What if bettors win every bet they place on your platform? That’s the worst nightmare for bookmakers.

Arbitrage gambling shapes this nightmare into a reality. It’s a silent threat to your business’s bottom line.

As a bookmaker, your company relies on maintaining an edge over your customers to stay profitable. But arbitrage bettors take away a huge chunk of your profits.

A 2022 study by the International Betting Integrity Association estimated that arbitrage betting costs the industry over $400 million annually in lost revenues and increased operational costs.

Sports betting, cryptocurrency, forex trading, stock markets, and online casinos are the primary businesses impacted by arbitrage betting strategies.

When arbitrageurs capitalize on discrepancies in odds or bonuses, your margins shrink. Over time, this can add up to significant losses.

What’s worse, arbitrage gambling is legal. Hence, companies don’t have legal support. The betting company cannot take any legal action against arbitrageurs, asking them to compensate for the losses.

That’s why having robust preventive measures in place is paramount. Financial and betting sectors must understand the factors that favor or prevent arbitrage betting opportunities. So these factors can be avoided before they become arbitrage weapons for bettors.

This article will dive into different arbitrage gambling practices, which opportunities and situations betting arbitrageurs often exploit, and how they avoid detection. Further, the article informs about effective methods to safeguard your business against these betting strategies.

Let’s begin.

What is arbitrage gambling?

Arbitrage gambling, often called “arbing,” is a strategy where bettors exploit price differences between betting sites to guarantee a profit. Arbitrageurs (people who place arbitrage bets) make overall profits, regardless of the outcome.

It’s the betting world’s equivalent of buying low and selling high, simultaneously.

Imagine you’re at a carnival, and there’s a coin flip game. One booth offers you $2 if it lands heads, and another offers $2 if it lands tails. If you bet $1 at each booth, you’re guaranteed to win $2 and lose $1, betting a profit of $1 no matter what.

This is what a sure bet (also called arbitrage) is in the betting world. You’re betting on all possible outcomes of an event but at different bookmakers. This guarantees a profit regardless of the result.

Here’s a simple example:

- Bookmaker A offers 2.10 odds for Team X to win

- Bookmaker B offers 2.05 odds for Team Y to win

- An arber bets $100 on each outcome, spending $200 total

- If Team X wins, the arber gets $210 from Bookmaker A

- If Team Y wins, the arber gets $205 from Bookmaker B

- Either way, the arber profits $5-$10

What are different arbitrage betting strategies?

Besides sure bet, arbitrageurs exploit betting opportunities using two other strategies, which are:

Cross market

Cross-market arbitrage is like being a savvy shopper who notices that apples are cheaper at one store than another.

In betting terms, it often involves placing bets and finding different odds for related events. For instance:

- Betting on a tennis player to win a tournament

- Betting on the same player to win their next match

Sometimes, due to how bookmakers calculate odds, arbitrageurs might find discrepancies that they exploit for an assured profit.

Bonus hunting

Bonus hunting is like extreme couponing but for betting.

Online bookmakers often offer bonuses to attract new customers. These might be:

- Free bets

- Matched deposits (they double your first deposit)

- No-deposit bonuses (free money to bet with)

Bonus hunters sign up for multiple bookmakers to claim these offers. They then use clever strategies to cash in these bonuses.

For example, if you get a $50 free coupon, you have two choices:

1. Use it on a bet with high odds

2. Use your own money to bet on the opposite outcome at another bookmaker

No matter what happens, you’ll make a profit.

Some arbitrageurs even use bots to maximize profits. Arbitrage betting bots are sophisticated software programs.

These bots simultaneously scour dozens, sometimes hundreds, of different betting companies and sites. They spot and exploit all subtle discrepancies in odds, within seconds.

Arbitrage gambling examples in multiple industries

While arbitrage gambling is more popular in sports betting, it can also occur in forex trading, cryptocurrency exchanges, and other financial markets.

Let’s explore some real-world inspired examples in different sectors.

Sports betting

Imagine the Cricket World Cup final between India and Australia. Bookmaker A offers odds of 2.1 for the Indian team to win, while Bookmaker B offers 2.2 for the Australian team.

An arbitrageur could place an arbitrage bet on both outcomes, guaranteeing a profit regardless of the result.

Similarly, a bettor might place 3 bets in the same event. The third bet could be for the case of a draw.

