Credit underwriting for lending businesses refers to the process of evaluating and assessing the creditworthiness of potential borrowers before extending them credit. This process is crucial for lending institutions to mitigate the risk of default and make informed decisions about whom to lend money to.

Identity verification is a pivotal aspect of credit underwriting for lending businesses and other financial institutions, serving multifaceted roles. Through this blog, we will explore the credit underwriting process, best practices, and the role of automation.

What is Credit Underwriting?

Credit underwriting is a loan or credit card lender insurance company’s way of assessing financial fitness. It’s a comprehensive check-up to see if the borrower can handle the loan repayment marathon. This process keeps lenders from financial headaches and ensures a healthy lending environment for everyone.

But why is the credit underwriting process important? Here’s how:

- Lenders Don’t Get Burned: The credit underwriting process protects lenders from financial losses by identifying borrowers who might struggle to repay. This keeps the loan system stable for everyone.

- Borrowers Get Protected Too: It’s not just the lenders who benefit. A thorough credit assessment prevents borrowers from taking on debt they can’t handle. It’s like a financial friend saying, “Hey, maybe hold off on that fancy car for now,” and helping borrowers avoid potential financial strain.

- Financial Inclusion Gets a Boost: A low credit score isn’t the only story. The credit underwriting process can consider factors beyond traditional metrics, opening doors for borrowers with potential but limited credit history. This fosters financial inclusion, empowering more people to chase their dreams.

Key Factors in Credit Underwriting

The following are the key factors involved in the process:

Credit Score

A credit score is a borrower’s financial report for credit card approvals, but only if it’s linked to the right person! KYC documents like Aadhaar cards and PAN cards act as ID checks, ensuring the score reflects the true borrower’s ability. Verifying income tax returns or salary slips can add another layer of credibility to the credit score. These documents provide a more comprehensive picture of the borrower’s financial situation and earning potential, potentially strengthening your confidence as a lender in the accuracy of the credit score.

Credit History

A credit history report tells the tale of a borrower’s past loan interactions. This report is verified through credit bureaus like CIBIL, which helps identify discrepancies or potential fraud. Think of it like fact-checking a borrower’s financial resume. Their credit report is like their financial report card, showcasing their past loan interactions. But is it the whole story? Verifying the report through credit bureaus like CIBIL helps identify any discrepancies or potential fraud. Inconsistencies might indicate errors or even attempts by the borrower to manipulate the credit history, highlighting the importance of verification in ensuring the report paints an accurate picture.

Income and Employment Stability

Consistent income is the fuel that keeps loan payments and repayments chugging along. The creditor institution should verify employment history through documents like salary slips and can even contact the employer directly. Income tax returns offer a more holistic view investment income, revealing additional monthly income streams or hidden financial obligations.

Debt-to-Income (DTI) Ratio

This fancy term compares a borrower’s existing debt to their income. Verifying a borrower’s income and paid or outstanding debts through documents like salary slips financial statements and bank statement analysis ensures an accurate calculation. The debt-to-income ratio helps the credit ninja assess whether the borrower can handle another loan amount on top of their current commitments. The DTI ratio shows how much of the borrower’s income is already going towards debt.

Collateral

For some loans, collateral – like a house or car – acts as a safety net. Verifying ownership documents and value through property registration papers or asset valuation reports ensures the collateral for secured loans or personal loans is legit. Verifying the collateral ensures it can catch you in case of a fall, protecting the lender from financial woes.

