Bank account verification (BAV) is an important process for any sort of onboarding. Whether you want to onboard customers, sign up users for loans, or set up recurring payments with vendors, you need to verify bank accounts for secure transactions.

Those who deal with a very high volume of transactions, especially, need a fast and secure method of verifying accounts.

This is where instant bank account verification comes into play. Let’s take a look at what it is and how you can improve upon instant verification within your onboarding process.

What is instant bank account verification?

Instant bank account verification (IBAV) is the process by which you can verify the details of a bank account within seconds.

This includes verifying that the account exists and that it belongs to the expected owner. Instant bank account verification is extremely useful in various scenarios like online payments, remittances, e-commerce transactions, and more.

As IBAV allows anyone to verify account details within seconds, the chances of fraud, embezzlement, and human error go down significantly.

Challenges of traditional bank account verification

Before IBAV became ubiquitous in modern banking, traditional bank account verification was the norm and manually implemented. This involved:

Physical documentation: Customers would need to provide physical copies of documents such as:

- Government-issued ID (passport, driver’s license)

- Proof of address (utility bill, bank statement)

- Bank statements showing account ownership and activity

In-person visits: Often, customers would need to visit a bank branch to submit documents and potentially undergo identity verification in person.

Manual review: Bank staff reviewed the submitted documents manually to verify the information.

Processing time: The verification process could take several business days or even weeks to complete.

The problem with traditional BAV is that it is a slow process and can take weeks for simple transactions, which is not feasible for modern transactions. More importantly, the delays in verification provided a fertile ground for fraud and embezzlement. It also offered a terrible user experience as customers were required to visit the bank for verification physically.

The delays can pile up and severely hamper the revenues.

This led to the advent of IBAV in modern banking, which brought about an era of instant yet secure transactions.

CTA: Verify accounts instantly

With lightning-fast onboarding

How does instant account verification work?

Let us now take a look at how IBAV works. The objective of instant verification is two-fold:

- Making sure that the bank account is valid, and

- Confirming the ownership of the account

IBAV execution steps:

- Bank account details input: The user enters their bank account number, IFSC code (in India), and other relevant information.

- Data validation: The system checks the provided details for accuracy and consistency.

- Real-time verification: The system interacts with the user’s bank(either by depositing a small amount of money or sending requests for verification) to confirm account ownership and status. This is confirmed in real time for instant verification.

- Confirmation: A verification code or other confirmation method might be used to strengthen security. This process can take a long time if not for instant verification.

Methods of instant bank account verification

Instant bank account verification leverages technology to streamline the process. Here are some common methods:

1. Micro-deposits (Penny-drop):

- How it works: Small amounts of money are deposited into the customer’s account, and they confirm the amounts to verify ownership.

- Benefits: Simple to implement but slower than other methods.

2. Bank statement analysis:

- How it works: Customers upload bank statements for verification. Advanced technologies like AI can analyze these documents for accuracy and ownership.

- Benefits: Can provide additional financial information but might be slower than other methods.

3. IFSC verification:

- How it works: This process, commonly via an API call, includes fetching the bank’s address, name, branch information, and other relevant details linked to the provided IFSC code.

- Benefits: The real-time verification ensures that the IFSC code corresponds to the correct bank and branch and eliminates the need for manual verification.

4. Data enrichment:

- How it works: Combining information from various sources (credit bureaus, public records) to verify account details.

- Benefits: Comprehensive verification but might require additional data sources.

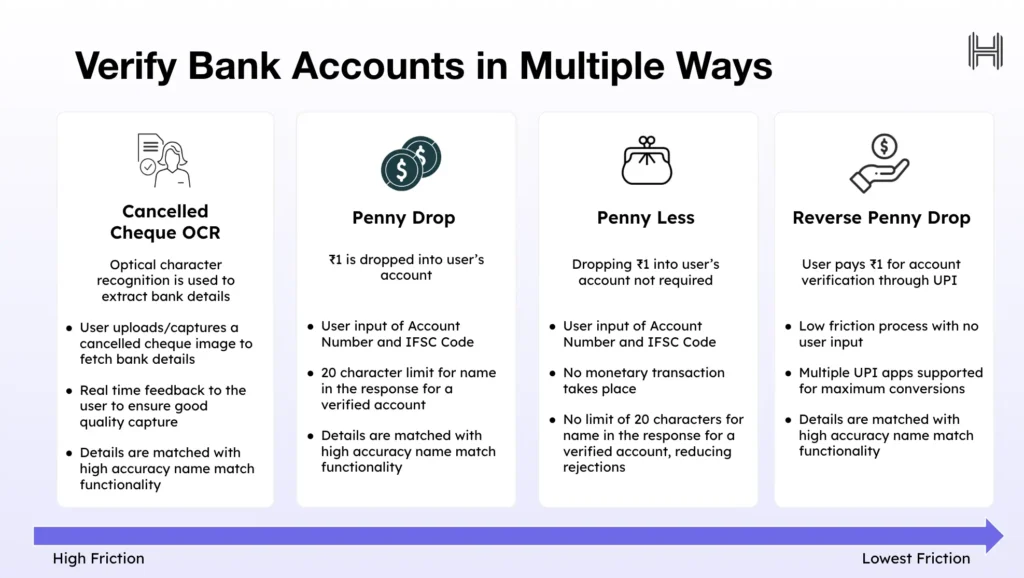

5. Cancelled cheque OCR

- How it works: The customer scans and uploads a canceled cheque. Optical Character Recognition (OCR) technology extracts account details from the cheque image.

