The lending industry in India is growing—banks and NBFCs saw an 18% growth in FY 2023 alone. Unfortunately, bad loans and frauds also have upward growth rates. That too, at a much faster pace.

At ₹18,746 crores, loan-related frauds constituted the biggest fraction of all financial fraud in the first half of 2023. Moreover, several Indian banks reported a high surge in defaults for personal loans and credit cards between March 2023 and June 2024.

The above scenarios can be a nightmare for lenders. But there’s a way to minimize bad debts and losses.

Robust income verification acts as the first line of defense against credit risk. For banks, NBFCs, and fintech lenders, it’s not just about checking salary slips. But about building a comprehensive understanding of borrower capacity.

You can not afford to lose a potential customer to a competitor due to inefficient income verification. Neither can you hurt your business by approving applicants with potential red flags.

The solution is building an income validation process that safeguards your organization from all risks and enables you to move fast with onboarding timelines.

In this article, we’ll dive into the significance and challenges of income validation for lending. We will also discuss how automation helps resolve those challenges and fuel growth for lending businesses.

Why income validation is crucial in lending

Income validation is important for three primary reasons.

1. To reduce the risk of loan defaults

- Lenders can verify that the income reported by borrowers is accurate and reliable.

- By employing technology-assisted income validation, lenders can quickly assess the authenticity of income claims, flagging discrepancies and potential misrepresentations.

2. To decide loan terms

- Businesses with consistent revenue and high-value assets get low-interest loans.

- Individuals with good credit scores get low-interest loans.

- Lenders can subject high-risk borrowers or high-value loans to additional conditions and scrutiny.

3. To adhere to regulatory compliance

- By checking the borrower’s economic background, lenders adhere to RBI’s guidelines for offering loans.

- Lending institutions can avoid external audits and penalties when they follow proper income validation protocols.

How income validation is used for lending

You need to ask for the following documents from your customers. They may have to present some or all of them depending on the type of loan and your institution’s policies.

Proof of income

- Salary slips for the past 3 months

- Form 16 for salaried individuals as proof of employment

- Income tax returns from the past 2 years

- Letter of increment

For self-employed/business owners

- Income tax returns from the past 3 years

- Proof of business registration

- Challans as proof of advance income tax

Financial statements

- Past 6 months’ bank statements

- Payment records of other ongoing loans and EMIs

- Liabilities and personal assets

- Credit card statements and CIBIL score

Identity documents

- PAN card

- AADHAR card

- Birth certificate

Once the borrowers provide proof of income, here’s what you assess through it.

Financial capabilities

By having visibility into your customer’s income structure, assets, and payment history, you get assurance about their ability to repay loans on time. The documents reveal if an individual has employment stability, consistent revenue streams, or sufficient assets to secure the loans. You also ensure the loan amount doesn’t exceed the borrower’s financial ability.

Debt-to-income ratio

If a borrower already has ongoing loans and EMIs, they must be financially capable of taking additional debt. The debt-to-income ratio helps in analyzing this. Consider a ratio of 20-35% as an ideal for low-risk borrowers.

Credit reports

Indian banks use credit scoring models like CIBIL to understand the risk associated with each borrower. CIBIL score of 750 and above signals a great credit score to offer low-interest loans. You can place borrowers with a below 685 score under additional scrutiny. Or offer them high-interest debt.

Risk profile

Income validation reveals patterns and insights that pinpoint fraudulent and risky borrowers. For instance, If an individual has been unemployed for the past 6 months, it could be a red flag. In another case, there might be discrepancies in personal information across different documents which signals suspicious activity.

Benefits of income validation for lenders

Robust income validation fetches multiple benefits for lenders, which are:

- Reduced loan defaults with a risk-based approach for customer profiling.

- Improved risk assessment by asking for additional documents from high-risk borrowers.

- Enhanced customer trust with stringent KYC checks.

- Better compliance with RBI guidelines.

Automate end-to-end income validation

with secure, compliant, & accurate AI-powered software Schedule a DemoChallenges faced by lenders without proper income validation

Without proper tools and processes for income validation, lenders face multiple challenges. If not resolved, these challenges result in revenue loss, legal proceedings, and damaged credibility.

Let’s understand them.

Higher rates of loan defaults

When you don’t assess a borrower’s loan repayment ability, it leads to missed instalments. More loan defaults compound into more losses.

