With the growth in the online documentation process and the impetus from the Digital India initiative, digital signatures will be more prevalent in the coming days.

However, digital signatures could also lead to trust issues between the parties especially if they are signing an agreement for the first time. This is where a Digital Signature Certificate (DSC) comes into the picture as it validates the person’s identity and builds trust.

In this blog post, we get into the details of what digital signature is and how it’s different from DSC. We also explore the types of the certificate, how to obtain the certificate and their applications.

What is a Digital Signature?

Before we go any further, let’s take a step back to understand a digital signature more clearly and how it’s different from a Digital Signature Certificate (DSC).

A digital signature is equivalent to a pen-and-paper signature but in a digital form. It uses a mathematical algorithm to encrypt your signature. Encryption is the unique identity of the person and the document on which they are signing. A digital signature guarantees that the owner is sharing the document and the content of the document was not altered in transit

When you sign a document digitally a cryptographic process runs in the background called hashing. This process creates a unique code called “hash” which represents the content of the document. This hash is then encrypted with your private key – a kind of secret code – to create your digital signature.

For example, you sign a contract digitally with the private key. Then you share it with your partner who accesses the contract using a public key to check the digital signature. When it matches, they know the contract is genuine.

What is a digital signature certificate?

A DSC is proof of identity for the signer. Consider it as the ID card for your digital signature, so that when people see your DSC they know it’s you. A DSC is issued by a Certifying Authority (CA) after verifying your identification documents.

Once you have your DSC, you must use it according to the guidelines of The Information Technology Act of 2000.

Types of Digital Signature Certificates

The different types of digital signature certificates have different purposes. Knowing them will help you choose the right DSC based on the requirements. Here’s a breakdown of each type and a comparison table highlighting the differences:

Class 1: This is issued to individuals for personal purposes like email correspondence and online forms.

Class 2: This digital signature certificate is issued for individuals and organizations. They are primarily used for signing documents online like filing income tax returns in the case of individuals. For a corporate entity, it’s useful to file GST returns.

Class 3: This is the highest level of DSC and is used for high-security transactions like e-tendering, e-bidding, and e-auctions. If you’re participating in online auctions or filling out tender forms held by the government, you will be asked to submit this digital signature certificate.

DGFT DSC: Importers and exporters registered with the Directorate General of Foreign Trade (DGFT) use this DSC. It’s one of the documents necessary for international trade.

Here’s a comparison table that will help you to be more clear about the definition and purpose of each DSC type:

| Type of DSC | Description | Use case |

| Class 1 | Issued to individuals for email correspondence and filling out online forms | Personal transactions |

| Class 2 | Used by individuals and organizations alike to sign documents electronically | Filing income tax returns |

| Class 3 | The highest level of DSC is useful when applying for an e-tender or e-bidding organized by the government | E-tendering and signing contracts online |

| DGFT DSC | Used by exporters and importers registered with the Directorate General of Foreign Trade (DGFT) to facilitate transactions | Export documentation and import licenses |

How to obtain a digital signature certificate in India

If you know what type of Digital Signature Certificate applies to your requirement, the next step must be procuring it from the right sources. In this part of the blog, we share the exact steps you must follow:

- Identify an authorized Certifying Authority (CA): Certified Authorities are licensed to issue Digital Signature Certificates. Check out the list of CAs on the Ministry of Corporate Affairs website to get more details.

- Complete the application form: Fill out the details in the application form like name, address, and type of DSC. You can visit the emudhra website to download the PDF of the application form

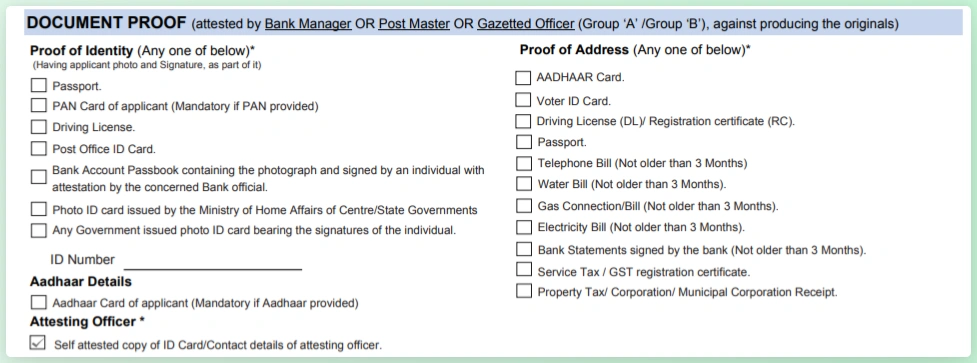

- Gather the required documents for verification: You will be asked to produce government-issued ID cards to prove your identity. Gather the original with the attested copy and add a tick (✓) beside the document type in the form.

Source: emudhra website

- Verification process: The CA will check the documents and after they have confirmed it’s authentic, they issue the digital signature certificate

- Payment of fees: Pay the fees for obtaining the Digital Signature Certificate. The amount depends on the type of certificate you’re applying for.

- Download the DSC: After the DSC is issued, download a soft copy of it on your computer or USB token.

