persons using global databases.

Real-time alerts: Scans transactions and identities for suspicious activities and notifies users of any red flags in the database.

Fraud scoring: Provides a fraud scoring feature where you can collect customer risk scores based on smart verification and analyze fraud accident reports.

Pros

✓Users like that iDenfy has a simple setup process for identity verification. It is straightforward and well-documented.

✓ iDenfy provides superior customer support. Users feel that their team is knowledgeable and offers instant assistance.

Cons

X According to reviews on listing sites, users sometimes experience inaccuracy and false positives in document & identity verification.

X They also feel that several AML features lack clarity.

| iDenfy vs Jumio iDenfy offers better support, integration, and an online identity verification feature toolkit. |

Choose HyperVerge to automate digital identity verification

Identity verification is essential for any financial institution or business that avoids fraudulent activities and protects its reputation. Jumio offers a great solution for verifying users’ IDs and onboarding authentic customers. But you still need a personalized identity verification solution that caters to your requirements better.

HyperVerge can solve all your problems related to identity verification and KYC automation with its HyperVerge ONE – an all-in-one identity verification solution. It is trusted by more than 200 businesses and has verified more than 900 million customer IDs with more than 96% accuracy. Contact us to learn more about how you can build workflows and create a solid customer verification process using the HyperVerge ONE platform.

Frequently asked questions about Jumio competitors

Who are the competitors of Jumio?

Jumio offers identity verification methods, and its primary competitors that offer similar services include HyperVerge, SEON, Onfido, iDenfy, and Persona.

Which industries use Jumio?

Numerous industries use identity verification services, such as finance, online gaming, healthcare, transportation, real estate, and delivery services. Companies in all these industries leverage tools like Jumio to automate their identity verification tasks.

Are there any cheaper alternatives to Jumio?

Since most pricing is custom, you can only know once you understand your compliance requirements. You may find numerous cheaper alternatives to Jumio for identity verification with just the features you need.

What type of company is Jumio?

Jumio is an identity verification tool that automates the verification process to prevent identity fraud and identity theft. It simplifies KYC/AML compliance while providing a frictionless customer onboarding experience.