Money laundering through cryptocurrency has been happening for several years. Still, there has been increased attention on the issue in recent times due to the growing popularity and adoption of cryptocurrencies, as well as the emergence of digital currencies as more sophisticated techniques for illicit transactions by criminals.

With the rise of various cryptocurrencies and crypto firms and the rapid pace of development of Decentralized Finance (DeFi) platforms, criminals have found new routes to exploit the crypto market for money laundering purposes.

This article will help you understand crypto AML compliance regulations, including the recent EU AMLD update and how to stay compliant in the crypto industry.

What Does AML Mean for Crypto Firms?

In cryptocurrency, AML refers to the laws, new cryptocurrency regulations, and policies to prevent criminals from financial crime risks, turning illegally obtained cryptocurrency into regular currency.

Criminals see cryptocurrencies as a convenient tool to hide the origins and destinations of illicit funds, making it challenging for law enforcement agencies to track and seize these digital assets.

Crypto AML regulations are important for crypto firms because they prevent criminals from using cryptocurrencies for illegal activities and financial crime risks like money laundering and counter-terrorist financing, protecting investors from fraud, maintaining financial system integrity, building trust, and ensuring legal compliance with crypto regulations.

How Do Criminals Use Cryptocurrencies for Money Laundering?

Even though the volume and risk of crypto exchanges for money laundering are nowhere near fiat currency, the increasing use of cryptocurrency by financial criminals has put the world’s financial institutions and the crypto industry on high alert.

Many argue that using crypto exchanges to launder money is more complex and tough. However, there is a multitude of ways cryptocurrency can be used as a tool for money laundering.

- Mixing: This is the most common form of money laundering using cryptos. Mixing services mix users’ cryptos with other users’ cryptos, sending them through multiple different addresses, resulting in “clean” crypto coming out from the other end.

- Online Gambling Platforms: This is very popular among money launderers since the process of laundering money on online gambling platforms is very straightforward and does not get flagged as suspicious activity. Funds on the platform are paid through cryptocurrencies. After some transactions, these funds are then cashed out or placed in bets.

- Non-compliant exchanges: These are exchanges that do not follow any regulations. They have little to no user identity verification procedures set in place, making them very attractive to bad actors.

- Cryptocurrency ATMs: Cryptocurrency allows anyone to purchase cryptocurrencies with a credit/debit card. Inversely, it also allows anyone to exchange cryptocurrency for cash.

- Peer-to-peer Networks: Using unsuspecting third parties, many criminals send funds. These decentralized peer-to-peer networks lower the risk and result in the “clean” cryptocurrency ending up in a country with little or no anti-money laundering regulation where they can be cashed out for fiat currency.

Updated Crypto AML Regulations

The Anti-Money Laundering Directive (AMLD) aims to regulate financial activities to combat money laundering and terrorist financing. The suggested updates can improve surveillance of crypto assets and compliance in different jurisdictions and the crypto industry. Here are some major updates for crypto AML as per EU’s AML directives:

Expanded List of Obliged Entities

- The agreement broadens the category of obliged entities to include crypto firms, luxury goods traders, professional football clubs, and agents.

- Crypto-asset service providers (CASPs) are required to conduct customer due diligence (CDD) on transactions over €1000, and measures are added to address crypto AML risks in transactions involving self-hosted wallets.

High-Risk Third Countries

- Obliged entities must apply enhanced due diligence measures for transactions and relationships involving high-risk countries, identified based on risk assessments by the Financial Action Task Force (FATF).

Refer to our complete guide to high-risk third countries here.

Cash Payment limits

- An EU-wide maximum limit of €10,000 as financial penalties for cash payments is established, making it more challenging for criminals to launder money.

- Member states have the flexibility to impose a lower maximum limit if desired. Obliged entities must identify and verify individuals conducting occasional cash transactions between €3,000 and €10,000.

Supervision and Risk Assessments

- Each member state ensures effective supervision of obliged entities through a risk-based approach, along with reporting suspicions to FIUs

Enhanced Due Diligence Measures

- Enhanced due diligence measures are introduced for cross-border correspondent relationships in crypto exchanges.

- Financial institutions will conduct enhanced due diligence (including KYC checks) for business relationships with high-net-worth individuals and politically exposed persons handling significant assets.

