In 2023, the insurtech firm Lemonade set a groundbreaking world record by processing an insurance claim using its sophisticated AI system in just two seconds.

That was two years ago. Today, leading insurers automate parts of claims processing for low-value, high-volume cases and continue to scale confidently. Among all insurance workflows, claim processing is where AI moves the fastest.

But no automation works without clean, structured data. That’s precisely where optical character recognition (OCR) for claims processing comes in.

Here’s how it’s transforming the way insurers run operations at scale.

Why Traditional Claims Processing Is Broken And How OCR Fixes It

The speed of settlement is the number one driving factor influencing customer satisfaction of a policyholder. With a hundred thousand claims to process every day, an insurance company cannot perform optimally without automation.

Let’s break it down.

Manual Claims Processing: The Hidden Costs

To decide on a claim, an insurer needs verified identity documents, bank account statements, policy documents, filled insurance forms, and supporting evidence.

They spend hours and weeks chasing documents, digging through scattered forms, and dealing with poor-quality paperwork before they even make a single decision on the claim.

Of course, it costs them time and increases their operational costs. But more than that, it agitates their customers when they are already under stress due to a medical emergency, an accident, or property damage.

When a customer needs timely payments from an insurer in a moment of distress, the industry standard benchmark for insurance payment turnaround time is 30 days.

This can be brought down significantly if the initial process of data extraction is automated.

Where Most Delays and Errors Happen

If one had to manually extract useful data from 50-something PDFs, low-quality scans, and handwritten forms and consistently enter those details into a system for days at a time, errors were bound to happen.

That’s even if your team dedicates its full attention.

And we are not even talking about time-consuming compliance checks necessary to process the claims.

The delays at this stage are primarily the reason why claim processing takes months at times.

OCR as the First Step Toward Intelligent Automation

The optical character recognition (OCR) technology cuts down the grunt work for you. It scans, extracts, and structures claim data in seconds, converting siloed documents into clean, digitized inputs ready for intelligent processing.

Authenticate and onboard a user in less than 60 seconds

With HyperVerge’s facial recognition software Schedule a DemoHow OCR Works in Insurance Claims Workflows

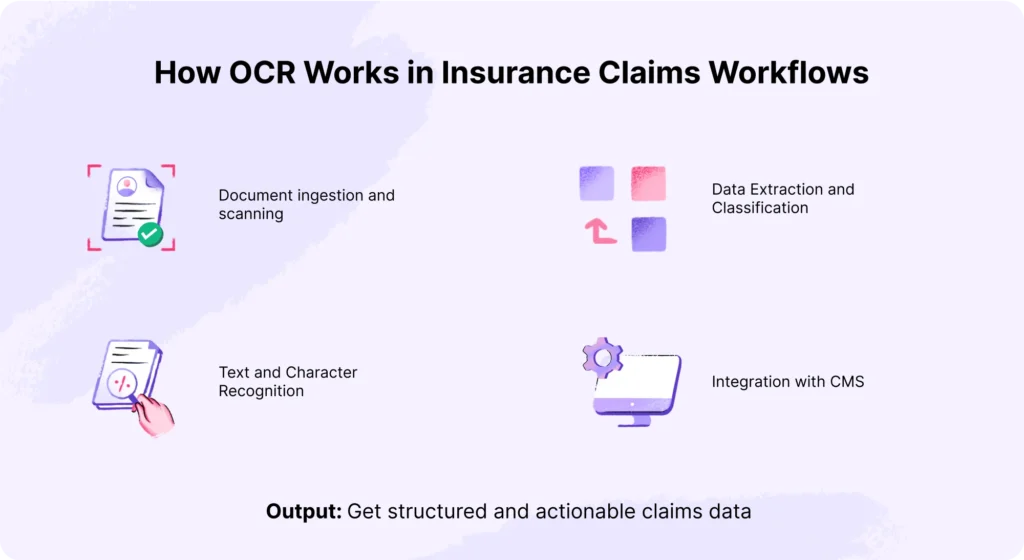

OCR automation processes documents faster and reduces the errors that are otherwise common in traditional methods. However, for OCR to actually work in insurance, you need to understand how it fits into your multi-step claims workflow.

