Digital transformation in every industry has brought about a seismic shift in how businesses in India approach identity verification. Signzy has been a dominant player in the identity verification industry with its no-code and quick onboarding processes. However, the market is now teeming with alternative solutions that offer a wider range of features, pricing structures, and customer support services.

In this blog, we’ll explore the top Signzy competitors to help you make the right choice for your business.

Why consider Signzy competitors

While Signzy has been a top name in the identity verification landscape, it may not always be the best fit for every business. Here are some reasons why it may be a good time to seek other identity verification solutions–

- Limited features: Signzy’s offering may not cover the full suite of identity verification capabilities that some businesses require.

- High costs: The pricing structure of Signzy’s services may not align with the budgetary constraints of certain businesses, especially mid and small-size companies.

- Unsatisfactory customer support: Some users have reported issues with Signzy’s customer support, and have rated them negatively.

- Scalability: As businesses grow, their identity verification needs may outpace Signzy’s ability to scale.

- Custom requirements: Certain businesses may have specific or unique identity verification needs that Signzy’s standardized offerings may not adequately address.

In such cases, exploring Signzy’s competitors can provide your businesses with a broader range of options to better meet identity verification requirements.

How we evaluate the top alternatives

To identify the best Signzy alternatives for you, we have–

- Carefully analyzed the reviews and ratings provided by platforms like G2 and CapTerra. This is to understand and analyze the user experience and satisfaction levels with different identity verification solutions.

- Taken into account relevant discussions and feedback from the Reddit community to gain a well-rounded perspective.

- And lastly, recorded identity verification solutions that Signzy’s competitors themselves recommend!

This is to help you gain a broader perspective on what solution best suits your unique business. Now, before we do a deep dive into each Signzy competitor, below is a table for a quick overview.

Overview of the top 10 Signzy competitors

| Top alternatives | Free trial availability | Standout features |

| A 30-day free trial is available | Deepfake detection & face authentication | |

| Free Trial Available | Versatile document handling | |

| N/A | Real-time verification of identities without an Internet connection | |

| N/A | Instant digital & e-signing | |

| N/A | Tokenized intelligence | |

| N/A | Facial recognition with 99.98% accuracy under a second | |

| Free Trial Available | GSTIN &UPI ID verification | |

| Free Trial Available | 24/7 human supervision within 3 minutes | |

| N/A | Location coordinate extraction of identified entities for easy redaction | |