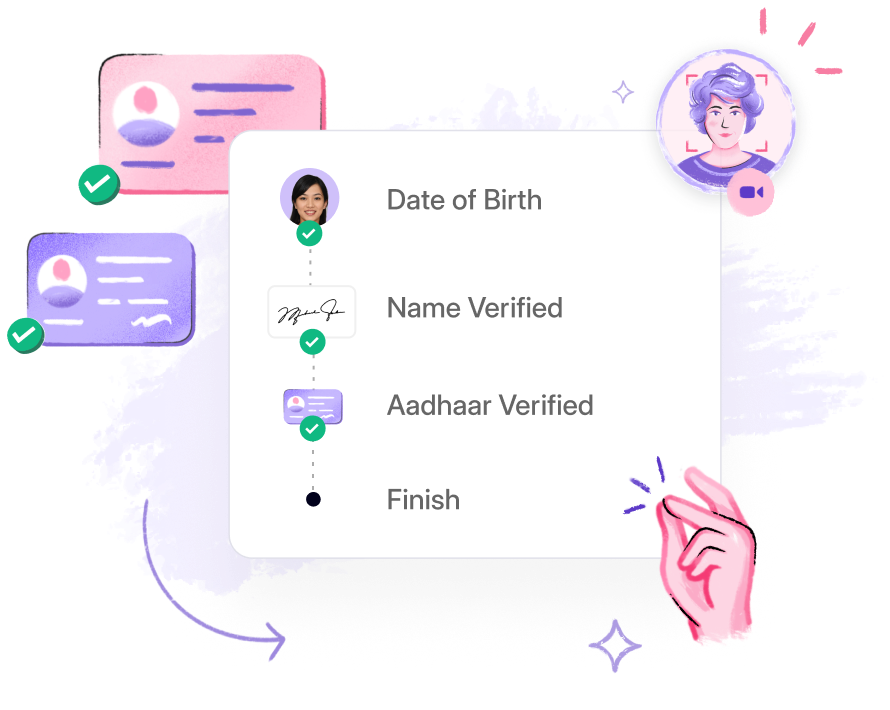

The Credit Underwriting Process: A Step-by-Step Approach

This section dives deeper into the step-by-step process of credit underwriting process in India, highlighting the significance of robust identity and document verification at each stage of loan process.

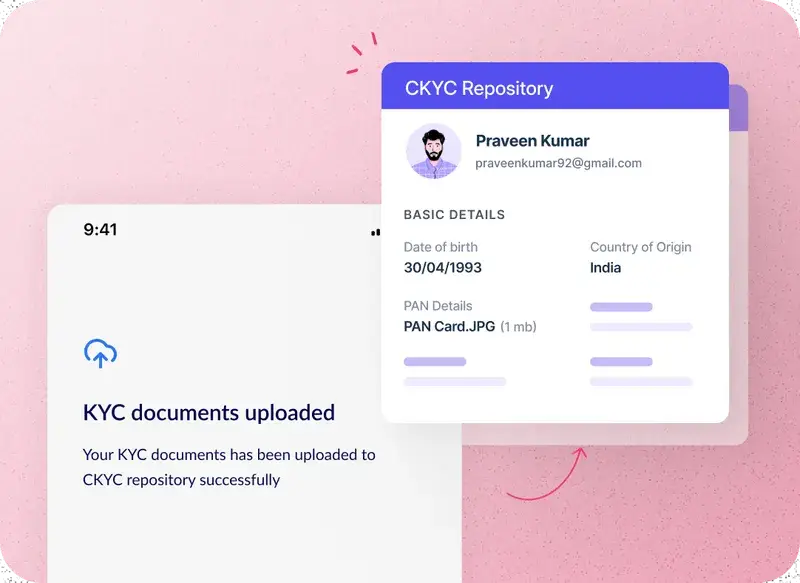

Collect the Information of the Customer

First, the borrower’s details are collected – personal info, their employment status, and payment history, and income sources. Verifying this information with KYC documents ensures everything checks out.

Document Verification

Documents like IDs, income proofs, and collateral documents (if applicable) get a thorough examination to ensure everything is legit. No fishy business here!

Let’s take an in-depth view:

- Identity Documents: Government-issued IDs like PAN cards and Aadhaar cards.

- Income Documents: Salary slips, bank statements, or income tax returns to confirm income stability.

- Collateral Documents: For loans with collateral, ownership documents and value estimates of the pledged asset.

Read more:

- What is proof of income?

- What is bank statement analysis?

