With the rise of fraud, including identity theft, ensuring KYC compliance has become more critical than ever. It’s essential for preventing fraud and meeting Anti-Money Laundering (AML) regulations.

The US took an early stand against money laundering by making it a federal crime with the Money Laundering Control Act of 1986. As a member of the Financial Action Task Force (FATF), the US enforces severe penalties for noncompliance, such as the hefty $29 million fine imposed on the crypto exchange Bittrex for violating the Bank Secrecy Act.

However, KYC in banking and other sectors is not static. As regulations for data storage and AML requirements evolve, so must the end-to-end KYC process. This changing landscape demands a fresh approach, often referred to as KYC remediation, which ensures that customer data remains current and compliant.

What is KYC remediation?

KYC remediation is about keeping customer data fresh and relevant. Essentially, it’s the process of reviewing, updating, and cleaning the information you hold on your customers to adhere to KYC and AML regulations

Your organization holds sensitive data from ID documents and other sources, which must be regularly updated to comply with sector regulations and manage AML risks effectively. Yet, many companies struggle with the volume of documents or lack clarity on compliance methods.

Non-compliance can result in hefty fines, as evidenced by over 20 billion euros in penalties issued by AML Intelligence in 2020 alone.

Regulations governing KYC and AML evolve continuously to combat financial crimes. Staying updated ensures compliance and reduces the risk associated with outdated data, which can expose your business to unforeseen vulnerabilities.

Moreover, as part of these compliance efforts, it’s essential to consider data protection regulations like GDPR. This regulation mandates deleting outdated client data under the “right to be forgotten,” ensuring that your data remains relevant and secure.

To execute KYC remediation effectively, automate key parts of the KYC process to streamline what can often be a tedious task. Here’s a straightforward approach:

- Review new regulations: Stay informed about evolving AML and KYC regulations specific to your operational country. Failure to adapt could jeopardize compliance and security.

- Assess compliance: Ensure existing processes align with new regulatory requirements and adjust as necessary to safeguard compliance.

- Update KYC processes: Implement regulatory changes promptly into your KYC processes, including onboarding new customers according to updated standards.

- Audit data accuracy: Regularly audit customer data to identify and rectify outdated or missing information, reducing operational risks.

- Client outreach: Engage with clients to collect any missing documentation or updates required by new regulations, ensuring data integrity and compliance.

- Continuous review: Establish periodic reviews based on risk levels (e.g., customer location, transaction size) to maintain data accuracy and compliance over time.

Common reasons for KYC deficiencies

KYC deficiencies often arise from a few common issues that can slip under the radar, including:

1. Outdated customer data

KYC deficiencies often stem from outdated customer data. As your clients’ circumstances change, their information might no longer be accurate.

For example, the information becomes inaccurate if a client moves to a new address or changes their employment but doesn’t update their profile. This situation can lead to several problems, such as failing to reach the customer for compliance communications or misidentifying risk levels based on old data. Keeping this data current is crucial for maintaining accurate customer profiles and ensuring compliance.

To address this, companies can implement regular reviews of customer information or set up automated alerts that notify customers when it’s time to update their profiles, helping to ensure that the data remains accurate and reliable.

2. Inaccurate or incomplete customer information

Another common issue is having inaccurate or incomplete customer information. This can lead to gaps in your data and potentially serious compliance issues.

For instance, if a customer’s identity verification documents, such as a passport or driver’s license, are missing or contain errors (like a misspelled name or incorrect birthdate), this can create gaps in your data. Such inaccuracies can complicate compliance efforts, leading to potential regulatory fines or issues during audits.

To mitigate this risk, ensuring all customer details are complete and correct is essential for effective KYC.

3. Lack of customer verification procedures

Without proper customer verification procedures, errors and fraudulent activities can easily slip through the cracks.

Implementing robust verification processes helps catch discrepancies early and maintain the integrity of your data.

4. Manual processes that are slow and error-prone

Manual KYC processes can be a major source of deficiencies. These methods are not only time-consuming but also prone to human error.

Automating these processes can help reduce mistakes and speed up compliance.

5. Inadequate training for staff on KYC compliance

Lastly, inadequate staff training on KYC compliance can lead to significant issues.

