Indian fintech companies are increasingly navigating complex regulatory environments, particularly in relation to Know Your Customer (KYC) protocols. The Reserve Bank of India (RBI) has yet again emphasized the importance of stringent KYC measures, urging fintechs to adopt robust verification processes to enhance security and compliance.

Video-based Customer Identification Process (V-CIP) emerges as a critical tool for fintechs aiming to streamline their onboarding processes while adhering to regulatory standards. But what exactly do businesses need to do to stay compliant?

In this article, we will explore the ins and outs of V-CIP for Indian businesses, its operational framework, benefits, and the challenges fintechs may face in implementation. We’ll also cover a detailed breakdown of the latest RBI requirements.

What is the video-based customer identification process?

RBI recognizes V-CIP, or video KYC as a method to facilitate customer identification for financial services through live video interactions. In many ways, video KYC is the best of both worlds when it comes to digital KYC and in-person KYC—it retains the human involvement in the onboarding process while still maintaining the ease of digital verification.

Video KYC enables regulated entities (REs) such as banks and NBFCs to verify the identity of customers remotely. It’s convenient for the end user and also ensures compliance with KYC norms.

Key features of V-CIP

Video KYC is a game-changer for fintechs looking to streamline their customer onboarding process. with video-based verification calls, fintechs can now verify a customer’s identity in real-time.

Here are some key features of video KYC:

- Real-time identity verification: With video KYC, fintechs can verify a customer’s identity during a live video call, ensuring that the person is who they claim to be.

- Facial recognition technology: Video KYC utilizes advanced facial recognition technology to match the customer’s live video feed with their government-issued ID, such as a passport or driver’s license.

- Liveness detection: To prevent fraud, video KYC includes liveness detection features that ensure the customer is physically present during the video call and not using a pre-recorded video or photo.

- Multilingual support: Many video KYC solutions offer multilingual support, allowing customers to communicate in their preferred language during the verification process.

V-CIP use cases

From customer onboarding to regulatory compliance, video-based customer identification is a useful, multifaceted process. Here are some video KYC use cases for fintech companies:

New customer onboarding

Video KYC allows fintechs to onboard new individual customers, proprietorships, and legal entities remotely and conveniently. The process involves verifying the customer’s identity and address through a live video session, eliminating the need for physical documentation.

Conversion of existing minimum KYC accounts

Fintechs can use video KYC to convert existing minimum KYC accounts opened through non-face-to-face methods. This helps upgrade these accounts to full KYC compliance, allowing customers to access a wider range of financial services.

KYC information updates

Video KYC enables fintechs to easily update KYC information for eligible customers. Customers can provide updated documents and verify their identity through a video session, ensuring their KYC details remain current and compliant.

Regulatory compliance

Video KYC helps fintechs adhere to RBI and SEBI regulations for customer verification. By using a secure, standardized framework, fintechs can prevent legal complexities and ensure 100% authenticity checks with support for third-party integrations.

Operational efficiency

Video KYC streamlines the onboarding process, reducing manual errors and improving reliability. Features like transcription, summary generation, and multi-language support enhance operational efficiency and customer experience.

Other use cases

- Savings/current/salary account opening: Fintechs can use video KYC to open various types of accounts, including savings, current, and salary accounts, remotely and efficiently.

- Pension life certificate: Video KYC can be used to verify the existence of pensioners and update their life certificates, ensuring uninterrupted pension payments.

- Credit cards: Fintechs can leverage video KYC to issue credit cards to customers without the need for physical documentation.

- Digital loans: Video KYC enables fintechs to disburse loans digitally, streamlining the loan application and approval process.

- Re-KYC: Fintechs can use video KYC to periodically re-verify customer identities, ensuring compliance with regulatory requirements.

- Credit verification: Video KYC can be used to verify the creditworthiness of customers and conduct periodic due diligence checks.