Let’s check that.

1. Document Ingestion and Scanning

Collect claim-related documents such as FNOL (First Notice of Loss) reports, medical records, claim forms, discharge summaries, police reports, ID proofs, and legal papers.

These documents can arrive in various formats, such as scanned PDFs, faxes, or images captured via mobile apps. At this stage:

- Digitize the physical documents using high-resolution scanners and ingest those scanned documents into the OCR software for optimal character recognition.

- Upload the digital documents directly into the system without scanning.

The quality of claim documents directly impacts OCR accuracy. If needed, pre-process the documents to reduce noise and correct skew (deskewing) to optimize the data capture process.

2. Text and Character Recognition Across Varied Formats

OCR then analyzes the ingested documents on these two fronts:

Handwritten and printed documents

Advanced algorithms and machine learning models are implemented to recognize writing styles across different fonts and handwriting variability. Additionally, ICR (intelligent character recognition) is applied to extract information from signatures or handwritten notes.

The result: accurate conversion of both printed and handwritten content into machine-readable digital text.

Variations in form

Insurance claim forms vary widely in layout, font styles, and languages. While some forms have structured tables, others are free-form narratives (unstructured).

Techniques like zonal OCR target specific fields, such as policy number and claimant name, within structured forms. This improves accuracy by focusing only on expected data zones.

OCR uses layout data analysis and natural language models to detect and extract relevant information based on context for unstructured forms.

3. Data Extraction and Classification

The OCR technology automates the extraction of relevant data points from claim forms and groups them into categories like

- Claimant details

- Policy numbers

- Dates of loss

- Diagnosis codes

- Itemized charges.

It uses NLP (natural language processing) and rule-based logic to parse unstructured text and filter out irrelevant information.

At this stage, OCR turns scattered, raw text into clean, labeled data. This gives your team everything needed for claim validation in one place.

Plus, the structured output can flow straight into your CMS. Meaning, no lengthy data entry process. You can review and process claims faster, with less manual work.

4. Integration with Claims Management Systems (CMS)

The structured, searchable data is pushed into your claims management system through APIs or built-in integrations. Since OCR fits seamlessly into existing setups, it doesn’t require a complete system overhaul.

5. Output: Structured, Actionable Claims Data

You now have structured, usable data that can be used to process claims, create reports, and update your digital records. Your pre-defined CMS format captures the extracted data without any manual intervention.

