What document authentication services do banks trust most?

Short answer to that question: Banks rely on AI-powered document authentication services that combine image forensics, forgery detection, and tamper analysis to verify identity and financial documents at scale. The most accurate systems use machine learning models trained on millions of real and forged documents to detect alterations such as photo substitution, text manipulation, template spoofing, and digitally edited PDFs, achieving accuracy levels above 99% for standard ID documents when deployed with layered checks.

These systems are a core part of fraud prevention, AML compliance, and digital onboarding for banks and regulated financial institutions.

Deloitte predicts that generative AI could fuel fraud losses of $40 billion in the US by 2027. In fintech alone, deepfake incidents soared 700% in a single year!

For businesses, this isn’t a future problem. Document verification, in every way, is the primary defense against AI-powered sophisticated acts in 2026. And to help guide you, this blog explores how modern document verification works, why it matters now, and how businesses can stay ahead of AI-driven fraud.

How document fraud occurs in banking workflows

Banks face multiple document-based fraud threats across onboarding, lending, and account servicing. These threats are no longer limited to low-quality forgeries and now include sophisticated digital manipulation.

The primary document fraud threat vectors include:

- Digitally altered identity documents where names, photos, or numbers are edited using image or PDF tools

- Template-based forgeries that replicate the layout of government-issued IDs or bank statements

- Photo substitution attacks, where the original photograph is replaced while preserving fonts and backgrounds

- Synthetic and AI-generated documents, including deepfake IDs and fabricated income proofs

- Partial tampering, where only specific fields (DOB, address, salary, account balance) are modified to evade manual review

Because these attacks are difficult to detect visually, banks require automated document authentication systems that analyze both visual and structural signals.

What is document verification?

Document verification is the automated process of confirming the authenticity and legitimacy of a physical or digital identity document. It involves checking security features, data consistency, and signs of tampering to ensure the document is genuine and issued by a legitimate authority.

Now, many may confuse document verification and ID verification. Here’s the difference. Document verification is a critical component of ID verification. ID verification is the broader process of confirming a person is who they claim to be, which can include document checks, biometric verification (like a selfie match), database checks, and liveness detection. You basically verify the document first, and then verify the person against it.

Types of document verification in India

The four core types of document verification target specific kinds of trust:

- Identity verification

This is the fundamental check. It confirms that the presented ID card, passport, or driver’s license is genuine and issued by a legitimate authority.

The goal is to answer one question: Is this document real, or a fake?

- Address verification

Separate from who you are, this proves where you live. It validates utility bills, bank statements, or rental agreements to confirm a customer’s claimed residence. This is vital for logistics, credit risk, and regulatory compliance.

- Education and employment verification

Here, the focus shifts to qualification and history. Businesses verify degree certificates, transcripts, or employment letters to confirm a candidate’s background. This is standard for hiring, professional services, and specialized industries.

- Financial verification

This process assesses economic standing. By checking bank statements, tax returns, or pay slips, companies can confirm income, cash flow, and overall financial health.

It’s the backbone of loan underwriting, premium services, and high-limit account approvals.

Ultimately, these verifications are executed through three methods: fully manual review, fully automated AI verification, or a Hybrid Human-in-the-Loop (HITL) model that combines both for optimal efficiency and accuracy.

Now, let’s quickly examine the most common documents used for verification in India in 2026.

Documents commonly used for document verification in India

Different verification (such as KYC verification vs police verification and more) may require a different set of documents.

Here is a generic list of documents used for most verification:

- Proof of Identity (POI) documents

- Aadhaar card: India’s foundational digital ID. Essential for any solution targeting India

- PAN card: Mandatory for financial transactions and tax purposes

- Driver’s licence: Common, includes address details

- Proof of Address (POA) documents

- Utility bills (Electricity, Water): Dated within the last 3 months

- Bank statements: Physical or digitally signed

- Rental agreement: Registered and notarized

- Financial and income documents

- Salary slips: For employed individuals

- ITR returns: For self-employed or business owners

- Bank statements: To verify income flows and financial health

- General business and compliance documents

- Certificate of Incorporation

- GST Registration Certificate

- Shop Establishment Licence

Note: States like Jammu & Kashmir, Assam, and more may ask for additional documents for verification. Some other verification processes may also ask for an online passport submission.

Key challenges in the document verification process

Document verification isn’t a solved problem. Here are the core hurdles businesses still face in 2026:

- AI-generated and deepfake documents

Per the Entrust 2025 Identity Fraud Report, deepfakes account for ~40% of all biometric fraud!