Step-by-step video KYC process

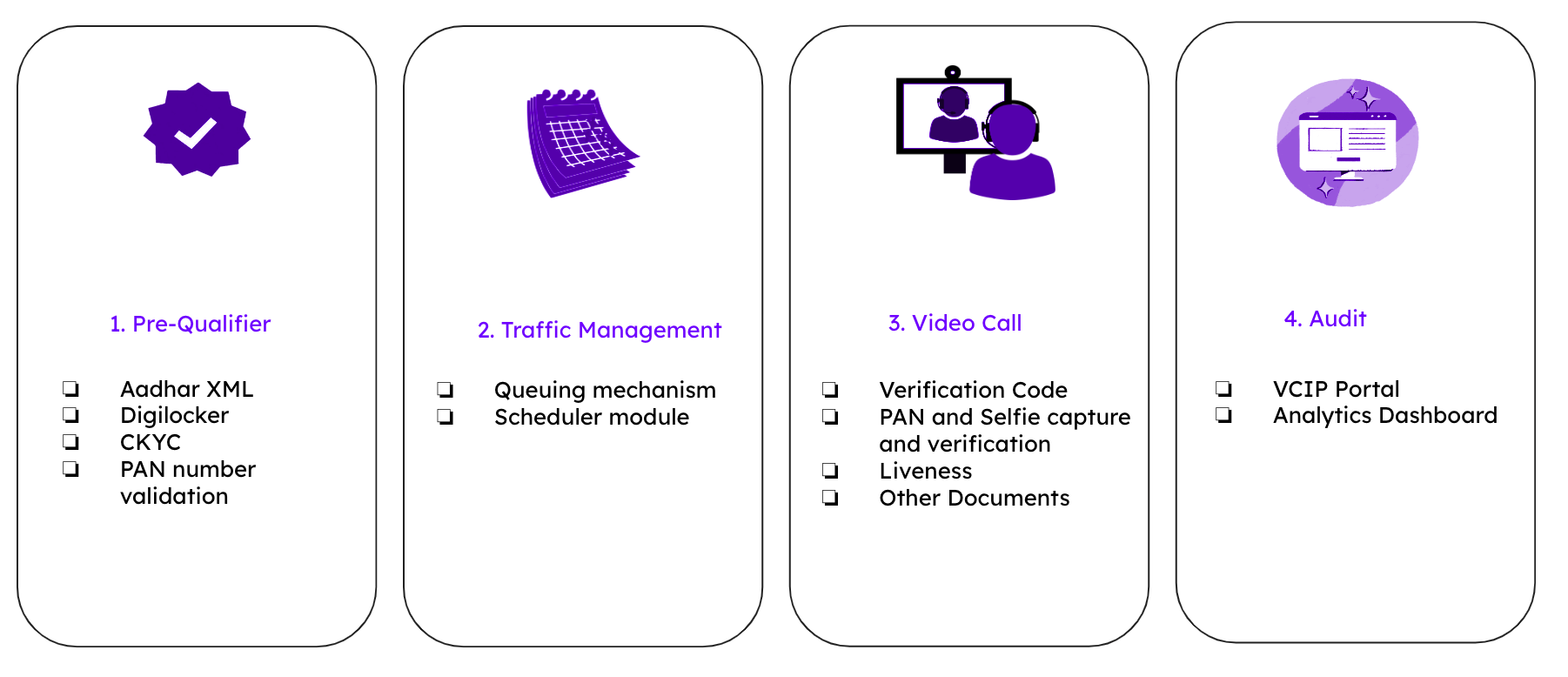

A robust video KYC platform will allow you to customize verification workflows as per your unique needs.

Overall, here’s a simple step-by-step guide on how the video KYC process works:

- After registration, the customer receives a notification to join a video call with a KYC expert. This call is scheduled at a convenient time for both parties.

- Some companies add a pre-qualifier identification method such as PAN card or Aadhaar card verification in addition to video-based verification.

- During the video call, the KYC expert will greet the customer and explain the process. This is a live interaction, allowing for real-time verification.

- The KYC expert will ask the customer to show their identification document on camera. They will check if the photo on the document matches the customer’s face.

- During the process, the agent also conducts liveness detection, confirming that the person verifying their identity is indeed present.