Let’s say a borrower defaults on a ₹10 lakh home loan, and the bank loses both the principal amount and expected interest income (say ₹5 lakhs), totalling ₹15 lakh loss.

Now recovery of a defaulted ₹5 lakh business loan might cost the bank ₹50,000-75,000 in legal and collection fees. This further degrades your organization’s credit rating and credibility in the market.

Increased operational inefficiencies

The lack of proper income validation tools makes the lending process inefficient at many levels.

First, money locked in defaults can’t be lent to new customers. This restricts growth and scalability.

Next, agent-led validation methods are labor-intensive and slow-paced. They offer a poor customer experience.

A lot of time goes into sending documents back and forth via email. This hassle together with privacy concerns makes customers drop off before completing the loan application.

Fraudulent loan applications slipping through the cracks

Failing to detect inconsistencies across financial statements leads to the approval of fraudulent applications. Not asking for complete documents or errors in verifying provided documents can put you in trouble.

With identity fraud on the rise, digital lending businesses need to be more cautious than ever. Fraudsters often use synthetic identities like deepfakes to approve applications.

Difficulty in complying with legal standards

By ignoring rigorous income validation, you not only miss revenue opportunities but also face heavy fines from regulatory authorities. Non-compliance can result in regulatory penalties of up to ₹1 crore.

Besides, it invites higher provisioning requirements taking away a bigger chunk of your revenue. In some cases, regulatory authorities also restrict lending operations and perform mandatory external audits.

Automating income validation can help lenders overcome challenges and unlock more growth. Have a detailed walk-through of how AI-powered tools reshape your business for the better.

How HyperVerge’s solutions improve income validation

Traditional methods for income validation are costlier and time-consuming. They are also unsuitable for modern-day privacy-conscious customers.

Agents ask for documents over email and WhatsApp. Either way, there’s a risk of data breaches.

It takes numerous days to onboard one customer. Even after that, there’s always room for error in verifying income.

According to McKinsey, the origination cost for a single mortgage is $7000-$9000. Automation can bring down this cost by 25%. It also reduces approval cycle time by 30%.

HyperVerge’s end-to-end income validation automation suite is designed for uncompromised security and compliance while offering a smooth customer experience at every step. Here’s how it helps lenders to eliminate bottlenecks and generate more revenue.

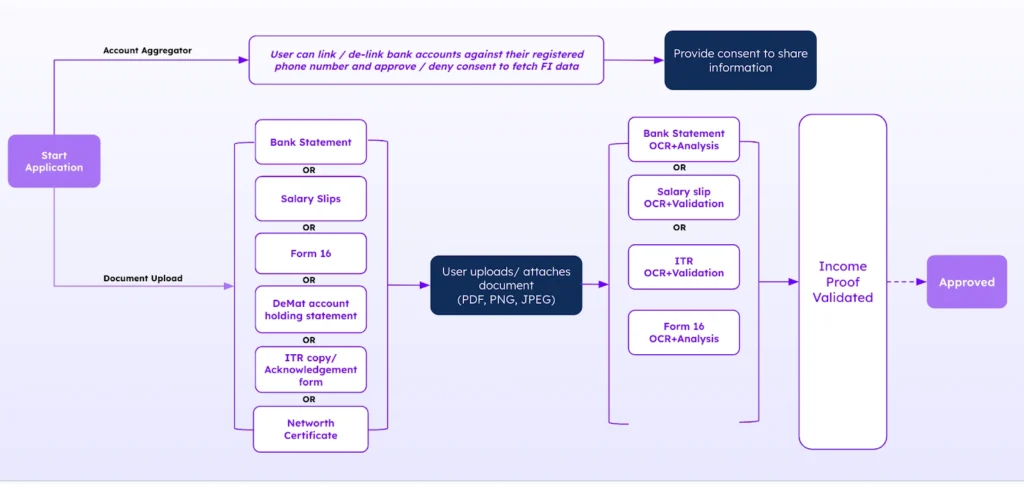

AI and automation

Hyperverge’s AI is built specifically to solve the challenges of the lending industry. Validate bank statements with unmatched accuracy within seconds. Users can capture and upload PDF documents from any device.

With advanced OCR technology, extract important insights from financial documents. Onboard every customer with confidence through rigorous risk assessment.

Real-time data integration

Enable your users to auto-share data from reliable sources. Hyperverge’s account aggregator framework fetches financial information from bank statements, ITRs, insurance policies, mutual funds investments, and more.

