Fintech is revolutionizing how money works in India. From easy online payments to quick access to loans, it’s making life simpler for millions.

For businesses and consumers alike, fintech brings endless possibilities. It’s changing how people manage finances, all from the comfort of their homes.

India’s fintech future looks bright, so keeping up with fintech trends in 2025 is important. It helps businesses grow and shows consumers smarter ways to manage money.

In this article, I will help you explore the top fintech trends that will continue to shape India financially in 2025.

Top trends shaping fintech in India

Fintech is evolving rapidly in India, and these top trends are shaping the industry. Let’s look at each fintech trend in detail, along with their applications and use cases:

1. Embedded finance

Embedded finance is one of the key trends changing how financial services are delivered. It seamlessly integrates services such as payments and loans into non-financial platforms. For example, an e-commerce site offering easy credit at checkout. Another example is a ride-hailing app providing insurance during booking.

In India, the growth of super apps like Paytm and PhonePe is driving this trend. These platforms offer a range of services beyond basic payments. Users can use these apps as a means to pay bills and shop online. They can also take loans or even invest within the same app.

This integration simplifies the customer experience and is expected to grow. It saves time and reduces the need to switch between multiple platforms. Embedded finance also promotes financial inclusion by bringing essential services to more people. Further, this also expands the services to those in rural or underserved areas.

Embedded finance is reshaping how Indians interact with financial services with its convenience.

2. Artificial intelligence and machine learning

Artificial Intelligence (AI) and Machine Learning (ML) make the fintech market smarter and more efficient. These technologies help financial institutions improve speed and accuracy.

AI and ML are also widely used for fraud detection. They analyze transaction patterns in real time to flag unusual activities. This way, companies can prevent financial fraud before it happens.

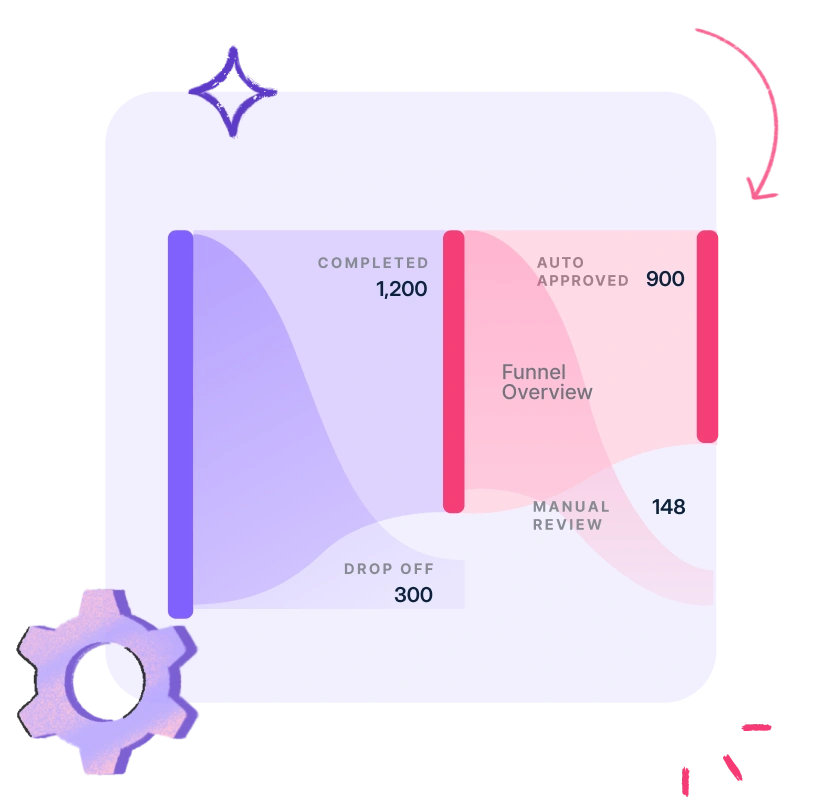

Identity verification is another key application. AI tools quickly verify user details to make onboarding faster. Additionally, personalized financial advice is now easier with AI. Apps can analyze spending habits to suggest tailored savings or investment plans.

