Global digital payment volumes are projected to reach 1.9 trillion transactions by 2025. As digital transactions continue to dominate, financial sectors witness one major challenge—risk-proof identity verification.

Imagine verifying a large number of customer identities through human oversight or basic checks. Any mistake during the verification process can result in non-compliance penalties, document fraud like forgery, and other financial crimes.

Further, this accuracy must be balanced with speed and positive customer experience. Can businesses achieve this holy trifecta while saving cost and efficiency?

Absolutely.

Automated document verification solutions are reshaping how financial institutions approach identity checks in the digital age. It is paving the way for industries, particularly, banks, e-commerce, fintech, and crypto, to serve customers while safeguarding against fraud and compliance checks.

In this article, we will dive into key features, benefits, and industry-specific use cases of automated document verification. Plus, how these benefits compound into revenue growth and competitive advantage for businesses.

What is automated document verification?

Automated identity document validation and verification is an AI-powered process. It authenticates identity documents in real time, without human intervention. Its advanced algorithms extract and validate information from IDs, passports, and other official documents.

Why automated document verification matters

A business is just one verification mistake away from reputational damage and monetary losses.

Banks, fintechs, and other financial institutions have to navigate a complex web of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Verification is a foundational step that directs the further KYC procedure. It decides if an individual needs intensified scrutiny or only basic CDD checks would be enough. Error in this step can mess up compliance standards or break your organization’s financial integrity.

Verifying documents manually is slow and lengthy. This makes customers drop off in between the process, translating into missed revenue opportunities.

Also, you will be hiring more employees to meet the growing demand. Still, human-led processes often fail to pinpoint subtle red flags.

Hence, manual checks aren’t sufficient to overcome the challenges that digital transactions present.

That’s why automated verification systems aren’t nice-to-have but must-have. They help businesses keep pace with the growing cashless economy while balancing customer expectations, fraud protection, and regulatory demands.

How automated document verification works

Customers are asked to upload identity documents for verification. The software scans through these documents and delivers output. It validates the integrity of documents based on a set of rules. Commonly verified documents including government-issued IDs, passports, driver’s licenses, and utility bills.

The document verification process

Below is the step-by-step process of how automated the document verification process works.

1. Users upload or scan their ID documents.

2. AI algorithms extract relevant information from the document.

3. The system analyzes security features, fonts, and layouts.

4. The system cross-checks extracted data for internal consistency.

5. Algorithms verify information against external databases when applicable.

Another marked capability of automated verification solutions is the customizability of the process. You can modify the above process to align with your unique organizational needs.

Role of AI in document verification

AI is the cornerstone of automated document verification.

Machine learning algorithms can:

- Recognize and classify document types with 99% accuracy

- Detect sophisticated forgeries by analyzing minute details invisible to the human eye

- Adapt to new document formats and security features, staying ahead of fraudsters

Document verification software features

Key functionalities of modern document verification tools include:

- Real-time processing

- Multi-document support

- Global coverage for various ID types

- Liveness detection to prevent spoofing

- Automated data extraction and formatting

- Integration with existing KYC/AML workflows

Benefits of automated document verification

Automation gives your business an edge over your competitors in multiple ways. Below are major benefits that contribute to growth.

Speed and efficiency

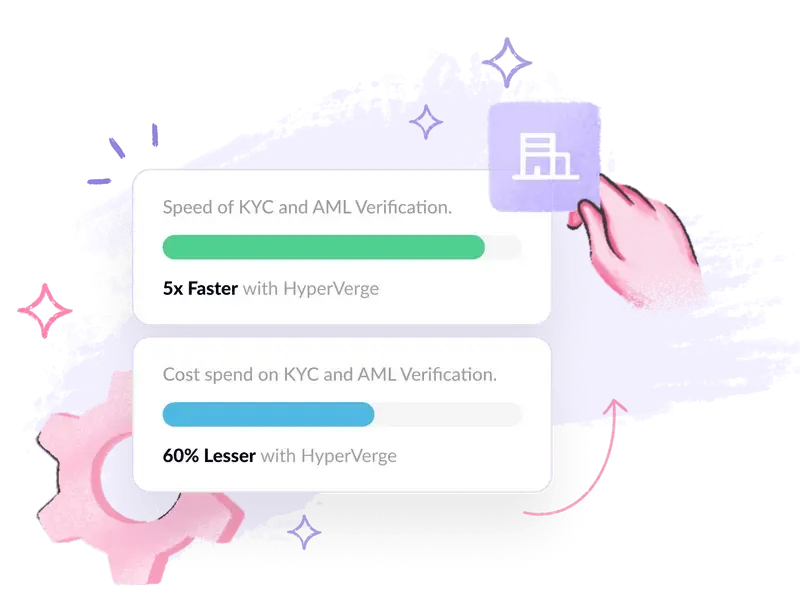

A 2023 study by Juniper Research says advanced document verification software can reduce KYC checks from 2 days to under 3 minutes, slashing operational costs by up to 70%.