Forex trading

Picture a scenario where 1 USD = 0.9 EUR on Exchange A, 1 EUR = 1.2 GBP on Exchange B, and 1 GBP = 0.95 USD on Exchange C.

A trader could convert $10,000 to €9,000, then to £10,800, and finally back to $10,260, pocketing a quick $260 profit.

Cryptocurrency

During the crypto boom, price discrepancies between exchanges were common. For instance, Bitcoin might trade at $30,000 on Coinbase but $30,500 on Binance.

Quick-moving traders could buy on Coinbase and immediately sell on Binance for a $500 per coin profit.

Online casinos

Some arbitrageurs exploit differences in slot machine payout rates. Casino A might offer a 96% return-to-player (RTP) on a specific slot, while Casino B offers 98% RTP on the same game.

By playing more on Casino B, a player could reduce their long-term losses.

Prediction markets

During elections, different prediction markets might offer varying odds. In 2016, some markets gave Trump a 10% chance of winning. Others went as high as 40%.

Arbitrageurs could have locked in profits by betting on both outcomes across multiple bets and platforms.

Stock market

American Depository Receipts (ADRs) sometimes trade at different prices than their underlying foreign stocks. Suppose, an ADR for Toyota trades at $100 in New York while the actual stock trades at an equivalent of $99 in Tokyo.

Traders who act swiftly can profit from this discrepancy.

Betting exchanges vs. traditional bookmakers

During a major tennis tournament, a betting exchange might offer odds of 1.95 for Nadal to win. While traditional bookmakers offer 2.05.

Bettors could back Nadal on the bookmaker and lay (bet against) him in exchange for a guaranteed profit.

Most of these opportunities require quick action, sophisticated tools, and significant capital to exploit them. Arbitrageurs spot a suitable opportunity through various instances.

Let’s see what instances favor arbitrage gambling.

When do arbitrage bets take place?

Market inefficiencies

Different bookmakers may have varying risk assessments or different market focuses. There might be an information gap, due to which platforms couldn’t determine the correct price of a particular thing.

In typical stock market terms, inefficiencies arise when securities prices do not reflect the consistent and fair value of its underlying assets. This leads to the fluctuating market value of the same stocks.

Some traders use these fluctuations to hold stocks at lower prices for a day, or even minutes. Then, sell them later at a higher price.

News and events

Breaking news about injuries or team changes can create temporary arbitrage opportunities. The time window between news breakout and price adjustment by bookmakers presents an opportunity.

Arbitrageurs use it to bag profits.

Fluctuating odds

As new information or changing betting patterns come in, bookmakers adjust their odds. This creates brief arbitrage windows where the odds momentarily don’t reflect a balanced market across all bookmakers.

Suppose bookmaker A initially offered 2.0 odds for Team X’s win. Bookmaker B offered 2.1 odds for Team Y. As more people bet on Team X, Bookmaker A adjusts their odds to 1.9. But Bookmaker B hasn’t updated yet, still offering 2.1 for Team Y.

In this brief window, a bettor could place two bets each on both outcomes and guarantee a small profit.

Bookmaker errors

Sometimes, bookmakers might mistakenly offer much higher odds than they intend. Or they may be slow to update their odds after obvious shifts in probabilities.

Bookmakers can also make mistakes in calculating complex bets or accumulators. This too results in inaccurate odds that mismatch with the true probabilities.

Arbitrageurs take advantage of such errors before bookmakers correct them.

Liquidity differences

Different exchanges or platforms may have varying levels of liquidity for the same asset. This creates price inconsistencies.

Consider a stock trading at $50 on the New York Stock Exchange. This might be available for $49.50 on a less liquid European exchange.

Now, an arbitrageur could buy the stock on the European exchange and immediately sell it on the NYSE, pocketing the 50-cent difference.

Is arbitrage betting legal?

Arbitrage gambling is legal in most jurisdictions. It doesn’t involve cheating or manipulating outcomes.

However, financial institutions can prevent it by having strict terms of service. Bookmakers take certain actions against exploitative behavior.

We will talk about them in upcoming sections of this article.

How do arbitrageurs try to avoid detection?

Arbitrageurs employ various tactics to fly under the radar:

- Creating multiple accounts through different emails

- Using VPNs and deceptive IPs to mask their location

- Placing bets with consistent amounts

- Rounding off the bet amount, like, setting $350 instead of $286.22, to avoid suspicion.