Free Trial Available | Deceased check |

A detailed list of the 10 best Signzy competitors for automated loan journeys

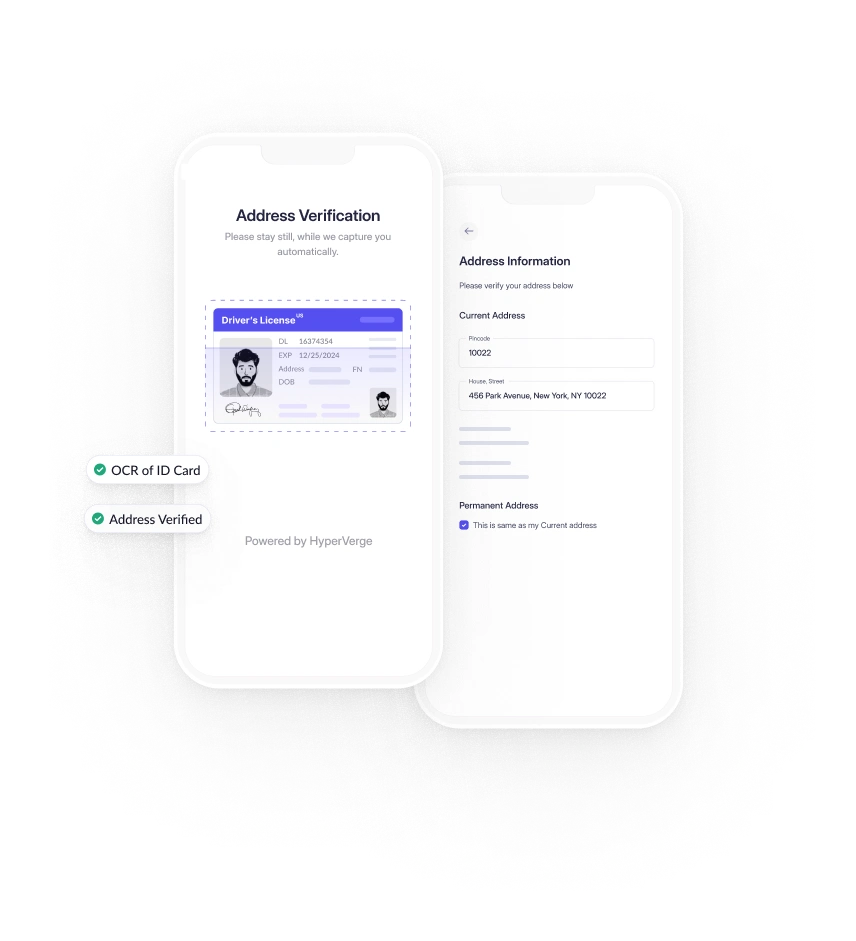

1. HyperVerge

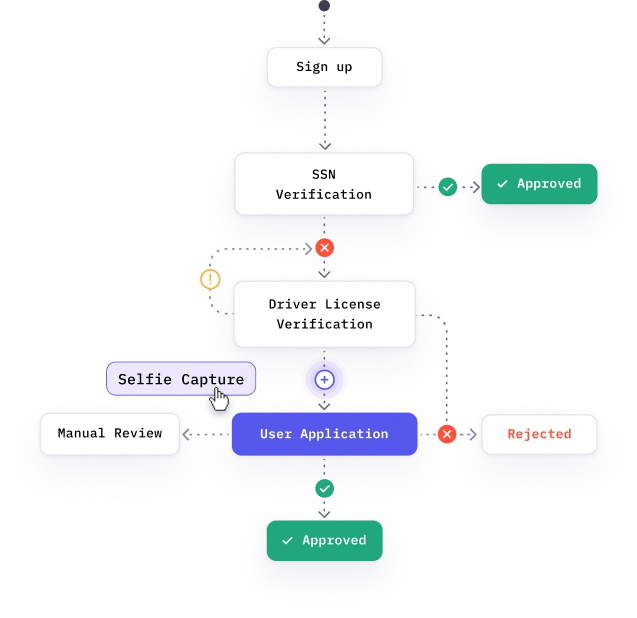

HyperVerge is an AI powered identity verification solution that enables businesses to onboard customers effortlessly while ensuring end-to-end security compliance.

It stands out as a leading identity verification solution with results that are hard to match–

- 98% completion rate–Ensuring almost every user completes the process

- 99% auto-approval rate–Significantly reducing the need for manual reviews

- 50% decrease in user drop-offs–Straightforward onboarding ensuring decreased drop-offs

Another feature that separates HyperVerge from its competition is its 99% accurate AI engine, which has helped organizations minimize fraud risks and safeguard their systems against fraudsters.

With a proven track record of verifying over 750 million IDs, the platform’s reliable AI-powered KYC solutions provide a lightning-fast 3-second identity verification process, making it the go-to choice for automated identity verification and KYC compliance.

Primary products

- Identity Verification

- OCR software

- Anti-Money Laundering

- Face Authentication

- Know Your Business

Top clients

HyperVerge’s clientele includes industry legends such as HSBC, Jio, slice, MPL, Jupiter, and Home Credit to name a few.

Benefits to businesses

- Affordable pricing: HyperVerge’s scalable pricing options can save your business up to 50% on costs, out-matching competitors.

- 24/7 support system: HyperVerge boasts responsive and proactive 24/7 technical support and customer satisfaction.

Best for

Financial services, education, gaming, remittance, crypto, marketplaces, logistics and eCommerce.

Features better than Signzy

- Comprehensive screening: HyperVerge screens against global and local databases, PEP lists, watchlists, and adverse media to outmaneuver fraudsters.

- Seamless document verification: HyperVerge ensures quick and hassle-free verification by tapping into centralized government databases for guaranteed authenticity.

