Technology is growing at an exponential rate and making lives simpler. But as the famous dialogue from the movie Spider-Man goes, “With great power comes great responsibility”, humans must also learn to deal with the dark side of the advancement in tech — greed. While technology can positively influence people’s lives, it can also be used to commit fraudulent activities. This makes organizations need to understand the importance of fraud management and its various strategies.

Overview of Fraud Management

Fraud management is the process of detecting illegal activities and safeguarding important information from falling into the hands of online fraudsters.

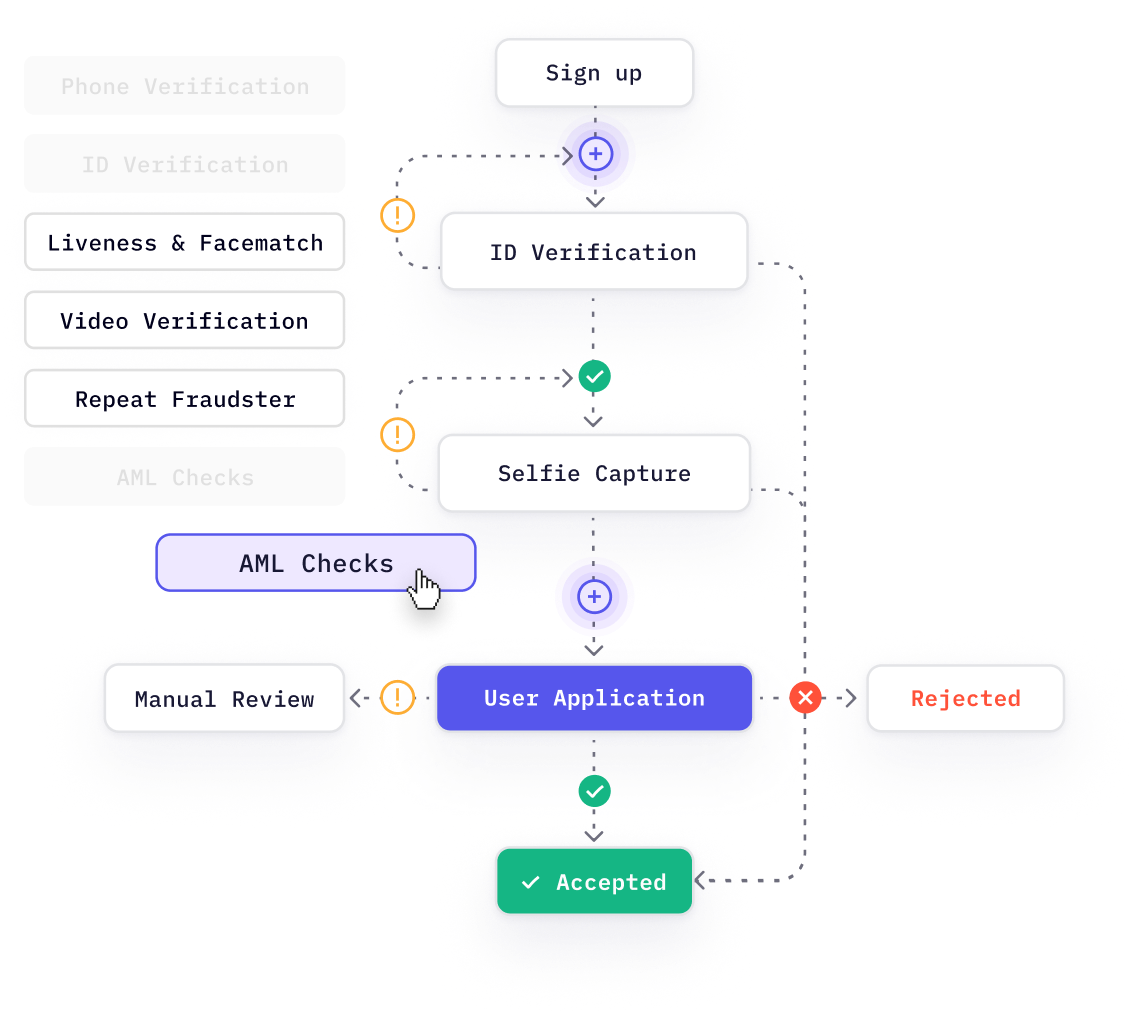

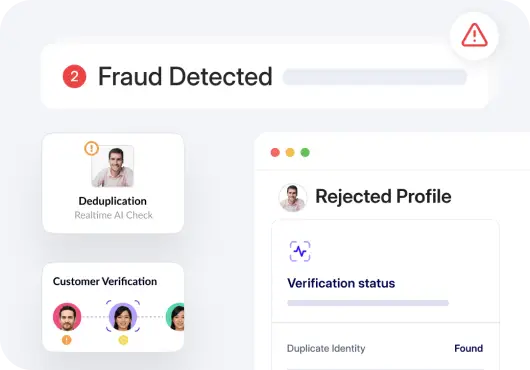

Developing an effective fraud management strategy requires evaluating potential fraud and customizing fraud management solutions to the company’s weaknesses if the firm has a digital channel. Organizations are given the ability to proactively detect and prevent fraud through real-time monitoring, anomaly detection, and risk-based user authentication. These methods boost success in the fight against fraud.

