Finance is undergoing a tectonic shift driven by technology. Anindya shares some time tested perspective and insights from 2 decades of shaping the financial landscape.

Time is a teacher with no parallel. On this episode of HyperInsights we’ve have a brilliant student and practitioner of time’s teachings in the financial domain. Anindya Karmakar has been through every major financial bubble and wave to shape the Indian ecosystem since the turn of the millennium. Through it all he has driven change with a technology first mindset, from his stints in CitiFinancial to ICICI and now Aditya Birla Financial.

On the 3rd chapter of HyperInsights season 2 we dive deep into themes around the “Next Normal” for BFSI, operating models, and more. Read on to get the gist and watch the video for all Anindya’s insightful perspective.

The “Next Normal” for BFSI (link)

Context

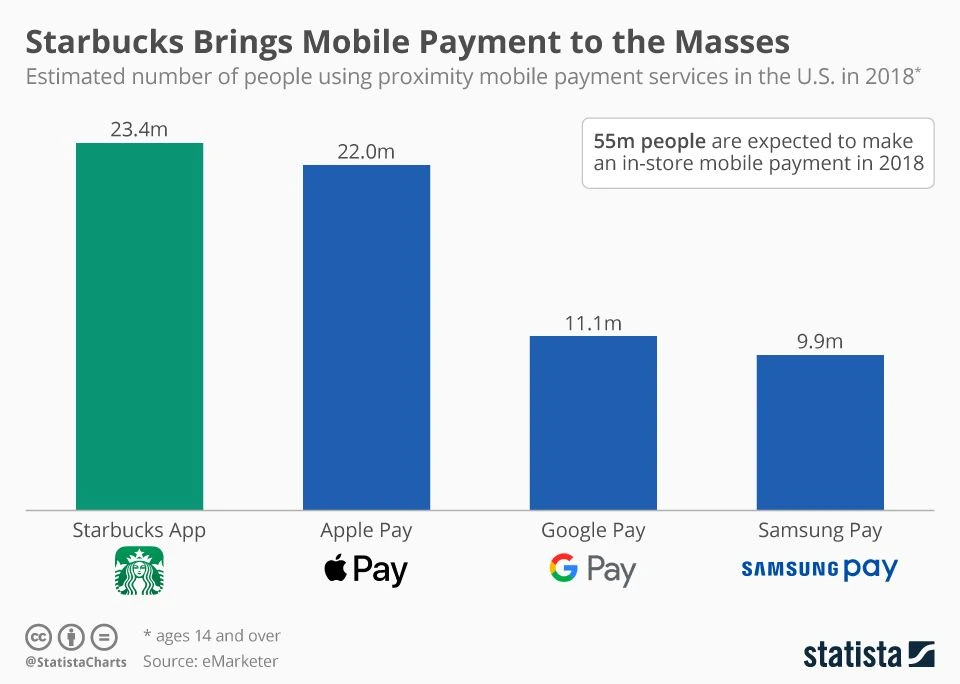

The coronavirus has altered the context in which the BFSI enterprise operate across product categories. It has also accelerated trends that were already apparent. From ride sharing companies that offer better insurance schemes to coffee apps with the most valuable Digital Wallets, Anindya helps clear the clutter in this new reality.

HyperInsights on deposits and lending

- Bank accounts exist today only to keep and store money. The value of financial services have shifted closer to points of transaction – a trend that becomes clear when one looks at the most valuable mobile payment wallets in mature financial markets such as the US.

- Anindya’s chapter in The AI book explores a future where the above trend is taken to its natural next step – where the point of access to a commodity/service will also be used to monitor and make purchases, where our refrigerators will make purchases for milk and vegetables.

- Closer to the present, we can see this change happening with the integration of financing options during payment journeys in e-commerce apps.

- Developments like this are driven by the insight that a person poor in monetary terms doesn’t imply that he/she is not credit worthy.

- The role of AI in this is central to establishing both the intent and ability to pay in the near term.

HyperInsights for traditional and new age lenders

Anindya spent a significant amount of time exploring what the Next Normal meant for banks and other traditional lenders

- With lending moving closer to the point of sale, the customer base also moves from banks to the providers of digital services and commodities. Although banks have started to use technology such as AI to change how they operate, they also need to rethink their role in the ecosystem.

- Anindya cites Ping An (China’s largest insurer) as a template for banks of the future. Ping An has used its legacy and staying power to shape an ecosystem of financial service providers around it with itself at the hub.

- Fundamentally, banks need to go past just catching up with the future, they need to start shaping it.

- Anindya believes fintech startups that survive today are close to end of their learning curve. A fact reflected by their lower costs, delinquency rates, and improving quality of Assets Under Management.

- Fintech startups have a unique ability to leverage massive amounts of data and AI to make better bets in the short term.

How banks and their operational models will change

Context

Anindya is no stranger to operating financial services at scale and what it takes to change them. Having spearheaded ICICI bank’s drive to digitise it’s branches, Anindya believes that the COVID-19 crisis might have a silver lining.

HyperInsights

- The fundamentals that drive lending: good underwriting and collections continue to apply for the health of a financial company.

- The “clobbering” of the economy by COVID-19 has meant that these fundamentals have become harder to attain in sectors like consumer lending.

- Consumer lending which was the road to profitability is no longer a predictable sector delivering consistent 15% annual growth.

- Lenders need to educate consumers in a time of moratoriums so that it benefits both parties.

- Alternative credit scoring will increasingly become more critical to modeling credit scores and collection.

Anindya: A fintech founder from the future

Context

One of the more fascinating topics we explored with Anindya was what would he would if he were to go back in time and start a fintech firm. Anindya had quite a bit to share that would bring hope to many first time and burgeoning founders.

HyperInsights

- Stay true to the fundamentals of good lending: understanding customers (underwriting) and healthy collections.

- Customers are continually changing, keep abreast with them. We exist in a time where there is more data than ever before to keep pace with this change, especially in markets like India.

- Consumerization is all consuming. Leverage data and AI to make it easier to automate how you deliver individualised experiences.

Discussions

- Are rural customers data poor? If so, how do we model those customers (link)

- Collections for rural, lessons from Micro Financial Institutions (link)

- Driving collections with AI (link)

- Account Aggregator ecosystem (link)

- If a customer avails a moratorium will affect Days Past Due (link)

- What about post moratorium load on collection (link)

One recurrent theme

Decades of experience bring with it wisdom that’s hard to find elsewhere. A recurring theme in all our interactions with Anindya is how the various marquee companies he has worked with have recruited him for new and bold initiatives. This reflects in how Anindya has approached his careers so far, a constant upward curve of learning and adaptation.

Our conversation with Anindya is part of a whole host of thought provoking dialogues on HyperInsights with change makers like Anuj Rathi and Bala Parthasarathy.

Follow us for more of HyperInsights and stories from India’s largest KYC provider.