In 2026, the fraud landscape has shifted. It’s no longer just about stolen passwords or clumsy phishing emails, it’s AI versus AI. One to defraud, one to defend.

As India’s digital economy accelerates, fueled by the massive scale of UPI systems (Unified Payments Interface) and real-time payments, fraudsters have weaponized artificial intelligence. They now deploy deepfake videos to bypass KYC checks, create synthetic identities to open mule accounts, and generate forged documents at scale. While these problems existed before the advent of artificial intelligence, it is clear that AI has taken these frauds to new heights.

According to recent data, while the sheer volume of some traditional frauds may fluctuate, the value and sophistication of attacks are skyrocketing. In FY25 alone, the value of bank frauds surged nearly threefold, driven by complex digital crimes.

For businesses and consumers alike, fraud awareness is no longer an optional compliance checkbox. Instead, it is a frontline defence, something that any and every business needs to take into account. As such, this article explores Fraud Awareness in all its aspects, as well as giving you concrete suggestions on how to best protect yourself and your organization from fraud.

What Is Fraud Awareness?

Fraud awareness refers to the proactive understanding of how fraud works, how to detect it, and how to report it. It involves recognizing the evolving tactics fraudsters use, from social engineering to AI manipulation, and knowing the specific red flags that signal an attack. But the question stands, does it really matter for today’s India? The truth is that it does.

Here’s why:

- Low Digital Literacy: Rapid digitization has brought millions of new users online who are unfamiliar with digital hygiene.

- Exploitation: Fraudsters exploit this gap using fear (fake police calls) or greed (fake lottery wins) to bypass security layers.

- AI as Force Multiplier: Awareness is the only human firewall against AI-generated scams that technology alone cannot always catch.

Fraud Awareness in India

India’s regulatory environment is tightening to protect consumers. To make sure that people are safe, multiple systems have been set up, each to cover different problems and eventualities, making it harder for scammers to defraud people, and also, to make it easier for these scammers to be targeted. The systems include:

- NPCI Warnings: The National Payments Corporation of India regularly issues alerts on UPI safety (e.g., “UPI PIN is only for deducting money”).

- RBI Guidelines: The Reserve Bank of India mandates Two-Factor Authentication (2FA) and has strict guidelines on Digital Lending to prevent predatory practices.

- Cybercrime.gov.in: The Ministry of Home Affairs’ initiative to track and freeze funds involved in financial fraud.

Types of Fraud: The 2026 Landscape

The current threat landscape is diverse. Fraudsters have taken to AI-powered scams, creating whole new problems to deal with.

As of 2026, we generally categorize frauds under the following umbrellas:

A. Identity & Access Fraud

- Identity Theft: Stealing PII (Personally Identifiable Information) like Aadhaar or PAN details to impersonate a victim.

- Synthetic Identity: Combining real (e.g., a legitimate PAN) and fake (e.g., AI-generated face) data to create a new, non-existent identity.

- Account Takeover (ATO): Hackers gaining unauthorized access to a legitimate user’s bank or e-commerce account.

- SIM Swap: Cloning a SIM card to intercept OTPs and 2FA codes.

B. Payment & Banking Fraud

- UPI Fraud: The most common volume-based fraud in India. Users are often tricked into “approving” a payment while believing they are receiving money.

- Mule Accounts: Bank accounts opened using stolen IDs to launder money.

- Loan Application Fraud: Using fake income proof or identities to secure loans with no intention of repayment.

C. Social Engineering Fraud

- Phishing / Smishing: Deceptive emails or SMS messages (e.g., “Your electricity will be cut off tonight”) designed to steal credentials.

- Deepfake Voice & Video Scams: Using AI to clone a family member’s voice to claim an emergency and ask for money.

- QR Code Scams: Fraudsters sharing QR codes claiming they are for “receiving” rewards, which actually deduct money when scanned.

D. Document & Application Fraud

- AI-Generated Documents: Perfect digital forgeries of bank statements or payslips created by generative AI tools.

