To fight money laundering and the gamut of other financial crimes, businesses face a tough choice: either spread resources thin and risk fraud or utilize too many resources and risk wastage.

This is where the risk-based approach (RBA) to AML comes in. It helps target the real threats intelligently. This proactive approach is critical to handle the changing methods of money laundering. RBA AML focuses on tackling risks before they become problems.

AML compliance with the risk-based approach protects customers and businesses from hefty fines and irreparable reputational damage.

What is a risk-based approach to AML?

A risk-based approach to AML channels efforts to fight money laundering. It does this by focusing on the risk level of different factors, wherein the risk assessment factors include individual, geographic, channel, and transaction. In the risk-based approach to AML, organizations assess the likelihood of money laundering based on these parameters and then channel efforts to tackle them before a problem arises.

Instead of applying the same measures everywhere, it directs resources to higher-risk areas with intelligent risk assessment. This way, greater scrutiny is applied where the risk of money laundering is highest.

Using a risk-based approach has many benefits in the fight against money laundering. First of all, it makes the best use of resources. Then, it improves the detection and prevention of money laundering. Finally, it lowers AML compliance costs by avoiding a one-size-fits-all strategy. This approach also allows for flexible responses to new and changing threats.

Businesses must apply AML compliance using the best practices to adhere to the Bank Secrecy Act, the USA PATRIOT Act, and the Anti-Money Laundering Act enforced by the FinCEN. However, the Financial Action Task Force (FATF) specifically urges the risk-based approach for its effectiveness.

Implementing a risk-based approach to AML

You can implement a risk-based approach to AML by following these steps.

Risk assessment

What is the risk posed by a customer? What is the risk posed by the geography? There are several such questions to be answered in the AML assessment process. Mitigation measures are implemented based on risk assessment.

Effective risk assessment is the key to mastering the risk-based approach. Businesses must identify and evaluate potential money laundering risks systematically to implement controls.

Risk assessment involves understanding various risk factors and categorizing customers based on their risk levels. Here’s how to navigate the process.

Identifying and assessing AML risks

Start by identifying potential money laundering risks within your business.

- This requires a complete review of products, services, and operations.

- Go through complete details of the customer base to understand the types of customers and their average transaction size. It is also pertinent to understand how you acquire customers.

- Also, assess the geographic regions where your business operates. Money laundering activities and exposure to financial crimes are higher in certain areas.

- Check the delivery channels of your products or services to spot vulnerabilities.

- Another thing to consider is the nature and complexity of transactions. Are they high-value? Unusual?.

Factors to consider in risk assessment

Consider multiple factors when conducting an AML risk assessment. They help determine the overall risk exposure.

- Individual Risks are the first thing to check. This involves examining customers. High-risk individuals like known fraudsters, money launders, and Politically Exposed Persons (PEPs) need more measures than low-risk ones.

- Geographic Risks relate to the area or country. Certain jurisdictions have inadequate money laundering controls. There, your business will have to channel more efforts.

- Channel Risks are another aspect. For example, online sales are at a higher risk of identity fraud and demand better digital identity verification.

- Transaction Risks are crucial as well. Substantial or unusual transactions, especially those involving cash or cryptocurrency, are more at risk of money laundering.

The risk-based approach to AML enables financial institutions to categorize risk factors and levels and streamline efforts without burning a hole in their pocket.

Categorizing customers based on risk levels

Categorizing customers based on risk levels is essential for applying appropriate AML measures. Use a risk matrix to rank and categorize customers.

- Customers with transparent, low-value transactions from well-regulated regions are usually low risk.

- Those with moderate-value transactions or from regions with some financial crime risks face medium risk.

- However, customers with high-value transactions, complex transaction patterns, or from high-risk jurisdictions are at the highest risk of money laundering and other financial crimes.

It is also recommended for financial institutions to study AML policy and the Financial Action Task Force rules that outline details of the RBA AML compliance.

Customer due diligence (CDD)

Organizations need to know the specific money laundering risks for each customer. This is where customer due diligence comes into the picture. This process involves creating a customer risk profile or customer risk score.

CDD involves identity verification and understanding financial activities. It usually includes Know Your Customer (KYC) and Enhanced Due Diligence (EDD) for high-risk clients.

Adapting CDD measures based on risk levels

It is important to adjust CDD measures to fit the risk profile of each customer.

For high-risk customers, do Enhanced Due Diligence (EDD). This includes detailed background checks and verifying the source of funds.

For low-risk customers, simple due diligence may be enough, involving basic identity checks.

Continuous monitoring

Regular monitoring, review, and updating of customer information is also vital. Businesses can use automatic systems that monitor transactions for unusual or suspicious activities and alert them at appropriate times. Ongoing monitoring helps businesses adjust risk profiles based on ongoing checks and findings to manage risks proactively.

Suspicious activity monitoring and reporting

Effective ongoing monitoring systems are crucial for finding and reporting suspicious money laundering activities.

Use robust transaction monitoring systems with advanced analytics and machine learning. These systems detect unusual patterns on time. For example, an effective risk-based approach to AML solution flags transactions different from a customer’s usual behavior. They also flag those involving high-risk areas.