Other key features

- Advanced fraud detection: Powered by face de-duplication, AI-based forgery checks, deep image analysis, and liveness detection.

- Biometric verification: Cutting-edge biometrics with single-image liveness detection and best-in-class face recognition technology.

Pricing

| Start-up companies: HyperVerge Start Plan offers a free trial within a sandbox environment for one month. You can integrate the system in under four hours, allowing you to view and manage verifications efficiently. Mid-size companies: HyperVerge’s Grow Plan includes all the features of the Starter package, with added benefits such as a comprehensive end-to-end identity verification suite, centralized database checks, access to anti-money laundering (AML) checks, and the ability to create custom workflows tailored to your business needs. Enterprise-level organizations: HyperVerge’s Enterprise Plan offers all the features included in Grow, with additional benefits such as tailored pricing, dedicated support, and personalized collaborative innovation. Our services enable you to collaborate more effectively, lead with greater insight, and solve complex challenges with customized solutions. |

What do HyperVerge users say?

G2 reviews

HyperVerge has an overall rating of 4.5 out 5 stars based on 6 user reviews on Capterra.

2. IDfy

IDfy is a leading provider of solutions for identity verification, including know-your-customer (KYC), know-your-business (KYB), employee background checks, risk and fraud mitigation, digital onboarding, and digital privacy. Founded in 2011, the company has performed 70 million+ verifications for over 600 customers across various industries. IDfy’s investors include MegaDelta Capital, Blume Ventures, BEENext, and Dream Incubators.

Primary products

- Customer Verification

- Background Verification

- KYC Verification

- Partner Verification

- User Verification

- Video KYC

- Merchant Onboarding

- RiskAI

- Digital KYC

- Video PD

Top clients

IDfy’s clientele includes Amazon, SBIcap Securities, Motilal Oswal, HDFC Bank, Tata AIG, Reliance Industries, Dream 11, Paytm, PhonePay, and more.

Benefits to businesses

- Efficient and scalable solutions: IDfy’s solutions enable businesses to effectively address their identity verification and KYC needs, while also mitigating fraud and risk.

- Enhanced security and compliance: IDfy is equipped with the highest-grade encryption and security features, and is built to scale infinitely to support large-scale implementations.

Best for

Banking, eCommerce and payments, capital markets, insurance, gaming and gambling, fintech, communities, HR and recruitment.

Features better than Signzy

- Integrated across local statutory databases: IDfy’s platform connects with local statutory databases to provide accurate and up-to-date information.

- Versatile document handling: Users can onboard using any document in any script, with the ability to extract and verify data.

Other key features

- Time-bound outcomes: Guarantees reliable and timely results, reducing uncertainty in verification processes.

- Incremental automation: Leveraging AI and machine learning, enhances automation, and reduces manual intervention.

Pricing

IDfy offers flexible pricing customized to meet the unique needs of each business. This ensures you pay only for what your organization requires. To know more, click here

What do IDfy users say?

G2 reviews

IDfy has an overall rating of 4.4 out of 5 stars based on 28 user reviews on Capterra.

3. Karza

Established as a comprehensive solution for the entire lending lifecycle, Karza specializes in onboarding, due diligence, monitoring, and collections. The company uses AI and machine learning to enhance fraud prevention, risk management, compliance, and automation. With over 400 clients and handling 8 crore monthly API calls, Karza is recognized as India’s top microservice provider for banks and financial institutions. Acquired by Perfios Software Solutions in February 2022, Karza has earned accolades such as Technoviti’s Best Video KYC Solution, and NASSCOM’s Emerge 50 Winners.

Primary products

- TotalKYC

- Video KYC

- KDiscover

- KLookup

- KBanking

- KScan

- KGST

- KITR

- KWatch

- KDiscovery

Top clients

Karza’s list of clients includes Google Pay, Cash Bean, IDFC First Bank, Accenture, Bajaj Finance, ICICI Bank, and more.

Benefits to businesses

- Seamless integration: Karza’s solutions are designed to integrate effortlessly with existing systems, without compromising performance.

