Inboxes overflowing with invoices can slow down your finance team. Manual data entry turns into a time-consuming task. This is the reality for many businesses today.

One solution to this concern is adopting OCR software. In recent years, the adoption of OCR technology has been increasing constantly. A report by Grand View Research projects that the OCR market will experience a Compound Annual Growth Rate (CAGR) of 14.8% from 2024 to 2030.

If you are looking for the best OCR software for invoice processing, keep reading this blog.

We have curated a list of the top 10 OCR software to help you select the software that best meets your invoice processing requirements.

Let’s discuss each software in detail, covering the benefits, pain points, reviews, and pricing.

What is invoice processing?

Invoice processing refers to receiving, verifying, and entering bills into an accounting system for payment. The invoice processing workflow involves the following steps.

- Receive invoices in several formats (paper, email, and EDI).

- Verify invoices for accuracy and completeness.

- Enter invoices manually into the accounting system using OCR or Robotic Process Automation (RPA) technology.

- Review and approve invoices by the designated personnel.

- Make payments on bills via cheque, electronic funds transfer (EFT), or various other methods.

- Record invoices and update payment information in the accounting software.

Let’s learn how optical character recognition is beneficial in invoice processing.

How does OCR technology help in invoice processing?

OCR technology helps automate and streamline the data entry process for invoice processing. The technology works by scanning the invoices and converting the images containing text into digital text that a computer can easily read and process. The technology then retrieves and integrates the digital text into your accounting software like QuickBooks or Sage Intacct.

OCR technology recognizes specific invoice information, including vendor names, invoice numbers, dates, and amounts. It also verifies data against predefined criteria or guidelines to ensure accuracy. Additionally, using a receipt scanner app can help digitize receipts alongside invoices, making financial record-keeping more efficient.

How we analyzed and selected the best OCR software for invoice processing

We followed a manual process to curate the list of top OCR software. In this process, we analyzed 44 OCR software options for invoice processing. We compared each software’s reviews and ratings from trusted platforms like G2 and Capterra.

We shortlisted the top software based on factors like features, pricing models, customer support, and integration capabilities. This detailed process ensures that our curated list includes the best software that aligns with your unique requirements.

Detailed overview of the top 10 OCR software for invoice processing

Here is a table containing an overview of the top OCR software.

| OCR Softwares | G2 Reviews & Ratings (Out of 5) | Best For | Platforms Supported |

| HyperVerge | 4.7 (52 Reviews) | • Startups • Small-scale businesses • Mid-sized companies • Enterprises | • Web • Android • iOS |

| Docsumo | 4.7 (51 Reviews) | • Startups • Mid-sized companies • Enterprises | • Web |

| Nanonets | 4.8 (72 Reviews) | • Startups • Mid-sized companies • Enterprises | • Web |

| MyQ | 4.7 (49 Reviews) | • Mid-sized companies • Enterprises | • Web • Android • iOS |

| Rossum | 4.4 (73 Reviews) | • Mid-sized companies • Enterprises | • Web |

| Docparser | 4.6 (50 Reviews) | • Startups • Mid-sized companies • Enterprises | • Web |

| Kofax | 4.3 (25 Reviews) | • Mid-sized companies • Enterprises | • Web • Android • iOS |

| DocuPhase | 4.3 (24 Reviews) | • Mid-sized companies | • Web • Android • iOS |

| Grooper | 4.6 (19 Reviews) | • Mid-sized companies • Enterprises | • Web |

| ABBYY | 4.1 (10 Reviews) | • Mid-sized companies • Enterprises | • Web • Android • iOS |

Now, let’s discuss each of the OCR software in detail.

A complete list of the 10 best OCR software for invoice processing in detail

Here is a thorough explanation of each OCR software for invoice processing.

1. HyperVerge

About HyperVerge

HyperVerge is reliable and efficient OCR software that provides a complete solution for automating invoice processing. HyperVerge OCR is a modern AI-powered tool that helps extract text from invoices with 95%+ accuracy. Also, the tool reduces the manual data entry efforts by extracting key information like invoice number, date, vendor details, and total amounts, reducing the manual entry efforts.

HyperVerge’s intelligent document processing capabilities help users easily import invoices in various formats, such as PDFs or images. The software supports multilingual document processing, making it easy to handle hundreds of documents worldwide in different languages. This capability helps improve global operability and breaks down the language barrier.

The software encrypts user information to avoid data breaches and complies with worldwide regulations like GDPR and ISO 27018 standards. With such a focus on security and compliance, HyperVerge stands out as a reliable option for your invoice processing requirements.

Key features of HyperVerge

- Document import: Easily upload documents in various formats like PDFs and images to streamline the data intake process.

- Multilingual processing: Processes documents in 150 languages to ensure global compatibility and easily overcome language issues.

- AI-powered OCR: Uses a 13-year-trained AI model to provide accurate optical character recognition.