Fraudsters are now using generative AI to create flawless document images complete with correct fonts, hologram simulations, and even valid but stolen document numbers.

- Image quality and real-world capture issues

Blurry images, glare, folded corners, and poor lighting can cause genuine documents to fail automated checks, creating false declines.

- Edge cases: Cernacular, handwritten, non-standard docs

While governments push digital IDs like Aadhaar, a massive part of the population still relies on physical, often low-quality documents; for instance, imagine a handwritten ration card from a rural area, or a laminated driver’s licence with a cracked hologram.

A solution trained only on pristine passports will fail on a handwritten rural land deed or a faded, older-generation ID card.

- Scaling manual review without skyrocketing costs

As volume grows, relying solely on human reviewers becomes operationally impossible and cost-prohibitive, creating bottlenecks. Scaling a manual process is a direct threat to business growth and operational margins.

- Keeping up with evolving compliance requirements

India’s RBI KYC guidelines, DPDPA, and global AML directives are constantly updated. Your system must adapt without costly re-engineering.

Let’s now see how modern document verification processes address these issues.

Forgery detection methods used in modern document verification

Modern document fraud isn’t just “fake IDs” anymore — it’s pixel-perfect edits, metadata tampering, and AI-generated documents that can pass basic OCR. That’s why leading verification stacks use forensics-style checks to detect manipulation even when the document looks genuine.

1) Pixel-level tamper detection

These checks look for invisible editing traces inside the image:

- Error Level Analysis (ELA): flags uneven compression patterns that appear when parts of an image are edited

- Compression artifact inconsistencies: detects regions saved/altered differently from the rest of the document

- Layer blending anomalies: spots unnatural edges around photo swaps, text edits, or patched fields

2) Metadata forensics

Even when the image is visually clean, the file can “give itself away”:

- EXIF inconsistencies: mismatches between device/capture metadata and the claimed source

- Editing software traces: signs the file was exported through image/PDF editing tools

Why it matters: These two layers catch a large share of fraud attempts that slip past OCR-only verification, especially photo substitution and selective field tampering (DOB, address, salary, account balance).

👉 Want to go deeper? Read our dedicated guide on forgery detection techniques to understand the most common tampering methods and how modern systems detect them.

How does online document verification work? A 6-layer defence model

The 6-layer defence model is what separates basic document verification from a system built for 2026. What are those layers? We explain below:

Layer 1: Document collection and capture

This is the user’s first experience. A good system guides them to take a perfect picture. It uses real-time feedback to flag glare, blur, or missing corners before they even upload. This quality check prevents 80% of processing errors at the source.

Layer 2: Image enhancement and boundary detection

Raw images are rarely perfect. AI automatically straightens the document, corrects perspective, removes shadows, and sharpens text. It finds the exact edges of the ID and also crops out unnecessary background, creating a clean, standardized image for accurate machine reading.

Layer 3: Data extraction with AI-powered OCR

Specialized Optical Character Recognition (OCR) doesn’t just read text; it understands where to find the date of birth on a passport versus a driver’s licence, and how to extract data into structured fields.