Without proper training, even the best processes can fall short. Ensuring your team is well-versed in KYC requirements helps maintain accurate and compliant data management.

The impact of KYC deficiencies

KYC deficiencies can lead to a range of serious consequences that affect various aspects of your business. Addressing these issues is crucial to avoid long-term negative effects.

1. Regulatory fines and penalties

One of the most immediate impacts of KYC deficiencies is the risk of hefty fines and penalties. Regulatory bodies impose these financial penalties for non-compliance with KYC and AML regulations.

The fines can be substantial, reflecting the seriousness of the lapses.

2. Reputational damage

Another significant consequence is reputational damage. Customers and partners lose trust when they see a company has poor KYC practices.

Rebuilding a damaged reputation takes time and effort, often involving costly public relations campaigns.

3. Operational disruptions

Operational disruptions also arise from KYC issues. For example, dealing with regulatory investigations or audits can divert resources from day-to-day operations. This can affect overall efficiency and productivity within the organization.

4. Increased risk of fraud and money laundering

Finally, deficiencies in KYC processes elevate the risk of fraud and money laundering.

Inaccurate or outdated information can allow criminals to exploit gaps in your system, jeopardizing your compliance status and exposing you to further financial and legal risks.

How to conduct KYC remediation

KYC remediation involves a systematic approach to ensure your customer information is accurate and up-to-date. Here’s how you can go about it.

1. Identify customers with missing or outdated information

The first step is to identify which customers have missing or outdated information.

Begin by scrutinizing your customer database to spot records that require updates. This could mean looking for expired documents, incomplete data, or discrepancies.

This identification phase is crucial as it sets the stage for remediation, ensuring you address all relevant cases.

2. Risk-stratify your customers

After identifying the customers who need updates, the next step is to stratify them based on their risk level. Risk stratification helps prioritize your efforts by categorizing customers into different risk categories—high, medium, or low.

High-risk customers, such as those involved in larger transactions or those from regions with higher AML risks, should be prioritized for more immediate and thorough reviews. You can review lower-risk customers less frequently. This stratification allows you to allocate resources more efficiently and focus on the most critical areas.

3. Collect and verify customer information

With your risk-stratified list in hand, the next step is to collect and verify updated customer information.

Reach out to the flagged customers to request any missing or updated documents, such as proof of identity or residence. It’s essential to ensure that this information is accurate and comes from reliable sources.

Verification might involve checking documents against government databases or other trusted records to confirm authenticity.

Proper verification helps prevent fraud and ensures compliance with regulatory standards.

4. Implement ongoing monitoring

Finally, establish a robust system for ongoing monitoring to maintain the accuracy of your customer data. This ongoing monitoring should be part of your standard procedures to ensure your KYC processes remain effective over time.

Setting up automated alerts or scheduled reviews can help streamline this process and ensure that updates are made promptly.

Benefits of effective KYC remediation

Effective KYC remediation offers several key benefits that enhance both compliance and customer satisfaction:

- Improved regulatory compliance: Staying on top of KYC remediation helps you adhere to ever-changing regulations, reducing the risk of facing hefty fines and legal issues.

- Reduced risk of fraud and money laundering: By regularly updating and verifying customer information, you minimize the chance of fraud. Effective KYC practices help prevent money laundering activities, keeping your business secure.

- Enhanced customer relationships: Maintaining accurate records and communicating effectively builds customer trust. It shows you are attentive to their needs and committed to their security.

- Increased operational efficiency: Streamlined KYC processes lead to faster data handling and fewer errors. This efficiency translates to cost savings and better resource management.

Best Practices for KYC Remediation

Here’s how you can enhance your KYC remediation efforts:

1. Establish a clear and documented KYC remediation process

Begin by setting up a clear, documented KYC remediation process. A well-defined procedure ensures that everyone in your organization understands their role and responsibilities. Documenting each step helps maintain consistency and makes it easier to track progress.

For example, studies indicate having a documented compliance process can improve testing efficiency by up to 75%. This clear process should detail how you conduct KYC checks, including how you handle both initial and ReKYC.