- Template-based extraction: Extracts data from structured templates, speeding up the processing of standardized documents and increasing workflow efficiency.

- API integration: Integrates OCR capability into existing systems using an API. This allows for easy deployment and expands system capabilities with minimum effort.

- Fraud detection: Detects and prevents fraudulent activities with its powerful fraud detection capabilities.

HyperVerge pricing

HyperVerge offers several pricing models to suit all types of businesses. These pricing models include.

- Start plan (For startups): Experience a free trial in the sandbox environment. The plan includes one month and the benefit of seamless integration in less than four hours.

- Grow plan (For midsize companies): Grow plan includes all the features of the Start plan and provides access to an end-to-end ID verification suite, AML checks, and custom workflow.

- Enterprise plan (For enterprise-level organizations): Enterprise plan offers all the Grow plan offerings, as well as collaborative tools, a custom pricing structure, and dedicated support.

What people say about HyperVerge

- HyperVerge OCR achieves an accuracy rate of 95%+ in document processing, such as invoices and bank statements, impressing users with its precision.

- Users appreciate how HyperVerge extracts data from documents containing different languages.

- HyperVerge offers flexible workflows to ensure a smooth experience. It simplifies implementation for users.

- Users like how HyperVerge quickly transforms data into machine-readable text, supporting unstructured and structured document types.

Client video testimonial

HyperVerge serves 100+ well-known clients, from startups to enterprises. Their top clients are PDAX, L&T Finance, HomeCredit, Freo, Ahamove, ZestMoney, Avail Finance, and Slice. Check out the feedback from one of our leading clients, HomeCredit. The feedback highlights the client’s experience of a 50% reduction in error rates, showcasing the reliability of our HyperVerge OCR technology.