Another way AI is transforming fintech is with automated credit scoring. It evaluates a person’s creditworthiness based on diverse data points.

Lastly, emerging applications include AI-driven chatbots. These bots provide instant support and the users can resolve issues without human intervention. Robo-advisors are also gaining traction in wealth management. They use algorithms to guide users in making investment decisions. This makes financial planning accessible and affordable.

AI and ML are making fintech services more intelligent and user-friendly. They enhance security and provide better experiences.

3. Blockchain and Decentralized Finance (DeFi)

Blockchain is revolutionizing the fintech landscape with its secure and transparent technology. While it is best known for powering cryptocurrencies, its applications go far beyond digital coins.

One key use of blockchain is smart contracts. These are self-executing contracts with terms directly written into code. They automate agreements and eliminate the need for intermediaries.

Blockchain also enhances identity verification. It securely stores user data, making identity checks faster and tamper-proof. Additionally, it ensures secure payments, offering a transparent way to transfer money.

Decentralized Finance (DeFi) is another major innovation. DeFi allows users to lend, borrow, or trade directly with one another. These peer-to-peer models eliminate the need for traditional banks through blockchain technology.

In India, DeFi holds great potential. It can empower individuals by providing easier access to loans.

4. Regtech (Regulatory Technology)

With financial regulations becoming more than complex, businesses need smarter tools. This is why Regtech is becoming essential for the fintech industry.

It uses advanced technology to be able to manage and monitor regulatory requirements. It automates processes like reporting, audits, and risk assessments. This reduces manual effort and minimizes errors.

One major advantage is faster compliance. Regtech tools help fintech companies meet regulatory deadlines without delays. This helps businesses to grow while staying within the law.

Regtech also helps in reducing risks. Identifying potential compliance issues early protects companies from penalties.

In a fast-evolving industry like fintech, Regtech is a powerful ally. It ensures that companies can focus on growth while complying with regulatory frameworks.

5. Sustainability in fintech

Sustainability is becoming a key focus for the fintech industry. Green fintech solutions are helping companies make environmentally responsible financial decisions.

One major area is environmental, social, and governance (ESG) compliant investments. Fintech platforms use technology to promote investments that meet ESG standards. This allows investors to align their financial goals with sustainability.

Another important initiative is reducing carbon footprints. Many fintech companies are optimizing operations to minimize energy use and environmental impact. For example, digital-only platforms eliminate the need for physical branches. This cuts down resource consumption immensely.

Fintech can play a big role in financing renewable energy projects. These platforms connect investors with clean energy initiatives. This helps drive the adoption of solar, wind, and other sustainable energy sources.

Sustainability in fintech is not just about eco-friendly practices. It’s about creating financial solutions that support a greener, more sustainable future for everyone.

- Buy Now, Pay Later (BNPL) and alternative lending models

The Buy Now, Pay Later (BNPL) model reshapes how people approach payments. Consumers today prefer flexible payment options over paying the full amount upfront. BNPL makes this possible by allowing users to split their payments into smaller installments.

In India, this trend in fintech is gaining momentum. Platforms like Simpl and ZestMoney are leading the way. They offer easy access to credit, even for those without traditional credit scores. This is especially useful for younger audiences and first-time borrowers.

BNPL is not just about convenience. It empowers consumers by making high-value purchases more affordable. Additionally, alternative lending models are expanding access to credit in underserved areas.

BNPL and alternative lending improve the accessibility of financial services.

Challenges and opportunities in fintech

Fintech in India is growing fast, but it faces several challenges. These challenges also present opportunities for growth and improvement. Here are the key financial technology trends challenges and opportunities you must keep in mind:

- Regulatory changes in India: Regulations for fintech are constantly evolving. This creates difficulties for companies that must stay compliant. Changing rules around taxes and data privacy can raise costs. However, having clear regulations can help companies innovate as long as they adapt quickly.

- The digital divide and infrastructure challenges: A major issue is the digital divide. In cities, people have better access to the internet and smartphones. In rural areas, digital infrastructure is often limited. Poor internet and low digital literacy make it harder for people to use fintech services. Companies need to invest in improving digital infrastructure and educating people on how to use these services.