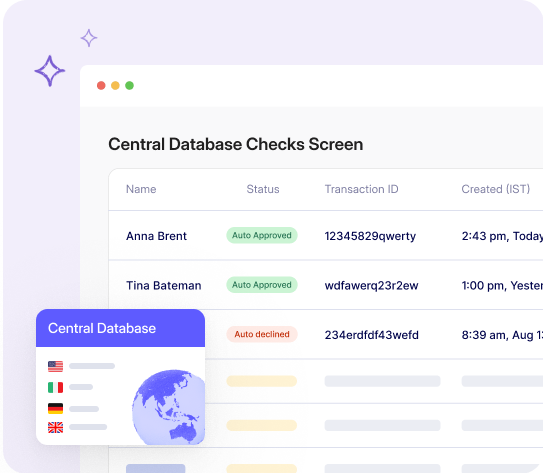

Credit Check

Credit reports from credit bureaus should be accessed to assess the borrower’s credit score and history. Verifying the report helps identify any potential red flags.

Income and Debt Analysis

Income documents and existing debts are analyzed to calculate the borrower’s Debt-to-Income Ratio. This will help you understand if the borrower has sufficient income to handle the loan repayment on top of any existing commitments.

Collateral Check

This involves the verification of ownership documents and value estimates of the pledged asset(s) for loans with collateral.

Decision Making

Based on the comprehensive evaluation, you must decide on loan approval, rejection, or modification of the mortgage loan and loan terms therein.