2. Docsumo

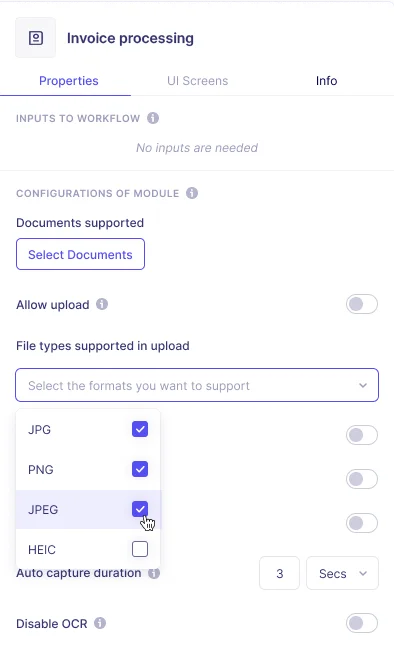

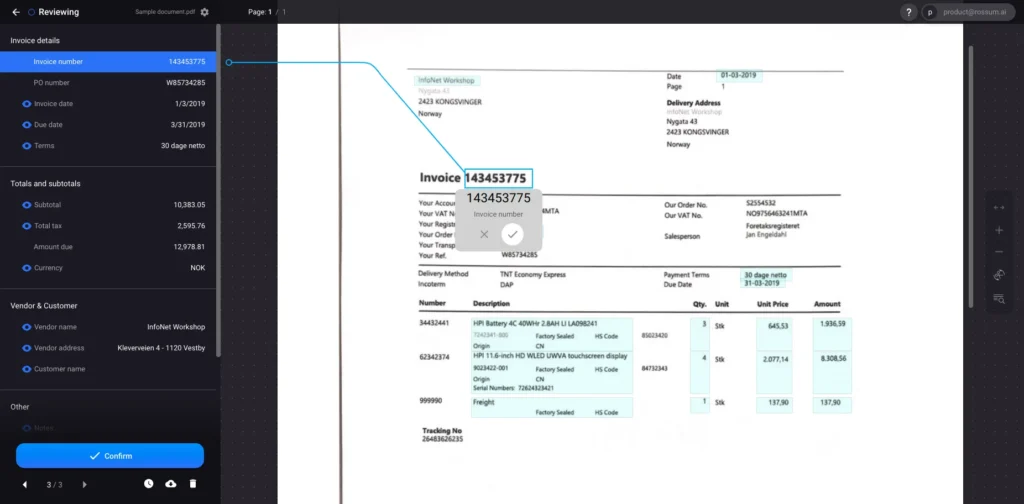

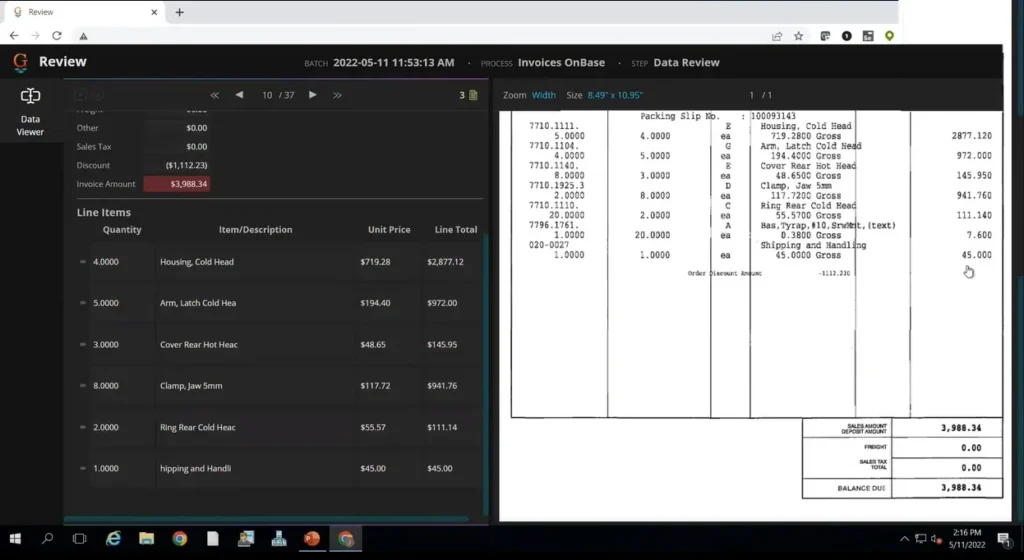

Source: Software Advice

About Docsumo

Docsumo is one of the leading intelligent OCR software catering to serve small and medium enterprises with invoice processing. This end-to-end data extraction tool offers features that include data capture from different documents with different formats, a pre-trained API stack, and an easy-to-use review and edit tool.

Well-known organizations trust Docsumo, including National Debt Relief, Arbor Realty Trust, PayU, Hitachi Payment Services, Valtatech, and GetJones. Docsumo follows GDPR-compliant protocols to prioritize security and compliance for handling the entire database with exceptional care and confidentiality.

Docsumo pricing

Docsumo offers three plans ranging from $500+/month for 3 users, which includes invoicing, purchasing orders, and ID cards, to custom pricing for the Enterprise plan, which consists of all features and supports unlimited users.

Key features of Docsumo

- Data capture: Captures data from various documents like invoices, receipts, and contracts, regardless of format.

- Pre-trained API stack: Enables quick and easy integration into existing systems. This allows businesses to start processing documents with minimal setup time.

- User-friendly review and edit tool: The interface makes it easy for users to review and edit extracted data, ensuring accuracy and reducing manual intervention.

- Data validation: Cross-checks extracted data with predefined rules and databases to ensure the integrity and accuracy of the information.

Pros of Docsumo

- Reduces the time for manual data extraction, with some users experiencing an 80-90% decrease.

- Helps admins customize data extraction according to their needs.

- Capable of extracting data from various document types like invoices, receipts, and contracts.

Cons of Docusumo

- You need time to learn and set up custom workflows and rules.

- Requires stable internet connection. This can be a challenge for remote users with unreliable internet access.

3. Nanonets

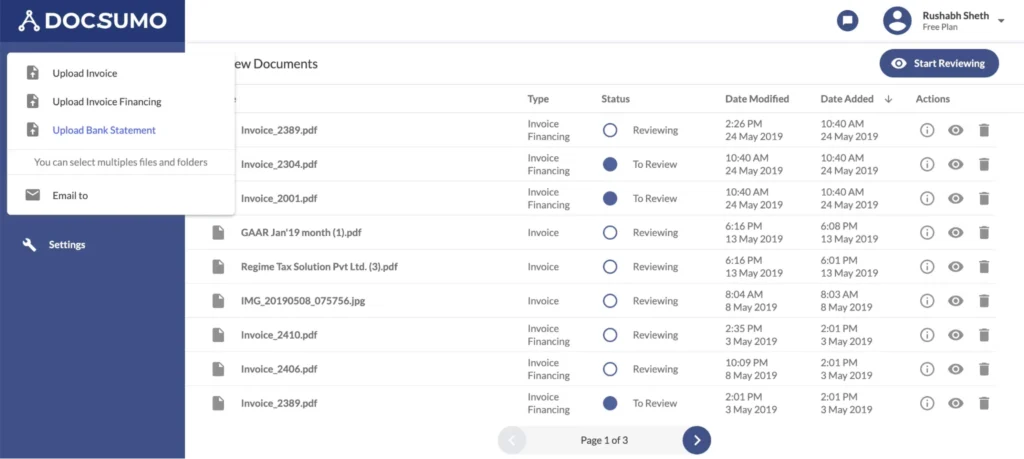

Source: G2

About Nanonets

Nanonets is a reliable OCR software for processing invoices and optimizing business operations. As an intelligent document-processing solution, Nanonets specializes in extracting key information from unstructured data sources like documents, emails, and databases.

