Identity theft is a rapidly escalating global concern. Cybercriminals capitalize regularly on our digital footprints, leading to a shocking 70% increase in public vulnerability related to identity-criminal offenses.

The illegal access and usage of personal information and financial and demographic data can constitute identity theft, putting people and businesses at considerable risk. Therefore, safeguarding against identity theft is crucial for ensuring customer trust and regulatory compliance, especially in sectors dealing with large amounts of sensitive data such as finance, fintech, and e-commerce.

In this primer, we’ll discuss strategies used by these criminals and explore strategic countermeasures that companies can adopt to combat digital identity theft.

Common methods of identity theft

Data breaches

Data breaches are among the most common ways criminals use to execute identity theft. The cases involve unauthorized access to a company’s confidential information, usually by targeting large databases that contain sensitive information of the customers. A data breach can lead to stolen personal and financial information, which may be used to open new financial accounts, including new credit cards, or commit fraud.

Modus operandi:

Cybercriminals are simply cashing in on the vulnerabilities present within a company—the result of outdated software versions, unpatched security vulnerabilities, and poor passwords. Other sophisticated techniques include SQL injection attacks that hit the database side and social engineering against employees. In such cases, identity thieves can target an unpatched vulnerability in software and gain access to the customer database to exfiltrate sensitive information that would be later sold or traded over the dark web for financial gain. If your data is compromised in a data breach, act quickly to report the incident to the Federal Trade Commission and review your credit report with the credit reporting agencies.

Prevention measures:

- Encryption: Be sure to encrypt sensitive information while in transmission and storage.

- Regular Security Updates: Update the security patches for both systems and software regularly.

- Network Security: Use Firewalls to block unauthorized access and employ intrusion detection systems to monitor unusual events.

- Security Audits: Run Periodic audits to find any flaws or potential weaknesses in the security infrastructure.

These solid security measures implemented by businesses can comprehensively minimize the risk of a data breach and protect customer information.

Phishing scams

Phishing schemes are a form of social engineering attack aimed at fraudulently acquiring sensitive information through fraudulent communication. These techniques normally make use of forged emails, fake websites, and phone calls that appear to belong to some legitimate organizations. When phishing attacks lead to the unauthorized collection of personal details, (like someone’s account information or social security number), they constitute identity theft as this information can be misused for various forms of fraud. If you are targeted by phishing scams, report the incident to the Federal Trade Commission and review your existing accounts with the credit reporting agencies.

Modus operandi:

The identity thieves spread emails or text messages apparently from well-known organizations trying to lure oneself by clicking the links or revealing personal information. Mostly, it is associated with rogue links that take users to a similar page to collect the entered information. For example, one phishing email will appear from a bank, asking recipients to “verify” account details via a deceptive link to a fake login page.

Prevention measures:

- Employee training: Train employees to identify and reject phishing attempts, check the authenticity of correspondence, and report any suspicious activities.

- Email filtering: Configure advanced systems to filter out phishing emails and delete them before they reach the user.

- Secure communication: Carry out sensitive interactions through an encrypted communication channel to safeguard against interceptions or eavesdropping.

A combination of effective employee training and robust email filtering will help minimize risks arising from phishing scams.

Dumpster diving

Dumpster diving refers to rummaging through discarded refuse to collect personal information. It is conducted by collecting documents obtained from the trash that have account numbers, bank statements, driver’s licenses, or Social Security Numbers. Improper disposal of sensitive documents can result in compromised online accounts and in case of any misuse, contact the credit reporting agencies and file a police report.

Modus operandi:

Identity thieves go through business or personal trash to recover discarded documents that may contain personal information. For instance, somebody would look for credit card statements, customer records, or any other forms of documents with sensitive information in a company’s dumpster.

Prevention measures:

- Document shredding: Ensure proper shredding of all documents containing personal information before disposing of them.

- Secure disposal services: Engage professional services involved in waste disposal and deal specifically while handling confidential documents.

- Document retention policies: Enforce and implement clear guidelines for retaining and disposing of documents.

Businesses should adhere to these stringent measures, which can help deter mail theft and dumpster diving and safeguard sensitive information.

Skimming

Skimming is a fraudulent activity whereby the thieves capture card information belonging to unsuspecting people and store passwords illegally when they are conducting some activities at the prompted ATM or point-of-sale terminals. If you come across suspicious activity on your account statements or find that your debit card information has been stolen, this may result in compromised accounts. In such cases, immediately report it to the bank or credit card company apart from contacting the credit reporting agencies.