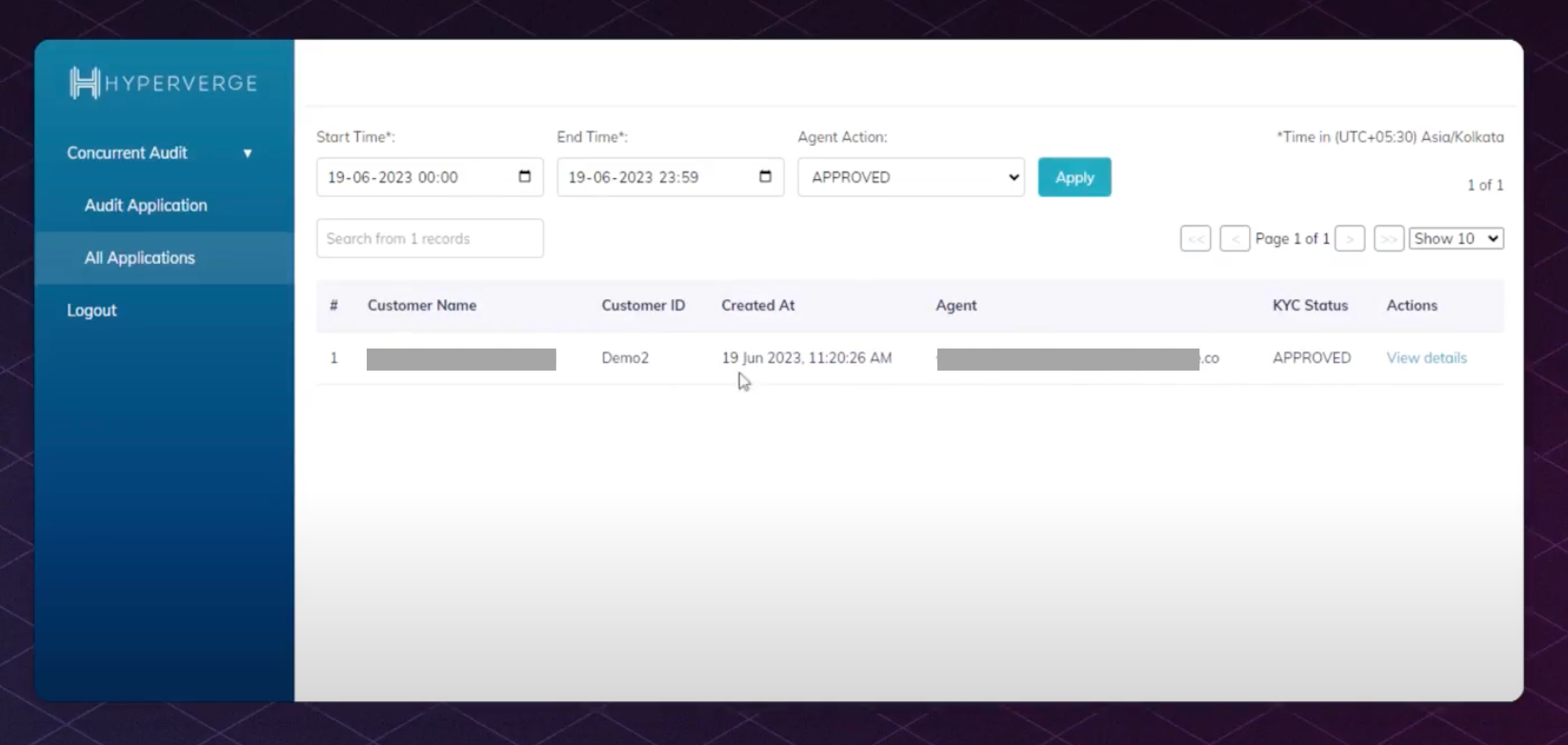

- After the completion of all checks, the video KYC platform also stores the recording of the process and presents a summary of results of the verification process on the dashboard.

Benefits of V-CIP

This innovative approach eliminates the need for physical branch visits, significantly reducing costs for both customers and banks. V-CIP ensures real-time verification through live video interactions, bolstering security with measures like end-to-end encryption and geo-tagging. In addition to providing convenience for fintech companies and customers, the video-based customer identification process also maintains the human element of the digital verification process.