Nanonets is a no-code platform for OCR automation that helps automate complex manual processes. The software uses AI-powered tools to automate processes across various departments, such as finance, accounting, supply chain, and sales. Its self-learning AI model assists in processing complex invoices and confirmations with exceptional accuracy.

Nanonets pricing

Nanonets offers three plans that range from a zero monthly fee for the Starter plan, which includes 500 free pages and $0.3/page, to custom pricing for the Enterprise plan, which includes all the features and supports custom workflows.

Key features of Nanonets

- File import: Allows to import files from popular sources like Gmail, Dropbox, Drive, and SharePoint.

- Intelligent data extraction: Extracts data using advanced AI tools without relying on predefined templates.

- Expenses dashboard: Track accounts payable, including amounts, due dates, vendor information, and payment status.

- Export: For offline use, export data to your CRM, WMS, or database in various formats, such as XLS, CSV, or XML.

Pros of Nanonets

- Nanonets provides comprehensive model configuration options for processing different document types.

- The AI’s self-learning capabilities in Nanonets ensure that data extraction is accurate and that it improves over time.

- Allows you to quickly set up the software and collect valuable data with minimal effort.

Cons of Nanonets

- Offers a trial period of 7 days which can be a limitation for enterprise users.

- Some users need help in automating testing with tagged data.

4. MyQ

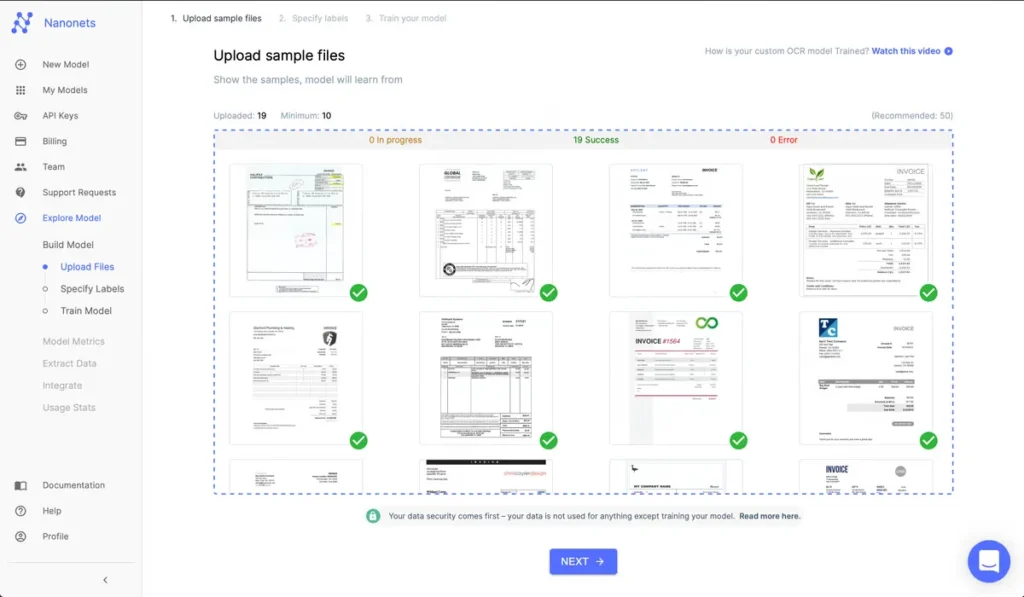

Source: G2

About MyQ

MyQ is one of the best OCR software for optimizing invoice processing through powerful document workflows. The software enables administrators to predefine scanning options or enable real-time communication with internal systems. Its functionality optimizes processes like business trip expenditure, expense reports, contact approvals, and purchase order processing.

The software uses advanced technology to recognize text, checkboxes, stamps, signatures, barcodes, and QR codes. Also, MyQ prioritizes strong security measures with features like password protection, digital signatures, and annotations to protect scanned documents. This OCR software ensures efficient invoice processing across Box.com, SharePoint Online, OneDrive, and Google Drive.

MyQ pricing

Contact MyQ to get current pricing.

Key features of MyQ

- Invoice scanning: This invoice scanning software uses OCR technology to scan and digitize invoices accurately. It extracts data like invoice numbers, dates, and amounts.

- Data verification: Software cross-checks the extracted data with the business database to ensure accuracy and compliance.

- Document classification: Classifies and sorts invoices based on criteria. This helps simplify the workflow process.

- Integration: Integrates OCR-processed invoices easily with your existing accounting systems. This integration helps streamline data transfer.

Pros of MyQ

- Simplifies user-friendly administration with features like selective synchronization from AD and process automation.

- Supports exceptional customer support for issues and suggestions.

- Receives frequent updates to add the latest features and new capabilities.

Cons of MyQ

- The software works slowly with specific devices and also lacks support for the Mac server version.

- The initial setup and model configuration are challenging for MyQ.

