Optical Character Recognition (OCR)is the new normal in the insurance industry, transforming the way data is extracted and processed. This cutting-edge technology has enabled insurance companies to automate data entry tasks and reduce the need for manual intervention. By digitizing handwritten or printed texts, OCR makes them machine-readable, allowing for more efficient and accurate business operations.

OCR can help process insurance claims in a fraction of the time, with minimal errors and maximum efficiency. The global optical character recognition market, valued at USD 12.56 billion in 2023, is expected to grow at an astonishing 14.8% compound annual growth rate (CAGR) from 2023 to 2030.

The benefits of OCR extend far beyond the insurance companies themselves. Customers, too, feel the impact of this technological advancement through faster claim resolutions and enhanced interaction. Imagine the relief of having your claim processed quickly and accurately, without the hassle of endless paperwork and delays. OCR makes this a reality.

Moreover, OCR reduces operational costs, minimizes manual intervention, and increases data accuracy. This ensures better compliance, fewer paper-based processes, and more competitive offers for customers. It’s a win-win situation for both insurance companies and their clients.

What is OCR?

OCR converts different types of text, i.e., printed and handwritten, into machine-readable text. It comprises document scanning and processing to extract the data in the scanned documents. OCR works with several documents: forms, invoices, ID cards, and insurance policy documents. By turning text into digital form, OCR makes it easy to manipulate, store, and retrieve data and is a key tool in document management digitization.

How OCR works in insurance

Several key steps go into the functioning of OCR in insurance. Here’s a detailed look at how OCR functions within insurance:

Data capture

Data capture is the first step in OCR. It involves collecting documents and preparing them for scanning. These are claim forms, policy applications, invoices, and identification documents. The idea is to collect all the paperwork that is supposed to be digitized and processed.

Scanning and data extraction

After documents are collected, they are scanned with high-resolution scanners. The document scanning creates digital images to be analyzed by OCR software. The software helps accurately identify the text within these scanned images and begins the extraction process. It separates text from the background and readies it for character recognition.

Character recognition

Character recognition is the core function of OCR technology. In this step, the software examines the shapes and patterns of the text characters in the scanned images. Sophisticated algorithms and machine learning techniques recognize these characters and convert them precisely into digital text. The accuracy in this stage is critical because it directly impacts the quality of extracted data.

Data integration and classification

In this stage, the extracted data is categorized and sorted into predefined categories, such as customer information, details of the insurance policy, and claim specifics. This structured data is then fed into the databases and systems of the insurance company and is easily accessible for further processing and analysis.

Output

The final step involves enabling the accurate output of the processed data into a usable format. This could be feeding the data into an insurance management system, creating reports, or updating customer records. The output stage ensures the data is in the correct format and validated for further use in several business operations.

OCR technology automates the data entry process, eliminating most errors from business operations. Through accurate data extraction, OCR helps insurance companies run their operations with higher efficiencies and informed decision-making.

Key applications of OCR in insurance

OCR technology extends to a wide range of functions in the insurance industry, each contributing to more efficiency and quality of service. Here are key areas in which OCR is making a significant contribution:

Claims processing

Claims processing stands to be one of the critical functions of the insurance industry. Traditionally, this was one of the most labor-intensive processes, with enormous dependence on manual data entry- a time-consuming and error-prone process. OCR has made the entire process smoother and more efficient. OCR can extract data from claim forms and supporting documents, including medical reports, repair bills, and photographs effectively. Automating data extraction helped shrink the processing time and significantly increase the accuracy level of data. Insurers can, therefore, settle claims with much greater speed and precision. The customers benefit from faster claims resolution, which, in turn, adds to their overall experience.

Policy administration

Policy administration involves a range of functions, such as data entry, policy document management, and renewals. OCR tech makes these functions easier and faster by automating the extraction and processing of data from various documents. For example, if an applicant sends a policy application, OCR can quickly digitize the information and feed it into the insurer’s database. This action helps in enhancing efficiency and also reduces administrative expenses. OCR can also handle large volumes of insurance policies flawlessly, making searching, retrieving, and updating information much easier.

Underwriting

Underwriting involves the assessment of risks and the determination of policy terms and prices. OCR will help underwriters by automatically extracting relevant information from application forms, medical records, and other supporting documents. Thus, OCR speeds up underwriting and ensures that underwriters have accurate and complete information for assessing risks. This leads to quicker decisions and more accurate risk assessments, enabling insurers to offer competitive policies.

Fraud detection

OCR can use data from various sources and detect inconsistencies or patterns that would otherwise hint at fraud. For instance, OCR can match data from different claims to detect duplicate submissions or discrepancies. OCR automates data analysis, enabling the insurer to detect and prevent fraud, consequently securing their financial health and operational integrity.

