Imagine onboarding a customer in under three seconds—sounds impossible, right? But for HyperVerge, it’s just another day of AI-powered identity verification. Meanwhile, Setu is redefining financial infrastructure with APIs so seamless, lenders can launch services in days, not months.

These two titans are transforming fintech but in very different ways. So, who comes out on top?

Setu, the full-stack fintech enabler, excels in lending, payments, and KYC, offering plug-and-play solutions for banks and startups alike. HyperVerge, on the other hand, dominates AI-driven identity verification with near-flawless accuracy, deepfake detection, and global compliance.

But why pit them against each other? Because their rivalry raises an important question: Should you prioritize spotless infrastructure or ironclad security? Whether you’re a digital lender, crypto platform, or eCommerce giant, this comparison isn’t just about features—it’s about choosing the best partner for both security and growth.

In this blog, we dissect Setu vs HyperVerge, their strengths, weaknesses, and ideal use cases in detail to help you pick the best for your growing business needs. Spoiler: The winner might surprise you!

What is Setu?

Setu is a full-stack fintech infrastructure platform providing modular APIs for identity verification, financial data aggregation, and digital lending.

It enables enterprises to integrate PAN validation, Aadhaar eKYC, bank account authentication, and RBI-compliant Account Aggregator flows via a single unified stack. The platform offers sandbox environments, configurable SDKs, and white-labeled UIs to accelerate deployment while maintaining ISO 27001 compliance and bank-grade security protocols.

Key features and functionalities

- Setu KYC verification: Streamline identity checks with PAN, Aadhaar, and bank account verification to reduce fraud and accelerate loan disbursals or payouts.

- Pre-built lending journeys: Offer loans through WhatsApp, GPay, or custom-branded flows with real-time notifications, boosting conversions and reducing acquisition costs.

- Multi-layer KYC engine: NSDL-integrated PAN validation, Aadhaar OTP/DigiLocker verification, and bank account authentication via NPCI-mapped APIs for fraud-resistant onboarding.

- Account aggregator integration: Direct pipeline to OneMoney for FIU (Financial Information Unit) data retrieval, including bank statements, holdings, and transaction histories with machine-readable formatting.

- Aadhaar eSign with IT Act compliance: Digital signature API supporting multi-party signing, positional customization, and cryptographic audit trails for enforceable contracts.

- BBPS EMI collection: Billing and payment reconciliation via Bharat BillPay System for automated recurring loan repayments across 200+ banking partners.

Target audience and use cases

Setu caters to fintechs, banks, NBFCs, insurers, and eCommerce platforms seeking rapid, secure financial integrations. Use cases include instant loan disbursals, gig worker verification, insurance onboarding, and investment platform compliance—all with industry-leading uptimes and customisable APIs.

| Did you know? In 2022, Setu was acquired by Pine Labs, a merchant commerce platform, for around $70 million! |

What is HyperVerge?

HyperVerge is an AI-powered identity verification platform that helps businesses onboard customers securely while preventing fraud. Using advanced deep learning and deepfake detection, it verifies IDs, checks liveness, and screens against global compliance lists—all in seconds.

Unlike traditional KYC tools, HyperVerge works across 195+ countries, supports low-bandwidth environments, and adapts to diverse demographics. Plus, its no-code workflow builder lets companies customize verification steps without tech hassles.

More than just a verification platform, HyperVerge is a strategic risk management partner, empowering businesses to scale confidently. Whether enabling instant customer onboarding or safeguarding against sophisticated fraud, it delivers enterprise-grade security in line with modern digital ecosystem demands.

Key features and functionalities

- AI-powered OCR document processing: Extracts text/data with 95%+ accuracy from global IDs (passports, licenses) using advanced AI, streamlining verification.

- KYC checks: Supports multilingual, region-specific identity validation, ensuring compliance with international regulations effortlessly.

- AML compliance: Offers real-time screening, global watchlist checks, and PEP detection to mitigate financial risks proactively.

- No-code workflow builder: Drag-and-drop interface to design custom onboarding journeys without coding, enhancing operational flexibility.

- Biometric authentication: Industry-leading face recognition with passive liveness detection, blocking spoofs via depth/reflection analysis for airtight security.

Target audience and use cases

HyperVerge solutions cater to industries where trust, speed, and accuracy are non-negotiable—from financial institutions securing transactions to marketplaces vetting users and gaming platforms enforcing age restrictions. The platform has helped the likes of Swiggy, WazirX, and SBI reduce drop-offs, cut costs, and onboard users securely—even in low-bandwidth environments.

