Errors in bank statement verification can slow down your insurance or fintech business. Are the manual processes in bank statements and identity verification impacting your business efficiency?

If you face any of the above concerns, bank statement OCR software can help you reduce your manual workload and streamline your verification processes. The demand for OCR software is quickly growing. The reports of Grand View Research predict a 14.8% annual growth rate for the optical character recognition market until 2030.

In this blog, we have explored the ins and outs of bank statement OCR, detailing how it works, its benefits, practical applications, and tips for selecting the best OCR software for your needs.

First, let’s discuss the OCR technology.

What is OCR?

Optical Character Recognition (OCR) is a technology that converts scanned paper documents, PDFs, or digital camera photos into easily searchable text. This technology helps businesses simplify data processing, reduce manual errors, and improve accessibility across digital platforms.

Here are the types of OCR systems, each containing different capabilities and uses tailored to different processing needs.

- AI-powered OCR

- Intelligent Character Recognition (ICR)

- Optical Mark Recognition (OMR)

- Intelligent Word Recognition (IWR)

- Barcode Recognition

These OCR systems offer unique functionalities to fulfill specific document processing requirements. From identifying handwritten text to interpreting checkboxes and barcodes, each type of OCR technology specifically automates data extraction operations.

Let’s be specific and discuss how OCR is useful in extracting data from bank statements.

What is bank statement OCR?