Benefits of OCR in Insurance

OCR technology in the insurance industry offers several significant benefits, improving efficiency, customer satisfaction, and competitive edge.

Improved efficiency

One of the most outstanding benefits of OCR is the elimination of manual tasks (like replacing manual scanning), therefore reducing time. The automation of data entry processes saves time, allowing employees to undertake other productive and high-value tasks, which will, in turn, help realize increased productivity, cost savings, and better use of resources. For example, claim processing time can be reduced from days to hours, significantly speeding up the workflow.

Enhanced customer experience

Faster claims processing and administration of policies have a direct bearing on customer satisfaction. With OCR, customers have their insurance claims and inquiries processed much faster, leading to a greater level of satisfaction and subsequent loyalty. Providing accurate and timely information enhances the customer experience, breeding trust and subsequent long-term relationships with policyholders.

Reduced errors

Manual data entry is inherently error-prone and can lead to dire consequences such as misstated insurance policy data, denied claims, and compliance issues. OCR greatly minimizes errors by ensuring accuracy in data extraction and processing. This reduction in errors improves data quality and enhances regulatory compliance. Insurers can confidently rely on the relevant information captured by OCR for decision-making and reporting purposes.

Increased competitiveness

Adopting OCR technology provides insurance providers with a competitive advantage over others in the market. The streamlining of operations improves the delivery of better services at lower costs. This competitive edge enables the insurer to attract more customers and better retain the existing ones. In addition, the fast processing of claims and policies improves the reputation of the company, strengthening its position in the market.

Conclusion

OCR is gradually transforming the insurance industry by automating document processing and other internal business processes. This aids in processing claims, administration of policies, underwriting, and fraud detection. OCR offers numerous opportunities to the insurance sector in efficiency, accuracy, and customer satisfaction. As insurers continue to adopt and integrate OCR technology, they will be well-positioned to meet the changing needs of their customers while keeping ahead in a competitive market. Leveraging OCR, insurance companies can ascertain cost savings, decrease manual processes and errors, and deliver top-of-the-game services to spur growth and success in the industry.

OCR fits directly into your end-to-end workflow- an ideal fit for the insurance industry. For instance, our Artificial Intelligence-based HV One platform optimizes customer onboarding processes to help financial institutions launch user onboarding journeys five times faster, with industry-leading conversion rates. The HV One platform comprises features for advanced OCR, which can quickly and effectively pull and process data for maximum accuracy and speed in processing. It also integrates multiple vendors, manages changes effectively, and possesses features like customizable UI, omnichannel nudges, and downtime protection to ensure a seamless user experience.

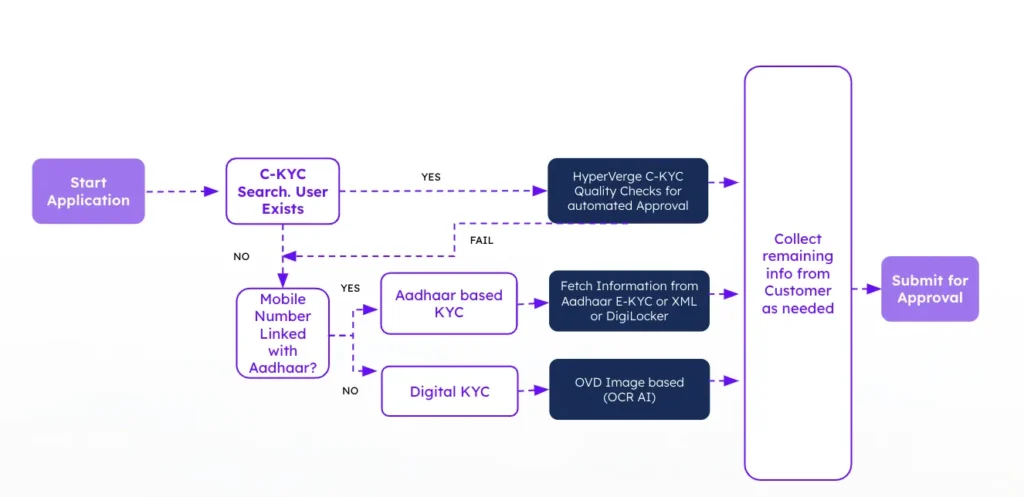

The following image showcases the end-to-end automation of insurers in India:

We are here to help. HyperVerge’s OCR software solution can extract data from any document with more than 90% accuracy. It can support structured documents like ID cards and official papers with 95% accuracy and unstructured documents like insurance forms and invoices. In addition, it is supported by coherent multilingual processing of documents across more than 150 languages, making it a versatile tool for international operations.

Explore OCR’s potential in your insurance operations today. Empower your business with our capable OCR solution for operational efficiency and high customer satisfaction.

US

US

IN

IN