Train staff to spot red flags like large cash transactions. They should also look for rapid movement of funds between accounts and using multiple accounts for no apparent reason.

Report suspicious activities to regulatory authorities such as the Financial Crimes Enforcement Network (FinCEN) in the US using Suspicious Activity Reports (SARs). Make sure reports are detailed and filed on time as the law requires.

Quickly monitoring and reporting suspicious activities will help stop potential money laundering.

Record-keeping and audit trail

Maintaining accurate records is important for an effective risk-based approach to AML compliance. Make sure all customer information and transaction records are correct and current. This means keeping copies of ID documents, transaction records, and customer communication.

Keep data accurate and ensure records are easy to access when needed for anti-money laundering efforts. Store records in secure, central databases and use strict access controls to protect sensitive information.

Regularly audit and follow regulatory requirements by keeping detailed audit trails. For example, save records of all customer interactions. Keep records of risk assessments, due diligence efforts, and reports of suspicious activities. Maintain these records for at least the minimum period required by regulations. In the US, this period is five years.

Benefits of adopting a risk-based approach

The risk-based approach gives a definite edge over other traditional ones.

Improved compliance

The significant benefit of a risk-based approach is alignment with regulatory requirements. Businesses and financial institutions comply with local and international regulations by focusing on specific risks relevant to their operations.

Businesses automatically reduce the risk of penalties and reputational damage as they prevent breaking any regulations using a risk-based approach to AML.

For example, when a financial institution uses advanced tools to watch transactions and sees suspicious activities, it handles it right away. This prevents rule-breaking and the heavy fines that come with it.

Enhanced customer experience

Tailoring AML measures based on customer risk profiles allows businesses to offer a smoother, more efficient experience. Not every customer poses the same risk of money laundering and other financial crimes. So, a one-size-fits-all approach creates unnecessary hurdles. Businesses can streamline processes for low-risk customers. This reduces their wait times and improves satisfaction.

For example, a financial institution will open accounts faster for low-risk customers. They will use stricter checks for high-risk individuals. This keeps security balanced with customer convenience.

Optimized resource allocation

Blanket policies are inefficient. With one-size-fits-all, organizations either lose money by putting high resources everywhere. Or they let money laundering and other financial fraud happen by reducing resources everywhere. With the risk-based approach to AML, one can concentrate more resources on high-risk areas per risk assessment.

For example, a financial institution using machine learning algorithms prioritizes alerts. This helps compliance teams focus on genuine threats and not spread their resources thin. Efficient operations lead to cost savings. This targeted strategy uses resources better and improves overall efficiency.

Competitive advantage

Proving commitment to responsible business practices is vital. Customers and partners prefer companies that prioritize compliance.

Companies seen as leaders in AML compliance differentiate themselves from competitors.

For example, a financial institution with a robust AML program will attract global partners looking for secure and compliant transactions. This not only brings in more business but also strengthens partnerships with other organizations that value similar standards.

Take a risk-based approach to AML with HyperVerge

Mastering the risk-based approach to Anti-Money Laundering shifts you from constantly putting out fires to taking a proactive stance. This gives you more control. Additionally, it makes your efforts efficient and effective.

Here is a quick recap of the benefits of a risk-based approach to anti-money laundering:

- Improved compliance with regulatory requirements and best practices. This minimizes the risk of penalties and reputational damage.

- Enhanced customer experience through tailored AML measures based on customer risk profiles. This means a smoother process and improves satisfaction for your customers.

- Optimized resource allocation by concentrating on high-risk areas. For you, this means cost savings and efficient operations.

- The risk-based approach gives you a competitive advantage by demonstrating a commitment to responsible business practices. It helps you play an active role in combating money laundering risk.

HyperVerge specializes in providing robust anti-money laundering solutions tailored to meet complex compliance requirements. Our platform offers:

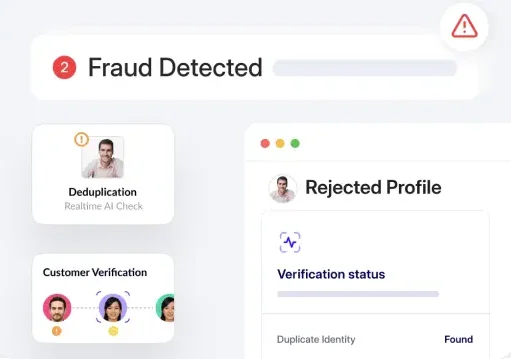

- Real-time AML screening and monitoring. Instantly detect suspicious activities and ensure timely responses.

- A comprehensive view of customer risk identification and risk assessment. Gain a holistic understanding of each customer’s risk profile using advanced data analytics.

- Compliance with anti-money laundering legal requirements. Be up-to-date with evolving anti-money laundering regulations. Make sure your processes are in line with legal standards of local, national, and international norms.

Ready to take the next step in mastering AML compliance with a risk-based approach? Sign up now and partner with HyperVerge for a safer, more secure future.