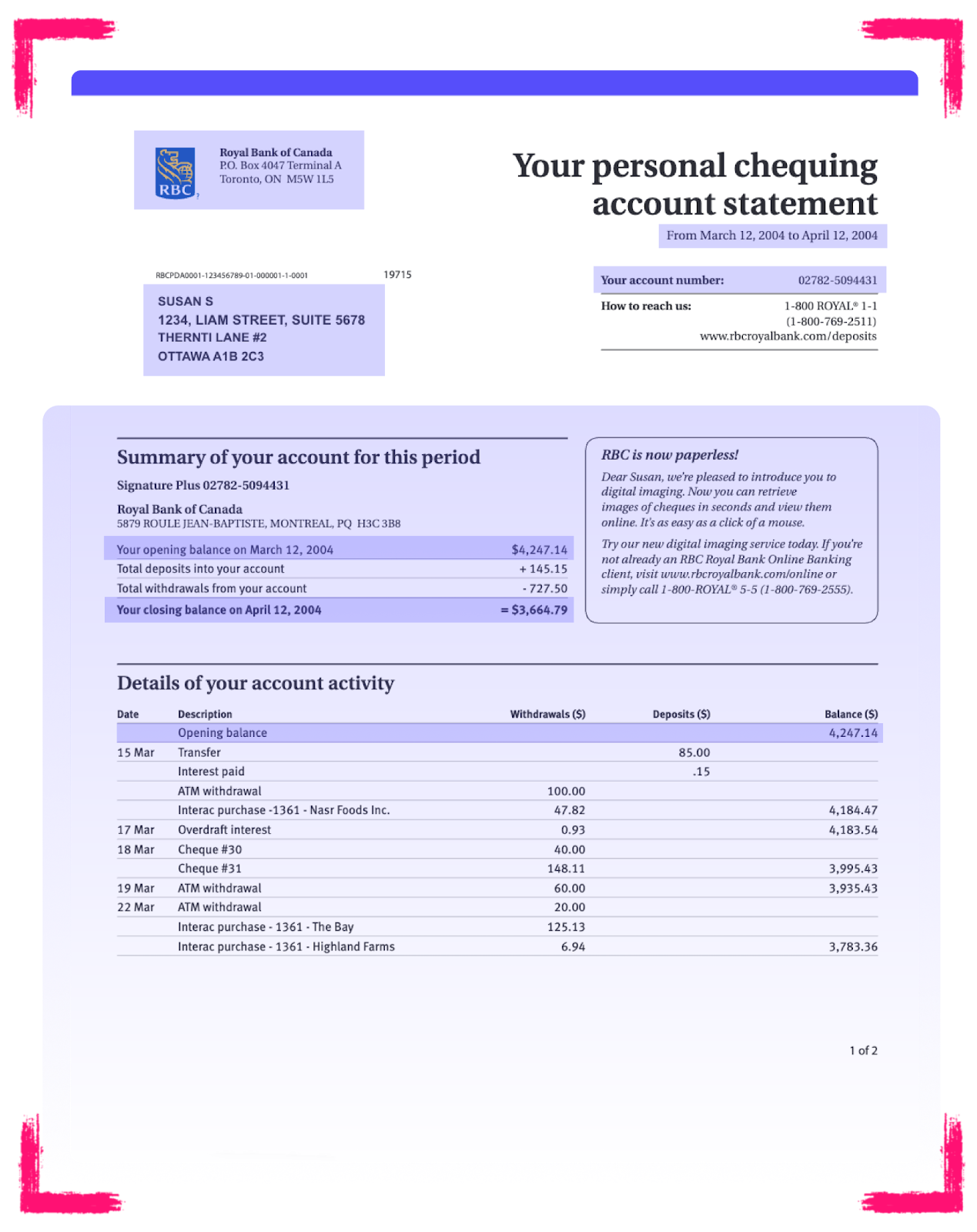

Bank statement OCR is a technology that automatically extracts data from bank statements. This method turns digitized or scanned pictures of bank statements into structured and machine-readable text.

Check out the types of information scanned by bank statement OCR.

- Name of the account holder or holders

- The account number associated with the statement

- Bank name and address

- Transaction details like dates, descriptions, and amounts

- Balance information (beginning land end of statement period)

- Statement period (start and end dates)

- Currency used in the statement

- Other identifying information, such as branch details or customer ID numbers

Further, let’s discuss how to automate data extraction from bank statements.

| Want reliable OCR software for your bank statements? Use HyperVerge’s 13-year trained AI model for OCR that offers exceptional accuracy and reliability for processing bank statements Get a free demo |

How to automate bank statement processing using HyperVerge

Here is the entire process to automate bank statement processing.