5. Rossum

Source: G2

About Rossum

Rossum is an AI-based, cloud-native platform that helps automate 99% of transactional documents. The software uses modern technologies like large language models (LLMs) and generative AI to optimize document categorization, data gathering, verification, and postprocessing. Such automation speeds up the entire process and eliminates manual data entry mistakes.

Rossum adapts to various document layouts without the requirements of new templates. This makes it ideal for processing complex transactional documents, including tables and grids. The platform also offers reporting and a dashboard to help track critical information, identify trends, and consistently improve document processing.

Rossum pricing

Contact Rossum to get current pricing.

Key features of Rossum

- AI-powered data capture: Extracts data from scanned documents across all formats and channels automatically using advanced AI.

- Automated document classification: Reduces the risk of errors and penalties associated with incorrect data entry by accurately classifying documents.

- Integration: Integrates with third-party software, including SAP, Coupa, Workday, Microsoft Dynamics, and QuickBooks.

- Low-code customization: Provides a low-code interface to personalize automation based on business requirements.

Pros of Rossum

- Rossum allows quick modification of the UI and data processing to meet specific requirements.

- Saves a lot of time for finance teams by streamlining document management.

- When it comes to OCR tasks, Rossum provides flexible customization options.

Cons of Rossum

- The document upload speed must be more consistent and match better internet speeds.

- Some users report issues with handling large PDF documents, which causes the UI to crash and take a lengthy process.

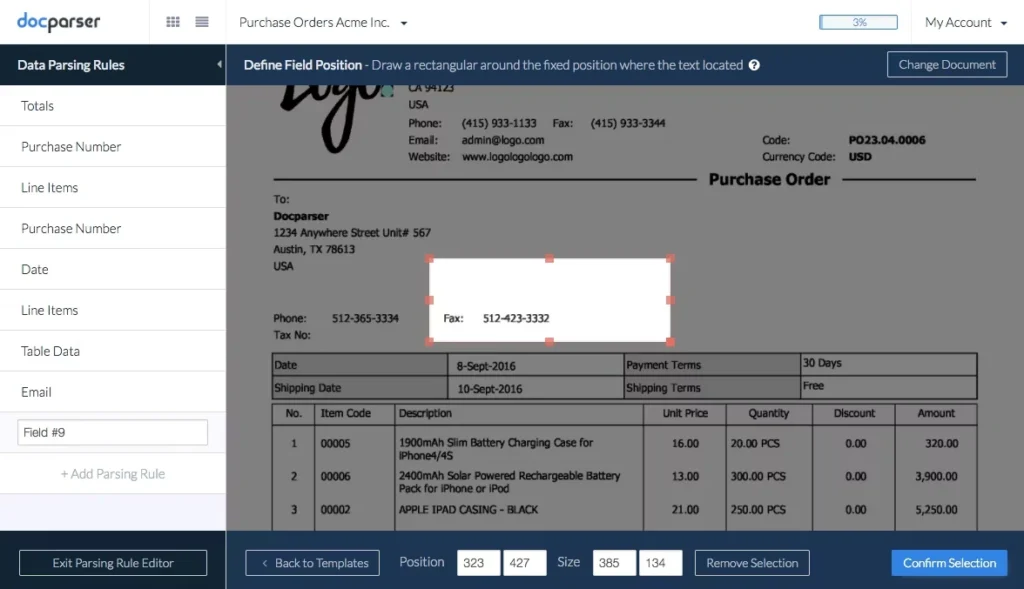

6. Docparser

Source: G2

About Docparser

Docparser is an invoice processing solution that helps extract essential data from Word, PDF, and images by applying Zonal OCR technology, pattern recognition, and anchor keywords. The software allows the creation of extraction rules without scripting, exports data to several formats, and links various cloud apps like Zapier and MS Power Automate.

Docparser is a financial and accounting-specific tool that allows users to extract essential invoice data like dates, totals, & line items and integrates these data into accounting systems. The software extracts data from invoices and supports data extraction from bank statements.

Docparser pricing

Docparser offers plans ranging from $3,250/month for 1,200 credits and 15 parsers to custom pricing for unlimited parsers, custom credits, and white labeling.

Key features of Docparser

- Document-specific filters: These allow you to apply specific rules to several document types, such as invoices, purchase orders, bank statements, and work orders.

- Custom parsing rules: You can create custom parsing rules to instruct the parsing engine to extract the required data type.

- Line item data extraction: Enables extracting and formatting repeating text patterns and tables from PDF, Word, and image documents.

- Multiple export formats: It offers various file formats for extracting data, including CSV, Excel, JSON, and XML.

Pros of Docparser

- Works accurately with Zapier and can scan multiple documents to multiple email accounts.

- Offers excellent features to address problems with documents before extracting them via OCR.

- Simple to use and comprehend with the documentation that comes along.

Cons of Docparser

- A single modification in any field in the source document causes a full change in the parsing configuration.

- The pricing structure needs to be clearer. Unused pages don’t roll over to the next month, and no auto-recharge option exists.

