What if verifying income in India could be as quick and reliable as checking your email?

Income validation platforms are redefining how businesses and individuals confirm financial credibility. These platforms leverage advanced technologies like AI, and real-time data integration to ensure accuracy and speed, making the process almost invisible.

For lenders, employers, and landlords, this means quicker decisions and reduced risk. Borrowers conversely are no longer limited by traditional barriers—even those with unconventional income streams can now prove their worth effortlessly.

If we have piqued your interest in income validation platforms, you’ll find more information and details on the same in this blog. Let’s first define an income validation platform.

What is an income validation platform?

An income validation platform is a digital solution designed to verify and assess an individual’s or business’s income accurately and efficiently. It is a critical tool for lenders, employers, and service providers to validate financial information, ensuring informed, data decision-making while minimizing risks.

By leveraging advanced technologies, these platforms streamline the entire income verification process and replace manual, time-consuming methods with automated, reliable systems.

Core benefits

- Enhanced accuracy in income assessment

Income validation platforms eliminate human errors and inconsistencies by using reliable data sources and algorithms. This ensures precise income verification, which is crucial for fair lending practices, employment screening, and financial planning.

- Increased efficiency by automating traditional processes

By automating income verification, these platforms significantly reduce the time and effort required compared to manual methods. This allows organizations to process applications faster, improving customer satisfaction and operational efficiency.

- Fraud prevention through advanced AI technologies

With the integration of AI and machine learning, income validation platforms can quickly detect anomalies and suspicious patterns in financial data. This helps prevent fraud, ensuring that only legitimate income information is validated.

Key features of modern income validation platforms

- Real-time income verification

Modern income validation platforms provide instant access to up-to-date income data, enabling quick and accurate verification. This is particularly useful for time-sensitive processes like loan approvals, employment history authentication, and more.

- Automation and AI-driven insights

Income validation platforms use automation to handle repetitive tasks and AI to analyze data trends. This not only speeds up the process but also enhances the quality of financial assessments.

- Seamless integration

Income validation platforms are designed to integrate effortlessly with existing systems, such as HR software, banking platforms, or lending systems. This ensures a smooth workflow without disrupting current operations.

Why income validation platforms are essential in India

In India, income validation tools have become indispensable for ensuring accurate and efficient assessment of individuals’ financial standing. Here are two main reasons why integrating income validation platforms has become nonnegotiable today—

- Addressing challenges in traditional methods

Income verification in India has long relied on manual processes, such as physical document checks and employer confirmations. These methods are not only time-consuming but also prone to errors and fraud. For instance, fake salary slips or manipulated bank statements can easily slip through the cracks, leading to unreliable assessments.

Additionally, the lack of standardized formats across employers and financial institutions further complicates the process. Income validation platforms step in to tackle these issues by automating verification, reducing human error, and providing real-time, accurate data.

- Ensuring compliance and accuracy

Meeting regulatory requirements set by the Reserve Bank of India (RBI) and other authorities is a critical aspect of financial operations in India. The RBI has established prudential norms for income recognition and asset classification to promote transparency.

Income validation tools and platforms play a key role here by offering a systematic approach to verify income details while maintaining compliance. These platforms use advanced technologies to cross-check data from multiple sources, ensuring information provided is accurate and tamper-free.

Moreover, such platforms promote fair and responsible lending practices. By providing a clear picture of an individual’s financial health, they help lenders make informed decisions, reducing the risk of defaults. This not only protects financial institutions but also ensures that borrowers are not burdened with loans they cannot afford.

Make smarter lending decisions.

Automate income and employment checks with real-time data and AI-driven insights. Schedule a DemoTop income validation platforms in India

1. HyperVerge

- Basic info

HyperVerge’s income validation platform provides an automated solution to validate and verify income details quickly and accurately.

By extracting data from various financial documents like bank statements, salary slips, Form 16/16A, and ITR copies, it empowers businesses to make better decisions in seconds. With features like document OCR & validation, bank statement analysis, and integration through account aggregators or PDF uploads, the platform reduces manual effort and improves efficiency.

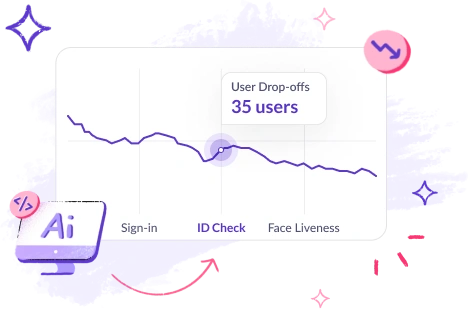

Plus, HyperVerge’s easy-to-use interface and fast processing ensure a smooth experience for both businesses and users, helping to boost conversion rates. The platform is designed to enhance accuracy while significantly reducing user drop-offs and back-and-forth communications.