- Enhanced data and insights: By leveraging advanced analytics and AI-driven insights, Karza improves the accuracy of data used in decision-making processes.

Best for

Banks, insurance, payment, diligence, and corporates.

Features better than Signzy

- Litigation BI: Karza can automate the creation of litigation reports using extensive court data

- KWatch: Karza features an early warning system for risk management and fraud analytics, offering proactive risk detection.

Other key features

- State-of-the-art digitized solutions: Advanced digital solutions, including TotalKYC and an AI-powered Video KYC platform with cognitive features, ensuring cutting-edge identity verification capabilities.

Pricing

Karza operates with a flexible pricing structure designed to fit various business needs. To explore their offerings, you can request a demo or write directly to connect@karza.in.

What do Karza users say?

Karza has now been acquired by Perfios and here are some G2 reviews on Perfios –

4. Digio

Digio is a leader in India’s digital transformation, focusing on eliminating paper-based processes with its suite of digital solutions. It specializes in legal digital signing, digitalizing recurring payments through e-NACH, and user identity verification. In less than a decade since its inception (2016), Digio has served over 1000 million individual customers and 1,500+ business customers. The platform also processed 8 million NACH transactions, generated over 80 million documents, and digitized more than 1 billion A4 pages.

Major investors include Groww, Rainmatter, Straddle Capital, and Nithin Kamath (Zerodha). Digio has also been recognized as one of the world’s 100 most innovative Regtech companies by the World Fintech Forum.

Primary products

- DigiSign

- DigiKYC

- DigiDocs

- DigiCollect

Top clients

Digio boasts a clientele list that includes Hero Fincorp, Zerodha, Axis, Paytm, Navi, and AngelOne.

Benefits to businesses

- Enhanced user experience: Digio offers a seamless digital interface for both customers and businesses.

- One-stop solution: Digio meets all your compliance and legal requirements quickly, in one easy-to-use platform.

Best for

Financial services, real estate, retail, eCommerce, human resources, legal, education and health care.

Features better than Signzy

- Cost and efficiency: Digio claims a reduction in operational costs by 60%, turnaround time (TAT) by 95%, and increased productivity by 75%.

- APIs and SDKs: Digio offers powerful plug-and-play APIs and SDKs for mobile and web applications, alongside developer-friendly integrations.

Other key features

- Quick and simple integration: Immediate onboarding and go-live for faster implementation.

- Better visibility: Provides end-to-end visibility of the entire document signing process, right from KYC, to NACH registration and more.

Pricing

For full details on Digio’s pricing, reach out to them for personalized assistance.

What do Digio users say?

Digio eSign has an overall rating of 4.8 out 5 stars based on 8 user reviews on Capterra.

5. Bureau ID

Bureau is a fraud prevention and identity verification platform that delivers data insights throughout the user journey to help prevent financial and reputational damage. Bureau adheres to the latest security practices and compliance standards, ensuring that no information is shared with third parties without explicit consent. The platform leverages a variety of technologies, including HTML5, jQuery, and Google Analytics, and is supported by prominent investors like Blume, GMO Venture Partners, and Okta.

Primary products

- Money Mule Score

- Device Intelligence & Behavioral Biometrics

- Platform

- Alternative Data

Benefits to businesses

- Simple APIs: Bureau accelerate all processes from onboarding to checkout with seamless integration.

- Revenue generation: Chance of increasing revenue by using real-time data.

Best for

Gaming, fintech and financial services, and compliance.

Features better than Signzy

- Frictionless login: Bureau offers a seamless one-tap login experience requiring no OTPs, passwords, or magic links.

- Tokenized intelligence: Bureau profiles millions of risk identities hidden behind phone numbers, offering enhanced protection against fraud.

- Protection guarantee: Bureau guarantees protection and recovery from fraudulent chargebacks.

Other key features

- Speedy onboarding: Quickly and securely verifies identity using KYC, OCR, and AML processes

- Mobile-first approach: Supports Android and iOS platforms with an available Flutter SDK for enhanced mobile integration.