- Mixing arbitrage bets with regular bets

Safeguard Your Business From Arbitrage Gambling Threats

With Hyperverge Powerful Identity Verification Solutions! Schedule a DemoWhy should you care about arbitrage gambling?

Arbitrage gambling poses several risks for betting companies and financial institutions. These include:

Reduced profits: Arbitrageurs skim guaranteed profits, reducing your margins.

Market distortion: Large arbitrage bets can artificially shift odds, affecting your market integrity.

Operational costs: Detecting and preventing arbitrage practices requires significant resources, including money and human labor.

Regulatory scrutiny: High volumes of arbitrage activity might attract unwanted regulatory attention, especially when it’s linked to money laundering and related activities.

How to detect arbitrage gambling using AI?

Present-day bettors bank on speed to exploit the opportunity as soon as it appears. They use smart techniques to act swiftly and deceive bookmakers.

Manual methods won’t be effective against evolved betting techniques and bots. To counter arbitrage attempts, present-day companies need smarter solutions.

Advanced software can detect arbitrage betting patterns across accounts and platforms. The below methods help you pinpoint and prevent unethical gambling practices before they can happen.

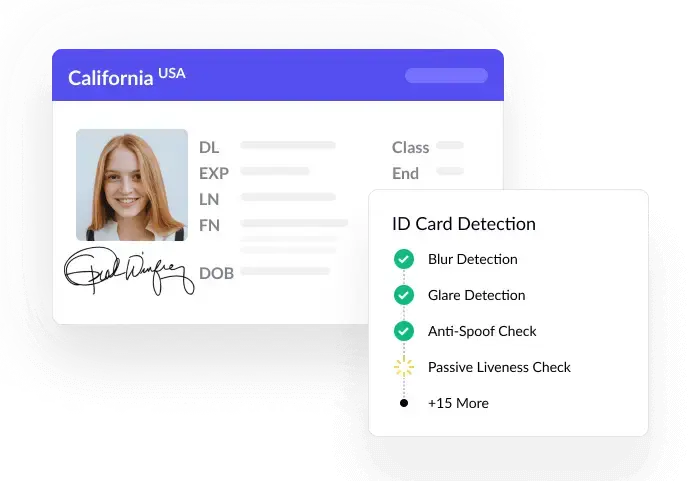

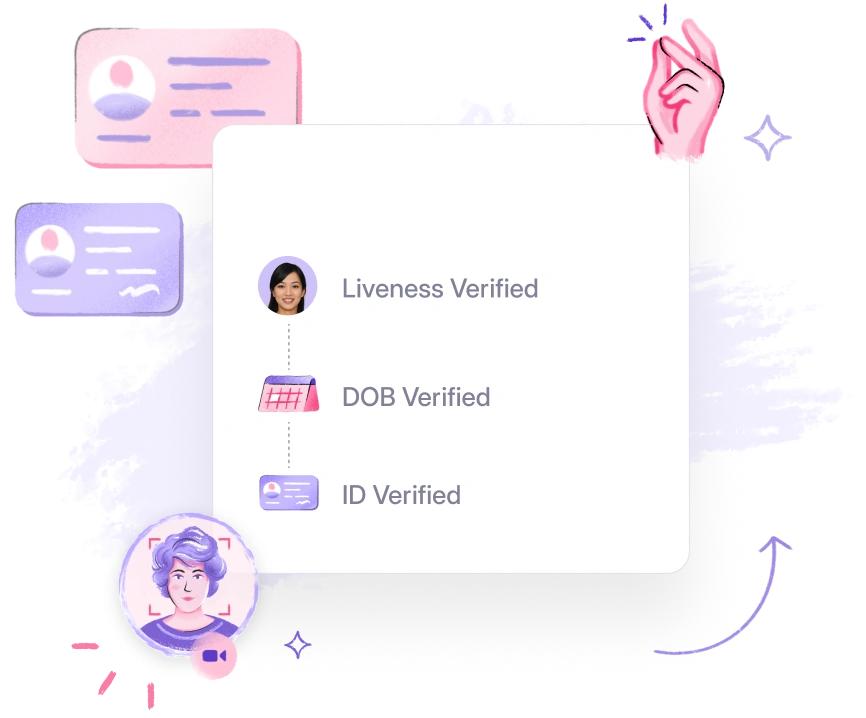

Identity verification

Implement stringent KYC processes to ensure each account represents a unique individual. Strengthen your KYC checks with advanced software that verifies details with high precision.