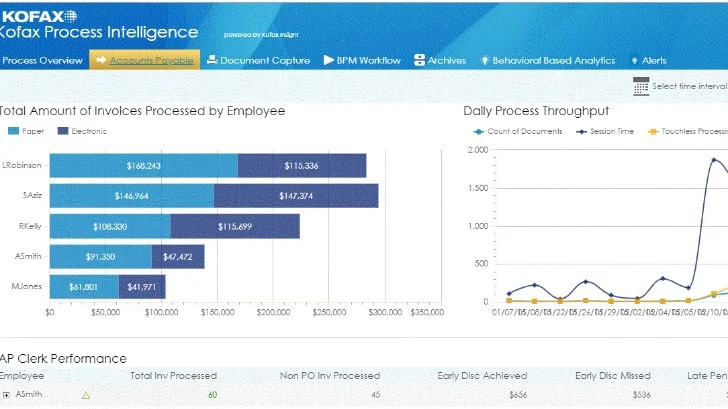

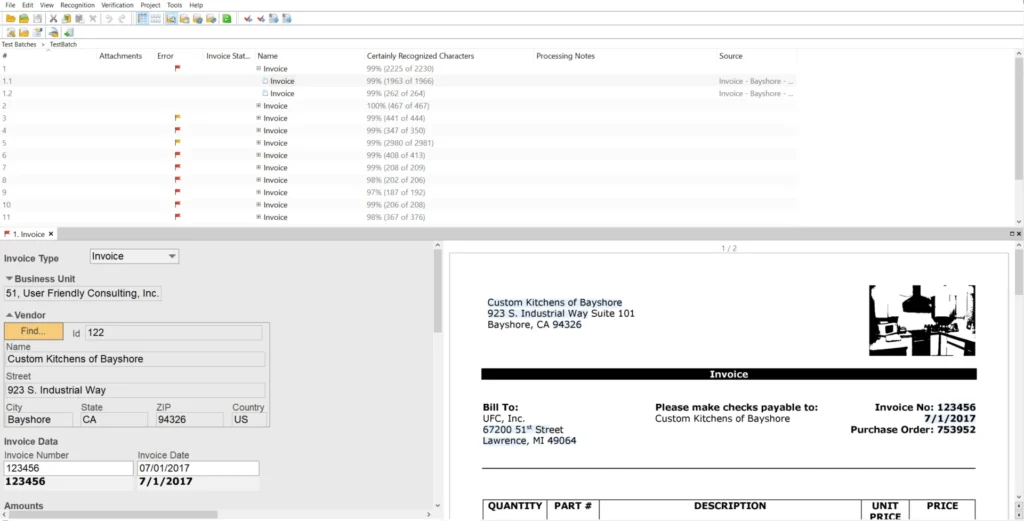

7. Kofax

About Kofax

As one of the top OCR software companies, Kofax specializes in collecting, categorizing, extracting, and transforming invoice processing workflows. The software uses AI-powered intelligent document processing that reduces the chances of data entry errors.

With secure invoice processing, the software provides production-level scanning and indexing for unstructured and structured invoices. Kofax optimizes capturing capabilities with intelligent devices like MFDs, network scanners, and mobile devices.

Kofax pricing

Contact Kofax to get current pricing.

Key features of Kofax

- System integration: Integrates with over 140 line-of-business applications, including ECM, ERP, BPM, and workflow systems.

- Customizable modules: Modify the solution without programming by adding modules for automatic document separation and form extraction.

- Flexible API: Customize the solution with scripting options like export destinations and data release rules.

- Multi-channel invoice capture: Supports different data conversion channels, including XML, scanned paper-based documents, and PDF.

Pros of Kofax

- Easy to set up and comprehend, with pre-configured locators.

- Provides excellent batch capture and document archiving features with a user-friendly interface.

- Supports a variety of output formats for invoice processing.

Cons of Kofax

- Users experience slow performance when integrating with the operating system and database.

- The obsolete user interface of the software requires a modern redesign to improve usability and overall experience.

