Social security identity theft is when one person steals and misuses another person’s social security number (SSN). Such identity thieves use a stolen SSN to pretend to be someone else.

They might issue credit cards or bank accounts, accumulate debt, or withdraw funds. They can also apply for car loans and mortgages or file fraudulent tax returns to claim refunds. Additionally, they might obtain employment, affecting the victims’ taxes and Social Security benefits.

With another person’s social security identity, fraudsters also access medical services, leaving the innocent parties responsible for the bills and altering their medical records. These actions damage the victims’ credit status and create great financial and legal difficulties.

It also harms businesses by causing monetary losses, reducing consumer trust, and increasing legal hassles and administrative costs. Seeing that this form of identity theft can cause so many problems, it is important to stop it to protect both individuals and organizations.

What is Social Security Identity Theft?

Social security identity theft is a unique type of identity theft. Here, a person’s Social Security Number is stolen and misused.

The Social Security Administration provides every US citizen and permanent resident with a unique SSN. This number essentially acts as their identity. Unfortunately, if anyone gets this unique identity detail of another person, then they can easily impersonate that person and commit fraud. This is what happens in identity theft of social security – fraudsters steal SSNs and illegally use them for personal gain. Victims face severe financial losses. They still face lasting damage to their credit report even after getting their identity back.

The Federal Trade Commission received more than 1 million identity theft complaints in 2023. According to the FBI Crime Report 2022, identity theft victims suffered $189 million in losses.

Read more about identity theft statistics

How does social security identity theft Happen?

Social security identity theft happens in many ways. Each targets different weak spots. Knowing these methods is essential as it helps you identify warning signs and take steps to prevent fraud. Here are some typical ways social security identity theft occurs:

Phishing scams

These scams involve tricky phone calls, mail, emails, or social media messages that look real. The identity thief fools people into giving away private details, like social security numbers, which are often linked to bank account numbers. For instance, scammers might pretend to be bank officials or government agents to obtain personal information through deception.

Related read:

Unauthorized access

Sometimes, miscreants can get into your personal details, including your social security numbers, without permission because of security breaches. This might happen when a company that has your data faces a security breakdown. This breach allows criminals to get in and steal personal details.

Account hacking

Criminals often break into personal or company accounts to obtain social security numbers (SSNs). Nowadays, the SSN is used in many accounts, so when identity thieves hack an account, they easily get access to the SSNs of one or more people at once.

Theft or loss of the social security card

Losing or having a social security card stolen puts you at risk. The person who finds or steals it can see your social security number and use it easily.

Also other rarer but just as dangerous methods include:

- Dumpster diving: Thieves search through garbage to find discarded papers containing personal details, including social security numbers.

- Insider theft: Sometimes, workers in a company might abuse their access to secret information and take social security numbers for personal profit or to sell illegally.

What can be done with the stolen social security information?

Criminals can use stolen social security information in several harmful ways. They use these numbers to carry out various frauds that affect the victims’ financial and personal lives. Here are some main ways thieves use stolen social security information:

- Opening Credit Accounts: Thieves use stolen social security numbers to open new credit accounts. They use the new accounts to spend money, apply for loans, and get a mortgage illegally.

- Medical Care Fraud: Social security identity thieves obtain medical care using others’ SSNs. They use stolen identities to make fraudulent claims, purchase prescription drugs, undergo surgeries, and obtain other medical aid.

- Tax Refund Theft: Identity thieves also file tax returns using stolen social security numbers. They get fake refunds before the victims have filed their own taxes, which causes legal issues and delays in refunds for the affected party.

- Claiming Government Benefits: Thieves can also use social security numbers to wrongly claim government benefits. This might include unemployment benefits, retirement benefits, or other social aid meant for those who really need it.

Moreover, stolen social security number can help criminals in other illegal activities:

- Creating Fake Identities: Criminals can create completely new identities using stolen social security numbers. They use these identities to start new lives illegally and might get involved in other crimes.

- Renting or Buying Property: Criminals may use social security numbers to pass background checks needed for renting or buying property. This is real estate fraud.

- Job Fraud: Individuals might use stolen social security information to get a job. Especially if they are trying to avoid legal problems or issues with their immigration status.

- More: Whoever has your SSN can also pretend to be you when arrested, get a phone or such utility account in your name, and so on.

How can individuals safeguard themselves against social security identity theft?