Access customer data instantly, in a secure and compliant manner. Reduce turnaround time with automated approvals.

Read more: Top Account Aggregators: A Comparison Guide

Needle-moving analytics

Gain visibility into metrics that matter. Discover the top reasons for rejections or manual approval. Through Hyperverge’s dashboard analytics, keep track of onboarding time, conversion rates, and rejection rates.

Drill down into insights that drive decisions. Know at which step your customers are dropping off to boost conversions. For instance, if uploading bank statements is the most time-consuming step, modify the process to make it easier for customers.

Enhanced fraud detection

Be it mismatches in personal details across documents, forged documents, or the use of synthetic identities, filter fraudulent applications during onboarding. Hyperverge’s smart algorithms detect anomalies in financial data.

Get a holistic overview of your customer’s financial profile. Stay ahead of fraudsters through behavioral checks and facial recognition.

Enhanced compliance

As per the RBI guidelines, you need the borrower’s consent to access financial and personal information. Using HyperVerge’s income validation solution, you can capture their explicit consent through e-sign in a few clicks.

Create customized workflows that align with the Indian regulatory framework. Shield your business from non-compliance fines while having shorter and faster onboarding cycles.

Best practices for lenders in income validation

Adopting the below practices helps lenders maximize income validation process efficiency.

Choosing the right technology

Your LSP (lending services provider) should cause minimal disruption to your existing business infrastructure. Therefore, choose a solution that integrates with your existing setup.

HyperVerge’s plug-and-play modules are designed to seamlessly incorporate into lenders’ existing systems. These ready-to-go workflows save time and cost of implementation at your end. Customize them further as per your specific needs.

Ensuring data security

According to a PwC survey, 44% of customers are willing to pay more for data protection. This necessitates end-to-end encryption and secure API infrastructure for building customer trust.

Keeping the validation process aligned with data localization (storing sensitive information within India) and the DPDP Act 2024 is another key practice for lenders.

Educating borrowers

When borrowers understand why and how to provide documentation, conversion rates go up. Communicating document details and providing regular updates are linked to improved approval rates.

Using Hyperverge, our clients provide real-time feedback to their borrowers while filling out forms. For instance, if a customer uploads a bank statement older than 6 months, the system doesn’t accept and nudges them to re-upload them at the moment.

Final thoughts

Income validation serves as the cornerstone of responsible lending, protecting both financial institutions and borrowers.

A robust validation process goes beyond assessing the loan repayment ability of borrowers. It also gives you a competitive edge by boosting customer experience.

When a customer goes through a well-coordinated process during their income verification, it sends a powerful message that your organization values their security and convenience. They trust your capability to avoid data breaches and fraud. This translates into improved conversions.

Hence, having a robust system in place, it’s a win-win for both businesses and their customers. Upgrade your onboarding process with Hyperverge’s income validation automation tools.

Begin approving applications with — speed, accuracy, security, compliance, and frictionless customer experience — all at once. So you never lose a potential low-risk borrower to your competitors again.

FAQs

1. Why do lenders need income validation before approving a loan?

Lenders need income validation to ensure borrowers can repay their loans. This protects lenders from losses due to defaults and borrowers from taking loans they can’t afford. It also helps detect fraud where people might lie about their income to get bigger loans.

2. What are the key methods of income validation used in India?

Banks and lenders in India verify income through these main methods:

For salaried individuals: salary slips, Form 16, bank statements, and PF statements

For self-employed/business owners: income tax returns (ITR), GST returns, bank statements analysis, financial statements, and audit reports

Digital methods: account aggregator framework, IT department e-verification, bank statement analyzers, and UPI transaction analysis

3. How does income validation reduce loan defaults?

Income validation reduces loan defaults by ensuring borrowers can afford their loan payments. By verifying real income through salary slips, bank statements, and tax returns, lenders can assess if monthly payments fit within a borrower’s budget. Lenders can reject applicants who might struggle to repay.

4. Is digital income validation secure for borrowers?

Yes, digital income validation is highly secure. It uses encrypted data transfer, and secure APIs, and follows strict RBI guidelines. Most platforms use bank-grade security, multi-factor authentication, and limited data access permissions. Your financial information is only shared with your consent. It can’t be accessed by unauthorized parties.

5. What role does the RBI play in income validation requirements?

RBI acts as the primary regulator. It defines mandatory guidelines for how banks must verify borrower incomes. It requires specific documentation, sets verification standards, monitors compliance, and imposes penalties for violations.