- Best for

HyperVerge’s BSA is ideal for financial institutions, security and brokerage firms, fintech platforms, the remittance industry, and lending companies that require fast and reliable income verification. It’s best for businesses that want to automate their onboarding process, reduce drop-offs, and enhance decision-making accuracy with minimal user friction.

- Pricing

HyperVerge provides flexible pricing plans to accommodate businesses at different growth stages:

- Starter: Designed for startups, this entry-level plan comes with a one-month free trial, allowing businesses to explore essential features.

- Grow: Geared toward mid-sized companies, this package includes everything in the Starter plan along with advanced identity verification, AML screening, seamless integration with central databases, and customizable workflows.

- Enterprise: Built for large-scale operations, this plan enhances the Grow package by offering tailored pricing, priority support, and specialized collaboration tools.

- What do users say?

G2

Capterra

2. Perfios

- Basic info

Perfios income validation platform is designed for institutional lenders to efficiently verify the income and employment details of customers applying for loans and credit cards. It automates the extraction and reconciliation of data from various financial documents, including bank statements, payslips, ITR forms, Form 16, and Form 26AS.

The platform generates detailed reports for income and employment verification, assisting in enhanced credit assessments and decision-making. Perfios also supports real-time analysis of credit card statements to determine applicants’ repayment capacity, further contributing to a comprehensive evaluation of financial health.

- Best for

Perfios is particularly useful for institutional lenders, including banks and financial institutions and those handling applications for loans and credit cards from salaried or self-employed customers.

- Pricing

Free

Gold: Rs 499/-

Platinum: 1499/-

- What do users say?

G2

3. Finbox

- Basic info

Integrated with the Account Aggregator (AA) framework, FinBox’s BankConnect helps lenders and financial institutions assess borrower credibility with unmatched accuracy.

By leveraging AI and ML, it detects fraudulent activities, evaluates income stability, and tracks spending patterns across multiple data sources—including Account Aggregator, statement uploads, and net banking. With over 150 fraud detection checks, 500+ financial parameters, and zero-touch workflows, its platform transforms raw financial data into insights that power smarter underwriting.

- Best for

FinBox excels in MSME financing, embedded credit, alternate data underwriting, and risk-based lending and is ideal for banks, NBFCs, fintech startups, and enterprises looking to launch digital lending products with minimal effort.

- Pricing

N/A

- What do users say?

N/A

4. IDfy

- Basic info

IDfy’s Bank Statement Analysis API leverages advanced AI/ML models trained on data from over 100 banks to extract intelligent insights from customer bank statements.

It equips lenders with deep transaction intelligence, allowing them to assess credit risk with unmatched accuracy. Beyond surface-level analysis, the platform detects hidden patterns that may indicate fraud or financial instability early in the lending process.

By cross-referencing bank statement data with public and proprietary databases, IDfy’s BSA uncovers anomalies, spending behaviors, and undisclosed liabilities, providing a comprehensive view of a borrower’s financial health.

- Best for

IDfy’s BSA is ideal for banks, NBFCs, and digital lenders seeking high-precision risk assessment in retail and SME lending.

- Pricing

N/A

- What do users say?

G2

Capterra

Validate income instantly with HyperVerge.

Cut delays, reduce risks, and approve loans faster with AI-powered verification. Get started today!5. ScoreMe

- Basic info

Designed for banks, NBFCs, and financial institutions, ScoreMe’s Bank Statement Analysis tool automates data extraction, categorization, and risk assessment from bank statements of any format—digital PDFs, scanned copies, or hard prints.

It eliminates manual errors, accelerates decision-making, and provides deep financial insights through AI-driven analysis. Whether you need to assess income consistency, transaction patterns, or creditworthiness, ScoreMe delivers accurate, comprehensive reports in minutes.

From initial borrower screening to periodic financial reviews, ScoreMe provides lenders with precise, real-time data and ability to handle large volumes of applications.

- Best for

ScoreMe is a good fit for underwriting teams looking to automate creditworthiness evaluation, fraud detection, and risk analysis. Additionally, financial institutions conducting periodic borrower reviews can leverage its AI-powered insights for ongoing monitoring.

- Pricing

N/A

- What do users say?

N/A

6. Pirimid

- Basic info

Pirimid Fintech is a financial intelligence platform that helps individuals and businesses gain a comprehensive view of their finances. By aggregating transaction data across multiple accounts, it offers deep insights into income, expenses, and spending patterns.

For lenders and financial institutions, Pirimid Fintech enhances underwriting by analyzing transaction histories and categorizing income. It provides credit scoring solutions tailored for thin-file and new-to-credit customers while helping reduce NPAs through real-time data tracking. The platform also facilitates BNPL partnerships and payday loans, optimizing risk assessment.