Liveness detection

Ensure that your users are real individuals, not bots or synthetic identities. Ask them to click a live selfie during KYC.

AML screening

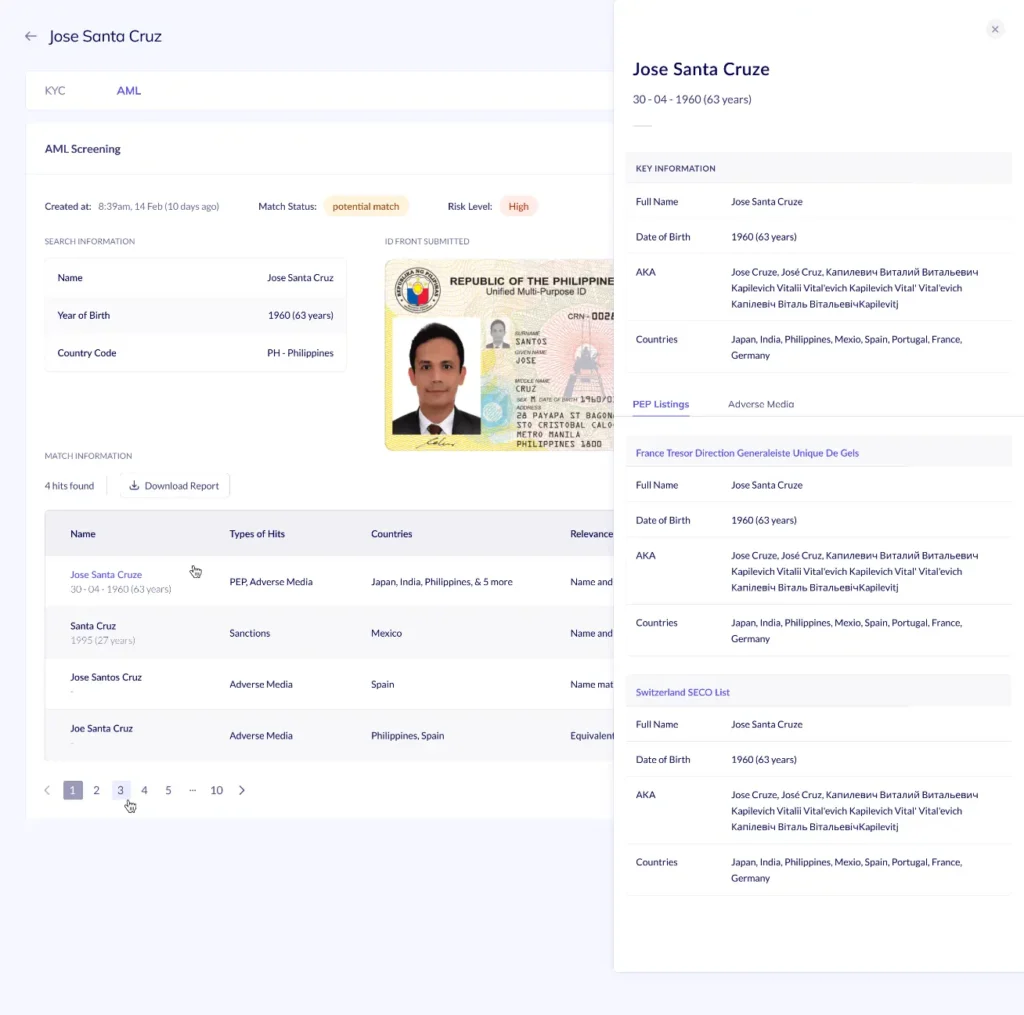

Search the user’s name against the existing database to find out if an individual has a record of being involved in money laundering or any other financial crime. Adverse media checks can reveal if a person has previously attempted arbing.

Transaction monitoring

Implement proactive Anti-Money Laundering checks to detect unusual high-volume bets. It helps you file timely SARs to respective authorities and comply with regulatory standards.

Bank card verification

Verify that the payment methods used belong to the account holder. When several accounts linked to the same card show suspicious patterns, it helps identify arbitrageurs spreading their bets across multiple accounts.

Risk profiling

Analyze a bettor’s behavior, betting history, and account details. By comparing this data against known arbitrage patterns, bookmakers can quickly flag accounts that may be exploiting the odds.