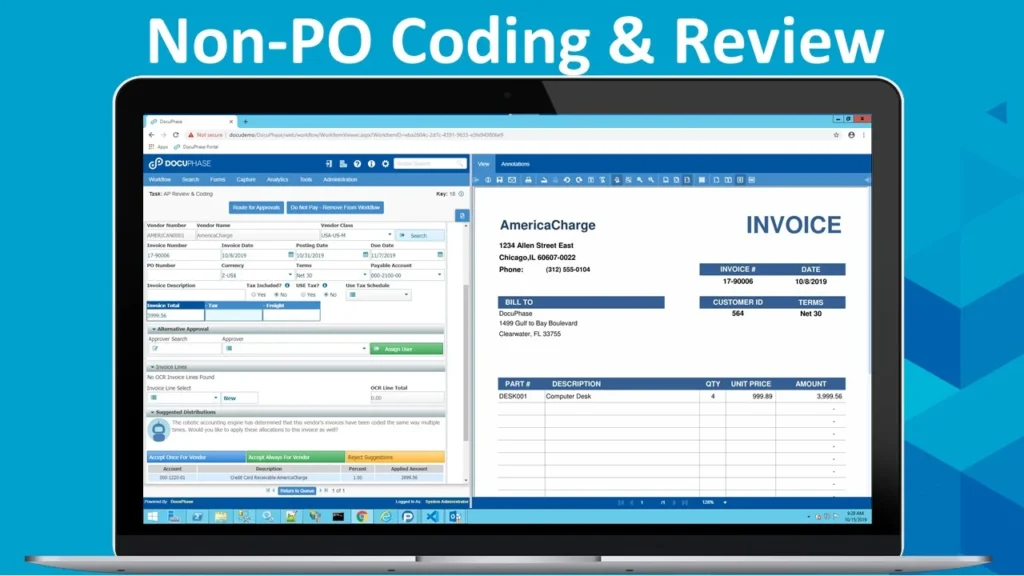

8. DocuPhase

Source: G2

About DocuPhase

DocuPhase is an all-in-one accounts payable automation software that simplifies procurement, from purchase to invoice approval and payment. It’s a cloud-hosted platform, which makes it accessible 24/7 to handle invoices and approvals.

DocuPhase also includes automated 3-way matching technology that eliminates manual matching of orders, receipts, and invoices. It easily integrates with ERP systems like NetSuite, Dynamics, and Sage. The OCR technology automates data entry by gathering line-item invoice information with a single click.

DocuPhase pricing

Contact DocuPhase to get current pricing.

Key features of DocuPhase

- ERP integration: Ensure data accuracy and consistency with smooth integration to ERP systems.

- Instant approval routing: Automatically routes new invoices to approvers, eliminating the chances of misplacing and duplicating invoices.

- Advanced-data capture: This uses OCR technology to extract exact line-item information from invoices with automation.

- Automatic GL-coding: Assign and look up GL codes with a single click. This function saves time and minimizes data entry errors.

Pros of DocuPhase

- Its electronic invoice workflow streamlines the invoice approval process.

- Saves time on processing invoices by managing and organizing the accounts payable process.

- Easy to use and integrate with the ERP system to speed up invoice processing.

Cons of DocuPhase

- The slow response from their customer support is challenging for some users.

- The software sometimes fails to read invoices, leading to errors and delays in invoice processing.

9. Grooper

Source: G2

About Grooper

Grooper is one of the best OCR software for processing invoices. The software provides high accuracy in extracting data from unstructured and structured documents. This AI-powered solution analyzes your invoices, precisely populates your accounting system, and minimizes manual data entry and mistakes.

This enterprise software uses machine learning and intelligent document processing to improve multiple workflows, such as the accounting AP process. The software serves diverse departments and sectors, such as invoice processing, healthcare claim processing, contract analysis, and image processing.

Grooper pricing

Contact Grooper to get current pricing.

Key features of Grooper

- Document processing: Allows flawless processing of digital and physical documents. You can connect directly to scanner hardware for efficient processing without any add-ons.

- Image processing: Ensures optimal OCR accuracy in data extraction with access to 70 image processing commands.

- Intelligent classification: Employs layered AI for powerful classification and data extraction which helps process vast documents.

- Adaptable integration: Connects to any CMIS-compliant document repository and cloud and local file systems. This supports easy data integration and data exporting into various formats.

Pros of Grooper

- The precision of data extraction and identification with AI technology is remarkable.

- The platform consists of advanced features and affordable prices when compared to competitors.

- Provides flexibility and customization for a variety of use cases beyond OCR.

Cons of Grooper

- Scanning large documents leads the software to hang up in between the process, which necessitates pausing and restarting.

- The software is costly as it requires periodic updates every three years.

10. ABBYY FlexiCapture

Source: ABBYY FlexiCapture

About ABBYY FlexiCapture

ABBYY FlexiCapture is reliable OCR software that uses artificial intelligence (AI), natural language processing (NLP), and machine learning (ML) to convert data from business documents. The software effectively gathers, classifies, and converts key data from unstructured and structured documents into your existing workflows.

This enterprise-scale solution provides highly accurate OCR/ICR/OMR and barcode recognition capabilities while supporting various document types and formats. The software’s deployment options, on-premise, and cloud, help serve different business requirements.

ABBYY FlexiCapture pricing

Contact ABBYY FlexiCapture for Invoices to get current pricing.

Key features of ABBYY FlexiCapture

- FlexiLayout: Uses a ready-to-use FlexiLayout for immediate invoice processing. You can extend the predefined data fields as required.

- Country-specific settings: The software applies predefined processing rules and settings for different countries. It ensures compliance with local regulations.