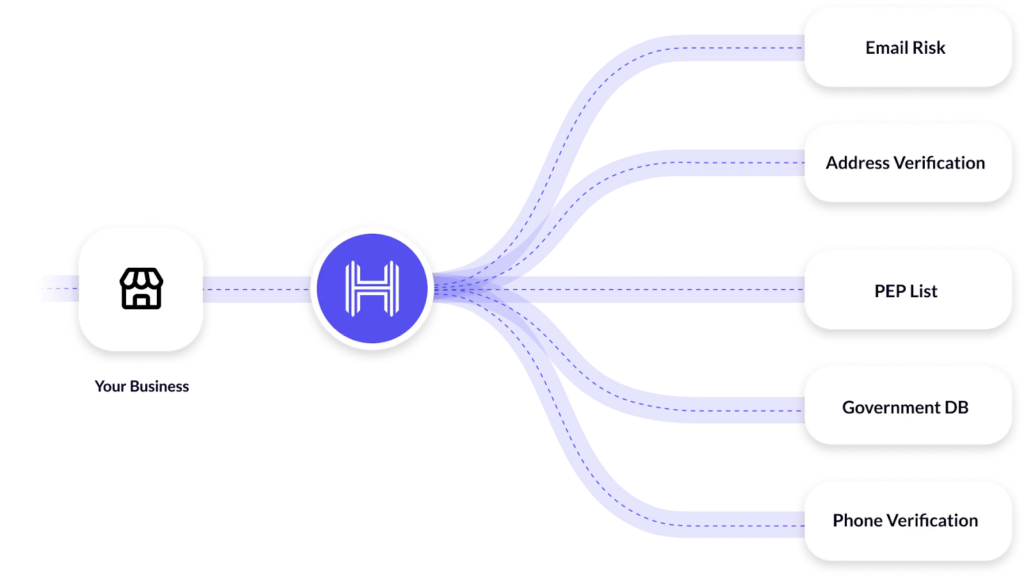

Layer 4: Validation and fraud checks

This is the core inspection layer. It performs critical checks (as mentioned below) simultaneously:

- Security feature analysis: The AI scans for specific, hard-to-forge elements like holograms, microprint, UV patterns, and RFID chip data in e-passports.

- Database and blacklist checks: The extracted data (like document number) is cross-referenced against internal watchlists and, where permitted, official databases for stolen or revoked IDs.

- Contextual risk signals: Metadata from the session, such as device fingerprint, IP geolocation mismatches, or suspicious user behaviour during capture, is analyzed to flag high-risk attempts.

Layer 5: Linking document to identity

This layer involves a live selfie, which is then checked for liveness (ensuring it’s a real person, not a photo or mask) and matched against the photo extracted from the ID document. This biometric tie completes the ‘proof you are this person.’

Layer 6: Human-in-loop review and feedback Loop

For cases where the system has low confidence, detects a novel fraud pattern, or flags a complex edge case, the file is routed to a trained human specialist. Their decisions are then fed back into the AI system, continuously training it to handle new fraud patterns and edge cases.

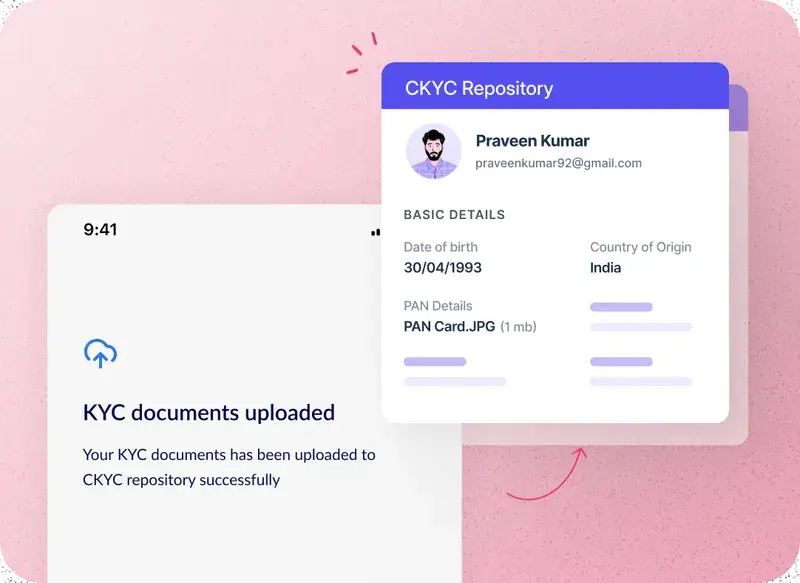

KYC document verification in India: documents and regulations

- Understanding India’s KYC document verification

India’s KYC document verification is mandated by the Reserve Bank of India to prevent financial crime. For businesses, it’s a legal requirement when opening accounts or for transactions exceeding ₹50,000. The core relies on Officially Valid Documents (OVDs) like Aadhaar, passport, or Voter ID, supported by PAN.

Modern options include digital methods like Aadhaar-based e-KYC, Video-CIP, and DigiLocker, moving beyond physical document submission. Customers must also update their records periodically based on their risk category.

- Global KYC requirements

For adherence to global KYC demands, businesses must align with the USA’s FinCEN rules, the EU’s AMLD, and specific systems like India’s Aadhaar or the UAE’s biometric registries. The core components are universal: customer identification, risk profiling, enhanced due diligence for high-risk cases, and ongoing monitoring.

Regulatory Expectations for Document Verification in India (2026)

Document verification is a regulatory obligation shaped by multiple authorities. In 2026, compliance expectations go beyond basic ID checks and require risk-based, auditable, and privacy-first systems.