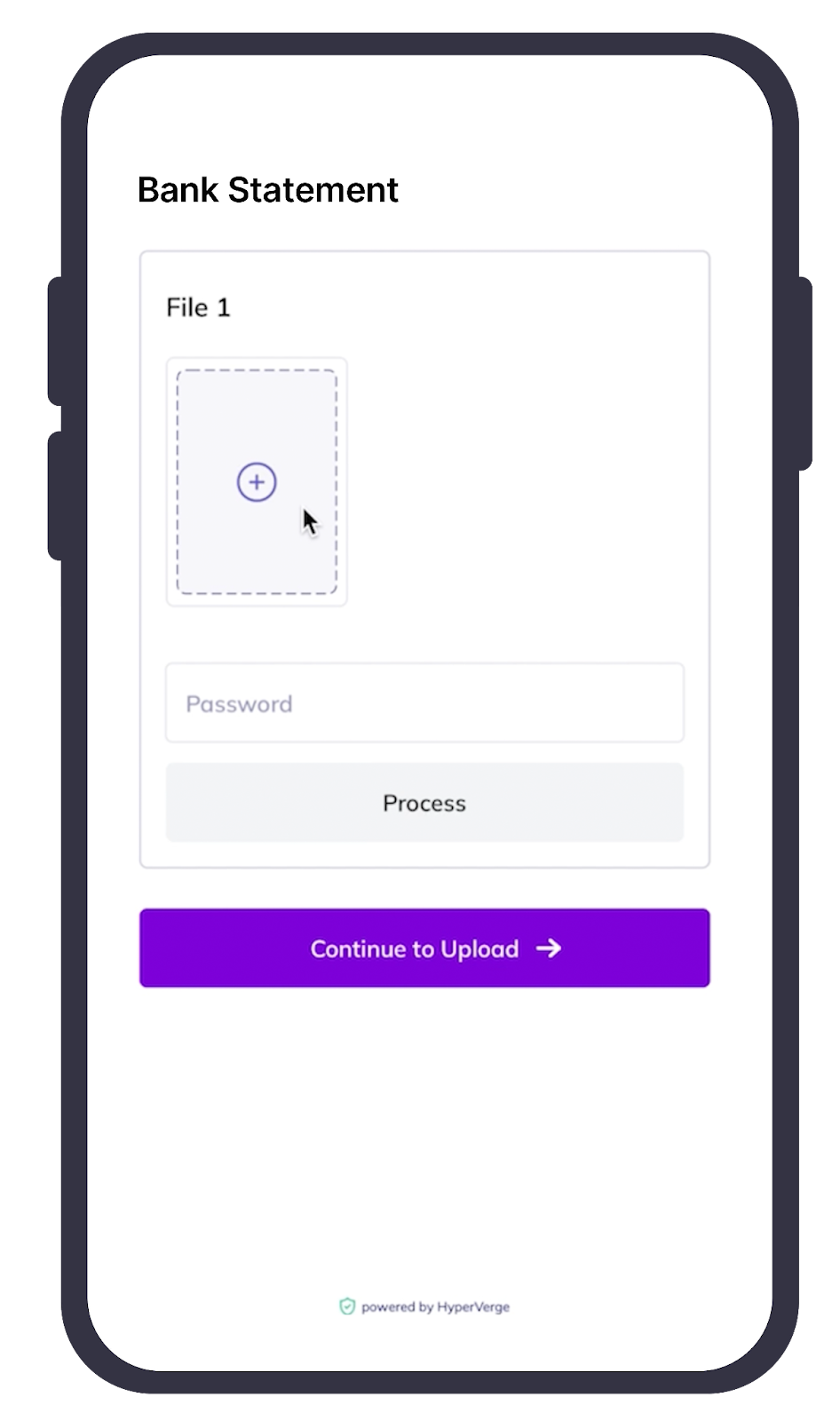

Step 1. Upload bank statement documents

First, click the “Upload” button and submit your bank statement. Our software supports various formats like PDF, JPEG, and PNG. Ensure your files are clear and legible to ensure the best accuracy in processing. If any issues persist during the upload, check the file size and format or contact our support team for assistance.

Step 2. Analyze bank statement documents

HyperVerge’s AI-powered OCR engine is template-agnostic and achieves over 90% accuracy. Upon upload, it immediately analyzes your bank statement documents, scanning all content and data points, even with format or layout variations. Our OCR engine ensures the accurate extraction of all financial information for further processing. This can feed right into your existing workflows (or end-to-end no-code workflows that you can create with our workflow builder.

Step 3. Verify extracted data

Following the analysis, HyperVerge provides the retrieved data for verification. HyperVerge’s template-agnostic engine accurately retrieves essential information from even unstructured bank statements.

Step 4. Structure extracted data

HyperVerge’s intelligent document processing capabilities then organize the extracted data. The software categorizes and arranges the data into appropriate fields like transaction date, name of the payee, reference numbers, and translation amounts.

Let’s take an example of an insurance company for better understanding. The software analyzes and classifies data like policyholders’ names, policy numbers, claim details, and payment amounts.

Step 5. Export structured data

Export the structured data for further processing or integration into your workflow. HyperVerge returns the extracted data in JSON format, enabling integration with your existing platforms and applications.

Financial analysts, compliance officers, and customer service representatives use this formatted data for analysis, reporting, and assisting customers. Now, let’s discuss the benefits of using OCR technology for bank statements.

7 key benefits of using OCR software for bank statements

Using OCR software for bank statement analysis offers several benefits. Let’s look at seven key ones

1. Ensures accuracy in extracting data

OCR bank statement software uses precise character recognition to avoid errors during manual data entry. This approach accurately retrieves important financial details like transaction amounts and dates from different bank statement formats. OCR technology not only improves data accuracy but also saves valuable time.

2. Improves operational efficiency and saves time

OCR technology simplifies the extraction and processing of data from bank statements, cutting time from hours to minutes. This helps financial teams manage their precious time and resources better. It also allows the teams to concentrate on higher-level tasks like financial analysis, strategic planning, and decision-making, leading to increased productivity and efficiency.

3. Offers cost savings through automation

OCR technology used for bank statements provides cost savings through automation. Businesses can reduce their operational expenses related to workforce and administrative overheads by minimizing the need for labor-intensive manual data entry. This automation decreases operational costs and helps companies reallocate resources to more valuable tasks.

