Money laundering is a financial crime in which a criminal disguises the source of money gained from illegal activities such as tax evasion, human trafficking, drug trafficking, and corruption.

Money laundering involves complex financial transactions through multiple channels of a financial system, making it difficult to trace its origin. As the real estate sector involves large-scale financial transactions, criminals find it easy to rotate money, causing lasting damage to the entire ecosystem.

A study estimated that $3.1 trillion of illegal funds flowed through the global financial system in 2023, severely impacting the international economic, social, and security sectors.

To ensure proper risk assessments, compliance, and money laundering supervision, real estate agents need to stay aware of and abide by the anti-money laundering (AML) regulations.

Why are AML checks important for estate agents?

It is quite evident that the property market is lucrative and involves huge financial transactions via cash and bank transfers. Cash transactions make it easier for criminals to launder money and avoid scrutiny from banks and other financial and government institutions.

Criminals keep taking advantage of the system’s loopholes and continue performing illegitimate property transactions, causing severe damage to the real estate sector, the credibility of public and private contractors, and the economy at large.

A thorough AML check can reveal a suspicious buyer who is interested in a high-end property but is hesitant to explain the source of their funds, raising red flags about the legitimacy of the purchase.

Protecting the integrity of the real estate market

A money laundering reporting officer and an estate agent play a pivotal role in ensuring the cleanliness and compliance of the real estate ecosystem.

An AML officer and real estate agent can identify huge transactions and big or unusual property purchases, especially by anonymous identities. They can also identify other red flags indicative of suspicious activities, thus preventing money laundering.

Legal and regulatory compliance

The estate agents need to ensure AML compliance and regulatory checks across all levels and facets of the real estate sector and adhere to all local, state, and federal laws, regulations, and codes.

Regulatory compliance and AML checks make all the internal and external processes of property transactions, leasing agreements, etc. transparent and help in the process of mitigating risks to legal disputes and financial penalties. His Majesty’s Revenue & Customs (HMRC) mandates these checks under the Money Laundering Regulations Act of 2017.

Reputation and trust

Staying compliant and ensuring AML checks for estate agents is important for fostering trust and reputation among investors, clients, and stakeholders.

Transparency in transactions, abiding by state laws, and integrity in the operating systems are methods to develop lasting business relationships. Abiding by the AML regulations works like a bedrock for long-term success and reputation in the industry.

Financial security

Identity verification and compliance with anti-money laundering regulations help to ensure the legitimacy of funds. This helps to prevent the real estate market from getting exploited, leading to strengthened financial security and stability.

What are the red flags in real estate transactions?

There are several red flags present in real estate money laundering that seasoned agents can identify. Some prominent red flags in AML checks for estate agents include the following:

- Cash purchases of high-value properties

- Any involvement of a politically exposed person

- Purchases by anonymous buyers

- Complex financial arrangements

- Non-compliance of clients with traditional processes

- Third-party involvement in transactions (shell companies, offshore entities, etc.)

AML checks for estate agents are a set of procedures and a legal requirement that real estate professionals have to abide by to prevent and detect money laundering at any transaction level. Various regulatory authorities carry out AML checks alongside estate agents to make them aware of red flags and their consequences.

What AML checks do real estate agents need to do?

There are various security checks that estate agents need to abide by for cleaner implementation of processes and transactions to prevent money laundering. In cases of doubt, agents must file a suspicious activity report (SAR) with the National Crime Agency and ensure to proceed with a risk-based approach.

For instance, under HMRC’s record-keeping regulations, estate agents must obtain sufficient documents to ensure customer due diligence and maintain records of seller and buyer transactions for 5 years after the end of a business relationship.

Registering with HMRC

HMRC is the national tax authority that ensures proper taxation and compliance across all institutions and sectors that involve substantial financial transactions. HMRC makes it mandatory for all estate agents to register with them for appropriate money laundering supervision, verification of financial transactions, and staying compliant with the AML regulations.

Proof of identity

To ensure proper compliance and authorization of the properties sold, all estate agents must check proper proofs of identity and cross-check the details related to each buyer, including their SSN, Know Your Customer (KYC), business or income proofs, taxation documents, and any other document required for proper verification.

Proof of funds

Large property assets become an easy target for terrorist financing. As a result, another important responsibility of an estate agent is to verify all financial transactions, perform customer due diligence checks, look for bank statements, identify sources of funds, especially when they’re in cash, and prevent any dirty money from entering the system.

To maintain transparency, it is critical to block any chance of money laundering and guarantee the authenticity of all transactions, thereby retaining the credibility of the entire system.

Proof of ownership

Proof of ownership is a property deed or a legal document that confirms an individual’s right or ownership of an estate or any asset. The evidence or proof suggests the authenticity of an individual’s ownership.