Moreover, it streamlines onboarding for various customer types and facilitates KYC updates for existing accounts, all while maintaining an auditable record for regulatory compliance. Overall, V-CIP enhances the banking experience by combining efficiency with robust security.

Latest RBI guidelines for V-CIP (updated 2024)

RBI has updated its guidelines for V-CIP as part of its Master Direction on KYC on January 4, 2024. These guidelines aim at enhancing customer due diligence (CDD) and ensuring secure identity verification for financial transactions. Below are the key updates and requirements:

Infrastructure and security

- Regulated Entities (REs) must comply with RBI’s cybersecurity guidelines, ensuring that V-CIP technology is housed within their own secure network domain.

- The V-CIP process must encrypt all data exchanged to protect customer information. The V-CIP must record consent from the customer in a manner that is auditable and tamper-proof.

- The V-CIP application should prevent connections from IP addresses outside India and detect spoofed IP addresses to enhance security.

Customer interaction

- The V-CIP must include live video interactions where the customer’s identity verifies through facial recognition. The video must capture the customer’s live GPS coordinates (geo-tagging) and include date-time stamps for verification purposes.

- During the V-CIP, the RE must verify the customer’s Officially Valid Documents (OVD) and ensure that the PAN card details match the issuing authority’s database.

- Banks can utilize Banking Correspondents (BCs) to facilitate the V-CIP process at the customer’s end, but the ultimate responsibility for CDD lies with the bank.

Record management

- REs must store all recordings and data from the V-CIP securely within India, ensuring compliance with existing record management guidelines. The recordings should have timestamps for easy retrieval.

