What is Vendor Due Diligence?

Vendor Due Diligence (VDD) is the evaluation done by businesses to assess potential third-party vendors.

Organizations are recommended to do due diligence when onboarding new vendors, periodically during ongoing relations, and at any point when the vendor’s setup changes.

VDD is all about making sure the companies you’re thinking of working with actually match up with what you believe in and that they won’t cause trouble down the line. The Vendor Due Diligence process achieves this by verifying the vendor’s details and analyzing their operations, financial health, and compliance with regulations.

What are the Objectives of Vendor Due Diligence?

The objectives of this due diligence process, now an essential part of vendor management, are clear and as follows:

Risk Management

It’s about identifying areas of inherent risks, uncovering hidden risks, and any risks that may arise as a result of partnering with the vendor. Mitigate risk to safeguard your operations against unexpected disruptions.

Read more:

What is AML risk assessment?

Compliance Assurance

It is important to make sure that a particular vendor complies with local and international regulations. This protects organizations from having to pay hefty fines that come with compliance failure of the vendor they are associated with. Plus, processes like sanctions screening ensure that vendors are not on any sanctions lists that would prohibit doing business with them under international law.

Operational Compatibility

The Vendor Due Diligence process ensures that potential vendors can meet your operational requirements and standards. What happens when a vendor’s quality standards start to slip unnoticed? Regular audits and reviews are essential to mitigate risks. Adequate due diligence helps catch and correct such issues early.

Financial Stability

Understanding a vendor’s financial health is vital. A financially unstable vendor can be a liability. This instability potentially disrupts your supply chain and impacts your service delivery. Imagine discovering a vendor is on the verge of bankruptcy. How would this affect your supply chain? Early assessments can prevent such a crisis.

A part of financial scrutiny is AML compliance, which verifies that the vendor follows Anti-Money Laundering (AML) regulations. It protects you from engaging with anyone who is involved in or susceptible to financial fraud.

Security Verification

In the digital age, assessing your vendor’s data security with due diligence is important. Is there a risk of a data breach? What are their security practices? Protect yourself from any scope of data leak of your confidential information.

Read more about customer due diligence and enhanced due diligence

Integrity Verification

VDD gets access to information determining whether the vendor’s actions align with ethical business practices. Imagine if your vendor was implicated in a corruption scandal. What impact would the vendor relationship then have on your brand’s reputation?

What is the Process of Vendor Due Diligence?

Vendor Due Diligence (VDD) protects you, the enterprise from vendor risk on one hand. And it also nurtures good vendor relationships.

It includes four broad steps. Here’s a breakdown of key steps:

1. Initial Screening

The first step in the Vendor Due Diligence process involves a preliminary review of a new vendor before you establish the vendor relationship.

It involves investigating basic information such as their background, history, market reputation, and initial financial health indicators. Here, you get to know the basics about them.

Read more about AML screening

2. Risk Assessment

Next in the process comes a due diligence deep dive to identify areas of any potential risks associated with the vendor.

This step in Vendor Due Diligence includes evaluating their legal compliance, operational risks, and any previous instances of misconduct or financial instability. Moreover, the vendor’s history is assessed for any past issues or red flags that could pose a risk to your business.

Checks like global watchlist screening and PEP (Politically Exposed Persons) Screening are also helpful in vendor risk management for international collaborations.

3. Financial Stability Assessment

Now, an in-depth analysis of the vendor’s financial statements, audit reports, and credit scores is done. This step ensures the vendor is robust enough to withstand market fluctuations and fulfill their obligations. You would not want the financial instability of the vendor to lead to supply chain disruptions, affecting your service delivery and operational efficiency.

4. Ongoing Monitoring

Finally, VDD doesn’t end once a vendor is onboarded. It is a continuous part of vendor management.

It is important to continuously monitor their vendor’s performance, compliance, and monetary ongoings to ensure they remain in good standing. This includes regular reviews of their financial status, compliance, and metrics for smooth business continuity. The ongoing diligence is like having regular check-ups to keep an eye on vendor risk.

Vendor Due Diligence Checklist

What should be your due diligence questionnaire? Setting out to do Vendor Due Diligence (VDD) involves getting answers to anything that impacts your risk level.

Here’s the due diligence checklist to guide you to collect information that matters.

Basic Company Information

Start with the basics: Who are you diving into business with?

Gathering basic company information involves understanding the vendor’s legal entity name, headquarters, history, leadership team, mission, vision, and business model. This phase is crucial for establishing a clear picture of the vendor’s background and operational context. It’s about answering the fundamental question: Who is the vendor?

Financial Information

Next in the Vendor Due Diligence checklist is to scrutinize the vendor’s financial health.

Here, the spotlight is on financial statements, credit reports, and other financial indicators. Vendor Due Diligence looks into metrics like liquidity ratios, debt levels, procurement process, and profitability margins.

This step identifies any financial vulnerabilities that could jeopardize the vendor’s ability to fulfill their contractual obligations or adapt to market changes. A vendor facing instability may pose risks to your supply chain, potentially leading to disruptions in service or product delivery.

Political and Reputational Risk

Assessing a vendor’s political and reputational risk in Vendor Due Diligence involves understanding their standing in the industry and any potential political exposures that could impact you. A vendor’s poor reputation or political entanglements can quickly become your own, affecting your company’s image and possibly leading to difficult situations.

This part of the due diligence questionnaire researches public perceptions, customer feedback, and any past controversies or legal issues.

The aim is to gauge the potential for reputational damage that could reflect poorly on your company by association. Negative publicity or political entanglements can disrupt business operations and damage your brand’s reputation, making this assessment a critical component of Vendor Due Diligence (VDD).

Cyber Risk

Lastly, acknowledging cyber risk is important. Vendor Due Diligence ensures that the vendor has robust cybersecurity measures and no security gaps to protect against confidential data breaches and cyberattacks.

Conclusion

Vendor Due Diligence (VDD) used to be just a simple thing you would tick off a list. Now, it’s exceptionally important to keep your business safe and ensure you work with the right people. In today’s landscape of rising fraud and compliance challenges, VDD isn’t just advisable; it’s indispensable.

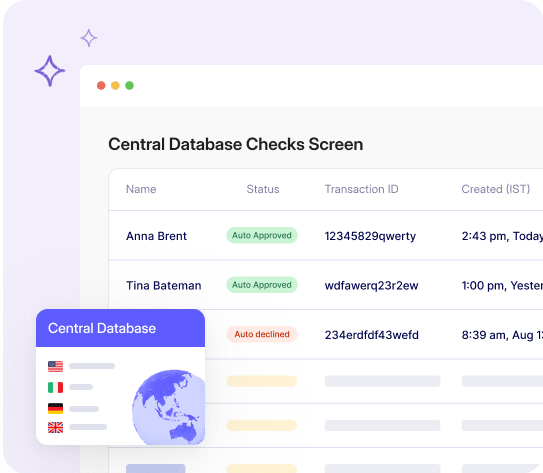

HyperVerge helps you protect your business with advanced AML solutions for Vendor Due Diligence. The real-time screening and monitoring empower you to make informed decisions at the right time to ensure your continued success.