Pricing

For more information on Bureau’s pricing, simply fill out the form on their website. Be sure to select the appropriate solution to get tailored details for your needs.

What do Bureau users say?

Here are some reviews directly from Bureau’s website–

6. Jukshio

Jukshio is an AI face recognition platform that specializes in fraud detection and other compliance solutions. It is a full-stack compliance and risk management solution, offering 360-degree identity and access management tools. Jukshio has verified 650 million identities, detected over 3 million frauds, and enabled KYC verification for 52% of eligible Indians. The platform supports over 150 languages and can verify an identity in under 1000 milliseconds.

Primary products

- KYC++

- DFraud

- Attendance Management

- Enterprise Access

- Know Your Business

Top clients

- Jukshio’s list of clients include Reliance Industries, Jio, Decentro, Manappuram Finance Ltd, Save and more

Benefits to businesses

- Wide reach: Jukshio supports over 150 languages, catering to a global user base.

- High accuracy: Jukshio has verified 650 million+ identities with over 3 million fraud cases detected, demonstrating a strong track record in fraud prevention.

- Regulatory compliance: Jukshio continuously monitors regulatory institutions to stay updated with compliance norms, protect against business risks, and manage brand reputation.

Best for

Organizations seeking high security, rapid processing times, and multi-language support.

Features better than Signzy

- Rapid response: Jukshio’s turnaround time is notably quicker than that of legacy solution providers.

- Easy integration: Jukshio offers low-code solutions, minimizing developer effort and simplifying the implementation process.

- Advanced CX: Jukshio achieves a superior user experience with fewer clicks and head tilts.

Other key features

- Multi-layered KYC++ experience: Combines AI-face detection and document verification with live customer data for comprehensive identity checks and 360-degree protection

- Modern tech: Adapts to and eliminates new fraud attack vectors.

- Customizable flows: Offers tailored web and mobile flows to meet specific business needs and regulatory requirements.

Pricing

| Starter: Jukshio’s Starter Plan provides value at $15 per team member per month, with an annual rate of $180. The plan includes seamless app integrations, automated backups, collaborative file sharing, robust security, and more Pro: Jukshio’s Pro Plan, their most popular option, is available at $35 per team member per month, or $420 annually. The benefits remain the same as the starter plan. Enterprise: Jukshio’s Enterprise Plan, is available at $80 per team member per month, or $960 annually. The benefits remain the same as the starter/pro plan |

What do Jukshio users say?

Here’s some reviews directly from Jukshio’s website–

7. Cashfree

Cashfree Payments provides a complete KYC stack for digital onboarding, and streamlining user identity verification. With a solid infrastructure in place, Cashfree Payments performs over 100 million verifications each month. Their system has achieved a 50% reduction in onboarding drop-offs and claims to deliver responses in under 1 second for over 90% of requests.

Primary products

- SecureID

- Bank Account Verification

- UPI ID Verification

- UPI ID from phone number

- IFSC Verification

- Reverse Penny Drop Verification

- Aadhaar Verification

- Aadhaar eSign

- Passport Verification API

- Driving License Verification API

- DigiLocker API

- GST verification

- KYC Link

- Face Match API

- Geolocation API

Top clients

Cashfree Payments clientele list includes Tata Capitals, Rapido, Dream11, Meesho, acko, Bajaj Finserv, and more

Benefits to businesses

- Regulatory compliance: Cashfree Payments help adhere to regulatory standards and KYC with bank-grade data security.

- Real-time identity verification: Cashfree Payments conducts live identity checks against current databases to confirm user identity instantly.

Best for

Investments, retail lending, insurance, eCommerce, marketplaces, HR and staffing, banks and fintech, social media, and gaming

Features better than Signzy

- Instant validation: Cashfree Payments quickly validate user details with their UPI ID phone number feature, enhancing quick onboarding.

- Advanced authentication: Cashfree Payments utilize facial recognition APIs and live location checks for secure user authentication and verification.

Other key features

- Comprehensive API range: Access to a broad array of APIs for verifying proof of identity, address, age, and more.

- Penny Drop verification: Verifies bank account details using the penny drop verification method eliminating the need for manual penny drop.