Individuals can take active steps to prevent and spot identity theft. Here are some effective methods:

Report the theft to the FTC and get a police report

It is critical to report suspicious activity to the Federal Trade Commission (FTC) immediately. You can report online on the official website. This report creates an official record of the theft. You’ll need this record to deal with credit bureaus or creditors. Also, get a police report. This acts as legal proof that you’re a victim of identity theft. It helps remove unauthorized charges and fix your credit reports.

Contact the SSA or IRS if you suspect phishing scams

Received suspicious mail, phone calls, or emails? Contact SSA or IRS. Both are actively looking out for the welfare of people to save them from such scams. Reporting quickly helps them be aware of security threats. It also helps protect the data of others.

Protect your SSN

Safety begins with you. Keep your social security number safe.

- Do not carry your social security card in your wallet. Instead, keep it in a safe, locked away place.

- If you have entered your SSN in any document and now need to throw it away, shred that document.

- Do not post official documents with personally identifiable information on social media.

- Never share your SSN with suspicious individuals or organizations.

- Don’t speak your SSN aloud in a public place.

- If someone or a business asks for your personal or financial information, verify everything about the individual and the setup. Only when you are very sure should you share your SSN.

- Educate yourself about fraud awareness.

Request a fraud alert

Are you a victim of social security identity fraud? Place a fraud alert. This alert makes it tough for thieves to open accounts in your name. Authorities have to check the identity of anyone trying to open an account, so when you place a fraud alert, they will take suitable steps. You can place the alert for free and also renew it for many years if you prove you have been hit with identity theft.

Use strong passwords for your electronic devices

It’s important to use strong, unique passwords on all your electronic devices.

- Mix letters, numbers, and symbols.

- Do not use your date of birth or such easy things as a password.

- Never share your password with anybody or write it in any place.

- Change them regularly.

- Use two-factor authentication where you can.

What can businesses do to prevent social security identity fraud?

Businesses play an important role in preventing social security identity fraud. They can do so by setting up strong security measures and keeping an eye out for potential threats. Here are several fraud detection and prevention strategies businesses can use:

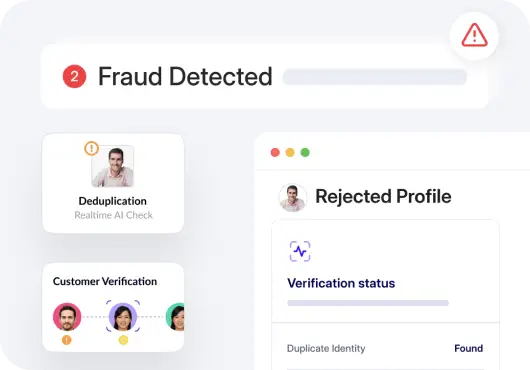

Employ a trustworthy fraud detection solution

It’s important to invest in a reliable fraud detection system. This helps you spot identity fraud early on. These systems use sophisticated mechanisms to watch out for signs. By spotting any unusual activity, fraud detection systems help businesses quickly react to threats. This minimizes damage and protects customer data.

Perform document verification

Businesses should set up thorough process to check authenticity of information. Tools like customer identity verification include checking social security numbers against official records and confirming other identification documents. Updating these checks regularly helps keep up with new tricks used by fraudsters. Checking documents helps prevent fraud and also builds trust with customers by protecting their personal information.

Read more about document verification in our detailed guide

Implement biometric verification

Using biometric verification methods, like fingerprint or facial recognition technology, adds extra security. Biometrics are unique to each person and hard to fake. This makes them a strong defense against identity fraud. Using biometric verification helps you make sure that the person who claims the number, is who they actually claim to be. Therefore greatly minimizing the risk of identity theft.

Regularly conduct review audits

Regular audits are essential. It helps businesses make sure that their security measures work well and that there have been no breaches. These audits check how personal information is stored, accessed, and shared in the organization. Regular audits spot possible weak spots and push for quick improvements to stop any social security identity fraud incidents.

Stay ahead of fraudsters and safeguard your business

Identity verification solutions are vital for businesses fighting social security identity fraud. Implementing secure identity validation checks helps businesses stay away from fraud by confirming user authenticity.

- Identity verification methods provide strong protection by checking the customers’ information. They compare info provided with trusted databases to confirm that the customer is who they say they are.

- These systems are important for early detection. This lets businesses spot potential fraud early on.

- By using these solutions, businesses build trust. It shows they are serious about security and fraud prevention. Customers and partners feel safer, knowing there are measures to guard their personal information.

- Identity verification helps businesses adhere to compliances. This lowers the chance of getting penalties and avoids getting into legal complications.

For advanced identity verification solutions that keep your business secure, check out our identity verification solutions or sign up here.