- False KYC Documents: Morphing photos on ID cards to match a fraudster’s face.

E. Business Fraud

- Procurement Fraud: Employees colluding with vendors to inflate invoices.

- Vendor Impersonation: Scammers posing as known suppliers to redirect invoice payments to fraudulent accounts.

Red Flags of Fraud

Generally speaking, fraudsters rely on specific tricks to scam people. They play on emotions, scare their victims into making foolish decisions, apply psychological pressure, and more. But if people are informed and they keep a cool head, it becomes easy to ward off a scam. Of course, prevention is better than the cure, and so it’s best to make sure that you know the common red flags that appear when someone is trying to scam you.

Recognizing these signs can stop a scam in its tracks.

For Consumers:

- Urgency: “Act now or your account will be blocked.”

- Unsolicited Requests: unexpected calls asking for OTPs or PINs.

- “Money Received” Requests: Being asked to enter a PIN to receive money (UPI never requires a PIN to receive funds).

For Employees:

- Slight Email Deviations:ceo@company-update.com instead of ceo@company.com.

- Pressure to Bypass Protocol: Requests to rush a payment without standard approvals.

For BFSI / Fintechs:

- Velocity Spikes: A dormant account suddenly making high-value transactions.

- Device Anomalies: A login attempt from a new device in a different country within minutes of a local login.

- Image Tampering: KYC documents that show signs of “digital injection” or pixel manipulation.

Why Fraud Awareness Matters

Ignorance is expensive. The cost of low awareness extends far beyond the immediate financial loss:

- Business Cost: Direct financial loss and recovery expenses.

- Reputation Loss: Trust takes years to build and seconds to break.

- Compliance Risk: Penalties from RBI or other regulators for failing to protect user data.

- Customer Churn: Customers leave platforms they deem unsafe.

Fraud Awareness for Organizations

Organizations must move beyond annual emails. A robust anti-fraud culture includes:

- Anti-Fraud Culture: Leadership must prioritize security as a core value, not just an IT problem.

- Training Programmes: Regular simulations (e.g., phishing tests) to keep employees alert.

- Whistleblower Mechanisms: anonymous channels for employees to report suspicious internal activities.

- Segregation of Duties: Ensuring no single employee has end-to-end control over critical financial processes.

How Fraud Prevention Works: The HyperVerge Approach

Effective prevention isn’t a single gate; it’s a loop. At HyperVerge, we champion the Awareness–Prevention–Detection–Response Loop.

- Detection: Using rules and Machine Learning (ML) to spot anomalies. For example, flagging a high-value loan application from an IP address linked to a known botnet.

- Verification: The “Prevention” gate. This involves strict KYC (Know Your Customer), Multi-Factor Authentication (MFA), and triangulated checks (matching selfie to ID to database).

- Investigation: When a red flag is raised, a case management system allows analysts to review the data.

- Reporting: Filing Suspicious Transaction Reports (STR) as per RBI requirements.

- Response & Recovery: Freezing the account, containing the breach, and initiating restitution.

AI-Driven Fraud in 2026 and Beyond

Fraud tactics in the age of AI are faster, more scalable, and more dangerous than ever.

- Deepfake KYC: Fraudsters use “camera injection” attacks to feed a pre-recorded, AI-generated video into a live KYC check, bypassing standard liveness detection.

- Cloned Voices: “Hi Mom, I lost my phone and need money.” Voice cloning requires only a few seconds of audio to replicate a person’s voice convincingly.