AI also helps businesses save on employee headcount by processing huge documents within minutes. This reduces losses due to human errors and boosts efficiency.

Enhanced security

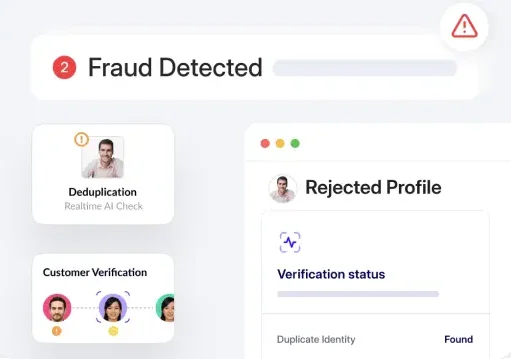

Identity fraud cost the global economy over $43 billion in 2023. Automated document verification software acts as a barrier against such fraud. Advanced systems can detect manipulated or fraudulent documents with higher accuracy than humans.

Moreover, these systems ensure consistent compliance with evolving regulatory standards. They can be quickly updated to reflect new requirements and minimize the risk of penalties.

Improved customer experience

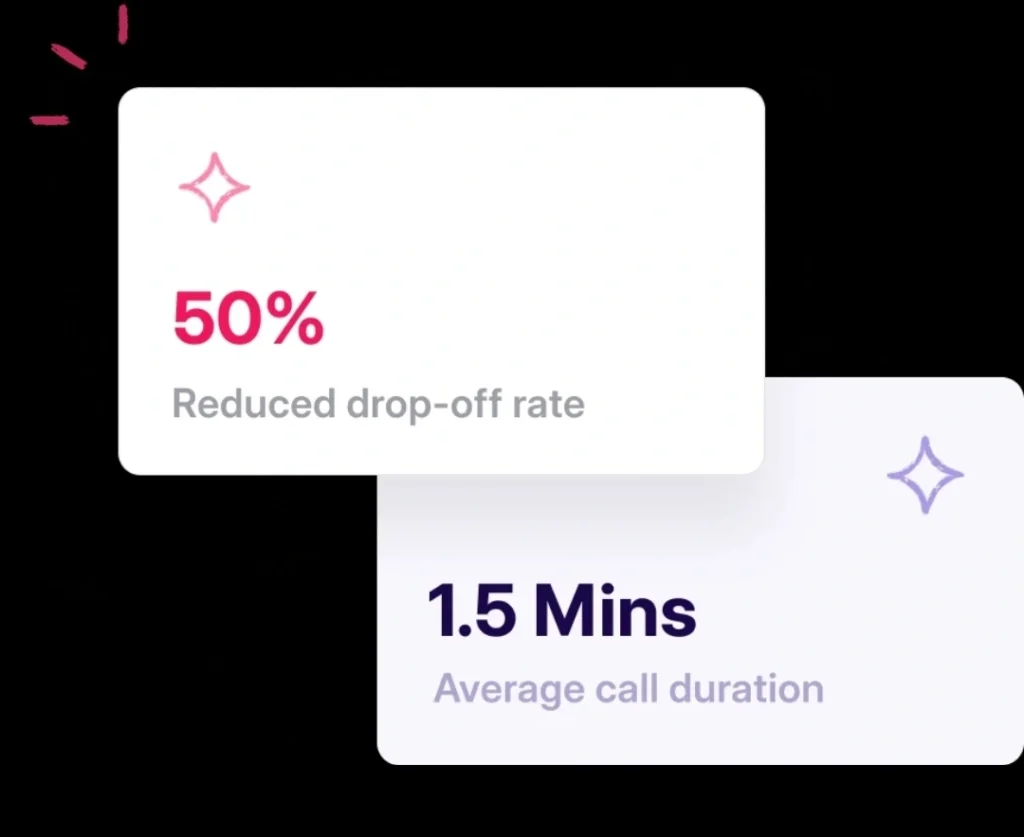

68% of customers abandon the application during the onboarding. This indicates the need to design a simple and engaging process.