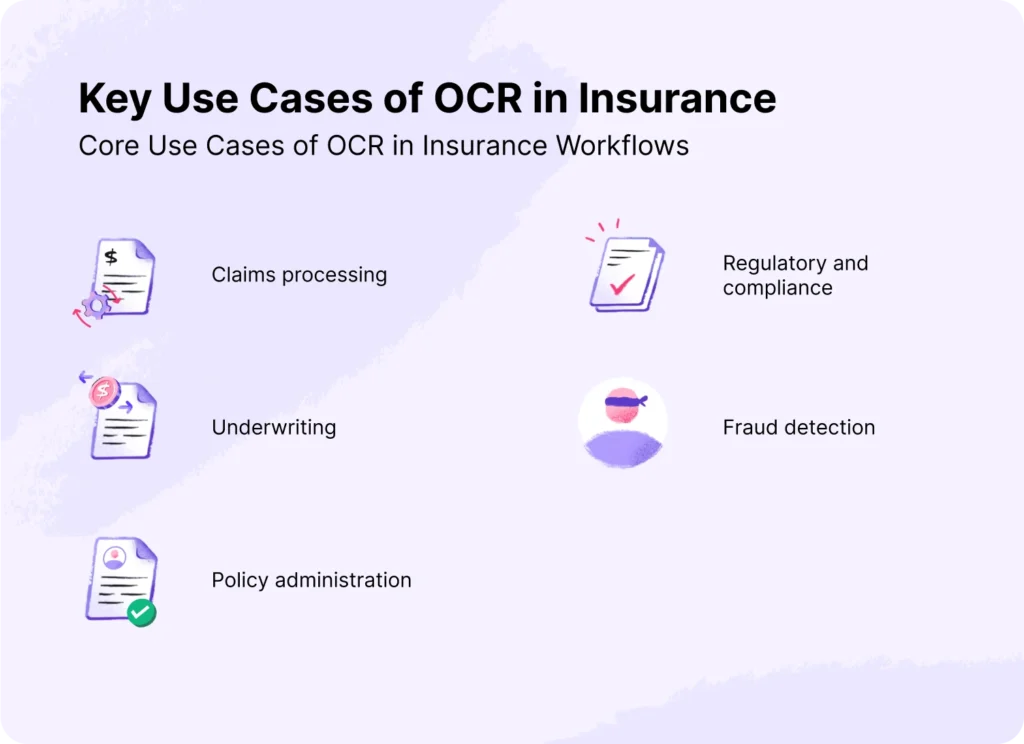

Key Use Cases of OCR in Insurance

As optical character recognition (OCR) streamlines data capture for insurance companies, it enhances the operational efficiency with which these businesses operate. Let’s understand how OCR influences different areas of an insurance work process.

- Claims Processing Automation

Traditionally, claims processing workflow depended heavily on manual data entry. It often took days or weeks to complete a single claim. OCR changes that.

It can extract key details from claim forms and supporting documents like medical records, bills, and ID proofs in minutes without compromising data accuracy.

According to research, $170 billion in premiums is at risk over the next five years as customers leave due to poor claims experiences. At this point, switching to OCR isn’t optional. It’s the only effective way to speed up your claims processing system.

The use of OCR in healthcare, auto, accounting, and life insurance is helping insurers speed up claims intake and reduce errors.

- Underwriting Efficiency

Underwriters refer to as many as 70 documents (sometimes 600 pages long) to find the answers they need during the underwriting process. That’s 2 hours of work every day spent on non-core tasks like sorting documents, checking formats, and re-entering data.

OCR helps reduce that load by extracting and structuring key data from policyholder documents, historical data, and financial statements.

This gives underwriters a complete view of each case, helping them assess risk without getting bogged down in paperwork. It saves time and allows insurers to handle more customers efficiently.

| Use Case: LUDA, a global reinsurance company, saw a 40% drop in case rejections after implementing Cognizant’s intelligent underwriting tool, opening up billion-dollar revenue opportunities. |

- Policy Administration

OCR speeds up policy administration by automating data entry and digitizing policy documents. When a customer renews or applies for a new policy, their information can be verified instantly without requiring extensive formalities or data validation. The customer has quicker access to their policy, and as a business, you reduce claim processing time and admin workload.

- Fraud Detection & Risk Mitigation

OCR tools today are powered by AI technologies. They extract and compare information with existing records to flag mismatched details, altered documents, or identity fraud.

For instance, OCR can match data from different claims to detect duplicate submissions or discrepancies. This helps insurers reduce risk exposure and avoid becoming part of the $40 billion lost to insurance fraud every year.

- Regulatory & Compliance Document Handling

Insurers deal with strict compliance requirements established by HIPAA (Health Insurance Portability and Accountability Act) and NAIC (National Association of Insurance Commissioners) in the US. According to the regulations, an insurance company must maintain detailed records of claims for audits and regulatory checks.

After capturing the data from forms, policy documents, and bank statements, OCR organizes it in a structured format for audits and compliance checks.

Related read: AML for insurance companies

Benefits of Using OCR for Claims Processing

OCR brings measurable improvements across key areas of insurance, i.e., accurate claims processing, customer service, compliance, and operational efficiency. Here’s how you stand to benefit:

Faster Turnaround Times

OCR cuts down the time spent on data entry and document checks. Claims that once took days can now move forward in minutes. Many insurers now use OCR with AI to auto-process low-risk or small claims, freeing up teams to focus on more complex cases.