- Benefits: Can be faster than manual verification of physical cheques.

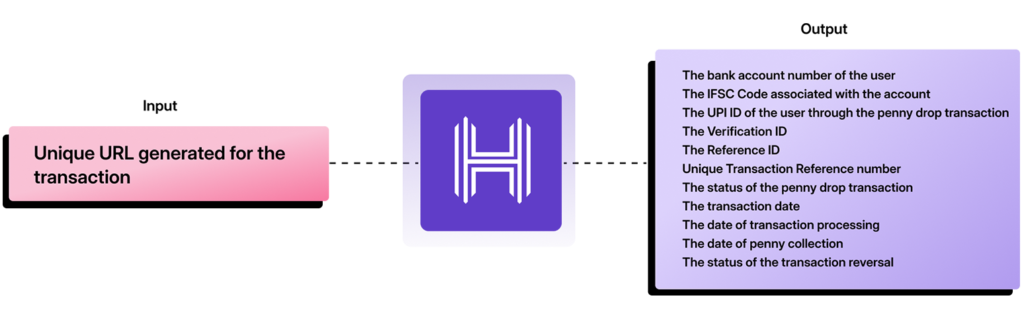

8. Reverse penny-drop

- How it works: Customers can conduct small transactions through UPI to verify their bank details.

- Benefits: Relatively simple to implement.

9. Penny-less

- How it works: Instead of depositing real money, the customer enters their bank account and IFSC details to verify the account.

- Benefits: Avoids the need to transfer actual funds.

10. Biometric authentication:

- How it works: Using biometric data (fingerprint, facial recognition, or voice) to verify identity and account ownership.

- Benefits: High security, but implementation can be complex.

The verification can be done via various methods but what makes IBAV effective is its success rate.

What do we mean by success rate? IBAV may be fast, but it isn’t always functioning at its peak.

Shortcomings of instant bank account verification

IBAV is an essential process for thousands of businesses across the globe. And yet, this process is still less than optimum. For most financial organizations, the cost of acquiring a customer is quite high. Also, account verification comes at the very end of this acquisition process.

Now, what if we told you that according to our benchmarks, the highest dropoffs occur at the BAV stage and only 10-15% of the users end up converting?

The problem is with the verification process itself.

Limited verification methods

Most verification services only offer one or two verification methods like penny drop or canceled cheque OCR. This poses an issue as customers may struggle to verify with limited options. For example, if a customer does not have a chequebook, they may drop off from the verification process.

No fallback options

If verification fails for any reason, such as bank servers being unavailable, the user drops off. This is because there are no fallback options to rely on if verification fails. This results in a high dropoff rate.

Friction points during input

The input process is particularly tedious for users. Looking for their chequebooks, cards, or figuring out their account numbers can delay the process, and even cause dropoffs due to inertia.

No visibility into the process

Generally, verification services do not tell you what is happening during the verification process itself. You will know the number of people who attempted verification, and the number of people who completed it, but the process in between is a black box. This makes it difficult to understand why drop-offs are occurring in the first place, and so minimizing them becomes difficult.

Limited banks supported

If smaller banks or institutions are not supported by the verification service, naturally users with accounts in these banks will drop off.

Wide support of banks is slowly becoming common within verification services but is still not universal.

Completion time

IBAV, on average, can take up to 5 minutes. While it doesn’t seem like a long time, a lot of dropoffs happen because the wait time affects the user experience. Plus while the average may only be 5 minutes, it can easily take up to 20-30 minutes for verification.

How HyperVerge has improved instant bank account verification

The issues we mentioned above hamper the user experience and overall conversion. So we have devised a supermodule that not only streamlines the BAV process, but also boosts the conversion rate up to 25-30%.

This is how HyperVerge handles IBAV

Different methods for instant bank account verification

We have found that certain verification methods work better than others. As there is higher friction with methods that require high user input. However, it is important to have options, failing which, the process may not serve a wide range of users.

The BAV supermodule offers various verification methods to ensure that verification is completed via any preferred method.

Fallback orchestration

Verification failure is one of the most common reasons for dropoffs during account verification. To combat this, our fallback orchestrator ensures that there are several fallback methods in case one does not work. This ensures that no user drops off due to verification failure on the part of the system.