2. Leverage automation and technology

Utilize automation and technology to streamline your KYC remediation process. Tools such as AI and machine learning can handle large volumes of data more efficiently than manual processes. According to a McKinsey report on the future of work, businesses are expected to increasingly adopt automation and AI technologies.

Automation can quickly identify discrepancies and update records, reducing human error and saving time. For instance, AI-driven systems can automatically flag high-risk transactions and perform real-time data verification, which enhances accuracy and speed. This approach not only speeds up the process but also cuts down operational costs.

E-KYC solutions further simplify this by providing electronic methods for identity verification and document management.

3. Train your staff on KYC compliance procedures

Regular training ensures your team is up-to-date with the latest regulations and best practices. Effective training programs can help reduce errors and improve overall compliance.

According to Finextra, investing in staff training can decrease compliance-related errors by up to 18%. Staff should be familiar with both traditional KYC and digital KYC practices, ensuring they understand how to handle various types of customer data and verification processes.

4. Communicate effectively with customers

It is crucial to maintain clear communication with customers throughout the remediation process. Inform them about any required updates or changes and provide guidance on how to submit their information.

Transparent communication helps build trust and ensures a smoother process. For example, regular updates and clear instructions can enhance customer satisfaction and cooperation, especially when transitioning to new KYC integration systems or updating their E-KYC information.

5. Leverage technology for effective remediation

Technology can significantly boost your KYC remediation efforts. Tools like HyperVerge are designed to streamline this process by offering advanced data verification and document management features. HyperVerge utilizes AI to automate identity verification and document validation, improving accuracy and efficiency.

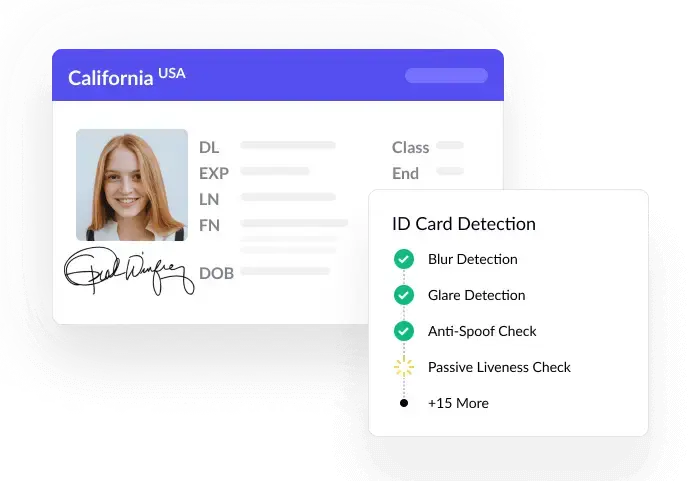

Secure and accurate identity verification

Our AML screening software complements this by identifying financial crime risks through scanning data against global watchlists and sanctions databases. Integrating AI and machine learning in AML screening further strengthens this process, allowing it to adapt to new threats and regulatory changes in real time.

Wrapping it up: Elevating your KYC remediation strategy

As regulations evolve and the financial landscape becomes more complex, it is essential to stay ahead with efficient KYC practices. Leveraging modern technology, such as HyperVerge, can significantly enhance your KYC efforts.

HyperVerge is an end-to-end digital identity verification platform that ensures full KYC and AML compliance. We provide end-to-end solutions for KYC, business verification, and AML compliance, empowering you to enhance security, boost efficiency, and simplify compliance.

With a proven track record of verifying over a billion identities to date, HyperVerge is your go-to for reliable KYC automation.

Book a demo with our team today and see how HyperVerge can transform your compliance efforts!

FAQs

What are the key steps involved in KYC remediation?

KYC remediation involves identifying customers with outdated or missing information, risk-stratifying them, collecting and verifying their data, and implementing ongoing monitoring to keep records accurate and compliant.

How often should KYC remediation be performed?

Depending on customer risk levels and regulatory changes, KYC remediation should be done regularly. High-risk customers are typically reviewed more frequently.

What technologies can be used to automate KYC remediation?

AI, machine learning, digital KYC solutions, e-KYC, and KYC integration tools can automate and streamline the KYC remediation process, reducing manual errors and enhancing efficiency.