Whether you’re a lender, employer, or financial institution—income verification plays a crucial part in helping you make sound financial decisions.

However, how do you choose a validation software that’s not only cost-effective but also easy to use, accurate, and compliant with regulatory standards?

With so many options, each claiming to be the best, it’s easy to feel stuck.

Remember, no two software are built the same. While some offer advanced automation, others barely scratch the surface of your needs.

With this blog post, we will help you choose the right income validation software that’s best suited for your unique needs.

Let’s dive right in.

Understanding Income Validation Software

Income validation software is a type of software that automates the verification process of individual and business proof of income. Such software pulls data from various sources such as bank statements, payroll systems, and financial records to ensure that the income reported is valid and legitimate.

Income validation software becomes extremely important for financial institutions, lending organizations, and employment agencies that must validate customers’ income as a part of KYC (know your customer) and AML (anti-money laundering) checks.

According to the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), businesses must follow strict rules to verify income as a part of credit risk assessment.

Traditionally, verifying income involved manual checks, contacting employers, and requesting multiple documents—processes that are time-consuming and prone to errors.

Income validation software, however, offers a reliable means to verify income while reducing turnaround times and streamlining processes for organizations.

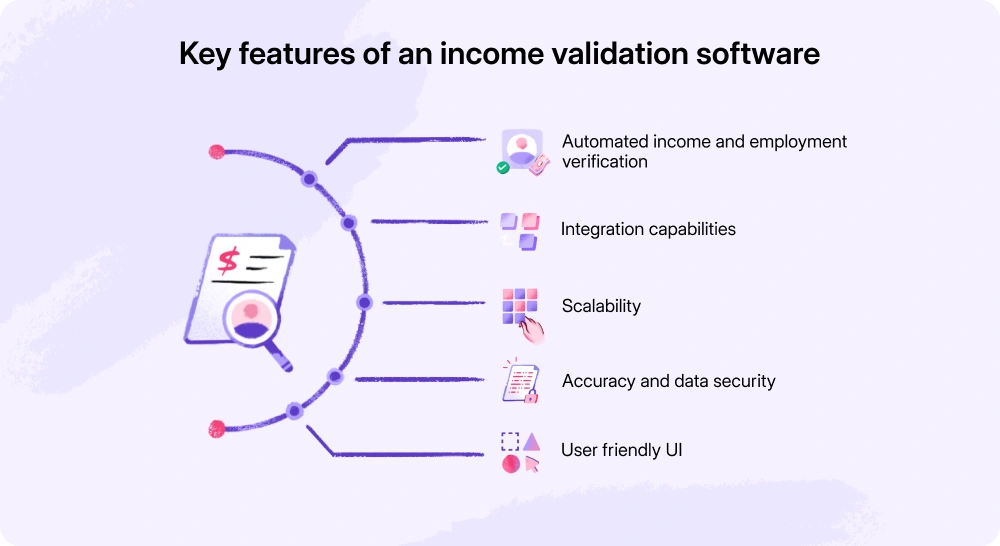

Key Features to Look for in Income Validation Software

The market is flooded with income validation software, each claiming to be the best. So how exactly do you pick a tool and integrate it with your verification process?

Well, we have created a checklist of essential features to help you pick an income validation software.

Let’s check them out:

1. Automated Income and Employment Verification

The right income verification software should streamline the process by automating most, if not all, aspects of income and employment verification. Automation saves time and minimizes errors by reducing the need for manual intervention.

Ideally, the software should connect and gather financial data from trusted sources such as:

- Bank statements

- Payroll systems

- Credit bureaus

- Tax forms

| Pro Tip: Test the tool’s ability to handle complex income scenarios for users with multiple income streams and unconventional income proofs. |

2. Integration Capabilities

Check if the income verification software can integrate with your existing financial systems, loan origination platforms, and CRM (customer relationship management) software. This is important for the smooth transfer of information and data within your existing workflow.

While evaluating, check if the software provider offers:

- Setup assistance and technical support

- Pre-built connectors, plug-ins, and APIs

3. Customization

Businesses rely on different proof of income to verify an individual’s income. It’s important that the income verification software you choose allows you to set and customize specific validation criteria for your business.

This includes customizing

- Income validation rules

- Setting income thresholds

- Regulating access to software.

| Pro tip: Choose a no-code workflow builder that can be customized by non-technical teams without any hassle. |

4. Scalability

Another equally important aspect of consideration is scalability. Confirm that the software can support income verification for your growing business without slowing down the system or increasing the errors. By confirming scalability, you reduce the risk of investing in technologies that may require frequent upgrades.

| Pro tip: If your team and processes are diverse, choose a validation software that offers cross-platform functionality, i.e. mobile devices, laptops, tablets, applications, etc. |

5. Accuracy and Data Security

Financial institutions are dealing with tons of personal data when verifying income through verification software. They are legally and ethically liable for the privacy and security of such data.

