Businesses across the globe today acknowledge that onboarding processes can make or break a customer’s experience with a brand. Imagine a potential customer clicking on your app, or website, excited to join your service, only to be met with a cumbersome verification process. Frustrating, right? This reality has pushed businesses to seek out identity verification solutions that not only streamline onboarding but also enhance security and compliance.

Enter Signzy and HyperVerge—two titans in the identity verification industry. Now, Signzy has been a game-changer for financial institutions, boasting impressive statistics and no-code processes. On the other hand, HyperVerge with its AI-powered solutions promises speed, efficiency, and seamless onboarding even in low-bandwidth scenarios.

Choosing between Signzy vs HyperVerge can be challenging as both platforms come with their unique strengths. In this article, we will unravel the complexities of both platforms, allowing you to make an informed decision based on your specific business needs.

What is Signzy?

Signzy, a digital banking infrastructure provider, is renowned for altering how financial institutions onboard customers. Designed to make complex regulatory and compliance processes simple, Signzy leverages AI (Artificial Intelligence) and ML (Machine Learning) for efficient onboarding and verification.

Signzy enables its clients to onboard customers end-to-end, streamlining the entire journey from lead generation to activation. With more than 99 million customers successfully onboarded and an impressive 2.2x growth during the COVID-19 pandemic, Signzy has become a standout player in the identity verification space.

Here’s a fun fact about Signzy–The company holds a US patent for onboarding in the Metaverse!

Now, let’s see what the numbers actually say about Signzy–

- 90% reduction in turnaround time (TAT)

- 80% lower cost of onboarding

- 50% decrease in customer dropout within 1 year

- 144X reduction in TAT per application within 1 year

- 6X increase in customer onboarding within 1 year

Key features and functionalities

- AI-enabled digital onboarding

Signzy’s platform is powered by advanced AI and ML technologies, streamlining customer onboarding with accuracy and speed.

- No-code integration

With a simple plug-and-play approach, financial institutions can integrate 240+ APIs into their workflows without writing a single line of code (arguably Signzy’s single largest differentiating factor from its competitors).

- Automation

Signzy automates backend processes, leading to faster turnaround times and reduced customer drop-offs.

Target audience and use cases

Signzy is particularly valuable for companies seeking faster, cost-effective onboarding solutions, like fintech firms, large banks, lending, and gaming. Its client roster includes 240+ FIs global customers, and names like Aditya Birla Financial Services, ICICI Bank, SBI, Money Fellows, IBM, and Cognizant, alongside a partnership with Microsoft and Mastercard.

What is HyperVerge?

HyperVerge is an AI-powered platform specializing in digital identity verification and fraud prevention. With advanced fraud detection capabilities through deep fake detection, ID document verification, biometric authentication, fraud pattern analysis, forgery/spoofing tests, passive liveness detection, and behavioral analysis, HyperVerge allows businesses to proactively identify high-risk users.

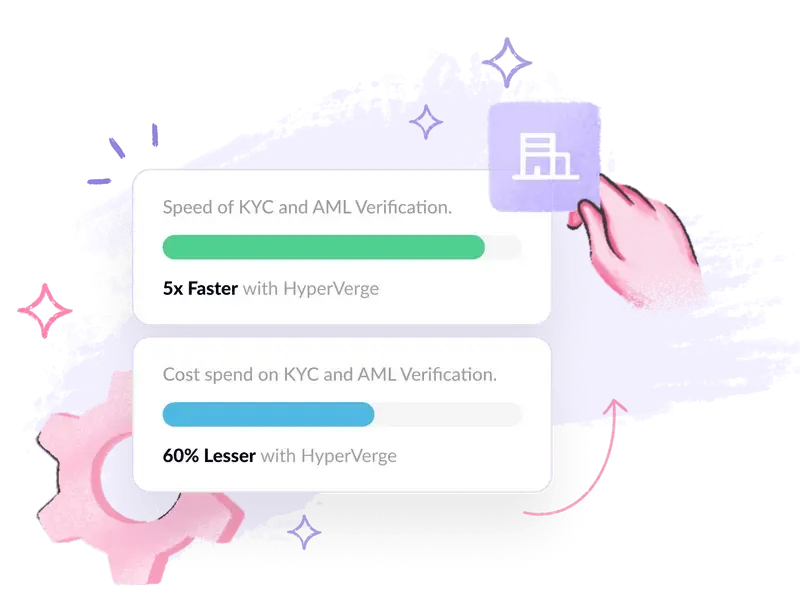

Here are some interesting stats from HyperVerge–

- Over $3 million in savings for businesses

- Best-in-class accuracy of 98.5%

- Global reach across 195+ countries

- Quick detection in under 3 seconds

- 50% reduction in customer drop-offs

- 95% auto approval rate

With over 750 million customers verified and a billion IDs verified, HyperVerge delivers exceptional performance, even in challenging network conditions like 2G bandwidth. This ensures accessibility across a wide range of devices and demographics. What’s more? 20x KYC cost savings and full compliance with global KYC and AML regulations.