How we evaluate the two platforms?/How we evaluate Setu Vs HyperVerge?

Our team’s evaluation dives beyond surface-level comparisons by analyzing real-world user experiences from trusted platforms like G2, Capterra, and Reddit. These reviews offer unfiltered insights into performance, reliability, and customer support, highlighting pain points and strengths we believe simple overviews can’t.

We also dissect features and scalability to match solutions with business needs. Further, we deeply analyze pricing models and weigh them against ROI–this approach balances technical capabilities and value provided with practical usability, helping you choose a platform that grows with your business.

Also Read: Beyond Basics: Navigating the Evolving Landscape of Bank Account Verification

Overview of Setu vs HyperVerge

| Features | Setu | HyperVerge |

| AI-powered verification | ✓ | ✓ |

| KYC compliance | ✓ | ✓ |

| AML compliance | ✘ | ✓ |

| Biometric authentication | ✘ | ✓ |

| Workflow builder | ✘ | ✓ |

| Document verification | ✓ | ✓ |

| Bank account verification | ✓ | ✓ |

| PAN and Aadhaar verification | ✓ | ✓ |

| Deepfake detection | ✘ | ✓ |

| Fraud pattern analysis | ✘ | ✓ |

| Liveness detection | ✘ | ✓ |

| No-code integration | ✓ | ✓ |

| API/SDK support | ✓ | ✓ |

| Sandbox environment | ✓ | ✘ |

Key comparisons

Want a super quick comparison of features, pricing, and more? If yes, read further!

- Features

| Feature | HyperVerge | Setu |

| Core offering | AI-powered digital identity verification and fraud prevention platform. | Full-stack fintech platform for onboarding, payments, and financial services. |

| KYC and identity verification | AI-powered OCR document processing, ID verification, biometric authentication, AML compliance, liveness detection, and deepfake detection. | PAN, Aadhaar, and bank account verification using APIs, SDKs, and DigiLocker integration. |

| Fraud prevention | Deepfake detection, spoofing checks, forgery checks, fraud pattern analysis, biometric authentication. | Fraud detection with PAN/bank verification, underwriting with financial data, and real-time creditworthiness analysis. |

| Workflow and integration | No-code workflow builder, drag-and-drop customization, seamless API integration. | Modular APIs, pre-built UI components, full-fledged sandbox, industry-best uptimes. |

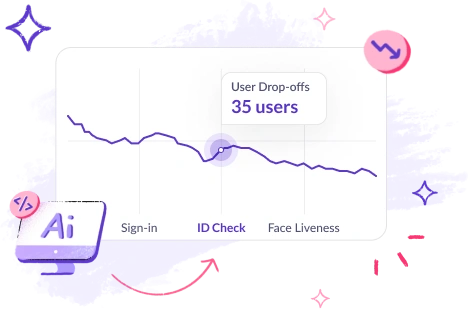

| Speed and efficiency | Quick detection in under 3 seconds, 50% reduction in drop-offs, 95% auto-approval rate. | Low-cost, high-speed onboarding, real-time verification, 75% lower loan processing costs. |

| Global reach | Supports 195+ countries and has verified over 1 billion IDs. | Primarily focused on Indian financial compliance, including RBI-approved account aggregation. |

| Regulatory compliance | Global KYC/AML compliance, PEP screening, sanctions list checks. | UIDAI-compliant, RBI-approved account aggregation, machine-readable financial data. |

| Loan and credit services | Identity verification for financial services, including risk assessment. | Pre-verified leads, lending APIs, borrower qualification, WhatsApp-based loan distribution. |

| Security and compliance | AI-based fraud detection, secure biometric authentication, image/video injection detection. | ISO 27001 certified, end-to-end encryption, RBI data localisation norms compliance. |

- Pricing

HyperVerge offers flexible pricing plans tailored to different business needs. The Start Plan is ideal for startups, while the Grow Plan caters to mid-sized companies with additional features like custom workflows. The Enterprise Plan provides dedicated support, collaborative tools, and custom pricing for large organizations.

Setu also ensures cost efficiency onboarding with custom pricing.

- Target audience

HyperVerge serves industries like fintech, eCommerce, gaming, crypto, and more, targeting businesses needing advanced AI-driven KYC, onboarding, and fraud prevention.

Setu focuses primarily on fintechs, lenders, and insurers, offering modular APIs for digital lending, eSign, and financial data aggregation.

- Security

HyperVerge prioritizes security with AI-powered fraud prevention, deepfake detection, and liveness checks. It complies with global KYC/AML regulations, screening sanctions lists, and Politically Exposed Persons (PEPs).