- Best for

Pirimid Fintech is ideal for financial institutions, lenders, and fintech platforms seeking precise credit scoring, smarter underwriting, and risk mitigation.

- Pricing

N/A

- What do users say?

G2

7. MeasureOne

- Basic info

MeasureOne is an income verification solution covering 100% of the U.S. employment market, including W2 employees, 1099 contractors, gig workers, and freelancers. Its AI powered automated platform allows businesses to verify income through payroll credentials, bank transaction history, or paystub uploads—the system ensures instant, fraud-resistant verification, reducing risk and operational workload.

With over 7,500 payroll processor integrations and smooth API compatibility, MeasureOne enables businesses to access verified income data effortlessly. Whether a lender, property manager, or employer, you receive accurate financial insights with minimal friction.

- Best for

MeasureOne is ideal for lenders, property managers, employers, and financial service providers needing instant, fraud-proof income verification. It’s especially valuable for businesses dealing with gig workers, freelancers, and non-traditional employees who lack standard payroll records.

- Pricing

N/A

- What do users say?

G2

Capterra

8. Finicity

- Basic info

Finicity by Mastercard’s income validation platform offers real-time income and employment verification, providing lenders with up to 24 months of accurate income history in as little as 30 seconds.

Designed to remove the hassle of manual paperwork, it enables financial institutions to make faster, data-driven lending decisions while improving borrower experience.

With Finicity’s income verification API, lenders across mortgage, auto, personal lending, and tenant screening industries can instantly confirm a borrower’s financial standing. The solution also supports analytics-driven credit decisioning, helping lenders mitigate risk while expanding financial access.

- Best for

Finicity’s income verification is ideal for lenders in mortgage, auto, personal, and rental markets who need fast, reliable financial data. It’s best suited for financial institutions that want to enhance credit decisioning, reduce risk, and provide a frictionless borrower experience.

- Pricing

N/A

- What do users say?

N/A

Best practices for using income validation platforms

Income validation platforms are essential tools for lenders to assess borrower credibility and reduce risks. However, their effectiveness depends on how they are implemented and managed. Here are some best practices to ensure optimal use of these platforms—

For lenders:

- Choose a reliable platform

Selecting a dependable income validation platform is the first step. Look for platforms with a proven track record, positive user reviews, and strong technical infrastructure.

A reliable platform should offer accurate data, top-notch security and compliance, minimal downtime, and responsive customer support. Features such as real-time verification, integration with APIs like India Stack, and comprehensive analytics should also be sorted to enhance the validation process

Conduct thorough research and consider trial periods to evaluate performance before committing.

- Ensure compliance with regulations

Adhering to legal and regulatory requirements is non-negotiable. In India, platforms must comply with the Digital Personal Data Protection Act 2023 and Anti-Money Laundering (AML) guidelines.

Implement consent-driven mechanisms for data collection and processing, ensuring borrowers are fully informed and agree to share their information. Regularly update your processes to stay aligned with ever-changing regulations.

- Integrate seamlessly with existing systems

Verify that the platform can connect with your Loan Origination Systems (LOS) or Customer Relationship Management (CRM) software. The platform should work harmoniously with other software deployed to avoid disruptions and inefficiencies.

Look for solutions that offer smooth APIs or custom integration options.

- Prioritize security and data privacy

Protecting sensitive borrower information is a top priority. Ensure the platform uses advanced encryption, secure data storage, and regular security audits. Implement multi-factor authentication and access controls to prevent unauthorized access.

Transparency in data handling practices will also build trust with borrowers

- Offer a user-friendly experience

Look for a platform that is easy to navigate and benefits both lenders and borrowers. Also, select platforms that simplify the verification process for borrowers by offering clear instructions (with minimal steps).

Additionally, consider multi-language support to cater to India’s diverse demographic.

- Leverage automation and AI

Automation and AI can significantly enhance the efficiency of income validation processes.

Use these technologies to analyze large datasets, detect anomalies, and generate insights. For instance, automating routine tasks, such as cross-referencing bank statements or salary slips, can improve efficiency.

- Monitor and optimize processes

Regularly review the platform’s performance and identify areas for improvement. Track key metrics such as processing time, accuracy rates, and user satisfaction.

Gather feedback from both your team and borrowers to refine the platform’s functionality.

For borrowers:

- Choose a trusted lender

Not all lenders are the same. Opt for a lender that uses reputable income validation solutions and has a track record of protecting customer data.

Research their policies and read reviews to ensure they prioritize security and transparency.

- Provide accurate and complete information

When submitting your income details (salary slips and bank statements), ensure all information is correct and up-to-date.

