Money laundering has always been one of the biggest threats to international financial stability. It may have risen significantly with the growth in digital banking. According to the Nasdaq 2024 Global Financial Crime Report, it is estimated that over $3.1 trillion in illicit funds flowed through the global financial system in 2023. This illegitimate activity is adverse to the integrity of financial institutions and sponsors some grievous crimes connected with terrorism and drug trafficking.

Understanding money laundering

Money laundering refers to concealing the source of income from illegal activities to make them appear legal. The practice of laundering money is normally categorized into three stages:

- Placement: This involves, at the very least, putting illegal funds ‘in motion’ within the financial systemic environment by different means, such as cash deposits, gambling, or buying something expensive like real estate or even a luxurious car.

- Layering: This is the concealment of the source of money. The funds go through complex multi-accounts and financial instruments in banks to mask the path of their origin. Zero traces of any paper trail are left pointing to the origin of the illicit funds.

- Integration: Here, the illicit funds are incorporated into the economy through activities, such as investment in a firm or real estate acquisition, to make them appear legitimate.

Identifying and detecting money laundering is crucial, even more so for business sectors that operate majorly in financial transactions. Effective Anti Money Laundering (AML) measures hinder the growth of organized crime, terrorist financing, and corruption.

Solid AML programs protect the integrity of a country’s financial system and safeguard financial institutions against severe legal and reputational risks. Furthermore, compliance within the financial sector w.r.t. AML is imperative for maintaining investor confidence and general economic stability.

Red flag indicators of money laundering

Financial institutions are at the forefront of defense against money laundering. By recognizing red flags, they can identify suspicious activity and report it to the authorities. Some common red flags include:

Customers being highly secretive

Excessive secrecy on the part of customers concerning their financial matters is a red flag. Usually, it points towards concealing possible illegal activities or the source of their dirty money. Therefore, financial institutions should identify such anomalies and ensure proper documentation in adherence to AML.

Cash-intensive businesses

Businesses, including restaurants, bars, or casinos, which deal primarily in cash, are at greater risk of money laundering. If frequent large cash transactions cannot be explained and have no apparent business reason, it may point toward money laundering. Therefore, financial institutions should keep a close watch on such businesses to identify probable cases of money laundering, such as frequent large cash deposits or withdrawals.

Unusual transaction patterns

There are warnings of deviations from a customer’s usual financial behavior, such as sudden surges in deposits, small transactions aggregating to a large amount, or frequent transfers to and fro from different accounts. These activities often do not appear to have a legitimate business purpose and require further inquiry.

Transactions from high-risk areas

Transactions with their origin or destination in countries usually associated with corruption, organized crime, or weak regulatory environments have indicative signs of money laundering. Financial institutions, including banks, should also be highly cautious regarding transactions from countries with weak AML regulations or those on the sanction lists.

Lack of transparency in beneficial ownership

Complicated structures relating to ownership, which attempt to obscure the genuine owner of money or other assets, are a major warning sign. In these cases, money launderers attempt to disguise their relationship by using shell companies, trusts, or nominees. Institutions should execute adequate due diligence measures to find the ultimate beneficiaries connected with accounts and transactions.

How do industries perform money laundering detection?

There exist several key strategies that industries use to detect money laundering. These are, in fact, the core of Anti Money Laundering compliance programs, namely-

Know your customer (KYC) process

KYC is the backbone of anti-money laundering. It means identifying who the customers are, understanding the nature of their financial activities, and gauging how risky the customer may be. This process will ensure that your customers are legitimate and that their money is from appropriate sources.

Risk assessment

Risk assessment helps chalk out possible criminals among your customer list. Every customer undergoes Customer Due Diligence (CDD) to collect information on their identity and background. Enhanced Due Diligence (EDD) applies to a subset of higher-risk customers, like Politically Exposed Persons (PEPs) or persons in countries where regulations are weak and tend towards corruption. EDD implies more sophisticated controls and monitoring, deep background checks, enhanced verification of sources of funds, and closer oversight of transactions in general.