Improved Accuracy and Fewer Manual Errors

Advanced technologies like AI and ML further enhance data accuracy by learning from past data and capturing information from low-quality scans or blurred images. They can also extract details from complex documents and adapt to dynamic layouts, thus reducing the need for human intervention.

Enhanced Customer Experience

By automating data extraction, OCR gives you clean, structured data that speeds up claim processing with fewer or no errors. Customers get faster decisions without having to go back and forth. This makes their overall experience smooth and positive.

Cost Efficiency and Operational ROI

A large part of the insurance workforce handles data entry and validation. By automating these tasks with OCR, insurers can reduce manual workload and shift focus toward more valuable tasks like customer support or fraud review. This cuts administrative costs and improves processing speed, leading to better operational ROI over time.

Competitive Advantage in a Digitized Market

According to research, technology leadership can lead to better performance on the dimensions of premium growth, expense ratio, and customer loyalty.

Yet, only 5% to 10% of carriers are currently capturing value from their data and technology investments.

Insurers using OCR can scale operations by handling more cases, improving customer service, and reducing turnaround times. All of these without increasing their costs substantially.

OCR powered with the latest tech helps the insurers stay ahead in a competitive marketplace.

Technology is your competitive edge. Leverage it.

Read More: HyperVerge OCR Solution: Benefits & Features

Intelligent Document Processing (IDP: OCR + AI in Action)

OCR was powerful. But in 2025, Intelligent Document Processing (IDP) takes precedence by combining OCR with advanced AI technologies like NLP and ML. It’s built to handle messy, unstructured documents and complex policy checks that traditional systems struggle with.

Here’s how:

- Handling Complex, Unstructured Data

OCR was limited to extracting data from structured documents like standard forms or typed PDFs. But IDP goes a step further. It reads and extracts information from unstructured documents, like handwritten notes, email threads, discharge summaries, or scanned paper documents with no fixed layout.

- Real-Time Decision Making with NLP and ML

AI technologies like NLP help the system understand the meaning of text. It can establish dependencies, match data with supporting documents, and flag missing or unclear fields that may need manual review.

Machine learning algorithms continuously learn from past claims, improving the system’s ability to detect patterns and assess risks. This helps insurance companies make quick decisions on complex matters without compromising accuracy or compliance.

- Scalable Automation for Enterprise Insurance Providers

The robust IDP system helps you scale operations without affecting insurance claims processing or customer service. It streamlines workflows and adds fallback systems to handle exceptions without slowing things down.

Implementation Challenges and How to Overcome Them

OCR is a strong solution to manual data extraction, but it comes with its own set of limitations. Let’s look at the key challenges and how insurers can overcome them.

Integrating with Legacy Systems

74% of insurance companies still rely on outdated legacy systems that don’t support modern APIs or flexible data formats. This makes it hard to plug in new OCR or IDP tools.

Solution: Look for OCR solutions that support batch processing to work around real-time integration gaps.

Ensuring Data Privacy and Compliance

Claims data includes sensitive personal and medical information. Insurance companies are responsible for protecting this information by complying with HIPAA and data privacy laws.

According to HIPAA guidelines, fines for violations can range from $141 to $2,134,831 per violation, depending on the level of culpability. There have been multiple instances of data breaches in which the leading insurance providers had to pay millions of dollars to settle lawsuits.

Solution: Use OCR solutions that support encryption, access controls, and audit logs and are certified for industry standards like HIPAA and NAIC.

Managing Accuracy in Low-Quality Scans

OCR struggles with blurred scans, low-quality resolution, and handwritten documents. Without AI, it even fails to capture data from unstructured documents.