Automated verification creates streamlined, frictionless user journeys. Your users can complete identity checks from anywhere, at any time, often in less than a minute.

Key features of automated document verification solutions

Let’s discuss what exceptional features automated verification has and why they matter for your business.

Real-time document verification

Modern-day customers are wired to instant gratification. Delays in the verification process can lead to abandoned transactions and lost revenue.

The impact of real-time verification extends beyond convenience. It empowers businesses with improved speed and customer satisfaction.

For example, HSBC Bank reported a 40% reduction in onboarding time after implementing real-time verification, leading to a 25% increase in completed applications.

Seamless integration

Your organization can integrate automated verification into existing infrastructure through robust APIs (Application Programming Interfaces). With a well-integrated verification system, you can launch new products faster. This gives you an early-mover advantage in your industry.

Key considerations for seamless integration include:

1. API flexibility: Look for providers offering RESTful APIs that support multiple programming languages. HyperVerge offers 100+ APIs with best-in-class integrations to its users, across multiple industries.

2. Testing environments: Testing helps identify and reduce integration errors before going live. With HyperVerge, users go live in only four hours.

3. Scalability: APIs should handle sudden spikes in verification requests, without performance degradation.

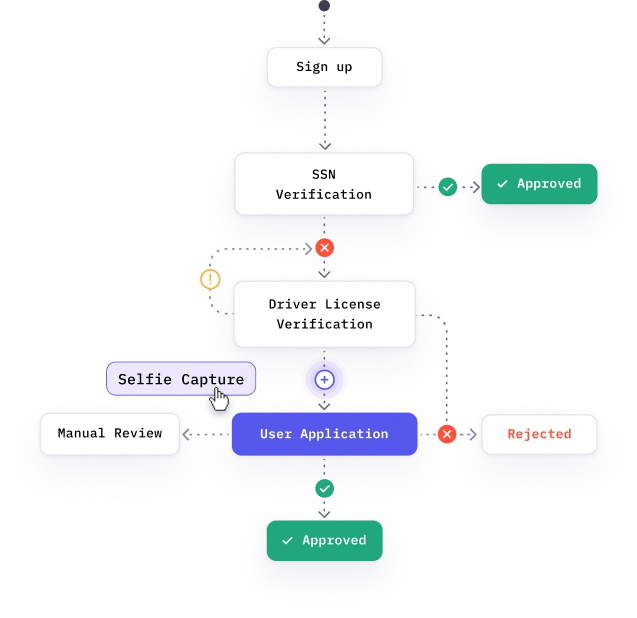

Customizable workflows

Customized verification processes don’t only bring flexibility to organizations. It also improves fraud prevention and customer experience as they go through the application.

Examples of customizable features include:

1. Verification steps: Define which documents your business requires and the verifying documents in what order. For instance, a crypto exchange might require both a government ID for document verification and proof of address. While a streaming service might only need age verification.

2. Risk-based approach: Create different verification levels based on transaction value or user risk profile. For example, a global payment gateway can apply stricter verification for first-time users making large transfers. This will help reduce fraud.

3. Localization: Adapt to regional regulations and various document type types. Customizable workflows help your organization expand beyond borders while adapting to unique KYC requirements.

4. Failure handling: Businesses can define custom retry attempts and alternative manual verification routes. Organizations offering options for multiple document types (PAN card, passport, bank statements, etc. during manual verification can decrease customer drop-offs.

Create customizable workflows using HyperVerge’s automated document verification services, without writing a single line of code. That too, in minutes.

Verify Identity Documents in minutes

with AI-powered precision and customized process Schedule a DemoBest practices for implementing automated document verification

Your organization’s ROI from automated verification largely depends upon three factors:

- Choice of service provider

- Correct compliance approach

- Effective integration into your onboarding process

Let’s talk about how to optimize all of them.

Selecting the right document verification service

Here are key criteria to consider:

1. Look for providers with 97%+ accuracy.

2. Ensure support for documents from all relevant jurisdictions.

3. APIs should easily connect with your existing systems, with minimal disruption.

4. The service must handle your peak volumes without compromising speed.

5. Verify SOC 2, ISO 27001, and other industry-specific compliance standards.

Leading providers like HyperVerge have delivered outputs with the industry’s highest accuracy and auto-approval rates to their clients. It cuts down the average document verification time to less than 20 seconds.