- Activation and usage: The CA might ask you to download certain software to activate the Digital Signature Certificate. Using this software, you can sign any document and share it with others online

Time and cost involved in obtaining a DSC

It usually takes 1 to 7 business days for the process to complete depending on which class of DSC you want to obtain. The same concept applies to the cost. Here’s a table to give you an overview of the cost:

| Type of DSC | Cost (INR) |

| Class 1 | 500 – 1500 |

| Class 2 | 750 – 3000 |

| Class 3 | 1,500 – 5,000 |

Applications and Use Cases of DSCs in India

Digital Signature Certificates have a wide range of applications and will only grow in the future. We have covered the most common use cases in this section:

Filing income tax returns

Taxpayers whose accounts are audited submit their income tax returns with DSC. This method verifies the person’s identity and the authenticity of the submitted documents.

Government e-Procurement

As a vendor participating in the government e-procurement process, you must share the DSC with the authorities. The goal is to maintain transparency and allow only legitimate entities to take part in the process.

GST and MCA filing

Similar to filing income tax returns, companies use a Digital Signature Certificate to sign different forms and documents while filing GST returns.

e-Tendering, e-Bidding, and e-Auctions

In addition to government e-procurement, if you participate in any e-Tendering or e-Auction, you must possess a DSC.

Contract signing and other legal documents

A Digital Signature Certificate facilitates signing documents or contracts remotely. This opens doors for you to collaborate with businesses based in other cities. As a DSC is legally valid, any contract signed using a DSC can be upheld in court in the case of a dispute.

Importance of DSCs for startups and SMEs in India

A DSC is useful for building more trust and credibility for startups and Small and Medium Enterprises (SMEs). It allows them to participate in government tenders and win big contracts. It also makes it easy for them to tie up with entities based out of different places to expand their operations. The way the digital economy is booming in India, a DSC is a worthy investment for startups and SMEs.

How does a Digital Signature Certificate Work?

So how does a Digital Signature Certificate work? Let’s find out about the technical overview of DSC and the role of public and private keys in this section

Technical overview: Encryption and Hashing

Hashing

When you take up a document for signing, it goes through hashing. Hashing is converting a document into a cryptographic fixed-length string of characters known as hash. In case of any alteration in the document, the hash changes completely. This makes it easy to track changes made to the document.

Encryption

In encryption, the hash is encrypted using a secure key known only to the sender. The encrypted hash is called a digital signature when the process is complete.

Role of public and private keys

Private Key: This type of key is only known to the signer and they use it while signing documents online

Public Key: This key is shared with anyone to help them verify a signature. The person receiving the document uses the sender’s key to decrypt the message to the original hash form.

The combination of hashing and encryption prevents tampering and ensures confidentiality. Hashing makes it easy to track alterations and encryption ensures confidentiality by giving access to only those with the public key.

Renewal and Revocation of Digital Signature Certificates

Digital Signature Certificates (DSC) come with validity and can be revoked under certain circumstances. First, let’s talk about renewing DSC. The validity of a DSC ranges from one to three years.

After its validity has expired, these are the steps you need to follow to renew it:

- Submit a renewal application through the Certifying Authority (CA) website

- Based on the CA’s requirement, you might be asked to submit the document proofs again

- Pay the renewal fee – the amount will be dependent on the DSC type

- After all the details have been verified and payment received, the CA will issue the new DSC via email

Second, a Digital Signature Certificate is revoked when it’s lost or the holder’s information changes. This is done to protect the holder’s identity and prevent any misuse.

In case, you want to revoke your DSC, here are the steps to follow:

- Contact your Certifying Authority expressing your need for revocation

- Provide necessary information like certificate number and the reason for revocation

- The CA will confirm once the DSC has been revoked

- Inform your partners and other parties about the revocation

Security and Privacy Concerns with Digital Signature Certificates

The Digital Signature Certificates are vulnerable to certain risks and concerns. However, they could be mitigated if you follow certain safety protocols. One of the most common safety concerns is unauthorized access which occurs when someone gets your private key. The best way to prevent this is by using strong passwords.

Loss, theft, or phishing attacks are other common concerns. You can safeguard yourself against these risks by continuously monitoring the DSC usage. It helps you to act faster when someone gets unauthorized access to your DSC.

In addition to the above steps, here are a few more tips for storing a DSC safely:

Use hardware tokens: Use a hardware token or a password-protected USB drive to store your Digital Signature Certificate.

Regular Backups: Always take backups of your DSC and store them securely. This will be useful at times of crisis like hardware failure.

Limit access: Allow only the most trusted people to access your DSC

Final Thoughts

DSCs are indeed a nifty solution for entrepreneurs to grow their businesses rapidly. Piggybacking on the digital growth, it’s a potent tool with a long list of positives. Having said that, it has its negatives, the most glaring being convenience, security and privacy concerns.

However, e-sign is more capable than DSC as it leverages advanced technology to prevent unauthorized access or forgery. Moreover, the process is simpler. It can be achieved through a quick OTP verification, and is a lot more secure than DSCs.

HyperVerge is one of the best platforms offering e-sign capabilities. It executes Aadhar-based eSignature with a 100% success rate. Check out the HyperVerge Aadhar e-sign page for more details.

Frequently asked questions

1. What is the cost of a Digital Signature Certificate in India?

The cost of a digital signature certificate depends on the type. Typically, the cost ranges from Rs. 500 to Rs. 5,000

2. How long is a DSC valid, and when does it need renewal?

The validity of a DSC is between one to three years. You need to renew DSC when it’s validity has lapsed.

3. Can DSCs be used for personal purposes, or are they only for businesses?

Yes, it can be used for personal purposes like filing income tax returns.

4. Is a DSC the same as an eSign?

No, a DSC and eSign are not the same. DSC are issued by certifying authorities only. Whereas eSign is any electronic representation of a signature.