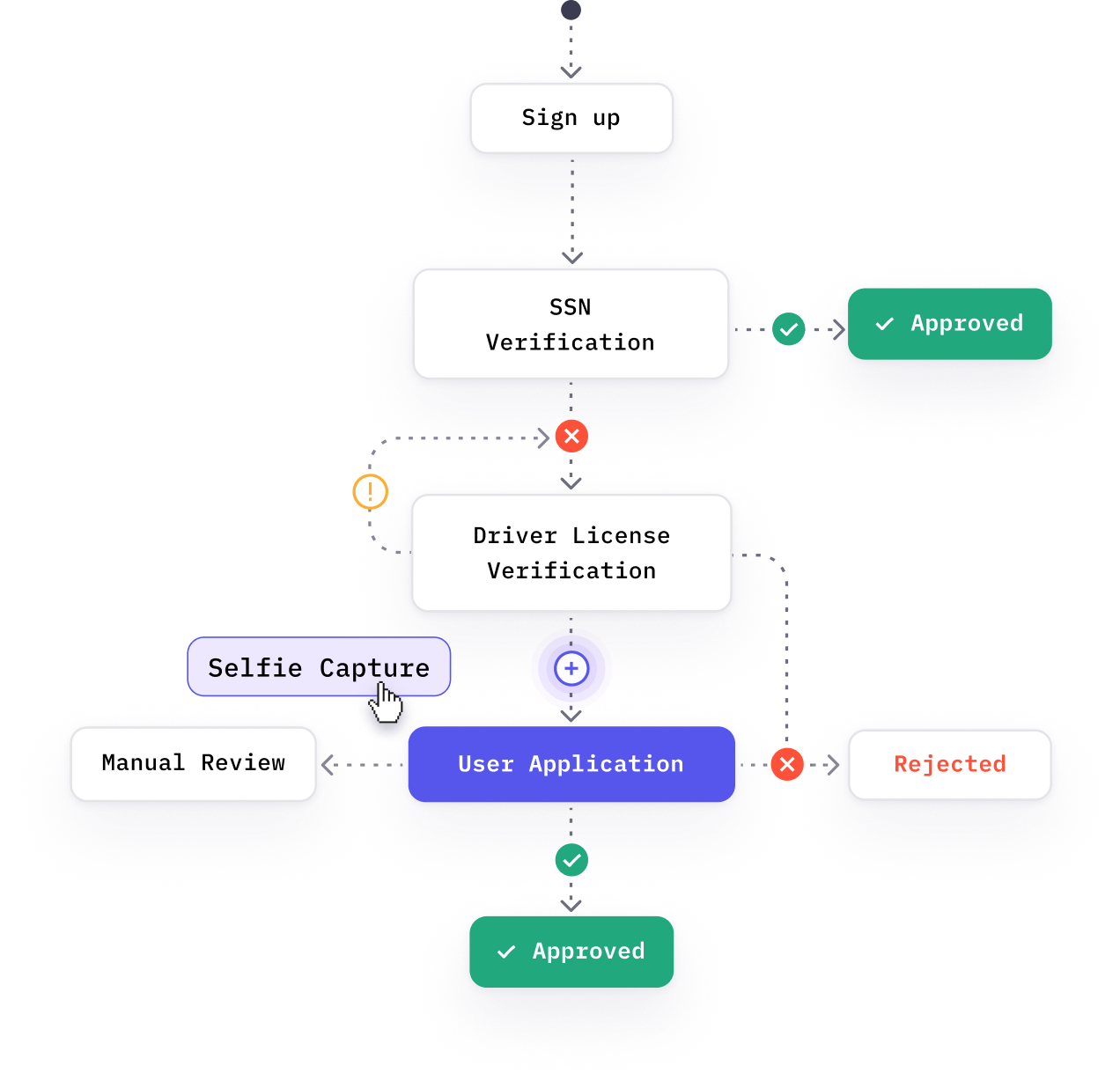

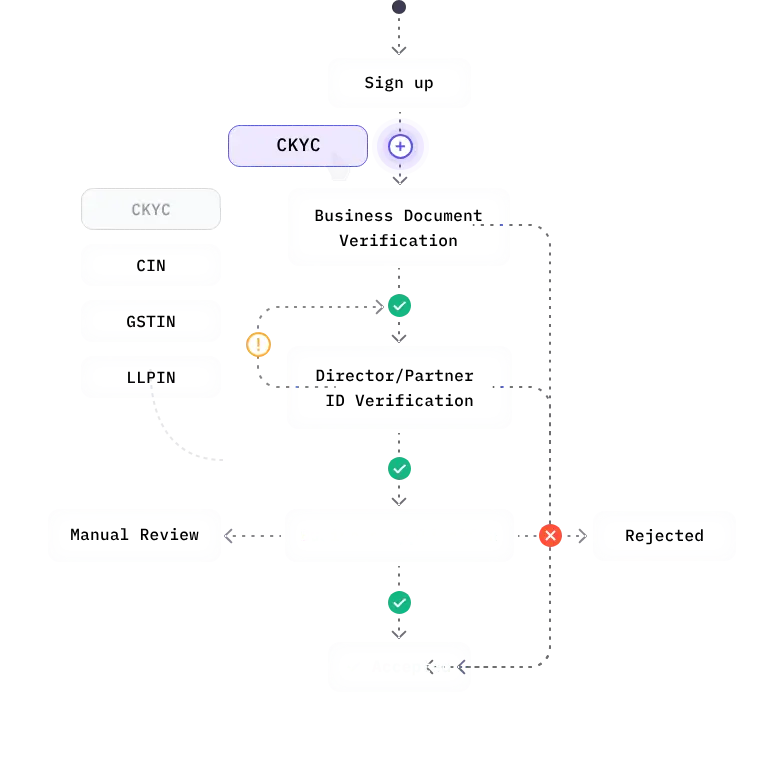

Build End-to-End Lending Journeys for Maximum Conversion

Ever feel like the credit underwriting process can be time-consuming and error-prone, slowing down the loan review process for your company? Imagine a world where the burden of manual document verification and analysis melts away. That’s the power of HyperVerge’s cutting-edge AI technology.

Take the first step towards faster, more secure lending. Sign up for a free demo today! Don’t just take our word for it. Explore the full potential of HyperVerge One and discover how our AI-powered platform can also transform your bank account, credit and loan origination process.

Read more about the loan origination software