Risk screening

Risk screening is an integral part of AML compliance that involves continual customer checking against lists of Politically Exposed Persons, persons with questionable press/reputation, and sanctioned entities. These screening tools leverage databases of known high-risk individuals and entities to flag transactions or bank accounts for further investigation. These databases are updated regularly to keep you informed of emerging risks and combat money laundering.

Ongoing transaction monitoring

The continuous monitoring of transactions is essential to detect suspicious activity. Advanced analytics and Machine Learning/Deep Tech are applied to identify unusual transaction patterns that might indicate the laundering of dirty money. By observing customer behavior over time, limits are set up on various transactions with alert notifications. In addition, even emerging/futuristic money laundering techniques and changing regulations must be incorporated swiftly into the systems.

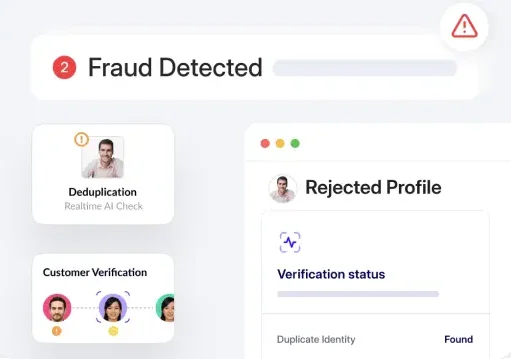

Real-time alert

Real-time alert systems are vital in identifying shady activities and reporting suspicious transactions. Automated alerts show up in cases where a transaction has surpassed a reporting threshold or indicates unusual patterns, thereby motivating further investigation by your compliance team. Such systems mostly use complex algorithms and data analysis to provide accurate and timely alerts, reducing the risks of dirty money processing.

Recordkeeping and reporting

For AML compliance, keep an accurate record of all activities, which includes transactions and customer interaction. You are obligated to submit a Suspicious Activity Report (SAR) with regulatory authorities upon noticing any potential money laundering activity. These reports help law enforcement agencies and the financial action task force in probing and prosecuting money laundering cases. Moreover, your recordkeeping should be audited regularly to ensure it complies with the regulatory requirements.

Protect your business and ensure compliance with our advanced AML solutions.

Schedule a Demo now!Stay compliant with automated AML solutions

The battle against money laundering continues to be fought diligently. Automated AML solutions with a boost of AI can add immense value to the AML compliance of any operation with the following features:

AI algorithms can process a colossal amount of data in identifying pivotal patterns that will make it recognizable as money laundering, further increasing the accuracy in detection and reducing instances of false positives. AI systems provide a holistic view of customer activity and the related risks. AI solutions scale in line with the growing volume and complexity of transactions in digital banking. This guarantees the availability of adequate and effective coverage during the growth of banks and financial institutions.

The AI/ML models offer deeper insights into customer behavior and risk profiling, helping uncover those hidden risks not usually traceable by traditional methods. Therefore, they enable a nuanced view of the potential risks and ensure strict scrutiny of high-risk customers to divulge undetected criminal activity.

Automated solutions enable the institutions to remain current with continually changing AML regulations. The systems make it easy to demonstrate compliance as they are characterized by full audit trails and report-generating capabilities. This assists in reducing the risks of hefty fines and penalties due to non-compliance.

Hence, by streamlining operations to boost operational efficacy, AI-powered AML solutions put banks and financial institutions at the helm of protecting the global financial system.

Conclusion

In the fight against money laundering, precision and efficiency are non-negotiable. HyperVerge offers novel AML solutions that ensure real-time screening and transaction monitoring, empowering your business to navigate regulatory compliance seamlessly. With integrated KYC capabilities and global coverage across 195+ countries, HyperVerge simplifies operations while reducing risks. Stay compliant and proactive—explore HyperVerge AML solutions today.