Automatic input

Users don’t always remember their IFSC codes or bank details. This is why we incorporated a bank search feature that allows users to search for their banks during the verification process itself, without having to leave the screen.

The HyperVerge BAV supermodule is the only one that offers easy search and requires almost no input from the user. This ensures that friction for users is extremely low.

Analytics

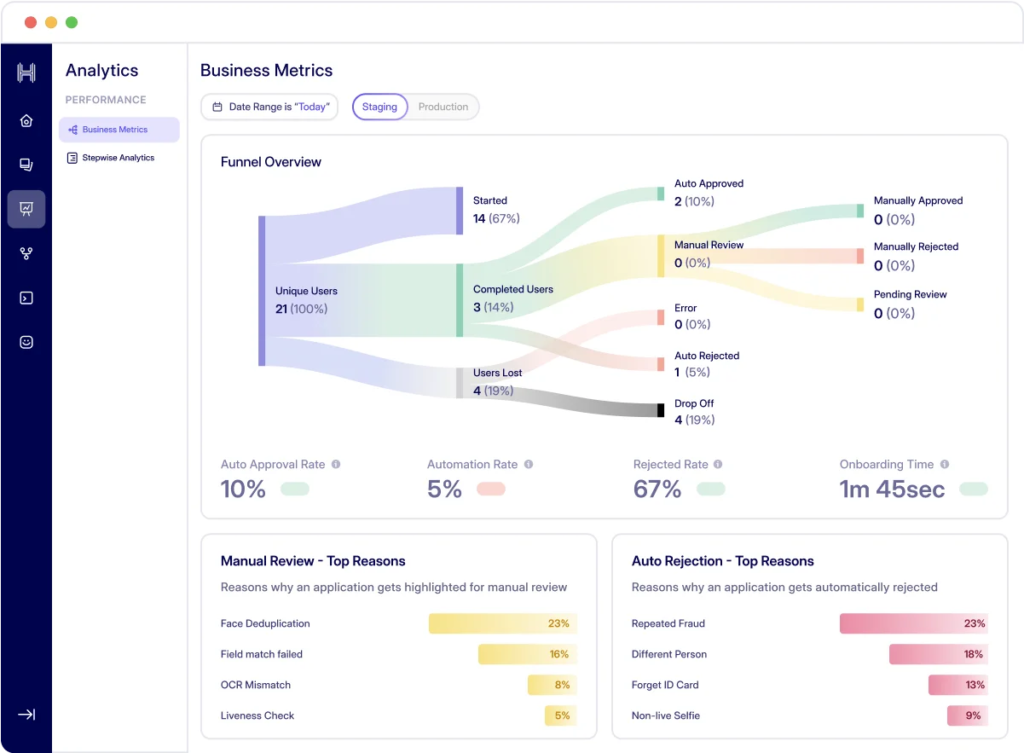

If you know where your users are dropping off in the process, you may be able to optimize the process to minimize it. HyperVerge ONE gives you a detailed view of the entire user journey which helps you analyze the dropoffs and their cause.

Wide support and integrations

Supporting a wide range of banks is important for good conversion rates. Our supermodule not only supports the maximum number of banks for penny-less verification, but also integrates with 4 different UPI apps for reverse penny-drop transactions.

Fast turn-around

While the average is 5 minutes for instant account verification, we have managed to bring it down to a mere 20 seconds!

We’ve ensured that users have minimal friction through the process which speeds it up for a truly amazing turn-around. With such a huge difference in time taken, drop-offs reduce drastically with HyperVerge.

Looking forward

Instant bank account verification is an extremely pertinent tool for major business transactions. It is only logical that this process is optimized to its fullest.

BAV is already in the purview of global regulations to reduce fraud and money laundering. As the number of global transactions increases, however, the regulation and compliance requirements will grow and more universal. It is important to ensure that your BAV process meets global compliance standards.

You can optimize your IBAV process, and ensure maximum compliance by partnering with HyperVerge or launching multiple new journeys with HyperVerge ONE. Reach out to us, and watch those dropoffs disappear.

FAQs

1. How to do instant bank verification?

Instant bank account verification is carried out in real-time, eliminating the need for manual checks or delays. Typically, it involves users entering their bank account number, IFSC code (in India), and other relevant information. This is validated by the system in real time to verify that the account is valid and the ownership is accurate.

2. Is instant account verification safe?

Instant account verification is encrypted and secure. The process only verified the validity and ownership of the account, and is quite safe.

3. Can you verify a bank account online?

Yes, online verification of bank accounts is not only possible, but very common. It can be done with various methods such as penniless, penny drop, or canceled cheque OCR.

4. How long does it take to verify a bank account?

Typically, it takes 5 minutes on average to verify a bank account. But if you have the HyperVerge BAV supermodule, it only takes 20 seconds!