In 2015, “Yates Memo” instigated and established a national focus on corporate wrongdoing that all companies deal with today. However, suspected fraud incidents can also impose legal implications on companies and their employees. Hence, having a solid fraud risk management program can help businesses convey the severe ramifications of adhering to such malpractices. It also helps in curbing the issues from escalating to the point of any legal risks.

Why is Fraud Prevention and Management Beneficial?

Prevents Dire Losses

Frauds that trigger exponential losses and threaten a company’s existence are relatively rare, but they do occur. Whether financial losses or loss of trust, the repercussions are scars that stay long.

The good news is that the overall cost of a fraud management strategy is not expansive, preventing any future losses upon implementation.

Fraud Detection Provides Critical Insights

Upon implementation, a fraud management strategy using best practices can shed some light on vulnerabilities in an organization. In addition, it will highlight both the strengths and weaknesses to be worked upon. Knowing this can also help organizations build a more efficient fraud management program.

A Strong Fraud Management System Boosts Confidence

An effective fraud risk management strategy gives more authority over an organization’s fate. It also boosts their confidence, making the organization more attractive to investors, business partners, and other opportunities.

Stages and Strategies of Effective Fraud Risk Management

Since all organizations are different, there is no “one-size fits all” strategy that can be implemented to eliminate fraud. But all strategies will go through the following stages –

Fraud Risk Assessment

Before implementing an anti-fraud program, one must analyze the organization’s weaknesses to learn which areas are more prone to fraudulent attacks.

Conducting an in-depth risk assessment can help gain insights into an organization’s vulnerabilities. In addition, the assessment will help understand the type, likelihood, and cost involved with each potential fraudulent activity.

From the results, a risk-tolerance limit can be tailored to best suit the organization’s needs. This proves to be quite helpful as it quantifies risk assessment and allows the company to shift its focus towards more damaging frauds. To adapt to changing business needs and emerging fraud threats, it’s crucial to regularly review and update internal controls, ensuring a robust control framework to minimize fraud risks.

Fraud Risk Governance

After risk assessment, care must be taken to engrain fraud risk management into the company’s DNA through policies and defined responsibilities. A solid anti-fraud strategy must be enforced, and all the stakeholders must be open to adopting new procedures.

Here is what’s included in a good anti-fraud strategy:

- Certified fraud examiners with adequate resources is responsible for running the program.

- Various fraud awareness techniques and tools.

- A clear plan of action for the upper management to deal with fraud.

- Delegated responsibilities with specific role descriptions.

- A detailed description of the investigation process and any corrective action.

- Quality whistleblower procedures.

- Quality assurance and ongoing monitoring.

Fraud Risk Prevention

One way of decreasing fraud is clearly understanding the policies and regulations around fraud management. Raising knowledge about fraud awareness and continuous communication across the organizational hierarchy can also help reduce the likelihood of fraud.

Fraud Risk Detection

An organization’s ability to detect fraud is determined by how effectively they implement Controls and Reporting. They are two effective ways that can not only help prevent fraud but also help detect it.

Controls are tools that warn employees about potential fraudulent behaviors. They can be installed across various layers of an organization. First, however, employers must be equipped with the knowledge of how these controls work and when to assess them.

Reporting is a crucial step in fraud detection. They can detect and report fraudulent activities if implemented correctly and save organizations from compromising on sensitive information. The reports must include all the necessary information, such as the date and time stamps.

Monitoring and Reporting

The above four stages will have no effect if they are not constantly monitored.

An organization’s success can be determined by how efficient its fraud management strategy is. The only way to do that is by conducting frequent reviews and monitoring that the policies and practices of the fraud management strategy continue to align with the company’s vision perfectly and are not outdated.

Another crucial step is actively reporting fraudulent activities to someone who can address the problem. This would trigger timely action and prevent organizations from incurring heavy losses.

Following these five stages while implementing the organization’s fraud risk management program will help detect and prevent a business’s suspected fraud — internally and externally.

Conclusion

Companies worldwide lose nearly 5% of their gross revenue on average. So if one has an organization that functions daily without an anti-fraud strategy, they are jeopardizing it.

Frauds can happen internally and externally, and an organization must be equipped with all the tools necessary to deal with such fraudulent activities. Therefore, fraud risk prevention must be embedded into the company’s culture and promoted through a united effort. It is dependent on the effectiveness of the controls, reports, and applied strategies.

With an efficient fraud management strategy, one can bolster their organization’s vulnerability to fraud and promote the health of their business. Moreover, they can save their company from losing lots of money by spending a little on an effective anti-fraud procedure.

FAQs

What is fraud management?

Fraud management is the process of detecting illegal activities and safeguarding important information from falling into the hands of online fraudsters.

Why must one consider implementing a fraud management strategy?

Implementing fraud management strategies helps organizations detect and prevent fraud. Additionally, it assesses their strengths and weaknesses, forming an understanding of which areas are more susceptible to fraudulent attacks.

Is it costly to implement an effective fraud policy?

No, it is pretty affordable and also money well spent.