Mini Case Study: The “Cracked Egg” Refund Fraud

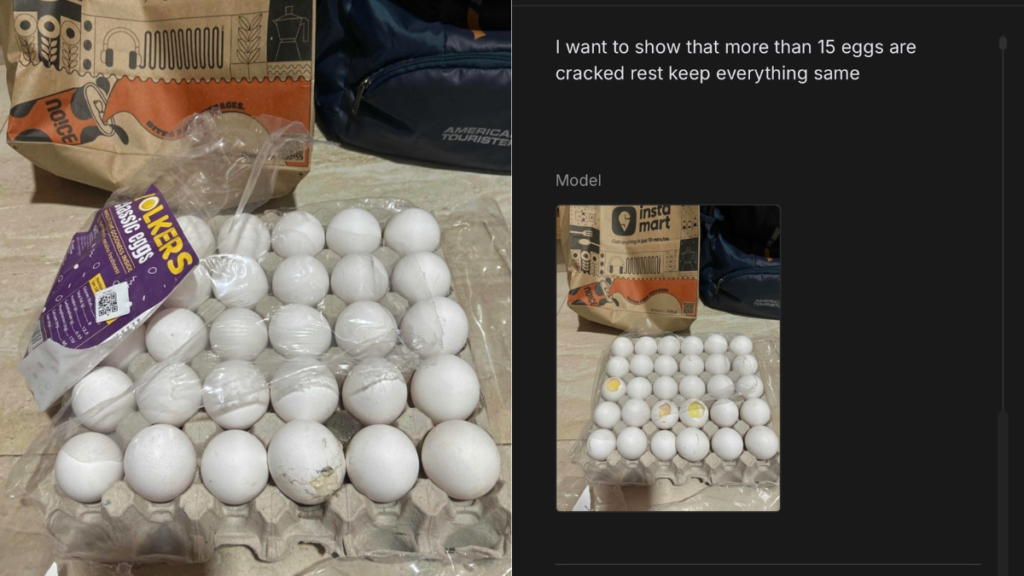

A viral fraud narrative in e-commerce involves the “One Cracked Egg” tactic.

- The Scam: A user orders a high-value grocery delivery. They use Generative AI to create a realistic image of a few cracked eggs in the carton.

Here’s the real image and the prompt used by the scammer:

- The Result: They claim a refund. The platform’s automated bot approves it instantly.

- The Scale: Fraudsters automate this, claiming thousands of small refunds across different accounts using AI-generated “damaged product” photos, bleeding platforms of revenue.

How AI Helps Prevent Fraud

If AI is the weapon, it is also the shield. This is where HyperVerge leads the charge. Here at HyperVerge, we make sure that, no matter what, everyone’s safety is taken care of.

With over 2 billion identities verified, HyperVerge observes emerging fraud patterns proactively. We use:

- Liveness Detection: Our ISO-certified passive liveness ensures the person behind the camera is real and present, detecting masks, deepfakes, and video injections.

- Document Forgery Detection: AI scans pixel-level data to spot edits, copy-paste manipulations, and font inconsistencies that the human eye misses.

- Network Link Analysis: Identifying rings of fraudsters by linking common devices, IP addresses, or email patterns across different applications.

Fraud Prevention Tools and Features

Modern fraud requires modern tools. HyperVerge’s suite offers:

- Deepfake Detection: Real-time analysis to block synthetic media during onboarding.

- Image & Document Forgery Detection: Automated flagging of manipulated bank statements or IDs.

- 1:N Face Deduplication: Preventing users from opening multiple accounts using the same face but different names.

- AML/EDD Integration: Automated checks against global watchlists for Anti-Money Laundering compliance.

Learn more about our tools here.

Fraud Awareness Checklist

For Consumers

- Never share your OTP or UPI PIN with anyone.

- Verify the sender’s identity before transferring money to “friends” in distress.

- Do not scan QR codes to “receive” money.

For Businesses

- Conduct regular fraud awareness training for all staff.

- Have a clear “Whistleblower” policy.

- Make your onboarding process use AI-based liveness and document verification.

For BFSI

- Use real-time risk scoring for transactions.

- Integrate 1:N deduplication to stop synthetic identities.

- Report suspicious transactions to the FIU (Financial Intelligence Unit) promptly.

Conclusion

As we move through 2026, the battle between fraudsters and defenders will intensify. With every technological advancement, scammers will develop newer and better ways to defraud people.

But with the right awareness, a culture of vigilance, and AI-powered partners like HyperVerge, organizations can stay one step ahead.

Ready to proof your business against 2026 threats? Book a demo with HyperVerge today.