Solution: Choose OCR tools that use AI to pre-process images, enhance clarity, and prompt users to update high-quality scans

Vendor Evaluation and Customization Support

Every insurance workflow is different, and off-the-shelf tools don’t always fit. Some vendors don’t offer support for post-deployment changes, making it really difficult for insurance companies

Solution: Prioritize vendors who offer flexible customizations and hands-on implementation support

Choosing the Right OCR Vendor for Insurance

As the challenges show, the problem isn’t with OCR, it’s with your chosen vendor. The right partner will offer the flexibility, compliance, and support needed to implement OCR in your workflow.

Here’s what you need to evaluate while choosing a vendor for your insurance business:

Accuracy Rates and AI Capabilities

OCR helps with accurate data extraction, but is it the case with your chosen OCR? Well, instead of relying on website claims, ask these questions of the vendor:

- What’s the actual accuracy rate of data extraction? Is it above 95%, like HyperVerge?

- Is it AI-powered, and if so, probe further about NLP and ML use.

- Does the OCR support unstructured documents, not just standard forms?

- What specific document types does it handle, and are yours included?

- How well does it perform on low-resolution scans or poor-quality images?

- Can it flag low-confidence fields that need manual review?

- Does it support data extraction from documents in multiple languages?

- Does it validate extracted data by comparing it with supporting documents or internal records?

Support for Industry-Specific Documents

OCR tools must support the specific documents insurance companies deal with every day. Before choosing an OCR, check if it supports policyholder documents (prevalent in your country), medical and billing documents, legal and regulatory certificates, and claim documents.

API/SDK Integration

The best OCR software work with your existing CMS, ERP, or CRM systems. Without proper integration, you’re likely to face delays, data mismatches, or workflow breakdowns.

To make an informed choice, ask:

- Does the vendor provide well-documented APIs or SDKs?

- Is it compatible with your CMS or ERP platforms?

- Can it support both real-time and batch data transfer?

- Does it allow you to build custom workflows?

- How much training or developer effort is needed to set up and maintain the integration?

Compliance, SLA, and Post-Sale Support

For insurance companies, compliance isn’t an option. You need clear answers on how the vendor protects that data and supports you after deployment.

Here’s what you should be asking:

- Is the tool compliant with HIPAA, NAIC, and other relevant regulations?

- Does the vendor offer data encryption, access controls, and audit logs?

- What SLAs are in place for uptime, issue resolution, and response times?

- How reliable is their customer support after deployment?

- How often do they release updates, and how are those updates handled?

Key Takeaways & Next Steps

For years, you’ve used OCR to extract data and move claims forward. But the volume, complexity, and expectations have changed. Traditional OCR can’t keep up with the scale at which modern insurers operate.

Now, more than ever, it’s time to move beyond basic OCR and adopt intelligent document processing (AI-powered OCR) that is built for faster and error-free workflow.

HyperVerge’s AI-powered OCR is built for modern insurance workflows, automating data extraction. Here’s how it stands out:

- Processes hundreds of global document types in 150+ languages

- Template-agnostic OCR with over 95% accuracy across diverse formats

- Compliant with global regulations like GDPR, SOC 2, and NIST

- Adapts quickly—trains on new document formats in under a week

FAQs

1. Can OCR handle handwritten or scanned claim documents?

Advanced OCR systems can accurately extract data from handwritten text and scanned images & documents with over 90% precision in most cases.

2. What are the benefits of using AI-based OCR over traditional OCR in insurance?

AI-based OCR can handle unstructured documents and extract data with more accuracy. They can even learn from past data, making them more relevant than traditional OCR, which only worked with templated, structured documents.

3. Is OCR secure for sensitive insurance data?

OCR solutions often include encryption and secure cloud storage options. However, to ensure utmost compliance, ensure that the OCR tool you choose complies with standards like HIPAA, GDPR, and SOC 2.

4. How long does it take to implement OCR in claims workflows?

Implementation can take anywhere from a few days to a few weeks, depending on your system complexity and integration needs. With proper planning and vendor support, most insurers can go live within 1–3 weeks.

5. What documents can OCR process in the insurance industry?

An insurance company can use OCR to process FNOLs, claim forms, medical bills, policy documents, and ID proof documents.