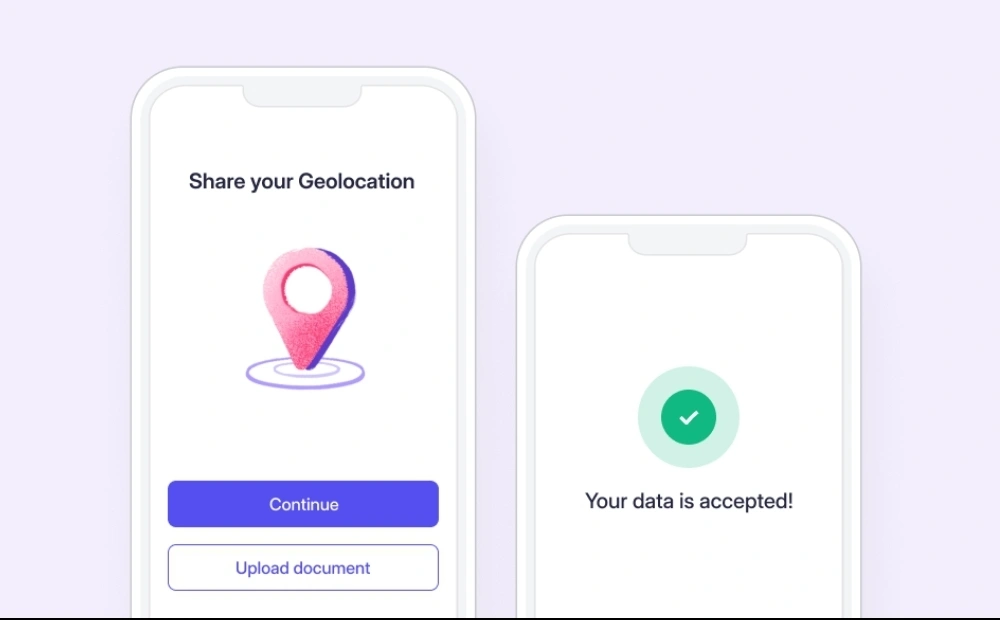

Geo-location tracking

Track the user’s physical location to identify rapid logins from different places. It also pinpoints the use of VPNs to access region-specific odds.

Pattern analysis

Use AI to analyze betting patterns and flag potential arbitrage activity in real-time.

These red flags are:

- A bettor who often places small bets suddenly places a large amount

- The bettor keeps repeating bets in an event

- A bettor withdraws money more than normal frequency and maintains a consistent account balance

- A bettor places bets on unpopular and unlikely event

What action can betting platforms take?

Limit the bets: Restrict the amount size for a particular bet or place limits on the number of bets from a single account.

Cancel the bets: Dismiss bets from accounts that indicate suspicious activities.

Shut down accounts: If an account constantly displays arbing potential, shut it down after 2-3 warnings.

Establishing preventive terms and conditions: Bookmakers can introduce wagering requirements in their terms of service to restrict easy exploitation. For example, bettors must bet the bonus amount several times to be eligible for withdrawal.

Stay ahead of arbitrage gambling threats with robust KYC/AML solutions

Implementing robust KYC/AML solutions is the key to beating the challenges arbitrage gambling presents.

HyperVerge’s AI-powered solutions offer a comprehensive approach to building a strong defense mechanism against arbitrage gambling. Through its advanced AML/KYC solutions, you can implement:

- Frictionless identity verification

- Precise liveness detection

- Real-time AML screening

- Adverse media checks with the most recent data

- Complete and detailed user risk profiling

- Consistent compliance with AML and KYC regulatory standards

Stay one step ahead of arbitrageurs. Protect your profits and maintain market integrity, while offering a positive experience to your genuine customers.

FAQs

1. Is arbitrage betting legal?

Yes, arbitrage betting is legal in most jurisdictions, but it often violates the terms of service of betting platforms.

2. What is gambling arbitrage?

Gambling arbitrage is placing bets on all possible outcomes of an event across different gambling platforms, to guarantee a profit due to discrepancies in odds.

3. Can you get in trouble for arbitrage betting?

While not illegal, you may have your accounts restricted or closed if betting platforms detect consistent arbitrage activity.

4. How do bookies detect arbitrage?

Bookmakers use sophisticated bots to analyze betting patterns, cross-reference accounts, and monitor for suspicious activity indicative of arbitrage betting.