Modus operandi:

Criminals attach skimming devices to an ATM or a card reader discreetly to capture card data. Normally, such devices are fitted with hidden cameras, which record the PIN upon entry. The stolen personal information related to your various bank accounts and cards is then used in subsequent fraudulent transactions. For example, a skimmer may be attached to an ATM’s card slot to capture the card information, while a hidden camera records the PIN entered by the cardholder.

Prevention measures:

- Terminal inspection: Frequently inspect automated teller machines and point-of-sale terminals for any signs of tampering or any other suspicious device attached to them.

- Secure payment systems: Use an encrypted payment system to safeguard the card data, which remains safe while a transaction is processed.

- Customer awareness: Customers should be made aware of the risks associated with skimming and be advised to keep an eye on any suspicious activity around the payment terminals.

Regular inspections, secure payment systems, and customer awareness help a great deal in reducing the risks associated with skimming and protecting cardholder information.

Malware

Malware can be categorized as malicious software that invades computers or devices, allowing the creator or distributor of this software to capture individuals’ sensitive information; it includes viruses, Trojan horses, spyware, and other mutinous programs that reproduce themselves to harm the device. If malware leads to the theft of personal and financial information, it can constitute identity theft, as identity thieves can use this stolen information to make new accounts and commit digital identity fraud.

Modus operandi:

Malware normally spreads through email attachments, infected websites, or through fake software downloads. After downloading, it can silently steal the information or disrupt the system’s activities. For example, a user will be tempted to download malware, mistaking it for an attachment from a legitimate e-mail, which will infect the device, resulting in loss of data.

Prevention measures:

- Software updates: Updating software, such as operating systems and applications, ensures that any vulnerability is countered immediately.

- Anti-malware protection: Using reputed antivirus and anti-malware software to scan your computer for any malware presence and clean them on detection.

- Regular system scans: Periodic scanning of the system to identify the malware and delete it.

Keeping the software updated and using efficient anti-malware will enhance the defense of any company against malware attacks.

Social engineering

Social engineering is the process of trying to cause individuals to divulge confidential information, or perform certain acts that might infringe on security. Such attacks use the exploitation of human psychology instead of technology vulnerabilities.

Modus operandi:

Cybercriminals deceive or psychologically manipulate targets to release sensitive information or perform unauthorized actions. For instance, a scammer may impersonate an organization’s executive to force another employee to reveal classified information or act on requests that will lead to a security breach.

Prevention measures:

- Employee Training: Employees have to be trained and provided with the skills and knowledge to identify possible social engineering techniques, authenticate identities, and question unusual requests.

- Security protocols: Develop procedures for both handling confidential information and the validation of requests.

- Security awareness: Build a culture of security awareness among employees that respects, at all levels, the need to be vigilant and proactive about reporting, without fear of reprisal, for any unusual activity.

Such robust training of employees with clearly defined security procedures will go a long way toward ensuring protection from the wide variety of risks associated with social engineering attacks.

Secure Your Customers’ Trust

Build customer confidence with our robust identity verification and fraud prevention solutions. Secure Your Business Now.Criminal identity theft

Criminal identity theft is where identity thieves commit crimes using another individual’s personal information, including details from the victim’s credit report, thereby resulting in wrong criminal charges and serious consequences against the victim.

Modus operandi:

Criminals use personal documents that have been stolen, through data breaches, or fraudulent activities to carry out their crimes under the victim’s identity, thus issuing the victim with the legal ramifications and a false criminal record. Therefore, criminal identity fraud can result in severe financial losses, and emotional distress, and cause damage to one’s reputation. Moreover, this can hinder one from getting credit, job opportunities, or housing.

Prevention and mitigation:

- Information monitoring: Monitor for any suspicious activity through frequent reviews of credit reports and bank statements.

- Reporting suspicious activity: Report any indication of identity theft to appropriate authorities and financial institutions promptly. If you are a victim of identity theft, you should contact the credit reporting agencies to dispute any fraudulent activities on your credit report and file a complaint with the local police department.

- Legal recourse: Contact an attorney to file charges regarding wrongful criminal allegations and correct the consequences of criminal identity theft.

Monitoring personal information, as well as prompt action on any suspicion, a fraud alert is important in minimizing the harm of criminal identity theft. Activate fraud alerts on credit reports and contact credit reporting agencies to dispute such frauds as early as possible.