Key features and functionalities

- No-code workflow

HyperVerge simplifies the process of designing customized onboarding journeys. Users can drag and drop components to create personalized experiences, all without needing extensive coding skills.

- Analytics dashboard

HyperVerge provides businesses with insights into customer behavior, allowing for data-driven decisions that optimize conversion rates.

- Passive liveness detection

HyperVerge ensures that the person being onboarded is alive and real without requiring extra steps like blinking or smiling, thereby preventing spoofing attacks.

- OCR technology

The OCR (Optical Character Recognition) tool extracts data from IDs (passports, voter cards, etc.) in seconds, aiding quick verification.

Target audience and use cases

HyperVerge serves a wide range of industries, including financial services, e-commerce, gaming, crypto, and more. Major brands like Jio, Razorpay, ICICI, Groww, and Swiggy rely on HyperVerge to streamline KYC and AML compliance and prevent fraud.

How did we evaluate the two onboarding solutions?

When our team evaluated Signzy vs HyperVerge, we focused on several factors that matter to businesses—features, pricing, and user reviews from credible platforms like G2 and Capterra. (This article covers reviews from G2 and Capterra in detail below for you to compare, and do a quick self analysis).

We also went a step ahead and took into account community feedback from platforms like Reddit, which while not always scientific, can offer valuable user perspectives.

Overview of Signzy vs HyperVerge

| Features | Signzy | HyperVerge |

| API integration | ✔ | ✔ |

| Biometric authentication | ✘ | ✔ |

| Real-time face recognition | ✘ | ✔ |

| Passive liveness detection | ✘ | ✔ |

Liveness detection | ✔ | ✔ |

| Global regulatory compliance | ✔ | ✔ |

Facial recognition | ✘ | ✔ |

| OCR (Optical Character Recognition) | ✔ | ✔ |

| End-to-end onboarding | ✔ | ✔ |

| Fraud detection | ✔ | ✔ |

Key comparisons: Signzy Vs HyperVerge

You may find a lot of information when reading through Signzy and HyperVerge guides on the internet. So, to aid your selection, we have created quick sections below, touching on important aspects such as pricing, key features, use cases, security, and more.

Features

| Features | Signzy | HyperVerge |

Identity verification | AI-powered KYC and digital onboarding solutions with real-time document verification for age and address. | Offers instant age verification, real-time document checks, and central database verification (e.g., SSN, BVN, AAMVA, NSDL). |

| Face match | Detects fraudulent attempts where credentials don’t match the individual’s face. | Uses face matching, passive, and liveness detection models to ensure the user’s face is consistent with the ID provided. |

| AML | Provides real-time, algorithmic due diligence including bank account and UPI verification. | Utilizes fraud detection tools for real-time screening, monitoring global sanctions, watchlist checks, Politically Exposed Persons (PEP), and more. |

OCR for businesses | Extracts data from official documents (OVDs) for verification, aiding quick document processing. | Extracts address and other user details with 99% accuracy from ID documents like passports, licenses, and residence permits. |

| Liveness detection | Ensures that the user is present and alive during verification through real-time video checks. | Fortified liveness detection combats deep fakes with specialized models to differentiate between real and fake users. |

| Fraud detection | Uses face match verification, and OCR to detect fraud attempts, including identity theft. | Advanced AI detects deep fake images and videos, analyzes user behavior, and runs spoofing and forgery checks to catch fraudulent users. |

Pricing

Based on your unique needs and the industry you operate in, Signzy offers customized pricing.

HyperVerge, conversely, offers a broad range of pricing options depending on the phase your business is currently in, as stated below–

- Start Plan (for startups): This includes a one-month free trial and integration in less than four hours.

- Grow Plan: This includes all the benefits of the start plan plus custom workflows (and seamless document processing).

- Enterprise Plan: This includes all benefits of the grow plan plus collaborative tools, custom pricing structure, and dedicated support.

Target audience

Signzy is ideal for companies requiring quick compliance and high-volume verifications. Think of banks, NBFCs, and large financial institutions. But, if you are a startup looking for KYC solutions, Signzy also offers ‘Signzy for Startups’ to quickly and efficiently automate your verification and onboarding processes.

HyperVerge, on the other hand, caters to businesses that prioritize speed and real-time accuracy and are more prone to sophisticated attacks—telecommunications, insurance, and fintech firms that need seamless, AI-driven onboarding solutions without compromise.

Security

Signzy’s advanced face-match technology helps detect fraudsters attempting to use fake credentials that don’t align with their real identity. Video KYC further ensures a fully encrypted onboarding process, safeguarding both video communication and data channels from potential breaches. Plus their real-time document verification adds an extra layer of protection by cross-checking age, address, and other critical details.