Ensuring compliance

Key regulations to consider are:

GDPR (EU): Mandates strict data protection and user consent protocols.

CCPA (California): Focuses on consumer data rights and transparency.

BSA (US): Requires robust AML procedures for financial institutions.

Besides compliance, regular audits are essential. Companies conducting quarterly compliance audits were 63% less likely to face regulatory fines.

Integrating into onboarding processes

Here’s how you can incorporate automated and automatic document classification, validation, and verification into the onboarding process:

1. Map your current onboarding journey.

2. Identify data points and document validation steps.

3. Design a fallback process for verification results or failed verifications.

4. Implement gradual rollout, starting with a pilot group.

5. Monitor key metrics like completion rates, time-to-onboard, and customer satisfaction.

But integration alone can’t fulfill the purpose. The automated process is as effective as the employees executing it. This is where staff training becomes important.

Goldman Sachs reported a 40% reduction in onboarding-related queries after implementing a staff training program for their new verification system. Develop an interactive training session that covers technical aspects and customer communication.

Use cases of automated document verification.

You can find AI-powered document verification across multiple financial institutions. Banks, e-commerce, fintech, crypto, and gaming sectors are at the forefront of using this technology to verify documents. Here are real-world inspired examples.

Banking

In financial services, automated verification is revolutionizing account openings. Traditional banks like JP Morgan Chase have reduced account opening times from days to minutes. Their 2024 report says it saw an 80% decrease in abandonment rates for new applications.

Fintech

For fintech startups, automated KYC is a game-changer. Zest Money, a fast-growing consumer lending company, reduced the document authentication process from 8 minutes to 10 seconds, using HyperVerge’s robust automated solution.

Crypto

Coinbase, a leading crypto exchange, implemented machine learning for identity verification. The system recognizes abnormalities and potential forgery across documents. These algorithms help the company onboard new customers much faster while having a powerful anti-fraud mechanism in action.

Gaming

Flutter Entertainment implemented an AI-powered age verification system in 2023. They reported a 92% reduction in underage gambling attempts and a 25% increase in customer trust ratings.

Future trends in document verification

The future of document verification is shaped by emerging technologies like:

Biometric authentication

Facial recognition and fingerprint scanning are becoming standard. Biometric systems are harder to deceive. They provide a strong defense against identity theft and fraud.

Unlike passwords, a person’s biometric data isn’t easy to steal. Also, people tend to forget passwords but can log in safely and stress-free using their biometrics.

Blockchain-based identity

Decentralized identity solutions promise enhanced security and user control. Blockchain technology puts individuals in complete control of their data.

Users can create digital identity tokens and share only necessary information with verifiers. This will eliminate the need for capturing data from national identity cards or government databases. Consequently, the number of cyber attacks will decrease.

Continuous authentication

Instead of one-time checks, continuous authentication implies ongoing verification.

This approach uses AI to analyze user behavior, device characteristics, and biometric data.

The system creates a real-time dynamic risk profile. Constantly verifying identity throughout user sessions minimizes fraud risk.

By 2030, 85% of all digital identity verifications will be automated and instantaneous. Future-oriented financial institutions are already using AI to verify a high volume of documents, without compromising on security or incurring additional labor costs.

HyperVerge enables such futuristic fast-growing businesses with frictionless user onboarding. After processing 750+ million IDs across borders, its AI is trained for maximum accuracy and fraud detection. Verify documents with the highest efficiency while staying compliant with international and industry-specific laws.

Join leading global organizations obtaining higher customer conversion, retention, and revenue with automated document verification services. To know more about how HyperVerge can accelerate your business’s growth, schedule a demo today.

FAQs

How to automate document checking?

Automating document checking involves using AI-powered software to extract, analyze, and verify information from various documents. The process employs Optical Character Recognition (OCR) to extract text and Machine Learning to validate the document’s authenticity. Advanced systems incorporate additional layers of security, such as liveness detection and biometric matching, to prevent fraud.

What is an automated verification system?

An automated verification system uses AI and machine learning to authenticate identity documents. It verifies personal information in real time, without human intervention. The system rapidly extracts data from IDs, passports, and other official documents. The extracted data is compared against databases and checked for forgery or manipulation.

What is automated document processing?

Automated document processing is an AI-driven technology that extracts, validates, and organizes information from various document types without human intervention. It uses advanced algorithms to interpret both structured and unstructured data. This technology reduces manual data entry, minimizes errors, and streamlines document-heavy processes across industries.