Pricing

CashFree Payments claims to offer one of the lowest payment gateway charges in India, starting at just 1.95%.

What do Cashfree Payment users say? G2 reviews

Cashfree has an overall rating of 4.4 out 5 stars based on 77 user reviews on Capterra.

8. iDenfy

iDenfy is an all-in-one solution that combines identity verification, business verification, fraud prevention, and compliance into a single platform. Leveraging AI-powered biometric recognition, iDenfy ensures high-quality identity checks while maintaining a manual review process to enhance accuracy. With support for over 200 countries and territories, iDenfy enables rapid data extraction from more than 3,500 active government-issued documents in just 0.02 seconds!

Primary products

- Full-stack identity verification service

- AML Screening & Monitoring

- Know Your Business

- Risk Assessment

- Fraud Prevention

- NFC Verification

- Fraud Scoring

Top clients

iDenfy has worked with names like UpStack, Artfinder, Xcoins, Betsafe, and more.

Benefits to businesses

- AI-powered and manual verification: iDenfy automated biometric recognition with manual review to enhance verification accuracy and approval rates.

- Versatile integration: iDenfy provides options for web, iFrame, or mobile app integration to suit different business needs.

Best for

Fintech, blockchain and cryptocurrency, proxy networks, gaming, transportation, sharing economy, and streaming platforms.

Features better than Signzy

- Responsive support: iDenfy’s support team is known for their prompt and helpful assistance.

- Customizability: iDenfy allows businesses to tailor mobile integrations to their specific UX/UI needs and easily connect APIs from any backend.

- Cost-effective pricing: iDenfy’s pricing model, which charges per approved verification, results in significant cost savings for businesses.

Other key features

- Liveness detection: Includes both 3D active and passive liveness detection to ensure that the person being verified is present and genuine.

- Automated and human-supervised verification: Offers both automated ID verification and a hybrid system with human supervision for added accuracy.

- Ease of integration: The platform’s API and iFrame integration capabilities make it easy to incorporate into various applications, including blockchain projects and cybersecurity solutions.

Pricing

iDenfy tailors its pricing strategies through a comprehensive analysis of your business needs.

What do iDenfy users say?

G2 reviews

iDenfy has an overall rating of 4.8 out 5 stars based on 9 user reviews on Capterra.

9. Newgensoft

Newgensoft‘s Newgen Intelligent IDXtract software enables enterprises to identify, extract, and redact information all while ensuring top-notch security and privacy. The software utilizing AI, machine learning (ML), and computer vision automatically detect, locate, and classify entities on identity documents.

Primary products

- Intelligent process automation

- Contextual Content Services

- Omnichannel Customer Engagement

- Low Code Application Development

- AI and Data Science

- Generative AI

Top clients

Newgen’s clientele list names Union Bank, MaxLife Insurance, Bajaj Allianz, ING Vysya Bank, IndusInd Bank, AstraZeneca and more

Benefits to businesses

- Auto-form filling: Newgensoft’s software can extract data to auto-fill forms for KYC and other processes, reducing time and effort.

- Risk management: Newgensoft ensures compliance with regulations like GDPR by identifying and redacting personally identifiable information (PII).

Best for

Banks, financial institutes, insurance firms, healthcare, and energy.

Features better than Signzy

- Validating documents: Newgensoft verifies the validity of an identity document by identifying issue and expiry dates.

- Data discovery: Newgensoft automatically identifies and extracts information from identity documents, eliminating “dark data”.

Note: Dark data is the portion of data that, (having not been utilized effectively or promptly for its intended purpose), becomes forgotten within an organization’s data ecosystem.

Other key features

- Entity localization: Extracts location coordinates of identified entities for easy extraction and redaction.

- Adaptability: Works effectively on all image types: mobile-captured, scanned, or others.

Pricing

Newgensoft provides flexible pricing with a 3-year billing option, totaling $18,036 or $501 per month.

What do Newgensoft users say?