Prevent Money Laundering in Crypto Firms

The inherently anonymous nature of cryptocurrencies, ease of cross-border transactions with crypto exchanges and virtual currencies, and decentralized peer-to-peer payments make them an ideal choice for laundering money. Imagine this, you can buy any amount of bitcoin (or any virtual assets or other cryptos) in one country via an exchange/casino, or online gambling, and encash it anywhere in the world.

While many nations have introduced anti-money laundering acts and regulations to create a safer environment, their implementation and on-ground compliance with regard to crypto companies remain a challenge. Anti-money laundering (AML) compliance is crucial for preventing suspicious activities like money laundering, tax evasion, and other financial crimes. New regulations in crypto compliance and blockchain offer solutions. Some good practices can make life difficult for wrongdoers, like:

- The blockchain ledgers are immutable. This means all transactions are recorded on it and cannot be changed. This opens up a great oversight opportunity. AI-backed technology solutions that can be deployed at scale can act as a great automated tool.

- Conducting thorough Know Your Customer (KYC) checks can be a massive deterrent to laundering money. A blockchain-based network can be engineered to record verified identification and can be attached to each transaction. Exchanges can run these ledgers, and technology firms can support this activity.

- Ensuring crypto compliance can be achieved using blockchain-based smart contracts. Smart contracts can be programmed to add various parameters for the transactions to be successful, and ML-based algorithms can conduct transaction monitoring and red-flag any anomaly.

- Blockchain analytics providers can help with regular updates on compliance and red-flag anomalies. This ensures a proper mechanism and audit trail for exchanges and enforces crypto compliance with AML regulations.

Stay Compliant with EU AMLDs

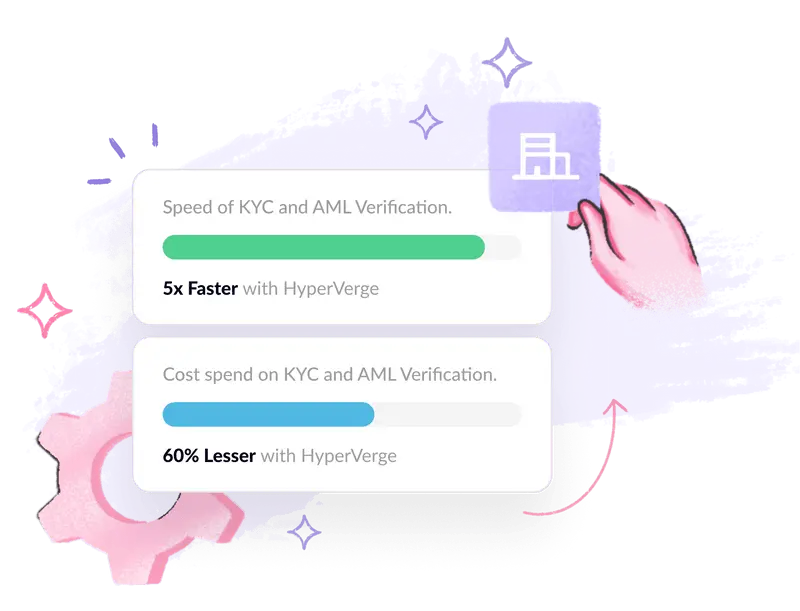

At HyperVerge, we offer advanced anti-money laundering (AML) solutions to help companies comply with regulatory requirements and the proposed 7th EU Anti-Money Laundering Directive (AMLD). Using AI technology, we streamline compliance processes, enabling robust customer due diligence, watchlist screening, KYC checks, transaction monitoring, and compliance with crypto anti-money laundering (AML) legislation and regulations can mitigate money laundering and terrorist financing risks.

The Anti-Money Laundering Directive (AMLD) introduces significant updates, including expanded obligations for crypto-asset service providers, enhanced due diligence measures for high-risk third countries, and the establishment of cash payment limits.

Effective supervision and risk-based approaches are crucial for ensuring compliance with crypto AML regulations and reporting suspicious activities to Financial Intelligence Units (FIUs).

Implementing Know Your Customer (KYC) requirements, employing blockchain technology for immutable transaction records, deploying smart contracts for crypto AML compliance, and leveraging blockchain analytics can aid in preventing money laundering.

Ensure regulatory compliance and safeguard your reputation by integrating HyperVerge’s AML solutions. Sign up here.