Getting a loan or credit isn’t just about asking for money—it’s about proving you can pay it back. That’s why banks carefully assess a borrower’s financial situation before approving loans.

Traditionally, banks relied on documents like salary slips and tax returns. But if you have been at the receiving end, you know this method is slow and sometimes inaccurate.

With more people seeking credit and financial institutions facing greater risks, there’s a growing need for a faster, more reliable solution. This is where automation comes in. Instead of manually checking documents, it lets banks use digital tools to verify income instantly. These tools connect with government databases, employer records, and tax systems to fetch real-time data.

In this article, we will explore how automation reshapes income verification and why it’s a game-changer for banks and borrowers alike.

Understanding income verification

To begin, let us understand what income verification entails and why it is necessary.

Income verification is the process of verifying the income of an individual or an entity. It is the process banks use to check if a customer has a stable income. This could be either for lending, insurance, or account opening. The verification process helps banks decide whether to approve a loan or credit request in case of lending. Also, it helps decide the maximum insurance amount in the case of term insurance. Insurance companies also use it to determine general insurance coverage.

Here are the common methods that banks use to verify the income of individuals:

- Salary slips and employment letters: It is used as proof of income for salaried individuals.

- Bank statements: The bank statements show a borrower’s income flow and financial stability.

- Income tax returns (ITR): Essential for verifying self-employed individuals and business owners.

- Credit bureau reports: They provide a borrower’s credit history and financial behaviour.

Why do banks need income verification?

The income verification process is important for banks for numerous reasons, including:

- Assessing repayment capacity: Banks check income to see if the borrower can repay the loan. A steady income means lower risk for the bank.

- Reducing loan defaults: It helps banks avoid lending money to people who may struggle to repay. This reduces loan defaults and financial losses.

- Assessing insurance premiums: Income verification helps banks assess the insurance terms and premiums for their customers.

- Ensuring compliance: RBI requires banks to follow strict rules before approving loans. Income verification helps meet these guidelines and ensures responsible lending.

Therefore, income verification for banks is important to ensure RBI compliance. It also ensures that the loans disbursed have minimal risk.

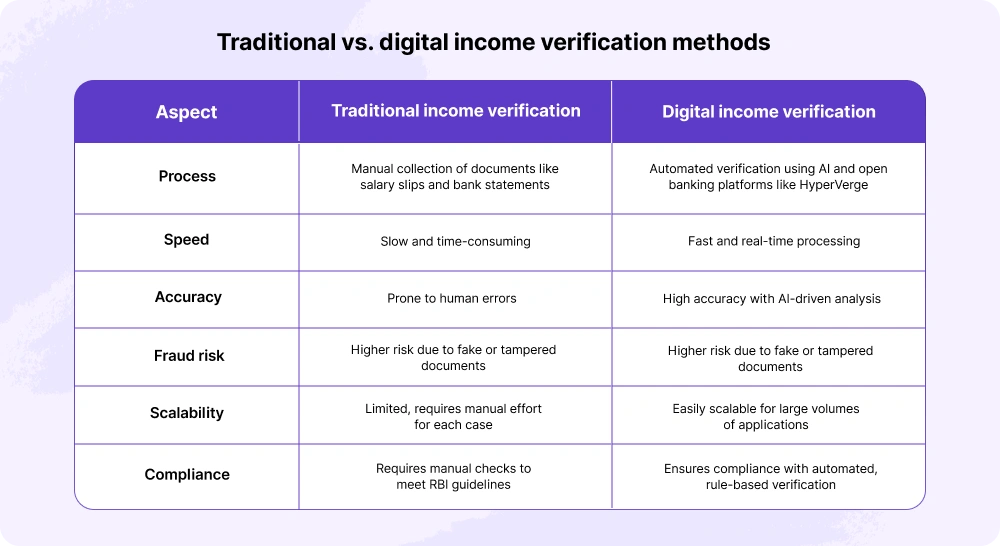

Traditional vs. digital income verification methods

Now we know why this process is important, let us look at how it is conducted traditionally and digitally.

Conduct accurate income verification faster

With auto validation and automatic extraction. Schedule a DemoHow digital income verification works

Digital income verification for banks makes income verification faster and more reliable. Here are the two common processes involved in digital income verification:

Open banking and income verification

Open banking APIs allow banks access to the borrowers’ financial data directly from their bank accounts. Banks can retrieve real-time income information through these APIs. Banks greatly benefit from it in the following ways:

- Faster verification – Reduces the time needed to process loans.

- Accurate data – Minimizes errors from manual document handling.

- Secure transactions – Ensures compliance with RBI regulations.