Make sure that the verification software you choose complies with the data protection regulations such as:

- IT Act

- Personal Data Protection Bill

- GDPR

- CCPA, and more

Also, compare the variety and reliability of data sources each provider uses. This is very important to ensure that the software pulls real-time data from different sources to help you make informed decisions.

Any inaccuracies in the data can have significant consequences for industries such as lending, insurance, and real estate.

Related read: AML for insurance companies

6. User-Friendly Interface

Choose a software that has the easiest navigation and guided workflows. The complex, multi-step approaches will irritate the users and increase the likelihood of errors and delays.

A well-designed interface makes it easy to navigate the software, upload documents, validate data, and generate reports without requiring extensive training or technical expertise.

Instantly Verify Income From Multiple Sources

With Hyperverge’s Income Verification software Schedule a DemoBenefits of Using Income Validation Software

By now, you have a quick checklist of things you should be looking for in the income verification software.

Let’s now understand how income verification is useful for your business:

- Faster loan approvals and credit decisions: Quick and accurate verification of the customers’ income allows you to accelerate the loan approval process

- Low customer drop-offs: Simplified process and intuitive interface encourage the customers to complete their income verification process

- Reduced friction in customer onboarding: Streamlines and automates the process making the entire customer onboarding experience smooth and error-free

- Improved customer experience: Faster processing times, clear instructions, and reliable data handling help gain customers’ confidence in your business

- Enhanced fraud prevention: Protects business from financial losses by flagging falsified documents and inconsistencies in income data early on

- Reduced operational costs: Saves time and cost by reducing the need to manually intervene

That said, income verification software is a must-have for organizations that are constantly required to verify customers’ income to run their business processes.

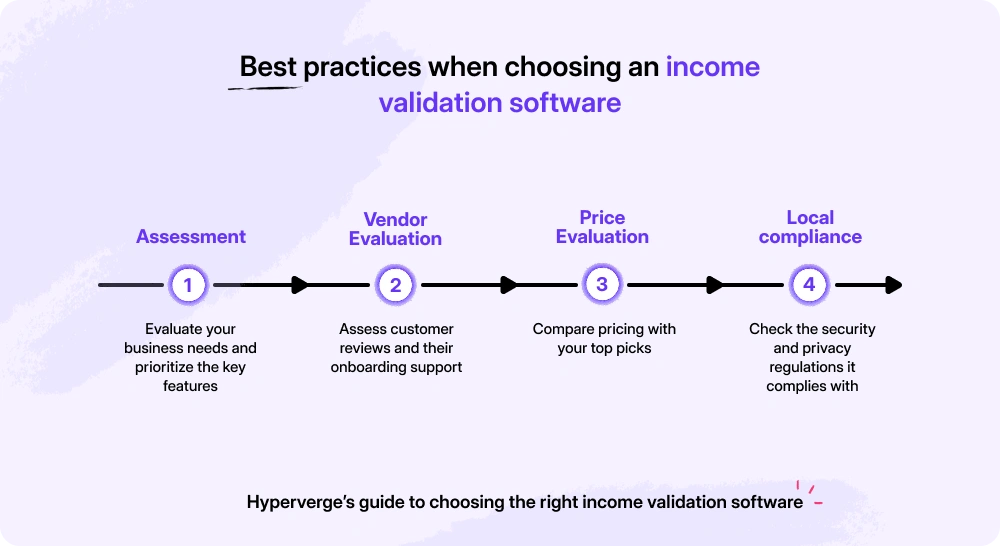

How to Choose the Right Income Validation Software

Let’s now refer to this extensive step-by-step guide that will offer practical insights into how to choose the best software suited for your needs.

1. Analyze Your Business Needs

From financial institutions to banks, rental businesses, insurance companies, and payroll service providers—these institutions require you to validate the income of your client/customer as you onboard them and offer services.

However, each of these businesses has different priorities and a checklist of features they need in validation software. The key is to understand what your business requires so that you can make an appropriate choice.

Here’s a quick table outlining different requirements such as the volume and speed

| Requirements | Key feature | How to evaluate | Who is it important for? |

| Volume of verifications | Quick and prompt bulk processing | Evaluate the software’s processing speed and capacity during peak times or trial runs. Read user reviews for thorough insight. | Large-scale vendors handling hundreds and thousands of loan applications |

| API integrations | Seamless and hassle-free API integrations | Check the list of supported integrations and test API functionality with your system | Businesses with multiple workflow tools and financial data sources |

| Customization | Custom workflows and permissions | Ask if the tool can be customized according to your existing workflows and evaluate its accessibility across different devices | Businesses with multiple teams need tailored processes |

| Security and compliance | Compliance with GDPR, SOC2, and other regional compliances | Confirm that the software supports local tax and regulatory requirements | Every business operating within legal bounds |

| Document verification | Built-in document validation with OCR | Test and evaluate if the software can handle the types of documents your business deals with, i.e. payslips, bank statements | Financial institutions, insurance companies, and businesses complying with KYC and AML regulations |

of the verification process, scalability, integrations, and much more along with a brief explanation of how to evaluate them and who needs them the most:

2. Evaluate Vendors Based on Key Criteria

Once you have your key criteria laid out, look for tools that fulfil your key requirements. At the same time, also assess the vendor’s credibility and support using:

- Customer reviews: Evaluate what the customers have to say about the tool (use tools like G2, Capterra, and Trustpilot) and pay special attention to reviews talking about performance, speed, support, and feasibility

- Onboarding support: Ensure that they provide end-to-end onboarding assistance along with guides, video tutorials, and customer support, promptly and adequately

- Track record: Look at the vendor’s experience in the industry and their adaptability to accommodate changing regulations

- Demo and trial period: Ask if the vendor offers a demo or free trial to assess its fit for your business

3. Compare Pricing Models

Now, evaluate different income verification tools based on their pricing models. This includes:

- Subscription Pricing model: Assess the monthly, quarterly, and annual packs and see what fits your budget the best for your verification needs

- Pay-per-verification model: Ideally suited for businesses with limited verification needs, say freelancers and small lenders

- Tiered pricing model: Evaluate different pricing plans of the same vendor when they offer different pricing plans for different features

| Pro tip: Assess if there are any hidden fees, such as setup charges, integration fees, or extra costs for advanced features like document verification, API access, and machine learning (ML) or AI-powered verification |

4. Look for Regional Relevance

Lastly, ensure that the software complies with the Indian financial and regulatory standards.

Here’s what you should look for:

- Compliance with Indian tax and GST laws

- Support for currency formatting in INR

- Ability to extract and verify data from ITR (Income Tax Returns)

- GST return validation for businesses

- PAN verification for income validation

- Support for e-signatures and digital document verification

- Adherence to India’s data protection and privacy regulations

- Integration with Indian banking and financial institutions for income verification

Also, ensure that the tool complies with data protection laws laid by GDPR. It should meet cybersecurity standards to safeguard sensitive income and personal data throughout the verification process.

Evaluating different tools on these parameters will finally help you choose an income verification software suited for your business.

Challenges in Implementing Income Validation Software

While automation streamlines and speeds up your income verification process, there are certain challenges businesses still face while implementing dedicated software.

Let’s discuss them:

1. Initial costs of implementation

The upfront cost of acquiring and setting up the software can be high for small businesses. Licensing, training, and integration add up to this cost.

How to overcome this challenge: Opt for subscription-based or cloud solutions with flexible pricing plans to reduce initial investments.

2. Resistance by internal teams

Fear of change, lack of familiarity, and increased workload during transition can make the internal team reluctant to adopt new technology.

How to overcome this challenge: Provide clear training and emphasize the long-term benefits to ease the transition.

3. Ensuring compliance with Indian laws

It is challenging to find a tool that offers complete compliance with India’s complex tax, GST, and data privacy regulations.

How to overcome this challenge: Choose software designed for the Indian market with built-in compliance features and regular updates.

Final thoughts

With that, you now have a thorough guide to help you choose the best income verification software for your business.

Whether yours is a lending agency, securities and brokerage unit, or an insurance company—robust income verification software will make your business processes smooth and efficient.

Hyperverge’s income verification offers a simple plug-and-play API module that can be integrated seamlessly with your existing software and verification technologies. It can extract data from multiple sources such as IT returns, bank account statements, salary slips, and form 16/16A, and validate the income proof in a matter of seconds.

The entire process is streamlined, secured, and agent-led ensuring maximum conversions and minimal drop-offs.

Register for a demo now

FAQs

1. What is income validation software used for?

Income verification software is used to verify the legitimacy and authenticity of a customer’s income across multiple sources digitally. Such software is designed to integrate seamlessly with existing solutions and fetch data from payroll systems, banks, and tax forms.

2. How can businesses ensure the accuracy of income validation?

Businesses can ensure the accuracy of income verification by fetching data from multiple sources in real-time and incorporating manual checks where necessary.

3. What are the key regulations in India regarding income validation?

Businesses required to perform income verification must comply with KYC and AML regulations laid by the Reserve Bank of India (RBI). Financial institutions must ensure compliance with the ‘IT Act, 2000’ and follow guidelines outlined in the ‘Prevention of Money Laundering Act (PMLA)’.

4. How do I integrate income validation software into existing systems?

Businesses can use APIs provided by the software to connect it with existing CRMs, ERPs, or financial systems. Such plug-and-play modules are easy to setup and offer compatibility with the existing systems, making them easy to use.