G2 reviews

10. Socure

Socure, backed by the likes of Accel and Commerce Ventures, harnesses the power of AI and machine learning to provide real-time identity verification. By integrating online and offline data sources—including email, phone numbers, addresses, IP addresses, device information, and broader internet data—Socure aims to eliminate identity fraud and verify 100% of legitimate identities. With over 2,400 clients spanning financial institutions, government agencies, and major enterprises, Socure’s ID+ platform stands out, especially for underbanked and credit-invisible populations.

Primary products

- Fraud Risk

- Compliance

- ID Document Verification

- Account Intelligence

- Decisioning

- Analytics & Reporting

Top clients

- Socure’s client list names Robinhood, citi, Gemini, Capital One, Stash, Chime, Betterment, Greendot and more.

Benefit for businesses

- Enhanced identity verification: Socure’s advanced AI-driven technology and comprehensive data sources provide a robust and real-time identity verification solution.

- Increased operational efficiency: By integrating predictive analytics and comprehensive risk assessment tools, Socure enables businesses to accelerate decision-making and also better regulatory compliance.

Best For

Financial services, eCommerce marketplace, sharing economy, online gaming, Buy Now Pay Later (BNPL), public sector, and crypto.

Features better than Signzy

- Portfolio Scrub: Socure’s Portfolio Scrub accurately identifies risks within accounts and offers strategies to address them.

- Address RiskScore: With Address RiskScore, Socure detects and verifies 15-20% more addresses compared to other credit bureau vendors.

Other key features

- Digital intelligence: Connects identities with associated devices, online behaviors, and historical consumer interactions.

- Analytics & reporting dashboard: Provides tools to explore, monitor, and audit key performance indicators (KPIs) for regulatory compliance, and risk management.

- Socure account intelligence: Enables instant verification of the status and ownership of non-traditional accounts, including those held at digital banks, credit unions, and regional banking institutions.

Pricing

Socure offers customized pricing solutions besides a free trial.

What do Socure users say?

G2 reviews

Choose HyperVerge to automate the customer identity verification process

Per a finding, more than 90% enterprises and small businesses had to deal with identity fraud in the last couple years. Insane isn’t it? As a business owner, it is only natural that you are worried for your organization and the safety of your customer’s identity.

So, if you have tried every solution on the market and are tired of lengthy identity verification solutions, HyperVerge can be the answer to your problem.

HyperVerge’s solutions automate identity verification processes to ensure your customers are who they claim to be. Best part? Unlike competitors with heavy code and lengthy onboard processes, HyperVerge has a quick, low-code approach! Just in four hours, your business can go live with its solutions. Unbelievable right?

Plus, beyond its user-friendly implementation, HyperVerge‘s robust security features, including AI-driven face validation, ID verification, and real-time fraud detection, ensure compliance with global standards such as GDPR and ISO 27018.

Don’t wait any longer. Sign up with HyperVerge today to secure and scale your business.

Conclusion

As digitalization jumps leaps and bounds, so does the threat of fraud. Traditional identity verification solutions struggle to keep pace, leaving businesses vulnerable to financial losses and reputational damage. As top industry players like Signzy, IDfy, Digio, and more grapple with these issues, the need for a future-proof solution has never been more pressing.

Enter HyperVerge – your trusted partner that leverages AI and state-of-the-art solutions to make identity verification a hassle-free job, no matter which industry your business belongs to. Partner with HyperVerge today and unlock a future-proof, customer-centric identity verification solution that safeguards your business, builds trust with your clients, and positions you for long-term success!

FAQs

1. Is Signzy a fintech company?

Signzy, an identity verification solution further classifies itself as a market-leading digital bank infrastructure provider, changing the way financial institutes and banks onboard customers.

2. What does Signzy do?

Signzy harnesses the power of AI and blockchain technology to help banks, NBFCs, and other financial entities streamline their operations, enhance compliance, and drive innovation. It aims to redefine the processes in the identity solutions industry and has already onboard ~100 million customers.

3.Which are the best Signzy competitors in India?

HyperVerge, with its AI-driven facial recognition, hassle-free KYC processes, and real-time fraud detection could be your best bet if you are looking for a Signzy alternative.