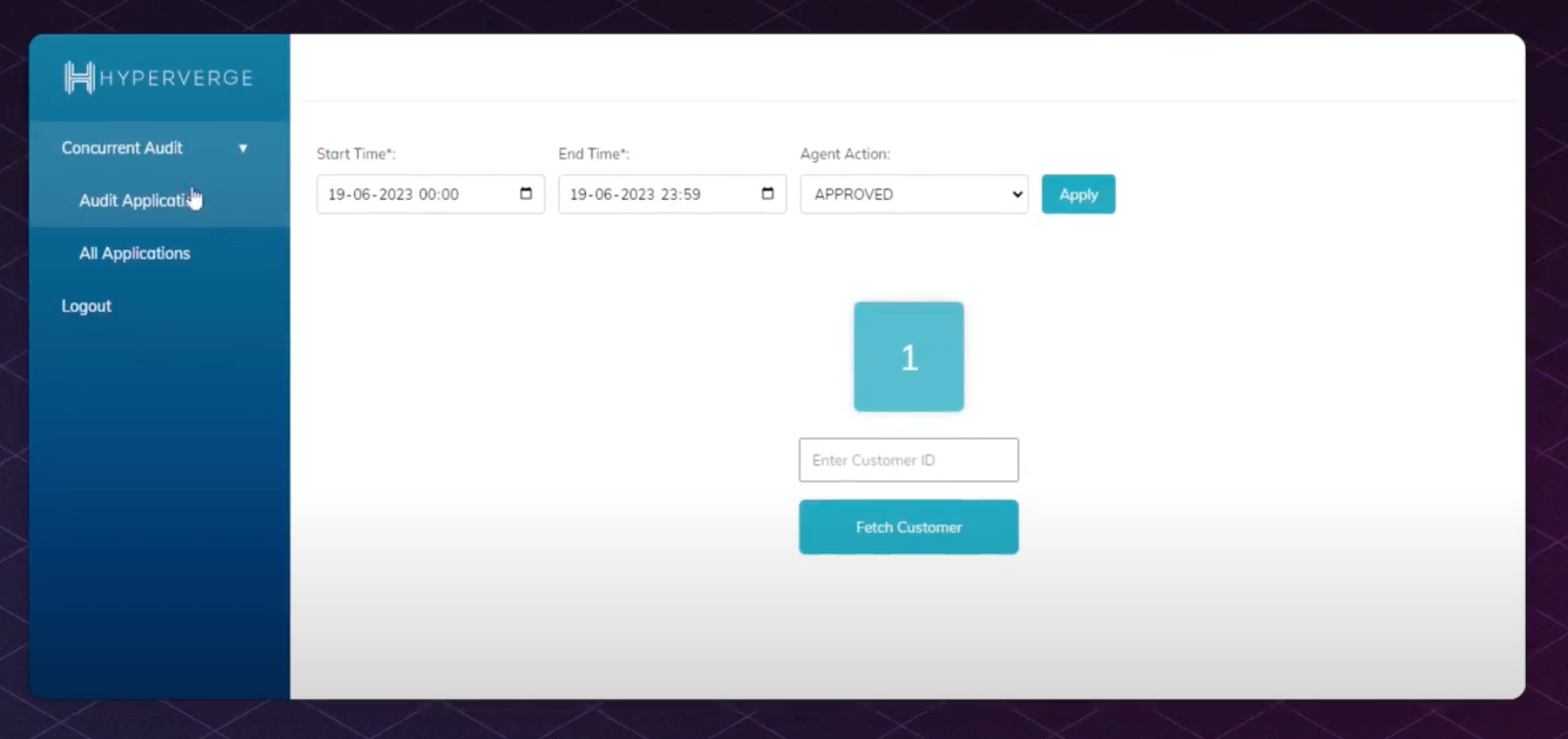

- Accounts opened through V-CIP must undergo a concurrent audit of the video call to ensure the integrity of the identification process.

These updated guidelines reflect RBI’s commitment to enhancing the security and efficiency of the KYC process in the digital banking landscape. Check out our article for a complete breakdown of RBI’s V-CIP guidelines and what you need to do to ensure compliance.

HyperVerge’s video KYC solution

HyperVerge’s video KYC solution is a game-changer for fintechs looking to onboard customers quickly while staying compliant with RBI’s V-CIP guidelines. It’s a simple, AI-powered solution that makes the entire process a breeze.

Here’s how it works:

- Customers provide their PAN and Aadhaar details, which are instantly verified. No more waiting around!

- They can either join a live call queue or schedule a video call at their convenience. HyperVerge’s smart scheduling ensures minimal wait times.

- During the video call, AI helps agents verify the customer’s identity through liveness checks and facial recognition. It’s secure, compliant, and super fast!

- The entire video call is captured and stored for future reference, so you can rest easy knowing everything is above board.

With a 95% conversion rate and the ability to handle hundreds of millions of users, HyperVerge’s Video KYC is a no-brainer for fintechs. It helps you stay compliant, reduce fraud, and keep your customers happy. What’s not to love?

So, if you’re tired of slow, clunky onboarding processes that leave your customers frustrated, give HyperVerge’s video KYC a try. It’s the future of KYC, and it’s here to stay!

FAQs

V-CIP full form: What is V-CIP?

V-CIP stands for Video-based Customer Identification Process. It is a new customer identification program introduced by the RBI that allows banks and financial institutions to verify customer identities remotely using video calls.

V-CIP is a secure, fraud-resistant process powered by advanced technologies like facial recognition, geo-tagging, and end-to-end encryption. It eliminates the need for customers to physically visit a bank branch for KYC verification.

What is V-CIP consent?

V-CIP requires explicit consent from the customer to proceed with the video-based identification process. The customer must provide their Aadhaar number, PAN card details, and a valid mobile number linked to Aadhaar.

The bank’s official conducting the V-CIP must record the audio-visual interaction and capture a photograph of the customer for identification purposes. Customers can revoke access to their KYC data shared during V-CIP anytime.

What is video KYC as per RBI?

RBI has issued detailed guidelines for banks to implement video KYC using V-CIP technology:

- The video quality must be clear enough for unambiguous identification of the customer.

- The V-CIP must be completed within 3 days of obtaining the customer’s identification information.

- A clear image of the customer’s PAN card must be captured during the video call.

- Banks can take help from banking correspondents to facilitate V-CIP at the customer end.