- Better fraud detection – Identifies inconsistencies in financial records.

AI-powered document extraction

AI plays a crucial role in modern income verification. It automates the analysis of financial documents like bank statements and tax returns. AI-powered systems extract key details and assess financial stability within seconds.

These systems use Optical Character Recognition (OCR) to read and convert document data. Machine learning models help detect inconsistencies and flag potential fraud. Additionally, AI helps automate the categorization and sorting of income sources. By integrating AI with Open Banking, banks can verify income faster. This helps them make the lending process more efficient and reliable.

Key benefits of HyperVerge’s income verification for banks

HyperVerge, an onboarding platform, helps conduct income verification for banks in seconds.

Here are some of its key features:

1. Comprehensive validation options

HyperVerge offers multiple ways to verify income, ensuring flexibility for banks. It supports Account Aggregator frameworks, PDF uploads, Payslip OCR, and Form 16/16A processing. This allows banks to verify income from various sources effortlessly.

2. Faster turnaround time

Manual income verification can take 1-3 days, causing delays in loan approvals. HyperVerge automates the process, enabling near real-time verification. This reduces wait times for both banks and borrowers.

3. Enhanced conversion rates

Errors in documents can slow down approvals. HyperVerge provides real-time feedback to detect and correct issues. This leads to higher approval rates and fewer rejected applications.

4. Cross-platform compatibility

HyperVerge’s solution is built to work seamlessly across Mobile and Web SDKs. It is optimized for all devices, ensuring a smooth experience for financial institutions.

5. Plug-and-play deployment

Banks can quickly integrate HyperVerge without complex setup processes. Its plug-and-play model saves time and effort. This allows financial institutions to implement income verification without major technical hurdles.

6. Advanced analytics

Banks get detailed insights and case management tools with the HV One platform. These analytics help monitor trends, identify risks, and make better lending decisions.

Thus, HyperVerge helps financial institutions conduct income verification quickly, reliably, and smoothly.

Challenges in implementing income verification solutions

While the digital income verification simplifies the process, there are certain challenges. You must be cautious of these challenges while implementing this digital solution:

- Data security concerns: Protecting data from unauthorized access is a major challenge. Strong encryption and security measures are needed to prevent data breaches.

- High initial investment costs: Setting up digital income verification systems requires advanced technology. Banks must invest in AI, automation, and secure data-sharing platforms. The high cost can be a barrier, especially for smaller financial institutions.

- Regulatory compliance in India: Banks must follow strict RBI guidelines for data verification. Ensuring compliance with evolving regulations requires continuous updates and monitoring. Non-compliance can lead to penalties and legal issues.

Best practices for banks adopting income verification solutions

Here are some best practices to ensure that you make the most of digital income verification solutions:

- Choosing the right tools: Banks must select income verification tools that are scalable, easy to integrate, and highly accurate. The solution should handle large volumes of data efficiently. It should also work seamlessly with existing banking systems. Accuracy is crucial to minimize errors and prevent fraud.

- Adhere to laws: Banks must comply with Indian data protection regulations to ensure the secure handling of financial data. This includes the Personal Data Protection Bill (PDPB) and RBI guidelines. Following these laws helps protect customer privacy and avoid legal issues.

- Encryption and secure data storage: Sensitive financial data should be encrypted during transmission and storage. Banks must use secure servers, multi-factor authentication, and restricted access controls to safeguard customer information.

Final ThoughtsDigital income verification is transforming banking by making the process faster and more secure. Traditional methods are slow and prone to errors, while AI and open banking enable real-time validation with minimal risk.

Solutions like HyperVerge Income Verification help banks improve efficiency and enhance customer experience. However, banks must address data security and compliance challenges when adopting these technologies. Financial institutions can streamline income verification and make smarter lending decisions by choosing the right tools.

FAQs

1. What is the primary purpose of income verification in banking?

Income verification helps banks check a borrower’s ability to repay loans and reduces the risk of defaults.

2. How does digital income verification differ from traditional methods?

Digital methods use AI and open banking to verify income quickly. Contrarily, traditional methods rely on manual document checks, which take more time and may have errors.

3. What tools are commonly used for digital income verification?

Banks use AI-powered OCR, machine learning models, open banking APIs, and account aggregators to verify income accurately.

4. Is digital income verification secure?

Yes, it follows strong encryption, secure data storage, and RBI regulations to protect customer information from fraud and cyber threats.

5. What are the RBI guidelines for income verification in India?

Banks must follow KYC norms, data privacy rules, and secure verification methods to ensure compliance and prevent financial fraud.