Under Reserve Bank of India (RBI KYC Master Direction – 2025 Update)

Regulated entities must ensure:

- Verification using Officially Valid Documents (OVDs) such as Aadhaar, Passport, Voter ID

- Compliance with Video-CIP (Video KYC) guidelines

- Periodic KYC updates based on customer risk category

- Continuous risk-based monitoring and record-keeping

Document verification systems must generate audit trails and support regulatory inspections.

Under India’s DPDPA (Data Protection Framework)

Document verification workflows must ensure:

- Explicit, consent-based processing

- Data minimization (collect only what is necessary)

- Storage limitation and defined retention policies

- Clear audit logs and processing transparency

Privacy-by-design is now mandatory, not optional.

Under SEBI & PMLA

Financial intermediaries and market participants must implement:

- Enhanced Due Diligence (EDD) for high-risk customers

- Ongoing transaction monitoring

- Structured AML reporting obligations

Document verification must integrate seamlessly with AML systems.

Alignment with Financial Action Task Force (FATF)

India’s regulatory ecosystem aligns with FATF standards, requiring:

- Risk-based KYC frameworks

- Beneficial ownership verification

- Stronger cross-border compliance controls

Industries using document verification (with real examples)

Here are some real-life examples of how different industries employ document verification in India:

Banking, payments, and NBFCs

All banks and fintechs in India run KYC checks during onboarding. HDFC Bank, for instance, uses Aadhaar/PAN e-KYC for accounts. Paytm requires Aadhaar/PAN for wallet and payments; Razorpay enforces merchant KYC for payouts.

Crypto, gambling, and gaming

Mandatory for age verification and enforcing responsible gaming regulations, ensuring minors are barred from access. Indian exchanges and gaming platforms use Aadhaar/PAN and live selfie checks before trading, withdrawals, or cash contests. CoinDCX and WazirX ask for PAN/Aadhaar via DigiLocker; Dream11 and MPL enforce KYC for payouts and age verification.

Healthcare

Verifies patient identity for telemedicine consultations and ensures only authorized personnel have access to sensitive medical records and controlled substances. Practo, for instance, validates Government ID proof, degree proof, and more.

eCommerce and logistics

Marketplaces verify sellers and high-value buyers with government IDs and business documents. Amazon and Flipkart require PAN, Aadhaar, or GST documents for seller activation and identity checks

Benefits of online document verification

Wondering if a verification system is worth your business’s time and money? Here are quick benefits for a high-grade, fraud-proof document verification system:

- Security and fraud reduction: Automated systems detect forgeries invisible to the human eye, directly protecting revenue and reputation.

- Speed and TAT improvements: Verification that took days is now completed in seconds, removing friction from customer onboarding.

- Regulatory compliance at scale: Automated audit trails, consistent checks, and easy updates to rule sets ensure you meet KYC/AML mandates across jurisdictions.

- Better CX and higher conversions: A smooth verification flow reduces friction at this critical point, directly lowering application abandonment.

How to choose the right document verification solution?

Wondering how to make the right document verification system choice for your business? We’ve got you covered. Evaluate based on:

- Coverage and accuracy: For banks, document authentication accuracy directly impacts fraud losses, regulatory compliance, and customer experience. False negatives can allow fraudulent accounts or loans, while false positives increase operational costs and customer drop-offs.

As a result, banks prefer document authentication services that:

- Deliver consistently high accuracy across document types and geographies

- Maintain low false-positive rates to reduce manual review

- Provide explainable signals for audits and compliance reporting

- Scale reliably during high-volume onboarding or credit surges

- Speed and tech: Is it a real-time API? Does it offer NFC reading for chips in e-passports?

- India-specific capabilities: Non-negotiable support for Aadhaar offline XML verification, DigiLocker integration, and adherence to RBI’s video KYC guidelines.

- Reporting and explainability: Can it show why a document was rejected, which is crucial for audits and user communication?

- Total cost of ownership vs. long-term fraud savings: Look beyond per-check pricing. Calculate the cost of a single breach versus the investment in a superior system.

Future of document verification in India

India’s document verification process is moving from basic ID checks. Businesses can expect deeper use of Aadhaar-linked signals, DigiLocker-first flows, behavioral biometrics, widespread NFC adoption, and consent-led data sharing.

Video KYC will get shorter, smarter, and harder to game. Completely powered by AI, regulators will push for clearer audit trails, tighter data access, and faster reporting. The direction is clear: fewer documents, more signals, and verification steps that keep up with fraud, not after it.

HyperVerge is a part of this future, helping Indian businesses verify users faster using AI-led KYC, face match, and fraud checks.

Want to see the difference for yourself? Sign up for India’s most accurate online document verification platform today!