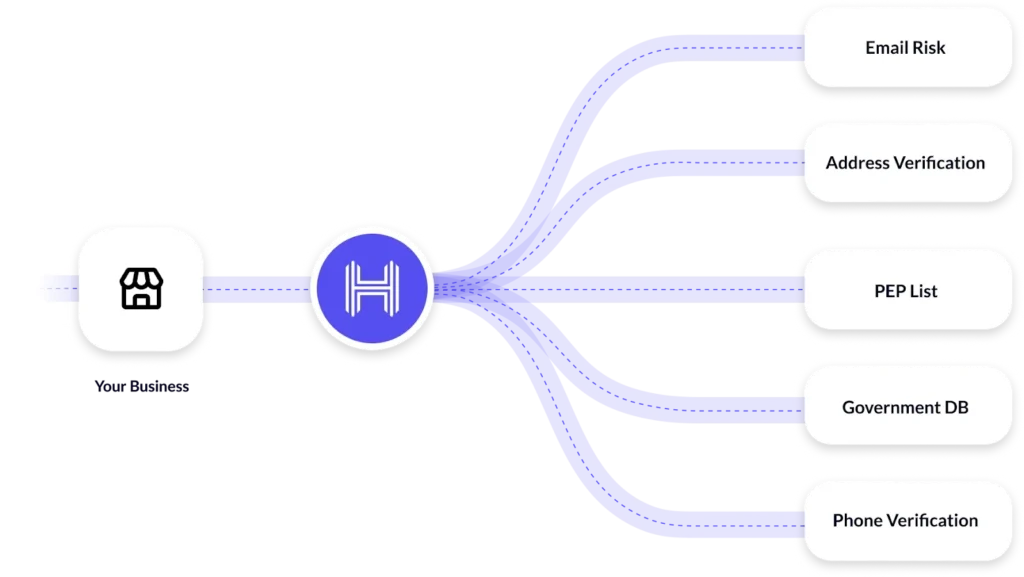

How HyperVerge can help prevent identity theft

HyperVerge offers a seamless, end-to-end identity verification platform that empowers businesses to instantly verify customers across 195+ countries. This comprehensive solution ensures robust security while reducing drop-offs, resulting in a smooth onboarding experience.

- Real-time AML screening and monitoring: With our solution, businesses can have continuous scanning through activities like suspicious transactions and high-risk individuals in place to meet all AML requirements. This proactive approach to the identification and management of threats enables businesses to take pre-emptive actions diligently to avoid any such situation from arising in the future.

- Identifying high-risk individuals and transactions: With advanced AI models, HyperVerge can identify high-risk people and transactions. This identification will lead to being careful and taking the necessary ways to avoid and secure the business from such risks.

- Ongoing monitoring for suspicious activity: Our platform provides constant monitoring by which a business can remain alert and take prompt action in case of danger signals or emerging threats.

- A complete view of customer risk: HyperVerge offers a comprehensive risk assessment based on multiple data sources, including global sanctions checks, PEP screening, and adverse media analysis. This holistic view empowers businesses to make informed decisions regarding customer risk.

- Meeting AML legal compliance requirements: Allowing for real-time AML screening and in-depth risk assessments, HyperVerge aids in checking against AML compliance requirements. Such compliance is important in avoiding potential legal fines as well as keeping intact the operational integrity of businesses.

- Ensuring businesses comply with relevant regulations: The wide coverage and compliance across 195+ countries and 10+ industry verticals ensure that the businesses comply with the relevant regulations, thereby protecting them from penalties and reputational damage.

- Avoiding penalties and reputational damage: Compliance and proper risk management help businesses evade strong penalties and reputational damage ensuing from identity theft and other fraudulent attacks.

- Future-Proof Your Business: Our best-in-class platform harnesses evolving AI models, updated regularly to combat emerging fraud trends and safeguard your assets. Scalable pricing and accelerated time-to-value facilitate rapid integration and a swift “go-live” within 4 hours, thanks to our intuitive, low-code workflow designed for an optimal user experience.

Conclusion

HyperVerge offers a comprehensive identity verification platform that enables protection against identity theft and fraud effectively. By leveraging real-time AML screening, ongoing monitoring, and thorough risk assessments, our platform helps make informed decisions, comply with legal requirements, and maintain customer trust.

Visit HyperVerge Identity Verification to learn more about how we can help secure your business against digital identity theft and sign up today.