- Document status detection: Based on validation results, the software assigns invoices one of three statuses (Valid, Exception, Rejected).

- Advanced database look-up: This feature matches invoice data against user databases during recognition. If it finds the correct records, it automatically populates field values.

Pros of ABBYY FlexiCapture

- OCR results are highly accurate, with support for numerous languages and fonts.

- Excellent at accurately converting documents to editable formats like Word.

- The software effectively extracts data from handwritten documents and streamlines business processes with minimal errors.

Cons of ABBYY FlexiCapture

- Setting up ABBYY FlexiCapture on modern systems takes time and necessitates IT support.

- A concern for small businesses might be the pricing. The software price is higher than other competitors.

How to choose the right OCR software for invoice processing

Here are the steps to select the right OCR software for invoice processing.

Step 1. Determine your specific requirements for invoice processing

Invest time in defining your requirements for the OCR software. Consider the following questions when defining requirements.

- How many invoices does your company process on average?

- What types of invoice formats and layouts do you encounter?

- Which systems do the OCR software need to integrate with?

- Which features are necessary for data extraction and automation?

- What is your budget for initial costs and ongoing expenses?

Understanding the requirements upfront helps streamline the selection process.

Step 2. Research and evaluate potential OCR software options

Make sure you invest maximum time in researching OCR software options. Check out reliable websites like G2 and Capterra for detailed reviews and ratings. These websites offer genuine reviews from real users. Apart from reviews, consider the following factors.

- Evaluate the software’s precision in extracting data from the invoices.

- Ensure the software integrates easily with the existing systems.

- Give priority to an easy-to-use interface for efficient workflow.

- Check the quality and availability of the software’s support.

- Compare pricing models based on affordability and value.

Step 3. Test the software with a sample set of your invoices

Testing the OCR software with sample invoices helps analyze the software’s performance and usability. This step also allows you to identify whether the software provides less precision in data extraction or has a slow processing speed. Testing helps you choose an OCR solution that meets your company’s requirements for efficient and accurate invoice processing.

Step 4. Make a final decision based on the testing results

Ensure to make the final decision with careful consideration. If the software you pick fails to fulfill the requirements during the testing period, consider another shortlisted option. However, if one of the options surpasses the fundamental needs, you can move ahead with the software.

After choosing OCR software, proceed to the deployment phase. Integrate OCR software into your existing workflow and optimize efficiency in your invoice processing operations.

Ready to streamline your invoice processing?

This blog provides a list of OCR software to save time and effort in researching and evaluating top options. By providing a shortlist of the best OCR software available, selecting the software that aligns with your invoice processing needs becomes easier.

If you find the above list lengthy and time-consuming, you can choose HyperVerge OCR for invoice processing. With its remarkable 90%+ accuracy in extracting data, HyperVerge OCR is the perfect solution for streamlining your invoicing process. Learn more about HyperVerge OCR or schedule a demo here.

Frequently asked questions

1. Which tool scans and extracts data from invoices?

Optical Character Recognition (OCR) is a tool for scanning and extracting data from invoices. Here are some of the top OCR software options.

- HyperVerge

- Kofax

- Docsumo

- ABBYY FlexiCapture

- Nanonets

- Rossum

2. Does OCR need to be updated when processing invoices?

No, OCR technology remains reliable and essential for processing invoices. Current OCR systems include modern algorithms and machine learning to ensure accuracy and efficiency. This makes OCR an important tool for optimizing invoice processing operations, improving automation, and eliminating manual involvement.

3. Which features to look for in OCR software for invoice processing?

Here are the features to look for in OCR software for invoice processing.

- Data extraction accuracy: Achieves high accuracy in data extraction to reduce errors.

- Template recognition: Automatically adapts to various invoice formats.

- Integration capabilities: Integrates seamlessly with existing systems for workflow automation.

- Automation: Automates tasks and reduces manual intervention.

- User-friendly interface: Enhances productivity with an intuitive interface.

4. What are the benefits of OCR software for invoice processing?

Here are the benefits of OCR software for invoice processing.

- Streamlines invoice processing by automated data extraction.

- Increases accuracy and reduces mistakes in invoice data collection.

- Reduces expenses by automating invoice processing.

- Accelerates invoice processing times through automation.

- Ensures compliance and mitigates risks associated with manual processes.

- Improves visibility and reporting by digitizing invoice data.

5. Can OCR software handle invoices in different languages and formats?

Yes, OCR software handles all invoices in various languages and formats, including scanned images, PDFs, digital docs, handwritten invoices, invoices with different font sizes and styles, invoices with tables or structured data, and invoices in various languages and character sets.

6. How much accuracy can be expected from OCR software?

The accuracy depends on the software’s quality and the document clarity. OCR software accuracy ranges from 90% to 99%. Opting for software within this accuracy range ensures precise data extraction and reduces errors. Certain factors influence the accuracy of OCR results, such as document quality, font clarity, and language complexity.