Recently, HyperVerge’s partnership with L&T Finance (LTF) proved the cost-effectiveness of HyperVerge’s OCR technology.

By automating KYC document data extraction and real-time identity verification, HyperVerge’s OCR technology enables LTF to reduce manual processing expenses by 40%, saving over $100,000 per year. This case study shows how HyperVerge’s OCR improves processes and substantially reduces costs.

4. Enhances data security measures

Converting bank statements into encrypted formats that are only accessible via secure systems can help reduce the risk of data breaches and unauthorized access. This protects against physical threats and strengthens cybersecurity measures.

5. Facilitate error-free monitoring of transactions

OCR technology in bank statements enables businesses to monitor financial transactions in real-time and receive automatic notifications for errors or suspicious activity. It helps to maintain up-to-date financial reports and ensure compliance with regulatory requirements.

Also, integrating a bank statement analysis API improves transaction monitoring capabilities. This integration assists businesses in detecting fraud or unauthorized transactions quickly to protect financial assets.

6. Streamline integration with financial systems

OCR technology ensures that the data collected from multiple bank statements is accurately and consistently transferred to financial management systems. This connection improves data integrity, minimizes reconciliation challenges, and makes financial reporting more reliable.

For example, businesses use financial systems like SAP or Oracle to handle and process financial transactions. OCR technology automates data entry from bank statements straight into these systems, increasing efficiency and reducing reporting errors.

Now, let’s learn about the use cases of OCR technology in different industries.

Application of bank statement OCR in various industries

Here are the use cases of OCR to help streamline financial operations for different industries.

1. Banking sector

OCR automation excels at extracting data from bank statements, speeding up transaction processing, and ensuring regulatory compliance. The technology allows banks to monitor consumer spending trends and provide customized banking solutions by extracting financial details from statements.

2. Retail and eCommerce

Retailers use OCR to digitize invoices and receipts, increasing inventory management accuracy and improving financial record-keeping. Also, OCR-enhanced systems automatically reconcile sales data with inventory levels. It helps businesses to manage inventories & minimize stockouts, hence increasing sales opportunities.

| HyperVerge Pro Tip: Use OCR technology to evaluate customer return forms. Identify trends in product returns to improve inventory management and reduce return-related losses. |

3. Lending industry

Lending institutions use OCR to speed up the loan origination process. Using OCR technology, lenders can easily process loan applications and related documents. It helps eliminate manual data input blunders and accelerates the loan approval process. Using OCR, lenders extract relevant financial information from bank statements, making it easier to evaluate borrowers’ creditworthiness faster and more accurately.

HomeCredit used HyperVerge OCR to speed up merchant onboarding and overcome manual verification difficulties. The adoption resulted in a 50% drop in error rates and an outstanding 33% drop in application processing time.

4. Legal and compliance

Legal firms and compliance departments use OCR to streamline document inspection, improve data security, and speed up contract analysis. OCR helps legal professionals identify significant information within enormous amounts of legal documents. It increases the efficiency of case preparation and lowers the chances of overlooking important details.

5. Insurance industry

Insurers use OCR to digitize claims forms and policy documents, which speeds up insurance claim processing and improves fraud detection. Also, OCR-enabled systems extract data like policyholder information and coverage details from different insurance documents. It allows insurers to deliver more accurate rates and personalized insurance options.

6. Real estate and property management

OCR helps real estate managers digitize rental contracts and maintenance information, making document retrieval easier and increasing efficiency in administration. Moreover, OCR-powered systems retrieve important data like rental costs and lease conditions, which enables better decision-making and lease negotiations.

After discussing everything about bank statement OCR technology, let’s understand how to select the right OCR software.

How to select the correct bank statement OCR software

Here is the process for choosing the correct bank statement OCR software.

Step 1. Identify your bank statement OCR needs

The first step is to conduct a thorough analysis to define your organization’s requirements for bank statement processing. Here are the criteria you can consider to define your requirements:

| How many bank statements do you process monthly or annually? What information must you extract (dates, amounts, and payee details)? How should the OCR software integrate with your existing financial systems and workflows? How quickly does the OCR need to process documents to keep up with your workflow? What level of accuracy do you require to meet your operational and compliance standards? |

Neglecting these factors may lead to choosing an OCR solution that doesn’t meet your business needs, which can cause slower bank statement processing and higher error rates.