- Growth opportunities in underserved regions: Rural areas lack access to traditional open banking services. Fintech can bridge this gap by offering mobile banking, digital lending, and insurance services. This can help bring financial services to those who need them the most and open up new markets for fintech companies.

- Data security and privacy concerns: Data security is a major concern for fintech. Companies handle large amounts of sensitive financial information. As cyber-attacks and fraud rise, users are increasingly worried about their privacy. To address this, fintech companies need to invest in strong cybersecurity systems to protect their data. Following privacy regulations will help ensure the safety of consumer information.

- Adoption of new technologies: New technologies offer significant benefits but come with challenges. Implementing these technologies can be costly and complex, especially for smaller businesses. However, AI can improve fraud detection, and blockchain can provide secure transactions. Fintech companies that adopt these fintech trend technologies will have a competitive edge.

Therefore, while the fintech industry in India faces several challenges, it also has many opportunities. The sector can grow and reach more people nationwide by addressing these challenges.

Future of fintech in India

The fintech industry in India is on the brink of a transformative era. Over the next five years, AI is expected to become a critical driver of Business Model Innovation, reshaping how financial institutions operate and deliver services.. AI-powered solutions will enhance fraud detection and offer personalized financial advice. It is also expected to streamline customer service through intelligent chatbots and robo-advisors.

Similarly, blockchain technology will expand its applications beyond cryptocurrencies. It will then play a pivotal role in secure payments, smart contracts, and decentralized financial systems. These advancements will make transactions faster and more reliable. Ultimately, these trends for financial management will drive innovation and trust in the sector.

Financial inclusion will also significantly boost as trends in the fintech industry bridge the gap between urban and rural India. Mobile wallets and digital savings will empower millions of unbanked and underbanked individuals. This will integrate them into the formal economy and improve their quality of life.

Meanwhile, government initiatives like Digital India and Startup India will foster fintech innovation. Programs like the Unified Payments Interface (UPI) have transformed digital transactions. Future reforms will further enhance fintech adoption across the country.

As the industry evolves, businesses must leverage cutting-edge tools to remain competitive. HyperVerge provides advanced AI-driven solutions tailored to different industries. It helps companies streamline verification, ensure crime compliance, and boost operational efficiency. With HyperVerge Security Brokerage, you can maximize conversion while onboarding investors. It is 100% SEBI compliant and simplifies end-to-end customer and investor onboarding.

Whether it’s a bank verification process, Aadhaar e-Sign, liveness detection, or wet signature validation, HyperVerge has got you. Book a demo today and make your onboarding journey seamless.

FAQs

1. What are the major trends in the fintech industry for 2025?

In 2025, fintech will see big changes with a focus on innovation and sustainability. AI will improve fraud detection and give personalized advice. Blockchain will enable secure payments and smart contracts. DeFi will grow with peer-to-peer lending. Embedded finance will make services easier to access. BNPL options will expand, offering flexible payments. Regtech will simplify compliance. Green fintech will support ESG investments and renewable energy projects.

Regtech helps fintech companies handle complex regulations efficiently. It simplifies compliance processes, reduces risks, and saves time. By using advanced tools, fintech businesses can meet regulatory requirements faster. This allows them to focus on managing compliance challenges.

2. What are the 5 key technologies in fintech?

The five key technologies in fintech are AI, blockchain, cloud computing, big data, and APIs. AI improves fraud detection and personalizes financial services. Blockchain ensures secure transactions and enables smart contracts. Cloud computing offers scalability for financial platforms. Big data provides insights for better decision-making. APIs integrate financial services into various platforms seamlessly.

3. What is the future of fintech?

The future of fintech is focused on innovation, inclusion, and sustainability. AI and blockchain will lead the number of technological advancements. Embedded finance and digital payments will make services more accessible. Regtech will ensure compliance with evolving regulations. Green fintech will promote eco-friendly investments. Government initiatives and global collaborations will further drive growth in the industry.