Money laundering is an evil crime that the assigned reporting officer should report. An officer must follow the legal processes set out in the Proceeds of Crime Act 2002 (POCA), the Terrorism Act 2006, and other legislation-related regulations.

Transaction monitoring

Using automated tools or manual processes to monitor real estate transactions continuously serves as an essential weapon for high-risk countries to detect unusual or suspicious activities and meet regulatory requirements.

The involved processes and tools are integral to maintaining comprehensive records, securing large sums of money, verifying identities, and adhering to AML regulations. Monitoring transactions helps in identifying and reporting any suspicious or criminal activity by any of the parties involved.

Documentation

Documentation is an essential step in money laundering regulations, ensuring quality and process control across all departments and sectors.

Documentation of all important files, financial transactions, proof of funds, bank statements, and sales deeds is required to authenticate the ownership of the buyer and the credibility of the seller. It is an integral and enhanced due diligence process that both parties must follow when buying or selling property in any sector.

Reporting

Property reporting involves detailing the property’s value, previous records, estimations, purchases, area specifications, and information about the suburb, which is imperative for any buyer or seller involved in the transaction process.

Best practices for AML compliance in estate agencies

The nature of the real estate business makes it convenient for money launderers to enter the business’s financial processes and exploit them. An estate agent needs to identify and adhere to best practices for AML compliance to ensure customer due diligence and prevent money laundering across the real estate industry.

The best practices for AML compliance include:

Developing a comprehensive AML policy

Developing a comprehensive anti-money laundering policy is important to ensure accountability across all functions of estate agency businesses.

The policy documents the reporting officer’s details, who is responsible for maintaining, managing, and monitoring the policies, controls, and procedures related to AML compliance in the real estate agency business. The document also lists the consequences of non-compliance by the officer or the departments in charge of ensuring complete adherence to the policy.

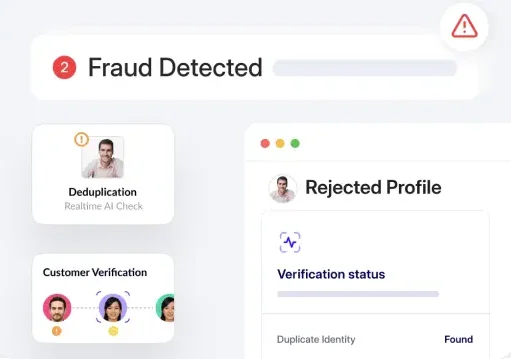

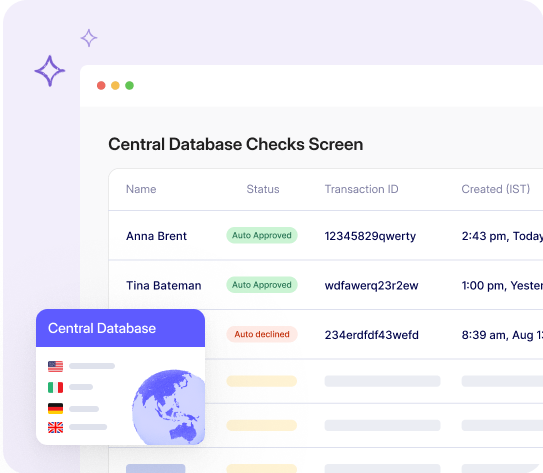

Automating the AML checks with the best AI tool

With the technical advancements across all sectors and industries, various Artificial Intelligence (AI) tools and software have been introduced in the AML and KYC processes as part of this sector’s procedural evolution.

HyperVerge, a leading provider of AI-powered AML solutions, offers real-time AML screening and monitoring that gives a complete view of customer risk identification and empowers estate agents to meet all compliance-related requirements and make better and more informed decisions. It also helps to fulfill all legal requirements concerning money laundering legislation and customer due diligence.

Conducting regular audits and assessments

Law enforcement agencies make it a mandate for estate agency businesses to conduct regular audits and assessments to ensure adherence to real estate regulations and industry standards.

Creating an audit calendar, scheduling audits across departments, and fostering accountability within the system are important steps for proper departmental functioning and increasing transparency, efficiency, and compliance within the estate’s operations.

Make your AML compliance seamless with AI tools

Technical advancements are empowering systems and processes across various industries and sectors.

If you wish to make your AML compliance seamless, you can check HyperVerge.

Hyperverge, a leading provider of AI-powered AML solutions, has been improving businesses around the world by offering real-time AML screening and monitoring that gives a complete view of customer risk identification.

We enable estate agents to stay compliant, manage their reputation, and adapt, anticipate, and succeed in all situations.