Step 2. Research available OCR options in the market

With defined requirements, begin researching OCR software specializing in bank statement processing. Consider the criteria below to evaluate potential options.

- Check customer feedback and the credibility of OCR software providers.

- Evaluate accuracy and technological advancements in OCR solutions.

- Consider the level of customer support and frequency of software updates.

- Prioritize solutions industry peers support with a proven track record in handling financial documents.

- Assess implemented security measures for handling sensitive financial documents.

Let’s save you time and effort by simplifying the process of searching and evaluating various options. HyperVerge OCR excels at extracting data from bank statements. Its expertise in seamless multilingual document processing breaks language barriers. With its 13-year-trained AI model, HyperVerge OCR enables processing documents in 150 languages.

Step 3. Evaluate the features and functionality of the software

Examine each OCR software on your shortlist, particularly the features and functions essential for processing bank statements. Ensure the software interacts easily with your existing financial systems, minimizing interruptions to current procedures.

Consider the user interface and convenience of use since these will influence your employees’ learning curve and adoption rate.

Step 4. Assess the cost and value of the OCR solution

Move on to assessing the cost effects of OCR solutions. Examine the initial purchase price and the installation and operational expenditures that arise. These expenditures include software integration, employee training, and hardware updates.

Compare these expenses with the expected increases in efficiency and the possible savings on manual labor spending. This cost-benefit analysis helps you decide which OCR software provides the most return on investment.

Step 5. Make a decision on bank statement OCR software

Lastly, when evaluating all the options, consider which option best fits your financial capabilities and long-term business goals. Choose OCR software that not only meets your current requirements but also has the potential to scale with your business.

Choose HyperVerge OCR technology to simplify data extraction

OCR enables you to turn printed and handwritten documents into digital data. This technology improves operational efficiency through automated data entry and enhanced precision.

If you are looking for OCR technology to extract data from bank statements, HyperVerge is the best choice. Here are the reasons why.

- Provides remarkable 90%+ accuracy in data extraction to ensure reliable results.

- Integrates easily with current systems, resulting in effortless process improvement.

- Multilingual document processing capabilities make it easy to break down linguistic barriers.

- Streamlines document processing, resulting in shorter response times and increased operational efficiency.

Choose HyperVerge to automate data extraction from bank statements and streamline your financial processes.

Frequently asked questions

1. How accurately does OCR work with different bank statement layouts?

The accuracy of OCR technology varies depending on the type and quality of bank statements. Modern OCR systems excel at processing a variety of digital formats and clear scans, with accuracy rates of up to 90%. Document quality and the OCR software’s ability to handle varied fonts and layouts are essential for best results.

2. How does bank statement OCR reduce expenses?

Integrating OCR eliminates the need for manually entering information and lowers errors that require correction. These cost savings include:

- Automating data entry reduces the cost of manual labor.

- Reduced data input errors save time and money on corrections and mitigate financial inconsistencies.

- Faster data processing improves financial decision-making and cuts operational delays.

3. What are some best practices for integrating bank statement OCR into existing workflows?

Here are the best practices for integrating bank statement OCR into existing workflows and systems.

- Begin by mapping current procedures to see where OCR can be most helpful.

- Ensure the OCR solution is compatible with your current financial software and databases.

- Before implementing the OCR thoroughly, do a test run to assess its performance and make any required changes.

- Provide your team with the required training to use the new system adequately.

4. Can OCR recognize handwritten text on bank statements?

Yes, OCR systems integrated with Intelligent Character Recognition (ICR) recognize handwritten text on bank statements. However, depending on the readability and consistency of the handwriting, the accuracy of recognition is lower than that of printed text.

5. Can OCR extract non-financial information from bank statements like customer details or transaction descriptions?

Yes, OCR is not restricted to retrieving financial data. The technology also extracts non-financial data such as client names, addresses, and transaction details. This works well when performing detailed data analysis and boosting customer relationship management.