HyperVerge’s AI-powered fraud detection system catches fraudsters by identifying high-risk users through advanced behavioral checks and fraud pattern analysis. It performs multiple security checks, including spoofing detection, face matching deep image analysis, liveness detection, and forgery identification to ensure businesses stay ahead of evolving fraud tactics.

User experience

Signzy has a simple, no-code, plug-and-play application builder. It is designed for faster onboarding processes through the power of automation. What’s more? It has a competent, automated onboarding system in place even if you are a startup.

HyperVerge alternatively offers the benefit of AI-powered automation, customizable analytic dashboards, and 100+ APIs. Also, did you know HyperVerge systems are compatible with 100,000+ devices and are race, age, and gender agnostic?

Integrations

Signzy offers a range of 240+ APIs such as fintech marketplace APIs, face match, verification API, liveness check API, OCR API, data breach API, Aadhaar e-sign API, ITR and 26AS API, 206AB & 206 CCA, voter ID verification API, passport verification API, offline Aadhaar API, Digilocker API, GST verification API and more.

HyperVerge offers 100+ API onboarding solutions in categories like AML, GST, KYB (Know Your Business)/entity verification, digital signatures, auto payments, and more alongside quick web and mobile SDK integrations.

Pros and cons: Signzy vs HyperVerge

Now that we have studied what distinguishes Signzy and HyperVerge majorly, here are a few pros and cons of each solution–

Signzy pros

- APIs: Signzy offers a range of API integration and seamless automation for quicker end-to-end onboarding and verification.

- Flexible pricing model: Signzy’s customizable pricing caters to smaller companies, allowing them to scale affordably as they grow.

Signzy cons

- Lack of advanced features: Signzy lags majorly when it comes to advanced verification features such as biometric authentication, passive liveness detection, and real-time face recognition.

- Non-reliability in high-stake industries: Signzy may not match the speed and accuracy of competitors like HyperVerge, especially in high-stakes, high-traffic environments.

HyperVerge pros

- High face recognition accuracy: HyperVerge’s face recognition system delivers near-perfect results (99.5%), offering an unmatched level of precision for industries where identity verification accuracy is paramount.

- Advanced passive liveness detection: HyperVerge has attained ISO 30107-1/30107-3 Level 2 compliance certification for their passive liveness technology, positioning them among the select few identity verification solutions globally to reach this standard.

HyperVerge cons

- Custom pricing: HyperVerge’s focus on tailoring packages for large enterprises may make it cost-prohibitive for startups or small businesses with limited budgets.

- Heavily focused on verification solutions: HyperVerge is largely focused on identity verification and onboarding solutions. Other features offered by competitors such as automated payments may lie outside its scope.

Hear it directly from the users

- What are users saying about Signzy

G2 Reviews–

Priti S.,Executive Assistant ★★★★★ (4.5/5)

Reddit Reviews–

user/the_smalDesignation/ Industry ★★★★★ (4.5/5)

- What are users saying about HyperVerge

Capterra reviews–

Tanmay,Manager-Operations in India ★★★★★ (4.5/5)

HyperVerge enjoys an overall rating of 4.5 out 5 stars on Capterra.

G2 Reviews–

Apoorv G.,Small-Business

Jeel P,Chief Executive Officer, Small-Business

Choose HyperVerge for the smoothest onboarding experience

Looking for a way to make your customer onboarding process as smooth and efficient as possible? HyperVerge ONE is your answer. Through its advanced AI-powered OCR document processing and state-of-the-art biometric authentication, HyperVerge ONE is transforming how you onboard users.

Now, competitors in the industry often struggle with high drop-off rates (during customer onboarding), but HyperVerge ONE has solved this pain point with its no-code workflow builder that lets you create personalized customer onboarding experiences with zero hassle–meaning fewer bottlenecks and more conversions.

HyperVerge One also nails it with its deep fake detection, spoofing checks, and passive liveness checks to ensure maximum security.

Whether you’re in financial services, e-commerce, or gaming, HyperVerge guarantees top-notch compliance and reduced drop-off rates, all while saving you 20x on KYC costs! So, why wait? Join brands like Jio and ICICI in leveraging HyperVerge for a streamlined, fraud-proof customer experience.

Head over to HyperVerge ONE today and supercharge your onboarding!

FAQs

- What does Signzy do?

Signzy provides a digital onboarding platform that simplifies customer verification processes for financial institutions through no-code solutions and a comprehensive API marketplace.

- What is an onboarding platform?

An onboarding platform facilitates the integration of new users into a service or product, ensuring customer association is smooth and compliant.

- Which onboarding platform has the best customer support?

HyperVerge’s name comes on top in terms of customer support with unparalleled response time, onboarding assistance, and prompt addressal of any issues that may arise.