Incomplete or inaccurate data can delay the verification process and even lead to loan rejection. Double-check your documents before sharing them.

- Understand your data rights

Before using an income validation platform, familiarize yourself with how your data will be used, stored, and shared.

Ensure the platform complies with India’s data protection regulations. Knowing your rights empowers you to make informed decisions and makes certain your data is safe and in the right hands.

- Stay alert for fraudulent requests

Be cautious of unsolicited requests for income verification or sensitive financial information. Scammers often pose as lenders or verification platforms.

Always verify the authenticity of the request before sharing any details.

- Be prepared for digital verification

Maintain electronic versions of essential documents for quick uploads during the application process.

Many income validation solutions often use digital tools like bank statement analysis or payroll integrations. Ensure your financial accounts are accessible and organized.

Important note: Ensure your Aadhaar and PAN are linked, as many platforms utilize these for verification.

- Leverage account aggregators

Account aggregators can simplify the process by consolidating your financial data from multiple sources.

If your lender supports this feature, consider using it to share your income details securely and efficiently. This method aligns with Indian regulations, promoting efficient and compliant data sharing.

- Ask questions if in doubt

If you’re unsure about any part of the income validation process, don’t hesitate to ask your lender or the platform’s support team.

Clarifying doubts upfront can prevent misunderstandings and ensure a smoother experience.

Pick the right platform for you

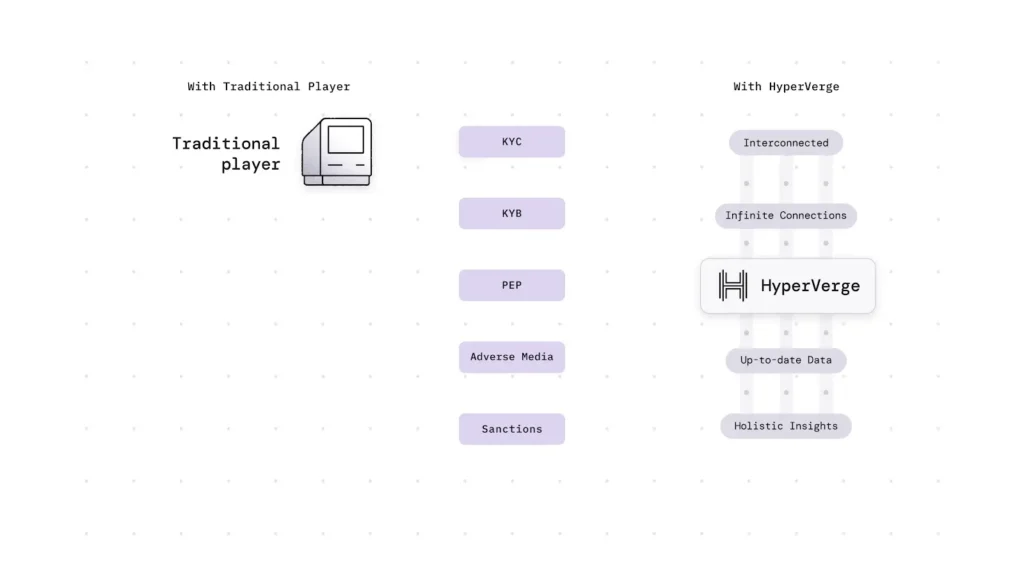

Lending success depends on accurate income validation. The right platform should automate income and employment verification, integrate smoothly with CRMs and loan origination systems, and adapt as your business scales. Plus, it should support cross-platform use, and comply with India’s data protection regulations.

HyperVerge checks all these boxes. Its AI-driven income validation platform, with an intuitive interface and analytics dashboard, delivers instant, accurate insights, reducing manual effort and decision delays.

With seamless API integrations, real-time verification, and a compliance-first approach, HyperVerge empowers lenders to make secure and risk-free lending decisions. As financial services evolve, embracing automated, data-backed solutions is no longer optional—it’s the key to staying ahead.

To know more, read about HyperVerge’s income verification.

FAQs

1. How does an income validation platform work?

Income validation solutions collect and analyze financial data from various sources to confirm an individual’s earnings. They access information such as bank statements, payroll records, and tax documents to provide an accurate assessment of income.

2. What are the benefits of using these platforms?

These platforms offer quick and precise income verification, reducing manual effort and minimizing errors. They enhance decision-making for lenders, banks, and fintech by providing reliable financial insights about an individual’s financial health.

3. Are income validation platforms secure?

Yes. Reputable platforms like HyperVerge prioritizes data security, employing encryption and strict privacy measures to protect sensitive information. It’s essential to choose services that comply with industry standards and regulations.

4. Can small financial institutions use income validation platforms?

Yes, many platforms are designed to be accessible and affordable for small financial institutions, helping them efficiently assess and validate income.