Setu reinforces security with RBI-approved systems, ISO 27001 certification, and end-to-end encryption.

- User experience

HyperVerge enhances UX with a no-code workflow builder, drag-and-drop onboarding, and passive liveness detection for frictionless verification. Setu, on the other hand, simplifies processes with pre-built screens, quick API integrations, and an award-winning UI.

Both platforms support diverse devices and instant PAN/Aadhaar checks to reduce drop-offs and improve customer satisfaction.

- Integrations

HyperVerge integrates seamlessly with existing systems via APIs and SDKs, supporting global ID verification and AML checks. Setu also offers flexible integration options, including sandbox testing, customizable APIs, and ready-made financial journeys.

Additionally, both platforms connect with banking systems, DigiLocker, and Aadhaar eSign, enabling quick deployment for loans, insurance, and investments.

HyperVerge’s Bank Account Verification detects fake accounts before they cause damage.

Schedule a DemoPros and cons

Setu and HyperVerge do come with their own list of pros and cons. What are those? Find out below—

Setu pros

- Modular KYC solutions: PAN, Aadhaar, bank account, and DigiLocker verification in a single bundle.

- Compliance and security: ISO 27001 certified, UIDAI-compliant, and handles all regulatory audits.

- Account aggregator support: Simplifies financial data sharing via RBI-approved OneMoney integration.

- Customizable UX: White-label options for branding, colors, and fonts improve customer experience.

Setu cons

- India-centric: Heavy reliance on Aadhaar/PAN limits global scalability.

- Limited fraud tech: Lacks advanced AI-driven deepfake or biometric spoof detection.

- Regulatory dependency: Tied to RBI frameworks, making it vulnerable to policy changes.

- Steep learning curve: Smaller businesses may struggle with API customization.

- No passive liveness check: Requires active user input for verification, unlike competitors.

Hyperverge pros

- AI-powered accuracy: 98.5% precision in document OCR and biometric face matching.

- Advanced fraud prevention: Deepfake detection, video injection checks, and spoofing safeguards.

- Passive liveness detection: Single-image verification without user interaction.

- Quick deployment: Integrates in under 4 hours with a free one-month trial.

HyperVerge cons

Feature overload for small businesses: Advanced features may be unnecessary for basic KYC needs.

Also Read: What Is Instant Bank Account Verification And Why Is It Important

Hear it directly from the users

- What are users saying about Setu?

Setu website reviews

Dinesh A. Co-founder and CTO

- What are users saying about HyperVerge?

G2 reviews

Dinesh A. Co-founder and CTO

Capterra reviews

Tanmay, Manager-Operations in India

Choose HyperVerge for the smoothest verification journeys

What if your customers could verify their identity in seconds—without frustration or drop-offs? HyperVerge delivers exactly that. Its AI-driven verification technology ensures seamless onboarding with 99.9% accuracy, processing checks in milliseconds while maintaining the strictest compliance with RBI, IRDAI, and SEBI regulations.

Beyond lightning-fast bank account verification, HyperVerge also excels in instant Aadhaar and PAN validation, leveraging advanced OCR and real-time government database cross-checks. Further, the platform’s proprietary face authentication technology thwarts fraud with passive liveness detection and 3D depth mapping, eliminating deepfakes and spoofing attempts.

The result? Faster conversions, higher trust, and completion rates.

Stop losing users to clunky verification! Sign up today with HyperVerge to completely transform how your business onboards customers.

FAQs

1. How does Setu’s penny drop verification work?

Setu’s penny drop verification confirms bank account validity by depositing ₹1 into the customer’s account. This transaction retrieves the account holder’s name, account number, and IFSC code, ensuring accurate linkage between provided details and bank records.

2. What are the advantages of HyperVerge’s penny-less verification?

HyperVerge’s penny-less verification authenticates bank account details and IFSC code without initiating monetary transactions, eliminating risks associated with micro-deposits.

3. Can these verification solutions integrate with existing banking systems?

Yes, both Setu and HyperVerge design their verification solutions for smooth and seamless integration with existing banking infrastructures. Setu offers flexible APIs, whereas HyperVerge provides no-code API connectivity, enabling visual integration through drag-and-drop interfaces.

4. How do Setu and HyperVerge ensure data security during verification?

Setu employs secure APIs and follows compliance protocols to protect sensitive information during the verification process. HyperVerge utilizes advanced AI algorithms and encryption techniques to safeguard data, ensuring confidentiality and integrity throughout the verification workflow.